Press release

Contactless Payment Transaction Market to Expand at 55.5% CAGR to reach US$801.44 bn by 2025 with Increasing Use of Smartphones

Stiff competition prevails in the global contactless payment transaction market. This is because there are a sizeable number of small and large service providers and entry into the market is quite easy. Of late, the entry of banks, card companies, telecom companies, and payment companies that are foraying into contactless payment services has further intensified competition in the market.In order to ensure sustainable returns, service providers are focused on crafting innovative marketing strategies for a higher rate of conversion. For example, Samsung developed magnetic secure transmission, which releases a magnetic signal that imitates the magnetic strip on traditional payment cards.

The key factor driving the contactless payment transaction market is the increasing demand for speedy transactions, especially in the retail and transport sectors underpinned by the rising use of smartphones. Proving to be a hindrance, on the flip side, is the high installation cost of point-of-sale (PoS) machines for contactless payment as compared to normal PoS machines.

As per a report by Transparency Market Research, the global contactless payment transaction market is projected to rise at a whopping 55.5% CAGR from 2017 to 2025 for the market’s valuation to reach US$801.44 bn by 2025.

global contactless payment transaction market

Get PDF Sample of Report @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2566

Retail Leading End-use Segment due to Demand for Speedy Counter Sales Processes

In terms of mode of payment, the segments of the market are wearable devices, contactless card (RFID/NFC), and contactless mobile payment. The segment of contactless card (NFC/RFID) is estimated to contribute the leading revenue to the global contactless payment transaction market over the forecast period. The segment of wearable devices comprise transactions carried out over smart watch or smart band. The segment of wearable devices is anticipated to rise at a substantial rate in the upcoming years. Contactless mobile payment segment includes payments made via smartphones.

The global contactless payment transaction market is classified into hospitality, media and entertainment, transport, retail, healthcare, and others depending upon end use. Among these, the segment of retail is anticipated to contribute the leading revenue to the global market for contactless payment transaction followed by the transport and hospitality sectors in the coming years.

Download TOC@ https://www.transparencymarketresearch.com/report-toc/2566

Europe to Remain at the Global Market’s Forefront

The global contactless payment market, based on geography, has been segmented into North America, Asia Pacific, Europe, the Middle East and Africa, and South America. Powered by the increasing adoption of NFC-enabled smart wearable devices and growing use of contactless cards, Europe is anticipated to display relatively speedy growth amongst other key regional segments. In the region, contactless cards is projected to contribute the leading revenue backed by growth in retail and transport end-use industries in the U.K., Poland, and Germany. According to the data published by the U.K. card association, the number of contactless cards issued in the U.K. was 857 million in 2015.

Asia Pacific is expected to display relatively fast adoption of NFC-enabled contactless devices and wearable devices with the launch of apps such as Samsung Pay. The region is expected to display higher growth rate over other regions and second after Europe. Within Asia Pacific, retail/e-commerce, hospitality, and transportation sectors are expected to contribute significant revenues backed by economic development in India, China, and South Korea.

Preview Report @ https://www.transparencymarketresearch.com/contactless-payments-market.html

North America contactless payment transaction market is displaying sound growth backed by a large consumer base of mobile phone users.

Some of the prominent names operating in the global contactless payment transaction market profiled in this report are Apple Inc., Barclays, Ingenico Group, Heartland Payment Systems Inc., Giesecke & Devrient GmbH, Inside Secure, Samsung Electronics Ltd., On Track Innovations Ltd., Verifone Systems Inc., Gemalto N.V., and Wirecard AG.

About Us

Transparency Market Research (TMR) is a global market intelligence company providing business information reports and services. The company’s exclusive blend of quantitative forecasting and trend analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information.

TMR’s data repository is continuously updated and revised by a team of research experts so that it always reflects the latest trends and information. With extensive research and analysis capabilities, Transparency Market Research employs rigorous primary and secondary research techniques to develop distinctive data sets and research material for business reports.

Contact

Transparency Market Research

State Tower,

90 State Street,

Suite 700,

Albany NY - 12207

United States

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: http://www.transparencymarketresearch.com

Research Blog: http://www.techyounme.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Contactless Payment Transaction Market to Expand at 55.5% CAGR to reach US$801.44 bn by 2025 with Increasing Use of Smartphones here

News-ID: 1155209 • Views: …

More Releases from Transparency Market Research

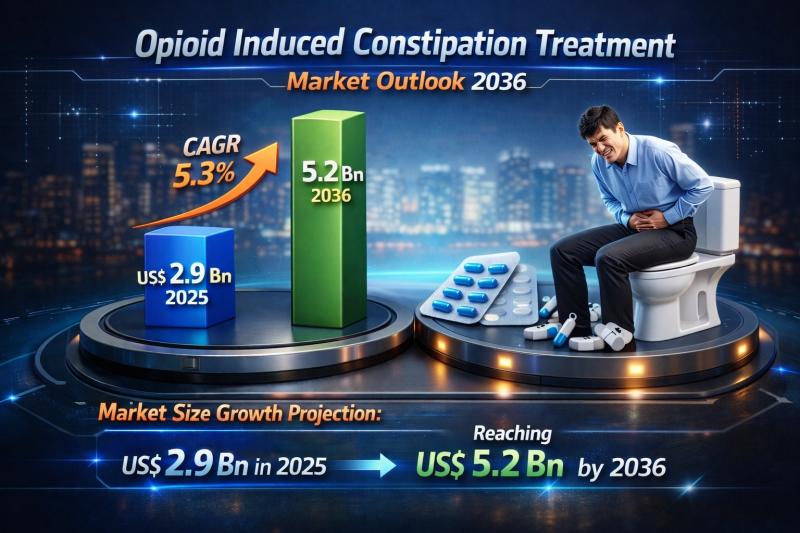

Global Opioid Induced Constipation Treatment Market Set to Reach USD 5.2 Billion …

