Press release

Global Digitization in Lending Market estimated to Reach US$ 33,547.3 Mn by 2022, Due to Increasing Digitalization in Banking Industry

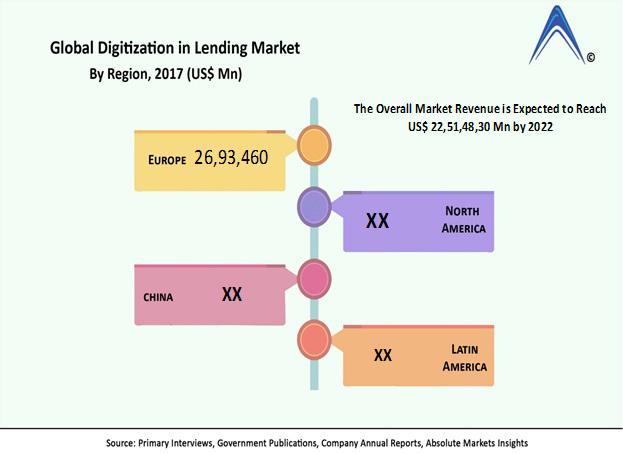

Absolute Markets Insights offers its latest published report “Digitization in Lending Market - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018-2026”. The author of the report analyzed that the Global Digitization in Lending Market accounted for US$ 2693460 Mn in 2017. The growing adoption of digitalization is the main factor that is driving the market. Through digitization, the lending system has changed completely. The benefits of the market are the lending process takes less time, increased data security and reduction of paperwork.Report Overview:

Digitization is the reason of large-scale transformations across multiple aspects of business. Digitization in banking industry is the major factor driving the growth of the market. Digitization also provides opportunities for value creation. It allows banks to more effectively target their customers with relevant, thoughtful, and more appropriately timed offers. Banks gain the ability to provide a better customer experience, increase loan originations in various asset classes, provide more loans with no additional risk or staff and reduce their cost per loan.

Request Sample Copy of Report: https://www.absolutemarketsinsights.com/request_sample.php?id=103

The lack of interoperability and standards may affect the growth of digitization in lending market. The financial services sector handles sensitive information about individuals and enterprises. With the emergence of fintech, more data is now available in digital formats, which makes it easier to analyze and generate insights but also makes the data more susceptible to security breaches, which may affect the growth of market. However, companies are looking forward in introducing good digital lending platform through the use of SSL layers for encryption, which may help companies to face these challenges effectively

Digital channels seek opportunity in improving customer experience. Non-digital lending processes for customers to interpret turnaround time, low predictability and low transparency. According to Federal Reserve survey in 2016, about 42% respondents felt that non-digitalized process was difficult, and about 45% complained of long wait for credit decision. Whereas, in contrast with online lenders, only 26% respondent’s complaint about difficult process, Hence, the digital or online lenders offer a smoother application process and faster credit decision, and this is expected to generate immense opportunity for digitization in lending market

Get the best Discount in the market here: https://www.absolutemarketsinsights.com/ask_for_discount.php?id=103

Top Key Player Covered In This Report:

Rise Credit, FirstCash, Inc., Speedy Cash, LendUp, Elevate, NetCredit, Avant, Inc., Opportunity Financial, LLC., Prosper Marketplace, Inc., The Business Backer LLC., Headway Capital Partners LLP, Blue Vine, Lendio, RapidAdvance, AmigoLoans Ltd, Lendico, Trigg, Lending Stream, 118118Money, Simplic, Wonga Group, OnDeck, Kabbage, Inc., Fundation Group LLC, among others. For instance, on 18 March 2016, AmigoLoans, UK’s leading guarantor loan provider, had significantly increased its new lending capacity through the completion of a new syndicated bank facility.

The on-Computer Segment Holds Major Dominance in the Aforementioned Market in 2017

The on-computer deployment segment accounted for the highest share in the global digitization in lending market in the year 2017. The large use of computers in various industries for digital lending is the key factor contributing towards the growth of the segment. With digital lending, the documents can be retrieved from the borrower's internet banking account or simply uploaded via computer. The borrower’s credit report is fetched online and helps a digital lending platform to provide collateral free personal loans. So, without actually seeing the borrower, the loan is approved and disbursed. Therefore, on-computer segment is the dominant segment and is projected to show substantial growth in forecast period.

Know More About Digitization in Lending Market at: https://www.absolutemarketsinsights.com/enquiry_before_buying.php?id=103

The Digitization in Lending Market Report mainly covers following Content.

Chapter 1 Cyber Insurance Market Overview

Chapter 2 Global Economic Impact

Chapter 3 Competition by Manufacturer

Chapter 4 Production, Revenue (Value) by Region

Chapter 5 Supply (Production), Consumption, Export, Import by Regions

Chapter 6 Production, Revenue (Value), Price Trend by Type

Chapter 7 Analysis by Application

Chapter 8 Manufacturing Cost Analysis

Chapter 9 Industrial Chain, Sourcing Strategy and Downstream Buyers

Chapter 10 Marketing Strategy Analysis, Distributors/Traders

Chapter 11 Market Effect Factors Analysis

Chapter 12 Market Forecast

Continued…

Absolute Markets Insights strives to be your main man in your business resolve by giving you insight into your products, market, marketing, competitors, and customers. By enabling you to make well informed choices, absolute markets insights will help you to develop a successful marketing grand design.

