Press release

Generics will continue their domination on the pharmaceutical market in Central and Eastern Europe until 2011

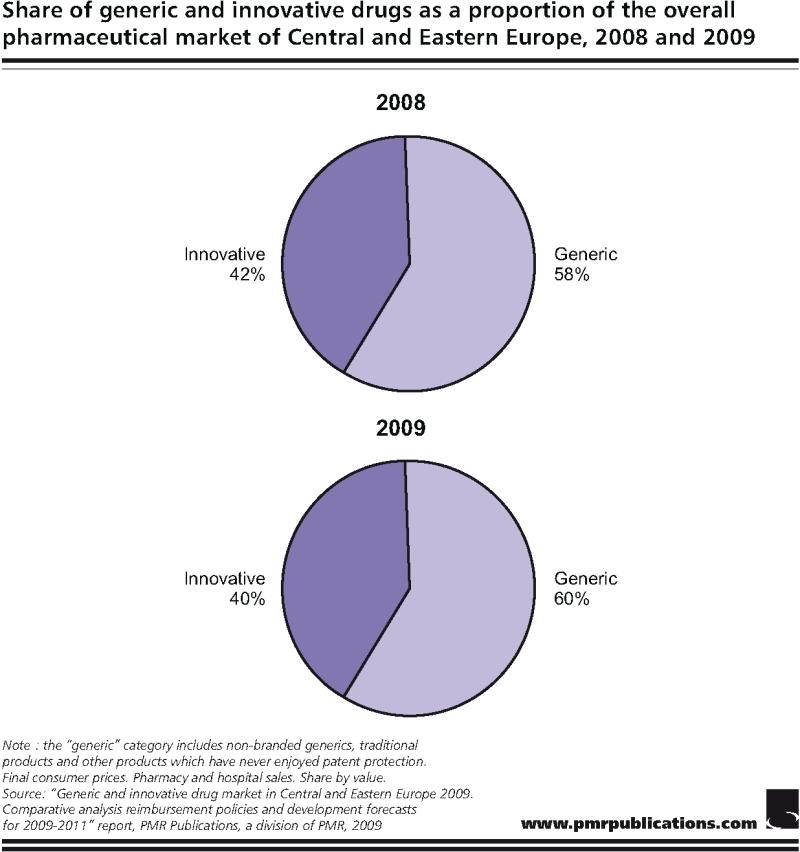

The pharmaceutical market in Central and Eastern Europe is dominated by generic drugs. This subdivision was worth €17.2bn in 2008 and is expected to develop by around 14% per annum between 2009 and 2011. The growth rate of the innovative drug market, which was worth €12.4bn in 2008, will be slower, according to the latest report from PMR, a research and consulting company, entitled “Generic and innovative drugs market in Central and Eastern Europe 2009. Comparative analysis, reimbursement policies and development forecasts for 2009-2011”.Generics to account for 60% of the market in 2009

According to PMR estimates, the generic drug market (including non-branded generics, traditional products and other products which have never enjoyed patent protection) in Central and Eastern Europe was worth €17.2bn in 2008, in contrast to a market value figure of €12.4bn for innovative drugs. Generic drugs therefore accounted for around 58% of the pharmaceutical market in the region in terms of value (taking into account both pharmacy and hospital sales).

The CAGR for generics will reach as much as 14% between 2009 and 2011, whereas that of innovative drugs will be much lower. “As a result, the share of generic drugs will constantly increase and in 2009 generics will account for around 60% of the pharmaceutical market in Central and Eastern Europe”, according to Agnieszka Stawarska, Pharmaceutical Market Analyst at PMR and a co-author of the report.

Although the innovative drug market in Central and Eastern Europe will develop at a slower rate than that of generic drugs between 2009 and 2011, the growth rate of original medicines for the whole region will be positive. It has, for the time being, been compromised by the cost-containment policies of the CEE countries, which have been stepped up during the global financial crisis. However, in the medium term PMR expects an improvement in health awareness and the modernisation of healthcare systems, including the development of private health insurance and the establishment of health insurance and drug reimbursement systems, similar to those in European countries, in Russia and Ukraine, to be drivers of the innovative drug market in the CEE countries. An additional driver will be the aging of the population in the region.

Local companies are generic-oriented…

There are few innovative pharmaceutical companies of local origin in Central and Eastern Europe. Most companies based in the region are generic drug manufacturers. “The largest players of this kind include Gedeon Richer, Krka, Egis and Zentiva. These companies have a presence in most CEE countries and they are well-established there” Monika Stefanczyk, Head Pharmaceutical Market Analyst at PMR and a co-author of the report, explains. For such companies, the region of Central and Eastern Europe is usually the main area of their activities.

The second group of companies consists of global generic players. Their presence differs from one CEE country to the next. For example, Dr. Reddy’s, an Indian generic manufacturer, concentrates on Russia, which is one of the company’s key markets worldwide. Actavis, an Iceland-based manufacturer, is at its strongest in Bulgaria and Russia. Ranbaxy’s key markets in the region are Romania and the CIS countries (Russia and Ukraine in particular). Stada has a strong presence in Russia, particularly after the acquisition of two Russian companies (Nizhpharm and Makiz-Pharma); and at the beginning of 2009 the company entered Poland and Bulgaria by establishing subsidiaries there.

A number of consolidation processes recently took place in the generic arena, which were of great importance for Central and Eastern Europe. For example, Teva gained a strong presence in the region through the acquisition of Barr in July 2008, which included one of the largest local generic drug producers − the Croatian company Pliva. In June 2008, Mylan, a US generic manufacturer, acquired the CEE generics businesses of Merck KGaA, the prominent German drug manufacturer. The deal includes Merck’s operations in Poland, Hungary, Slovakia, Slovenia and the Czech Republic. In March 2009 Zentiva, one of the leading generic players in the region, was bought by Sanofi-Aventis. In May 2009 Novartis acquired the generic cancer drug production division of the Austria-based EBEWE Pharma.

