Press release

New Jersey Bankruptcy Attorney Daniel Straffi Clarifies Key Differences Between Chapter 7 and Chapter 13 Bankruptcy

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-the-difference-between-new-jersey-bankruptcy-chapter-7-and-chapter-13/), of Straffi & Straffi Attorneys at Law, sheds light on the critical distinctions between Chapter 7 and Chapter 13 bankruptcy for individuals and small businesses facing financial challenges. When unexpected circumstances such as job loss, illness, or divorce lead to overwhelming debt, understanding these two legal pathways can provide much-needed relief. Daniel Straffi explains how each option offers tailored solutions to help debtors regain control of their financial futures.Bankruptcy is a federal legal process that provides individuals or entities unable to repay their debts with a structured means of seeking relief. "Filing for bankruptcy," explains New Jersey bankruptcy attorney Daniel Straffi, "can offer a fresh start by either discharging debts or restructuring repayment plans." Chapter 7 and Chapter 13, the most common bankruptcy options for individuals and small businesses, serve distinct purposes and suit different financial circumstances.

Chapter 7 bankruptcy, often called "liquidation bankruptcy," involves the sale of nonexempt assets to settle outstanding debts. As the New Jersey bankruptcy attorney outlines, the process includes filing a petition, disclosing creditors, income, and assets, and undergoing a means test to confirm eligibility. Nonexempt assets such as vacation homes or valuable collections are liquidated under court supervision, while essential items such as a primary residence or personal tools may be exempt.

"Chapter 7 can be completed in as little as four to six months," notes Straffi, "but it's critical to remember that not all debts are dischargeable, including child support, taxes, and student loans." This type of bankruptcy stays on credit reports for 10 years, making it a solution best suited for those with limited income and significant unsecured debt.

In contrast, Chapter 13 bankruptcy, also known as the "wage earner's plan," allows debtors to retain their assets by reorganizing debt into a manageable three-to-five-year repayment plan. According to Daniel Straffi, this option is especially beneficial for those earning above the state's median income or individuals seeking to protect assets such as a home or car from foreclosure or repossession.

"Chapter 13 offers flexibility by allowing delinquent payments to be included in the plan," Straffi explains. Unlike Chapter 7, there is no liquidation of assets, and creditors are paid through structured monthly payments. This type of bankruptcy has a lesser impact on credit, remaining on reports for up to seven years, and may offer a more sustainable path forward for many debtors.

Each type of bankruptcy offers unique benefits and challenges. For individuals with non-dischargeable debts or those aiming to save a home or other significant assets, Chapter 13 may be the preferred choice. Meanwhile, Chapter 7 provides a quicker resolution for those primarily burdened by unsecured debts.

Daniel Straffi emphasizes the importance of thorough consultation before deciding: "Understanding the differences between Chapter 7 and Chapter 13 and how they apply to your financial situation is crucial. Consulting with a bankruptcy attorney can help ensure the best possible outcome."

Although bankruptcy can significantly impact credit and future financial opportunities, it also provides a way forward for those drowning in debt. Straffi underscores that bankruptcy should be approached as a last resort, with careful consideration of its long-term effects. The firm provides guidance tailored to individual circumstances, helping ensure clients are equipped to rebuild their financial futures.

For New Jersey residents facing financial difficulties, filing for bankruptcy may seem daunting. With Daniel Straffi and the team at Straffi & Straffi Attorneys at Law, clients can gain a trusted ally to manage the complex aspects of the bankruptcy process and make informed decisions toward a brighter financial future.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law, located in Toms River, New Jersey, is committed to helping individuals and small businesses achieve financial relief through sound legal counsel. With years of experience in bankruptcy law, Daniel Straffi and the team can provide personalized support to clients exploring debt relief options such as Chapter 7 and Chapter 13 bankruptcy.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=bSBcMVRNYL8

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website

Email: familyclient@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-bankruptcy-attorney-daniel-straffi-clarifies-key-differences-between-chapter-7-and-chapter-13-bankruptcy]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Bankruptcy Attorney Daniel Straffi Clarifies Key Differences Between Chapter 7 and Chapter 13 Bankruptcy here

News-ID: 3849711 • Views: …

More Releases from ABNewswire

Sydney Business School Alumni Launch Australia's First AI-Driven Wholesale Inves …

Sydney Business School alumni Adnan Tanveer and Adam Newman are launching Investing Platform, Australia's first AI-driven wholesale investment marketplace, in Q1 2026. The platform addresses a key problem: qualified investors currently face seven months and thousands in fees to access a single alternative investment. The founders combine 20+ years of experience with hands-on AI development.

SYDNEY, AUSTRALIA - Investing Platform aims to cut months of friction from wholesale investor access.

Adnan Tanveer…

Sydney Fintech Founder Attending Emergence 2026 Ahead of Platform Launch

Sydney fintech founder Adnan Tanveer is attending Emergence 2026 investment conference (Feb 18-20) as he prepares to launch Investing Platform, Australia's first AI-driven wholesale investment marketplace. Tanveer and co-founder Adam Newman are building infrastructure to cut months of friction from how qualified investors access alternative investments. Platform launches Q1 2026.

SYDNEY, AUSTRALIA - Investing Platform preparing to launch Australia's first AI-driven wholesale investment marketplace.

Adnan Tanveer, co-founder of Investing Platform, is attending…

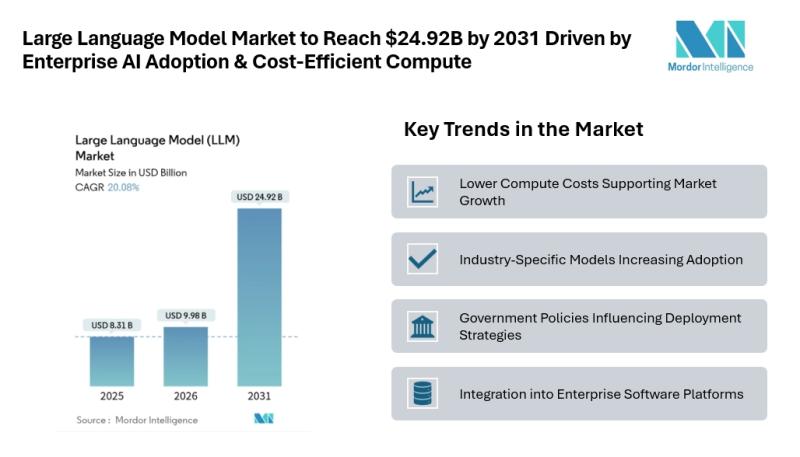

Large Language Model Market to Reach $24.92B by 2031 Driven by Enterprise AI Ado …

Mordor Intelligence has published a new report on the large language model market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Large Language Model Market Outlook

According to Mordor Intelligence, the LLM market size [https://www.mordorintelligence.com/industry-reports/large-language-model-llm-market?utm_source=abnewswire] was valued at USD 8.31 billion in 2025 and is estimated to grow to USD 9.98 billion in 2026, reaching USD 24.92 billion by 2031 at a CAGR of 20.08% during the forecast period.…

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…