Press release

Online Payment Security Market: Increasing Adoption Of Digital Payment Modes

In the recent back, owing to the growing ubiquity of smartphones, laptops, and tablets, the market for online payment has expanded leaps and bounds. But, at the same time, the incidences of cyber-attacks have multiplied exponentially too. Under these conditions, a number of organizations operating in the financial sector are resorting to strongest security measures that are available and consequently, the market for online payment security is flourishing. According to this business and commerce publication, the demand in the global online payment security market will expand at a notable CAGR during the forecast period of 2017 to 2025.Apart from increasing adoption of digital payment modes, the growing need to adhere to PCI DSS guidelines and rise in fraudulent activities in ecommerce are some of the other factors augmenting the demand in the global online payment security market. On the other hand, the lack of trust on online banking in a number of underdeveloped regions, low awareness levels in rural areas, and high cost of advanced payment security solutions are a few restraints obstructing the market from flourishing. Nevertheless, the vendors operating in this market are expected to gain new opportunities from the rising demand for advanced payment solutions from digital ecommerce.

This report on the global online payment security market has been developed by a group of professional research analysts for targeted audiences such as payment security vendors, government agencies, network solution providers, and system integrators. The report provides comprehensive analysis of all drivers and restraints and evaluates their eventual impact over the demand. The report also tries to gauge the quantity of demand that can be expected out of various regions and countries. To finish a thorough study, the report has included a dedicated chapter on the competitive landscape in the global online payment security market, profiling a number of leading companies and evaluating their position at the international level.

Request PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=30200

Global Online Payment Security Market: Snapshot

Online payments and transactions are the order of the day. Not just the millennial generation, but those from the older demographic too have been lapping it up because of the convenience it accords – fast and easy transfer with just a few taps or clicks on smartphones or laptops. From banks, becoming increasingly keen on customer retention, to the numerous online wallets – all of them are serving to drive up online payments by focusing on innovative solutions.

A crucial element of online payments and transactions are is safety. With data theft, hacking attacks, and phishing attacks on the rise, it has become increasingly necessary to bulwark the sensitive data of customers and bring about secure transaction between a merchant and its customers via web, PoS machines, or mobile.

Payment security platforms – comprising of both solutions and services – enable both private and public entities to thwart payment frauds and secure business transactions carried out online. Payment security solutions help organizations to minimize the loss of financial data through control and regular monitoring of malicious activities across various payment modes.

The demand for payment security software is expected to increase in the coming years owing to the investments in payment security software technologies, partnership between payment security software providers and financial organization, FinTech investments, and digitization across various industries globally. The payment security software market is compressive of a large number of private and public companies.

North America is expected to have the largest market share and dominate the payment security market during the forecast period, due to the presence of a large number of payment security vendors in this region. APAC, on the other hand, offers potential growth opportunities in the payment security market as there is a wide presence of Small and Medium-Sized Enterprises (SMEs) in this region. These SMEs are turning toward payment security services to defend against advanced payment frauds.

Global Online Payment Security Market: Snapshot

Online payment systems are quickly being actualized because of advancement in innovation. Security concerns are ascending with the expanding utilization of associated gadgets and a huge number of computerized payments. Protection and classification of data, particularly identified with money related information is harming to consumer loyalty. There are heaps of money related exchanges performed online on consistent schedule including payments to online shopping sites, dealer stores, charge payments or bank exchanges. Every single such exchange make immense measure of secret information that should be secured against security breaks. Secure execution of web based business payment framework incorporates recognizing burglary and online cheats and lightening them.

There are different strategies utilized for execution of secure online payment framework. Encryption and tokenization are utilized to enhance payment security process, and make it without vulnerabilities and dangers. Secure attachment layer (SSL) encryption guarantees client's classified card information isn't bargained or presented to outsiders amid exchanges. Equipment ensured alter safe security module (TRSM) is use for ensuring information before it enters the shipper framework, keeping up security amid a basic piece of the exchange lifecycle. Firewalls are likewise being introduced to perform secure online payment exchanges.

Report TOC: https://www.transparencymarketresearch.com/sample/sample.php?flag=T&rep_id=30200

About TMR

Transparency Market Research (TMR) is a global market intelligence company providing business information reports and services. The company’s exclusive blend of quantitative forecasting and trend analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information.

TMR’s data repository is continuously updated and revised by a team of research experts so that it always reflects the latest trends and information. With extensive research and analysis capabilities, Transparency Market Research employs rigorous primary and secondary research techniques to develop distinctive data sets and research material for business reports.

Contact TMR

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email:sales@transparencymarketresearch.com

Website:http://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Payment Security Market: Increasing Adoption Of Digital Payment Modes here

News-ID: 1077935 • Views: …

More Releases from Transparency Market Research

Power Lawn and Garden Equipment Market Size Forecast to USD 188.4 Billion by 203 …

Power Lawn and Garden Equipment Market Outlook 2036

The global power lawn and garden equipment market was valued at US$ 93.9 Billion in 2025 and is projected to reach US$ 188.4 Billion by 2036, expanding at a steady CAGR of 6.6% from 2026 to 2036. Market growth is driven by increasing residential landscaping activities, rising demand for battery-powered equipment, expanding commercial landscaping services, and growing consumer interest in outdoor aesthetics.

