Press release

Loan Servicing Market- By Research Approach, Segmentation, Growth Analysis, Future Trends, Business Development, Competitive Landscape, Cost Structure, and Key Players | FICS, Fiserv, Mortgage Builder, Nortridge Software, Shaw Systems Associates etc. |For

Loan Servicing Market Global Research Report 2018 is a professional and in-depth study of market size, industry status and forecast, competition landscape and growth opportunity. This research report categorizes the global Loan Servicing market by companies, region, type and end-use industry.Get Sample Copy at https://www.orianresearch.com/request-sample/593188

Development policies and plans are discussed as well as manufacturing processes and cost structures. This report also states import/export, supply and consumption figures as well as cost, price, revenue and gross margin by regions.

Complete report on Loan Servicing Market spread across 90 pages, top key manufacturers and list of tables and figures.

Enquire More @ https://www.orianresearch.com/enquiry-before-buying/593188

Key Companies Analyzed in this Report are:

• FICS

• Fiserv

• Mortgage Builder

• Nortridge Software

• Shaw Systems Associates

• ...

The report focuses on Global Loan Servicing Market major leading industry players with information such as company profiles, product picture and specification, capacity, production, price, cost, revenue and contact information. Upstream raw materials, equipment and downstream consumers analysis is also carried out. What's more, the Loan Servicing industry development trends and marketing channels are analyzed. Finally, the feasibility of new investment projects is assessed, and overall research conclusions are offered. In a word, the report provides major statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Place a Direct Order Of this Report @ https://www.orianresearch.com/checkout/593188

Market segment by Regions/Countries, this report covers:

• United States

• Europe

• China

• Japan

• Southeast Asia

• India

Market segment by Type, the product can be split into:

• Conventional Loans

• Conforming Loans

• FHA Loans

• Private Money Loans

• Hard Money Loans

Market segment by Application, split into:

• Homeowner

• Local Bank

• Company

Years considered to estimate the market size of Loan Servicing are as follows:

• History Year: 2013-2017

• Base Year: 2017

• Estimated Year: 2018

• Forecast Year 2018 to 2025

Major Points Covered in Table of Contents:

1 Global Loan Servicing Market Size, Status and Forecast 2025

2 Global Loan Servicing Competition Analysis by Players

3 Company (Top Players) Profiles

4 Global Loan Servicing Market Size by Type and Application (2013-2018)

5 United States Loan Servicing Development Status and Outlook

6 Europe Loan Servicing Development Status and Outlook

7 Japan Loan Servicing Development Status and Outlook

8 China Loan Servicing Development Status and Outlook

9 India Loan Servicing Development Status and Outlook

10 Southeast Asia Loan Servicing Development Status and Outlook

11 Market Forecast by Regions, Type and Application (2018-2025)

12 Loan Servicing Market Dynamics

13 Market Effect Factors Analysis

14 Research Finding/Conclusion

15 Appendix

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

Contact Us

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US: +1 (832) 380-8827 | UK: +44 0161-818-8027

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Servicing Market- By Research Approach, Segmentation, Growth Analysis, Future Trends, Business Development, Competitive Landscape, Cost Structure, and Key Players | FICS, Fiserv, Mortgage Builder, Nortridge Software, Shaw Systems Associates etc. |For here

News-ID: 1162753 • Views: …

More Releases from Orian Research

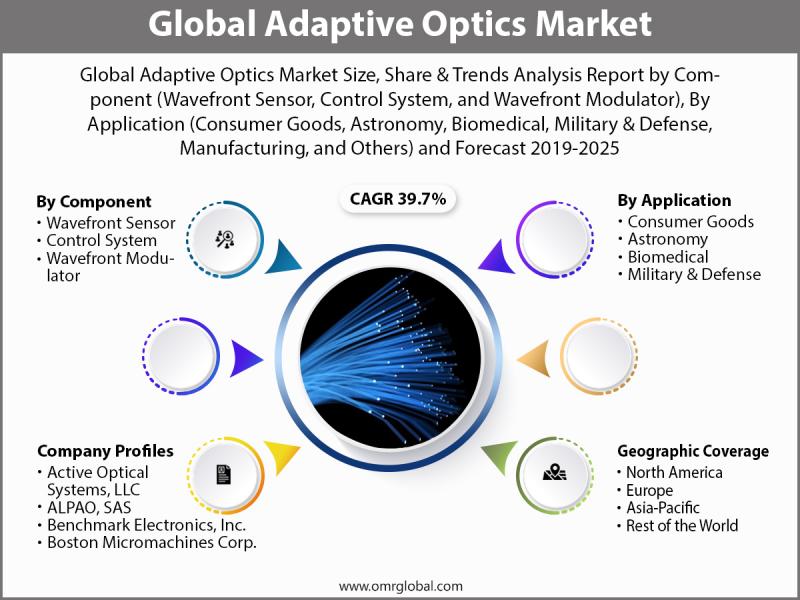

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

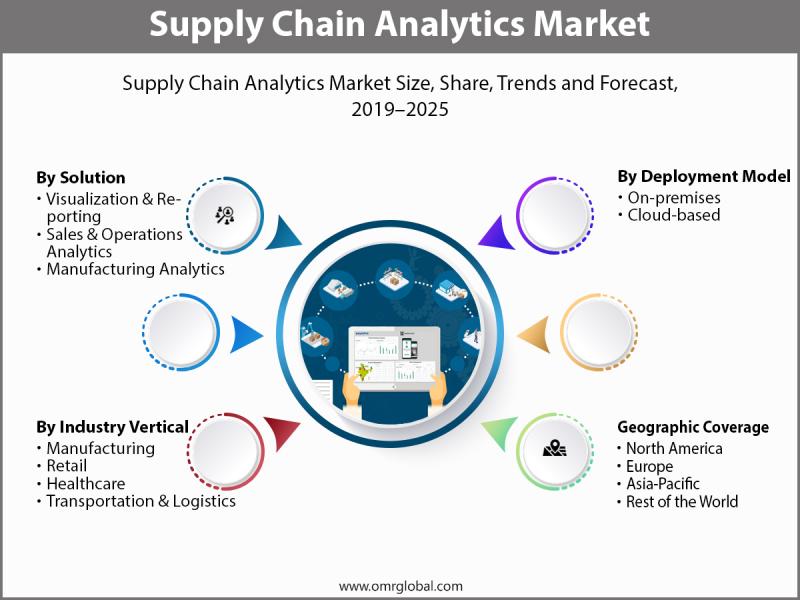

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…