Press release

Modernisation of the power sector in Poland – tough challenges for investors

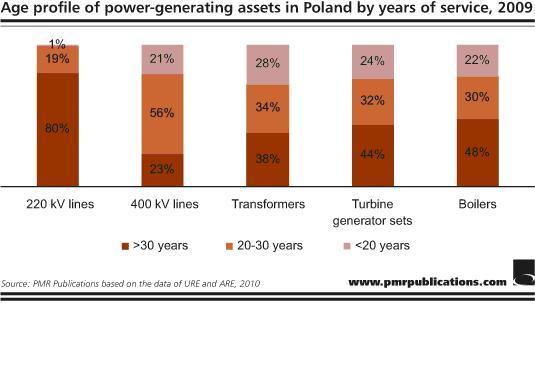

Due to long-standing underinvestment, the Polish power sector is facing a genuine need of finding up to €50bn on investments in new power-production capacity and transmission systems in the coming years. However, only part of the projects initially announced by investors will be actually implemented. Thus, the amount of around €25bn earmarked for capital investments in the power sector in 2010-2020 seems to be a more realistic figure.As stated in research and consulting company PMR’s report entitled “Power Sector Construction in Poland 2010 – Development forecasts and planned investments”, the most substantial growth in new power generation capacity is expected in 2014-2016 when power generating units of 8,000-10,000 MW will be commissioned. What’s interesting, in addition to the plans of Poland’s four largest power groups, including PGE, Tauron, Energa and Enea, major investments are also planned by foreign investors present in the Polish market (Vattenfall, RWE, GDF SUEZ, CEZ, EDF and Fortum); moreover, investments in the power sector are also planned by many companies which have not been directly involved in the power sector to date, including PGNiG, PKN Orlen, Lotos, KGHM and Kulczyk Holding. Also, large projects are planned in the renewable energy sources sector.

As far as investments within the renewable energy sources sector are concerned, the wind power segment has by far the best prospects. In the next decade, Poland will be among the fastest growing markets in terms of new wind power projects with the average annual growth in installed capacity in the range of 800-900 MW. The wind power market offers highly promising prospects, as it was only recently that it has started to grow. However, this branch of the power sector can face numerous barriers, including the lack of a unified and common strategy of the government and inconsistency in the approach to wind power of individual ministries, long time taken to complete wind power projects (four to seven years), long time waiting for delivery of wind turbines (even up to two years), no coordination of network extension planning between individual distributors and the policy of “booking” connection capacity, which creates an informal market for trading in connection rights.

PMR analysts estimate that the biggest market players will plan to obtain up to half of the funds necessary for project financing from external sources. Due to the required volume of capital expenditure related to power sector projects, there are several potential external sources of project financing. The major of them include loans and borrowings from domestic lenders, bonds, issues of shares on the Warsaw Stock Exchange, financial commitment of a strategic investor and loans from the European Investment Bank and the European Bank for Reconstruction and Development (in the case of the EIB and the EBRD funding, Poland is the largest borrower in Central and Eastern Europe). However, raising funds for all the projects planned in the power sector will be by no means a simple task. Consequently, part of the projects will be financed with the funds coming from energy price increases.

When analysing the planned projects, it should be borne in mind that the power sector is operating in a highly volatile economic and legal environment where political decisions have an increasingly strong impact on projects’ profitability. Therefore, implementation of long-term projects in the power sectors must take into account the laws and regulations which will come into force in the future. However, there is little certainty about the future regulations concerning the power sector or environmental issues. Thus, any specific investment decisions in the power sector are exposed to a considerable risk. Hence, some of the power projects initially announced by investors will not actually materialise. They can be potentially substituted by new projects which have not yet been disclosed or are in the early preparation stage. Despite the anticipated difficulties in securing the funding for all the planned projects, well-prepared projects which have a sales market and a convenient location and use an appropriate technology are bound to secure the necessary funding and they will be put into practice.

This press release is based on information contained in the latest PMR report entitled “Power Sector Construction in Poland 2010 – Development forecasts and planned investments”.

