Press release

Mobile Payment Technologies Market Is Predicted To Rise At An Outstanding 20.9% CAGR Between 2017 And 2024

The majority market share in the mobile payment technologies market is reserved with a chunk of well-established players, observes Transparency Market Research (TMR) in a new report. Despite being technology intensive, the vast growth opportunities is attracting new companies to foray in the market and thus escalate the degree of competition. For now, the vendor landscape is foreseen to remain moderately consolidated among a few vendors that are broadly categorized as merchants, API providers, MNOs, and OTT Providers.Visa Inc., MasterCard International Inc., American Express Co., Boku Inc., PayPal Inc., Fortumo, Bharti Airtel Ltd., Vodafone Ltd., AT & T Inc., Google Inc., Apple Inc., and Microsoft Corporation are to name leading companies currently operating in the mobile payment technologies market.

As per the TMR report, the global mobile payment technologies market is expected to clock a phenomenal 20.9% CAGR between 2017 and 2024. Rising at this rate, the opportunities in the market are likely to translate into a revenue of US$1,773.17 bn by 2024 end from US$469.59 bn in 2017.

Get Full Report Description https://www.transparencymarketresearch.com/mobile-payments-market.html

Proximity segment, in terms of type, is expected to surpass on the basis of growth rate as near field communication is widely used for mobile payment. By end-use application, retail segment is predicted to contribute the leading revenue to the mobile payment technologies market over the 2017-2024 forecast timeframe. Geography-wise, Asia Pacific is expected to emerge as a lucrative market because of outstanding growth of telecom industry in recent years.

Host of Advantages Drives Adoption among New-age Consumers

First and foremost, growing adoption of smart devices and increasing mobile data usage is fuelling the mobile payment technologies market. This is mainly because of ease of communication and growing demand for convenient mode of transaction. The ceaseless adoption of mobile devices and digitization wave has been instrumental for the mounting use of mobile transaction especially among new-age consumers.

For example, according to statistics of the Groupe Speciale Mobile Association (GSMA) Mobile Economy Report 2016, smartphone penetration globally is predicted to increase from 63% in 2015 to 72% by 2020. For instance, in emerging economies of Asia Pacific, large swaths of consumers have skipped the credit card culture switching straight from cash to mobile payment apps such as We Chat and LINE.

Brochure for Latest Advancements and Research Insights https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=157

Increasing adoption of immediate payment practices is a key factor boosting the mobile payment technologies market. The proliferation of digital payment solutions has been a welcome move among new-age consumers. With Internet-enable smart devices increasingly becoming common among the middle-class population, the adoption of immediate payment technologies via mobile applications and mobile wallets is rising at an unprecedented pace. This is attracting cashless technology corporations to serve the digital payment space. Mobile payment technologies are increasingly becoming de facto among B2B and C2B to complete transactions.

Lastly, rapid development in payment technology has radically changed expectations of consumers and businesses for completing transactions. The adoption of wireless technology such as near-field communication (NFC) and mobile point of sale (mPOS) are expected to lift the demand for mobile payment technologies in the coming years.

Risk of Loss of Critical Data Slows Adoption

However, factors such as unwillingness of consumers to adopt new technology is slowing the growth of this market. Security concerns and risk of loss of critical data using mobile wallets is limiting adoption of mobile payment solutions. Therefore, traditional payment systems continue to remain popular predominantly among senior citizens.

Request For Custom Research https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=157

Lack of awareness among consumers regarding specific mobile payment solutions available for particular smartphones is also a bottleneck to the growth of this market.

The review presented is based on the findings of a TMR report, titled “Mobile Payment Technologies Market (Type - Proximity Payment (Near Field Communication and QR Code Payment) and Remote Payment (SMS-based, USSD/STK, Direct Operator Billing (Credit/Debit Card-based), and Digital Wallet); Purchase Type - Airtime Transfers & Top-ups, Money Transfers & Payments, Merchandise and Coupons, and Travel and Ticketing); End-use Application - Hospitality & Tourism, BFSI, Media & Entertainment, Retail, Healthcare, IT and Telecommunication, and Education) - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 – 2024.”

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. We have an experienced team of Analysts, Researchers, and Consultants, who us e proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Each TMR Syndicated Research report covers a different sector – such as pharmaceuticals, chemical, energy, food & beverages, semiconductors, med-devices, consumer goods and technology. These reports provide in-depth analysis and deep segmentation to possible micro levels. With wider scope and stratified research methodology, our syndicated reports thrive to provide clients to serve their overall research requirement.