…whereas innovation is the domain of global concerns

The innovative drug market in the region is dominated by multinational pharmaceutical concerns. Such companies have representative offices in most of the Central and Eastern European countries, but, as they are active all over the world, the region is not, in most cases, their main market. However, innovative drug producers often choose Central and Eastern Europe as a place in which to locate clinical trials, because of the low costs, high population and limited access to innovative therapies in such countries.

Today innovative companies face a crisis associated with the loss of patent rights pertaining to their most important products, which is expected to affect their sales performance in Central and Eastern Europe also, as many players of domestic origin may launch the generic equivalents of their drugs on the market.

This press release is based on information contained in the latest PMR report entitled “Generic and innovative drugs market in Central and Eastern Europe 2009. Comparative analysis, reimbursement policies and development forecasts for 2009-2011”.

PMR Publications (www.pmrpublications.com) is a division of PMR, a company providing market information, advice and services to international businesses interested in Central and Eastern European countries and other emerging markets. PMR key areas of operation include market research (through PMR Research), consultancy (through PMR Consulting) and business publications (through PMR Publications). With over 13 years of experience, highly skilled international staff and coverage of over 20 countries, PMR is one of the largest companies of its type in the region.

PMR Publications

ul. Supniewskiego 9

31-527 Krakow, Poland

tel. +48 12 618 90 00, fax +48 12 618 90 08

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Generics will continue their domination on the pharmaceutical market in Central and Eastern Europe until 2011 here

News-ID: 108978 • Views: …

More Releases from PMR Publications

Russian retail market recovered after the economic slowdown

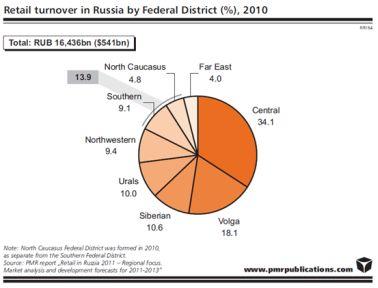

Retail markets in all Russian Federal Districts increased in 2010 by total $80bn

In 2010, Russian retail market recovered after the economic slowdown observed in the previous year and increased by 12.6% to RUB 16.4tr ($541bn). However, the latest PMR report „Retail in Russia 2011 – Regional focus. Market analysis and development forecasts for 2011-2013” shows that particular regional retail markets still reveal differences in their development due to their unique…

Construction output in Poland up by 10% in 2011

The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled "Construction sector in Poland, H2 2010 -…

Russian construction industry recovers after the downturn

For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions…

Retail market in Russia to grow by almost 10% in 2010

The growth rate of the Russian retail sector dropped severely last year due to worsening economic conditions, weakening purchasing power growth and the depreciating rouble. As a result, the retail market's value increased by only 5% in 2009 after several years of roughly 25% annual growth. Nevertheless, the situation has improved this year, and the retail market is expected to once again reach double-digit growth rates in subsequent years.

According to…

More Releases for Europe

2019 Strategy Consulting Market Analysis | McKinsey, The Boston Consulting Group …

Strategy Consulting Market reports also offer important insights which help the industry experts, product managers, CEOs, and business executives to draft their policies on various parameters including expansion, acquisition, and new product launch as well as analyzing and understanding the market trends

Need for strategic planning in highly competitive environment and to develop business capabilities to meet & exceed the emerging requirements are the major drivers which help in surging…

Strategy Consulting Market 2025 | Analysis By Top Key Players: Booz & Co. , Rola …

Global Strategy Consulting Market 2019-2025, has been prepared based on an in-depth market analysis with inputs from industry experts. This report covers the market landscape and its growth prospects over the coming years. The report also includes a discussion of the key vendors operating in this market.

The key players covered in this study

McKinsey , The Boston Consulting Group , Bain & Company , Booz & Co. , Roland Berger Europe…

Digital Strategy Consulting Market is Thriving Worldwide with Deloitte, McKinsey …

A Digital Strategy is a form of strategic management and a business answer or response to a digital question, often best addressed as part of an overall business strategy. A digital strategy is often characterized by the application of new technologies to existing business activity and focus on the enablement of new digital capabilities to their business.

A new report as a Digital Strategy Consulting market that includes a comprehensive analysis…

Strategy Consulting Market 2019: By McKinsey, The Boston Consulting Group, Bain …

This report studies the global Strategy Consulting market, analyzes and researches the Strategy Consulting development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

• McKinsey

• The Boston Consulting Group

• Bain & Company

• Booz & Co.

• Roland Berger Europe

• Oliver Wyman Europe

• A.T. Kearney Europe

• Deloitte

• Accenture Europe

Get Sample Report@ https://www.reporthive.com/enquiry.php?id=1247388&req_type=smpl&utm_source=AB

Market segment by Type, the product can be split into

• Operations Consultants

• Business Strategy Consultants

• Investment Consultants

• Sales and…

Strategy Consulting Market Analysis 2018: McKinsey, The Boston Consulting Group, …

Orbis Research Present’s “Global Strategy Consulting Market” magnify the decision making potentiality and helps to create an effective counter strategies to gain competitive advantage.

The global Strategy Consulting status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Strategy Consulting development in United States, Europe and China.

In 2017, the global Strategy Consulting market size was million US$ and it is expected to reach million…

Influenza Vaccination Market Global Forecast 2018-25 Estimated with Top Key Play …

UpMarketResearch published an exclusive report on “Influenza Vaccination market” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 115 pages which highly exhibits on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability. This report focuses on the Influenza Vaccination market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This…