Address:

1 st Floor,The Work Lab, Model Colony, Pune, Pin - 411016

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Digitization in Lending Market estimated to Reach US$ 33,547.3 Mn by 2022, Due to Increasing Digitalization in Banking Industry here

News-ID: 1134087 • Views: …

More Releases from Absolute Markets Insights

Gesture Recognition Market Present Scenario and Growth Prospects 2023-2031| Goog …

The latest report, Global Gesture Recognition Market by Absolute Markets Insights is analyzed and researched on the basis of the comprehensive analysis of the global market. The report focuses on key market-related aspects including market segmentation, geographic segmentation, dynamics, and other market growth factors. The report contains detailed analysis of the distinct industrial growth strategies, which helps to determine the dominant segments and to know about different factors. The scope…

Blockchain Identity Management Market to Reach a Valuation of USD 60 million by …

Global Blockchain Identity Management Market Report is a compilation of comprehensive research studies on various aspects of the Blockchain Identity Management Market. With accurate data and highly authentic information, it makes a brilliant attempt to provide a real, transparent picture of current and future situations of the global Blockchain Identity Management Market. Market participants can use this powerful tool when creating effective business plans or making important changes to their…

Payment Software Market Size Revenue to Cross USD 510 million by 2031: Absolute …

Global Payment Software Market was valued at USD 240 million in 2023 and is anticipated to exceed USD 510 million by 2031.

The Global Payment Software Market Report studies extensive evaluation of the market growth predictions and restrictions. The strategies range from new product launches, expansions, agreements, joint ventures, partnerships, to acquisitions. This report comprises of a deep knowledge and information on what the market's definition, classifications, applications, and engagements and…

Artificial Intelligence in Healthcare Market Size Worth USD 5,310.31 Million By …

A New Market study by Absolute Markets Insights on the Global Artificial Intelligence in Healthcare Market has been released with reliable information and accurate forecasts for a better understanding of the current and future market scenarios. The report offers an in-depth analysis of the global market, including qualitative and quantitative insights, historical data, and estimated projections about the market size and share in the forecast period. The forecasts mentioned in…

More Releases for Chapter

New Chapter-by-Chapter Column to Spotlight Local Authors Across the Sandhills

SANFORD, N.C. - September 2025 - Sandhills.News is launching Chapter-by-Chapter, a new column dedicated to celebrating writers from Moore, Lee, and Harnett counties. The series will highlight books, authors, and storytelling that reflect the culture and creativity of the Sandhills region.

"This column is a way for neighbors to discover the writers in their own backyards," said Stephanie Sellers, editor of Sandhills.News. "It's about strengthening connections through literature and offering…

Austin Bankruptcy Lawyers Guide Clients Through Chapter 7 & Chapter 13 Filings

Austin Bankruptcy Lawyers helps individuals and families in Texas overcome debt through Chapter 7 and Chapter 13 filings. The firm's bankruptcy attorney in Texas offers personalized legal support, clear guidance, and long-term financial solutions.

Austin, TX - For many individuals and families in Austin, TX, who face overwhelming debt, bankruptcy provides a pathway to a fresh start. Austin Bankruptcy Lawyers provides comprehensive legal services for Chapter 7 and Chapter 13 filings.…

New Jersey Bankruptcy Attorney Daniel Straffi Clarifies Key Differences Between …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-the-difference-between-new-jersey-bankruptcy-chapter-7-and-chapter-13/), of Straffi & Straffi Attorneys at Law, sheds light on the critical distinctions between Chapter 7 and Chapter 13 bankruptcy for individuals and small businesses facing financial challenges. When unexpected circumstances such as job loss, illness, or divorce lead to overwhelming debt, understanding these two legal pathways can provide much-needed relief. Daniel Straffi explains how each option offers tailored solutions to help debtors…

Chapter 13 Lawyer Daniel Straffi Unveils Comprehensive Guide on Understanding Ch …

Chapter 13 lawyer [https://www.straffilaw.com/new-jersey-chapter-13-lawyer/] Daniel Straffi of Straffi & Straffi Attorneys at Law has recently published a detailed article enlightening individuals on the intricacies of Chapter 13 bankruptcy in New Jersey. This guide serves as an essential resource, offering clarity and direction for those grappling with significant debt and seeking financial rehabilitation.

The article by the Chapter 13 lawyer provides an in-depth look at the "wage earner's plan," which is tailored…

AFEA Welcomes New Chapter President

Leader in Financial Literacy Continues to Expand

The American Financial Education Alliance is dedicated to providing financial education and increasing financial literacy within communities all over the country. Today, the Board of Directors has chosen to continue to do just that, by unanimously voting in Robert Wolf as the new Chapter President of AFEA’s Orange, CA Chapter.

With the addition of Robert Wolf as the new Chapter President, AFEA is expanding…

AFEA Welcomes New Chapter President

Leader in Financial Literacy Continues to Expand

The American Financial Education Alliance is dedicated to providing financial education and increasing financial literacy within communities all over the country. Today, the Board of Directors has chosen to continue to do just that, by unanimously voting in Angelica Jones as the new Chapter President of AFEA’s Glendale, California Chapter.

With the addition of Angelica Jones as the new Chapter President, AFEA is expanding…