The global opioid induced constipation (OIC) treatment market is witnessing steady and sustained growth as healthcare systems worldwide place increasing emphasis on comprehensive pain management and supportive care. Valued at US$ 2.9 billion in 2025, the market is projected to reach US$ 5.2 billion by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. Growth is primarily fueled by the rising prevalence of chronic…

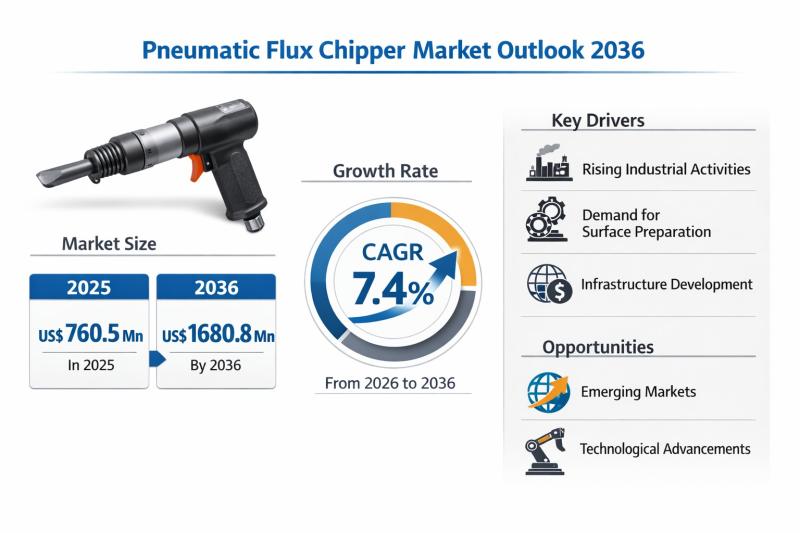

Pneumatic Flux Chipper Market Expanding at 7.4% CAGR Through 2036 - By Product T …

The global Pneumatic Flux Chipper Market is set to witness sustained and resilient growth over the next decade, underpinned by expanding heavy manufacturing activities, rising welding and fabrication demand, and continuous investments in industrial infrastructure across emerging and developed economies. According to the latest industry analysis, the market was valued at US$ 760.5 Mn in 2025 and is projected to reach US$ 1,680.8 Mn by 2036, expanding at a compound…

AI in Automotive Market Outlook 2036: Global Industry to Surge from US$ 19.8 Bil …

The AI in automotive market is entering a phase of exponential expansion, supported by rapid digitization of vehicles, growing safety mandates, and consumer demand for intelligent mobility. The global market was valued at US$ 19.8 Bn in 2025 and is projected to reach US$ 244.4 Bn by 2036, registering a remarkable CAGR of 27% from 2026 to 2036.

This growth trajectory reflects the transition of automobiles from mechanically driven products to…

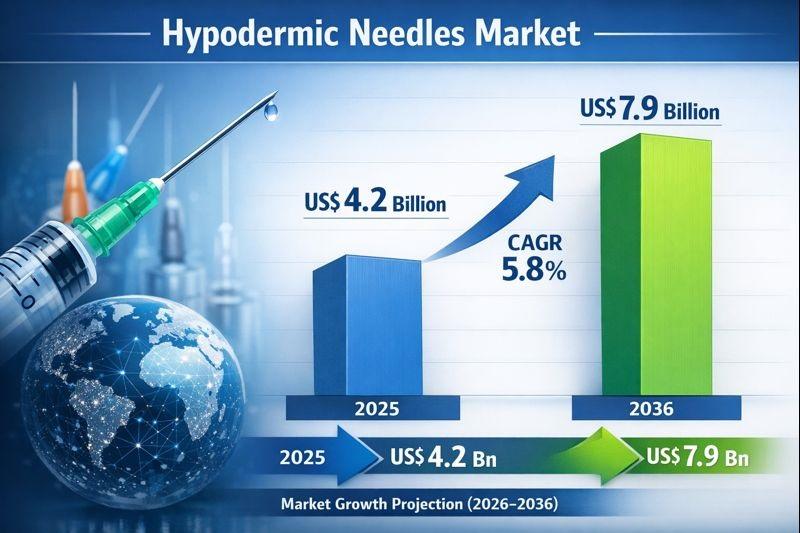

Hypodermic Needles Market to Reach US$ 7.9 Billion by 2036 on Rising Injectable …

The global hypodermic needles market was valued at approximately US$ 4.2 billion in 2025 and is projected to reach around US$ 7.9 billion by 2036, expanding at a CAGR of nearly 5.8% from 2026 to 2036, driven by the rising prevalence of diabetes, cancer, and chronic diseases, growing demand for injectable drugs and biologics, and the expansion of global vaccination and immunization programs; increasing adoption of safety-engineered and disposable needles,…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…