Press release

Loan Servicing Market 2018 Industry Global Trend, Size, Key Players (FICS, Fiserv, Mortgage Builder, Nortridge Software, Shaw Systems Associates) and Future Insights Report 2023

Loan Servicing Market studies the process by which a company (mortgage bank, servicing firm, etc.) collects interest, principal, and escrow payments from a borrower. One of the major drivers for this market is need to comply with multiple regulations.Get Sample Copy of this Report @ https://www.orianresearch.com/request-sample/619006 .

The Asia-Pacific will occupy for more market share in following years, especially in China, also fast growing India and Southeast Asia regions.

North America, especially The United States, will still play an important role which cannot be ignored. Any changes from United States might affect the development trend of Loan Servicing.

Europe also play important roles in global market, with market size of xx million USD in 2017 and will be xx million USD in 2023, with a CAGR of xx%.

Inquire more or asks any questions about this report @ https://www.orianresearch.com/enquiry-before-buying/619006 .

Growth of the Loan Servicing market is largely associated with the growth in the construction industry. The construction industry is expected to push the adhesive industry to new heights, which in turn will help the construction market achieve greater volumes and revenues in the near future; hence this drives the demand for adhesive at a significant pace.

The worldwide market for Loan Servicing is expected to grow at a CAGR of roughly 4.5% over the next five years, will reach 640 million US$ in 2023, from 490 million US$ in 2017, according to a new study.

Loan Servicing Industry Segment by Manufacturers:

• FICS

• Fiserv

• Mortgage Builder

• Nortridge Software

• Shaw Systems Associates

Market Segment by Type, covers:

• Conventional Loans

• Conforming Loans

• FHA Loans

• Private Money Loans

• Hard Money Loans

Market Segment by Applications, can be divided into:

• Homeowner

• Local Bank

• Company

Purchase Report @ https://www.orianresearch.com/checkout/619006 .

There are 15 Chapters to deeply display the global Loan Servicing Market.

Chapter 1: Describe Loan Servicing Introduction, product scope, market overview, market opportunities, market risk, and market driving force.

Chapter 2: Analyze the top manufacturers of Loan Servicing, with sales, revenue, and price of Loan Servicing, in 2015 and 2017.

Chapter 3: Display the competitive situation among the top manufacturers, with sales, revenue and market share in 2015 and 2017.

Chapter 4: Show the global market by regions, with sales, revenue and market share of Loan Servicing, for each region, from 2011 to 2017.

Chapter 5, 6, 7, 8 and 9: Analyze and talked about the key regions, with sales, revenue and market share by key countries in these regions.

Chapter 10 and 11: Show the market by type and application, with sales market share and growth rate by type, application, from 2011 to 2017.

Chapter 12: In Chapter Eleven Loan Servicing market forecast, by regions, type and application, with sales and revenue, from 2017 to 2023.

Chapter 13, 14 and 15: Describe Loan Servicing sales channel, distributors, traders, dealers, appendix and data source.

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Servicing Market 2018 Industry Global Trend, Size, Key Players (FICS, Fiserv, Mortgage Builder, Nortridge Software, Shaw Systems Associates) and Future Insights Report 2023 here