Transparency Market Research

90 Sate Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Technologies Market Is Predicted To Rise At An Outstanding 20.9% CAGR Between 2017 And 2024 here

News-ID: 1116606 • Views: …

More Releases from Transparency Market Research

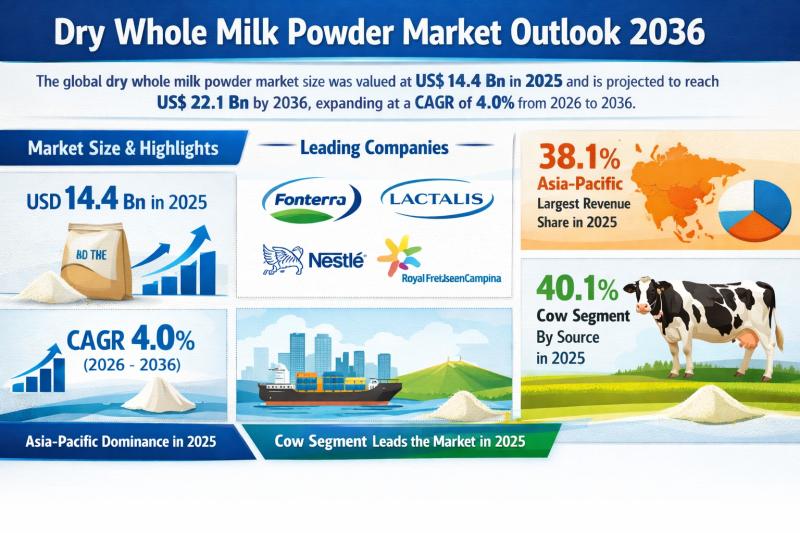

Dry Whole Milk Powder Market Outlook 2036: Set to Reach USD 22.1 Billion by 2036 …

The global Dry Whole Milk Powder (DWMP) market was valued at US$ 14.4 Bn in 2025 and is projected to reach US$ 22.1 Bn by 2036, expanding at a steady CAGR of 4.0% from 2026 to 2036. The market's expansion reflects growing global demand for shelf-stable dairy ingredients, rising consumption of processed foods, and increasing reliance on milk powder in regions with limited cold-chain infrastructure.

Asia-Pacific dominated the global market in…

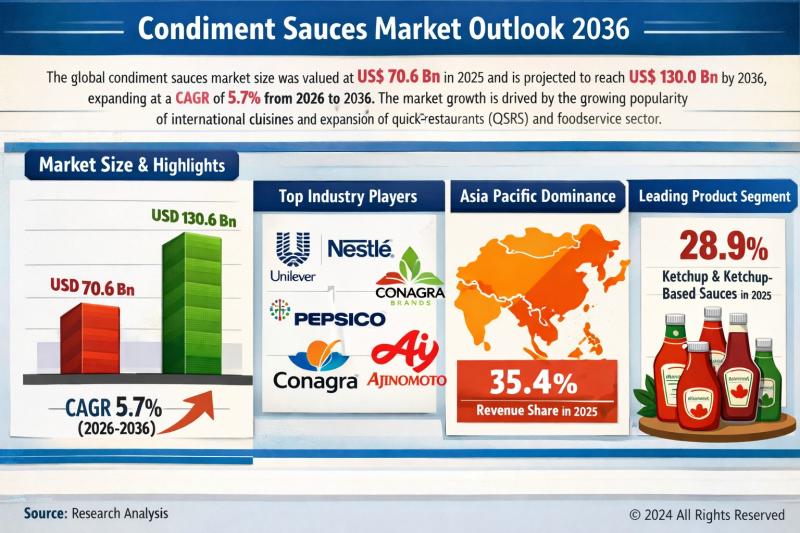

Global Condiment Sauces Market Outlook 2036: Industry to Reach US$ 130.0 Billion …

The global condiment sauces market was valued at US$ 70.6 Bn in 2025 and is projected to reach US$ 130.0 Bn by 2036, expanding at a steady CAGR of 5.7% from 2026 to 2036. The industry's growth trajectory reflects strong structural demand across both household and commercial foodservice channels.

Between 2021 and 2024, the market demonstrated consistent resilience, supported by urbanization, expansion of quick-service restaurants (QSRs), and rising consumer inclination toward…

Smart Parking Technologies Market to be Worth USD 17.49 Bn by 2031 - By Off-Stre …

The global Smart Parking Technologies Market is witnessing significant expansion and is poised for sustained long-term growth. Valued at US$ 3,543.9 Mn in 2020, the market is projected to reach US$ 17,492.4 Mn by 2031, expanding at a robust CAGR of 17.3% during the forecast period (2021-2031).

Unlock crucial data and key findings from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=84619

The rapid evolution of urban infrastructure, growing vehicle density in metropolitan areas,…

Soft Magnetic Composites Market Expanding at 7.2% CAGR Through 2031 - By Materia …

The global Soft Magnetic Composites (SMCs) market is poised for substantial expansion over the coming decade. Valued at US$ 4,673.8 Mn in 2020, the market is projected to reach US$ 9,883.5 Mn by 2031, registering a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2021 to 2031.

Unlock crucial data and key findings from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=60138

The steady rise in demand for high-efficiency electric…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…