PMR Publications (www.pmrpublications.com) is a division of PMR, a company providing market information, advice and services to international businesses interested in Central and Eastern European countries and other emerging markets. PMR key areas of operation include market research (through PMR Research), consultancy (through PMR Consulting) and business publications (through PMR Publications). Being present on the market since 1995, employing highly skilled staff, offering high international standards in projects and publications and providing one of most frequently visited websites, PMR is one of the largest companies of its type in the region.

For more information on the report please contact:

Marketing Department:

tel. /48/ 12 618 90 00

e-mail: marketing@pmrcorporate.com

PMR

ul. Supniewskiego 9, 31-527 Krakow, Poland

tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08

www.pmrcorporate.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Modernisation of the power sector in Poland – tough challenges for investors here

News-ID: 121201 • Views: …

More Releases from PMR Publications

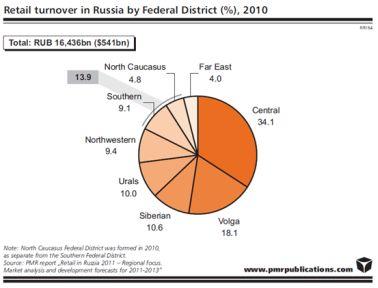

Russian retail market recovered after the economic slowdown

Retail markets in all Russian Federal Districts increased in 2010 by total $80bn

In 2010, Russian retail market recovered after the economic slowdown observed in the previous year and increased by 12.6% to RUB 16.4tr ($541bn). However, the latest PMR report „Retail in Russia 2011 – Regional focus. Market analysis and development forecasts for 2011-2013” shows that particular regional retail markets still reveal differences in their development due to their unique…

Construction output in Poland up by 10% in 2011

The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled "Construction sector in Poland, H2 2010 -…

Russian construction industry recovers after the downturn

For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions…

Retail market in Russia to grow by almost 10% in 2010

The growth rate of the Russian retail sector dropped severely last year due to worsening economic conditions, weakening purchasing power growth and the depreciating rouble. As a result, the retail market's value increased by only 5% in 2009 after several years of roughly 25% annual growth. Nevertheless, the situation has improved this year, and the retail market is expected to once again reach double-digit growth rates in subsequent years.

According to…

More Releases for Poland

Poland Agriculture Market, Poland Agriculture Industry, Agriculture Livestock Ma …

Poland is a significant European and global producer of numerous agricultural products. The agricultural land market in country is divided in two parts: privately owned farms and land owned farms by the State Treasury. Privately owned farm is an enterprise to cultivate various agricultural products under the control of one or more investor. Poland is among the world's primary producers of potatoes, rye, and apples, as well as pork and…

MAUSER Poland Celebrates 5th Anniversary

Bruehl/Germany, June 27, 2017

MAUSER Group, a worldwide leading company in industrial packaging, celebrates the 5th anniversary of its factory in Gliwice, Poland. Ideally located in the industrial heartland of Upper Silesia, and operated by a strong local management team, the plant offers high-quality industrial packaging solutions and services.

MAUSER Poland serves customers with a comprehensive product range of Composite Intermediate Bulk Containers (CIBCs) and plastic tight-head drums. In line with…

Agrochemicals Market in Poland

ReportsWorldwide has announced the addition of a new report title Poland: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Poland: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

A+ ratings on Poland

Jelenia Gora/Poland, 20.09.2011 - In August 2011 two rating agencies i.e. Standard & Poor's and Moody's Investors Service affirmed their A+ rating on Poland with a stable outlook. Both agencies noted that the Polish economy is competitive and increasingly diversified. Moody's evaluated Poland as relatively well placed to withstand global turmoil with its relatively resilient economy. Both agencies stressed that the Polish economy continued to expand in 2009, in contrast…

IT market in Poland

IT providers in Poland are starting the post-crisis period in actually quite good moods and are already beginning to predict what solutions will be most sought after by their customers during prosperity.

However last year hardware distributors recorded significant reduction in the number of orders placed, especially by business customers, software and IT services providers performed far better. A majority of them had similar sales as in previous periods, while some…

VoIP in Poland

At the end of 2008 the Polish VoIP telephony market was worth PLN 440m, with CaTV operators having generated the largest share of revenue in the segment. In recent years also fixed-line operators have included VoIP services into their offer.

According to research and consulting company PMR Polish VoIP market continues to represent a small share of the fixed-line telecommunications market. In 2008 it accounted for approximately five percent of the…