👉 Get…

Global Embedded System Market to Reach USD 211.6 Bn by 2036, Expanding at 6.5% C …

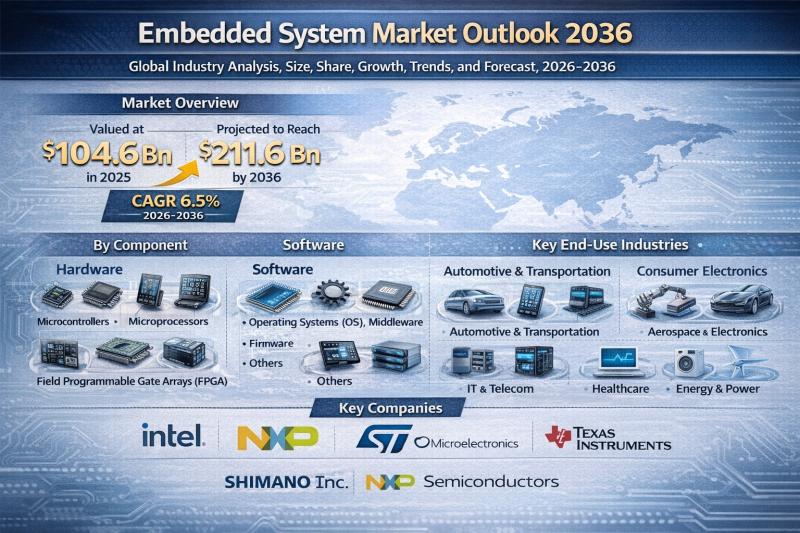

The global embedded system market is poised for steady and sustained growth over the next decade, driven by rapid digital transformation across industries. Valued at US$ 104.6 Bn in 2025, the market is projected to reach US$ 211.6 Bn by 2036, expanding at a CAGR of 6.5% from 2026 to 2036. The increasing integration of embedded systems in automotive electronics, industrial automation, and IoT-enabled devices is positioning the industry as…

Industrial Fasteners Market Outlook 2036: Global Industry to Reach US$ 146.5 Bil …

The global industrial fasteners market was valued at US$ 104.6 Bn in 2025 and is projected to reach US$ 146.5 Bn by 2036, expanding at a steady CAGR of 3.1% from 2026 to 2036. The industry reflects consistent, volume-driven growth supported by expanding construction activities, infrastructure modernization, automotive production, and aerospace engineering advancements.

Between 2021 and 2024, the market demonstrated stable recovery post-pandemic, driven by revived industrial production and capital investments…

Digital Biomanufacturing Market Outlook 2035: AI-Driven MES, PAT, and Digital Tw …

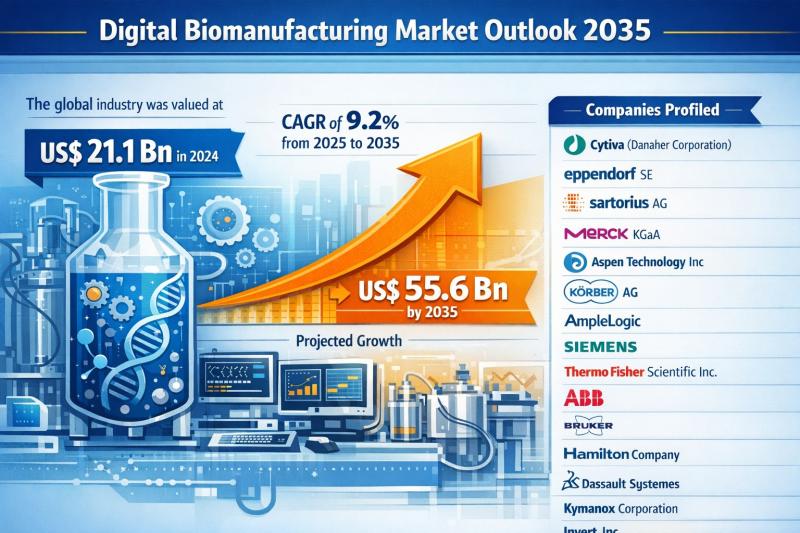

The global digital biomanufacturing market was valued at US$ 21.1 Bn in 2024 and is projected to expand at a robust CAGR of 9.2% from 2025 to 2035, crossing US$ 55.6 Bn by the end of 2035. The strong double-digit expansion trajectory underscores the accelerating adoption of digital tools across biologics production facilities worldwide.

Between 2020 and 2024, the market witnessed steady adoption, supported by rapid digitalization efforts following pandemic-driven supply…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…