News-ID: 1213513 • Views: …

More Releases from Orian Research

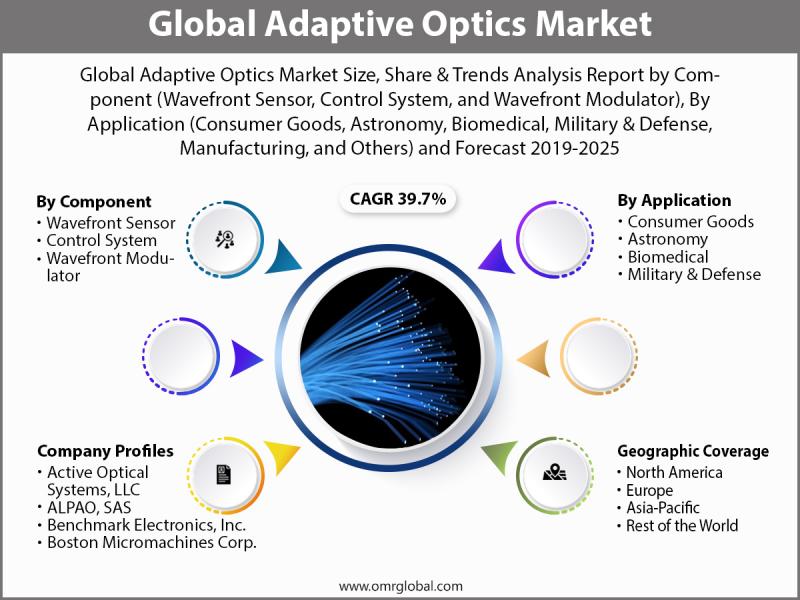

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

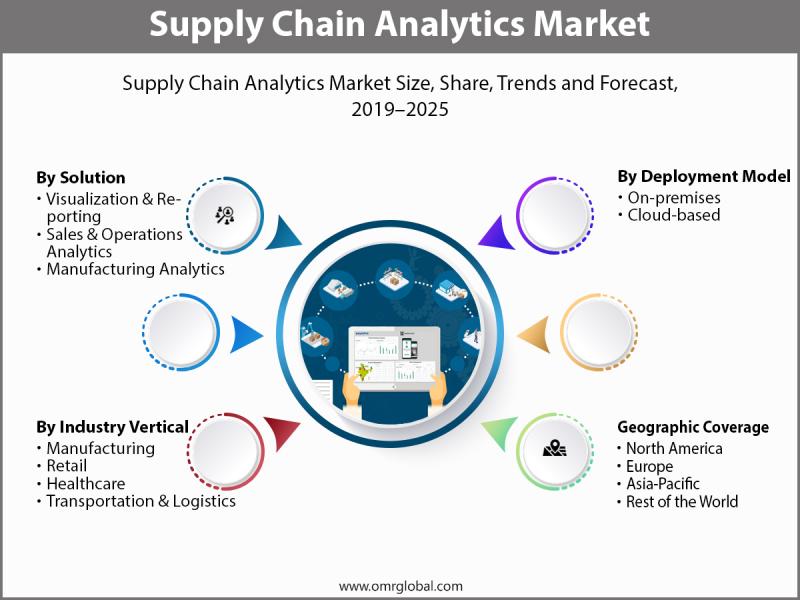

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

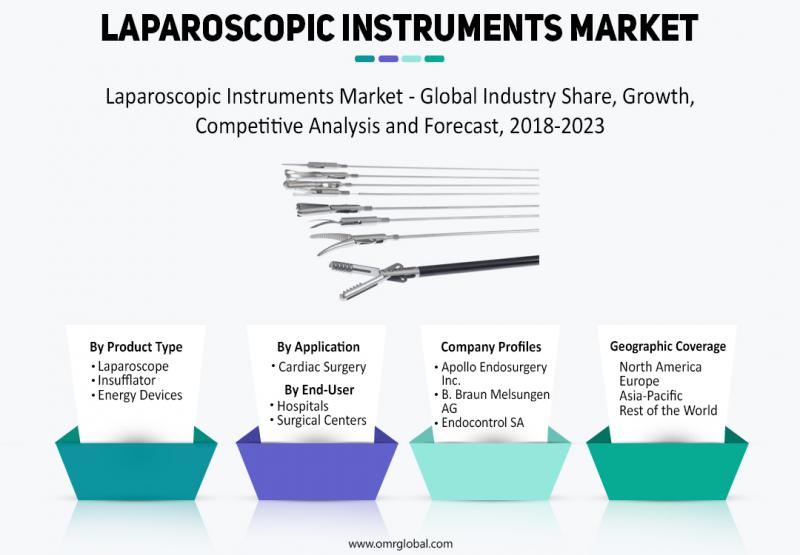

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…