Press release

Light at the end of tunnel for the Russian construction industry

The construction industry in Russia has been hit hard by the global economic downturn. The slowdown on the domestic construction market began in 2008 and has intensified in 2009. The majority of construction projects have been suspended and virtually no new residential or commercial property projects have been started. For the first time this decade, the value of construction works will have shrunk – by over 15% in comparison with 2008. Despite this though, it seems that the worst of the storm has passed and market stability should return in 2010, with the promise of growth in 2011.According to the “Construction sector in Russia 2009 – Development forecasts for 2009-2012” report recently published by PMR, a research and consulting company, the situation on the Russian construction market began to deteriorate in the second half of 2008 and the slowdown deepened towards the end of the year. Yet thanks to healthy growth figures posted in H1, growth figures for the entire year remained strong. “Without the buffer of a strong first six months, 2009 has witnessed a fully fledged construction crisis, with output, employment and other key indicators for the industry falling sharply.”, according to Robert Obetkon, a Senior Construction Analyst at PMR and the author of the report. In rouble terms and at the time of publication, the Russian construction industry contracted by 18.4% in the first three quarters of 2009. In dollar terms, however, and due to the depreciation of the rouble, the value of the industry plummeted to just $81bn for the period Q1-Q3 2009 – down from $129bn in the same period one year earlier.

Residential construction figures indicate that this segment has thus far not been dramatically affected by the economic crisis. After a 6.5% growth last year, the number of housing units built in Russia underwent a slight decrease during the first nine months of the year. The total floor space of apartments completed (up 4.6% last year) fell by 0.6% in Q1-Q3 2009. However, the decline in housing construction levels is expected to intensify in the upcoming months as hardly any new residential projects are being commenced.

“While residential and non-residential construction activity will remain relatively subdued at least for the next year due to ongoing difficulties in securing financing, most construction contracts will be related to infrastructure development projects.”, says Robert Obetkon. These will serve to boost the overall level of construction activity in the country.

Increased capital expenditure on road and railway construction, as well as airport expansion, will be driven by the federal programme aimed at modernising the country's transport system between 2010 and 2015. This programme will require a total investment of $420bn, of which $147bn will be sourced from the federal coffers. Assuming a conservative scenario whereby only 10% of the programme will be implemented, this will equate to a $7bn annual boost in construction activity each year through to 2015. With the federal budget deficit expected to be 3-7% of GDP over the next three years, much of the funding for Russia's infrastructure projects will have to be provided by private investors through schemes such as public-private partnerships and other non-budgetary sources, which will thus increase in importance.

The projects that will provide a boost to the construction industry in the upcoming years include the first public-private partnership (PPP) projects, signed in 2009. These include the $1.5bn contract for the construction of the first section of a toll motorway between Moscow and St. Petersburg, and the $2.1bn contract for the upgrade of Pulkovo Airport. The PPP scheme in Russia demonstrates great potential: 20% of infrastructure development and modernisation projects planned for the next ten years in Russia are to be financed through PPPs.

Apart from transport infrastructure, substantial investment is also planned in the energy sector. The main projects include the $1.2bn reconstruction of the Sayano-Shushenskaya Hydroelectric Power Plant and the construction of several nuclear power plants. Other major infrastructure projects planned in Russia include the new spaceport, Vostochny Cosmodrome, the construction of which should commence in 2011 and is expected to cost $12.5bn.

An additional boost in infrastructure spending will be provided by the $1bn infrastructure investment fund established jointly in July 2009 by Vnesheconombank, Renaissance Capital Group, the European Bank for Reconstruction and Development (EBRD), the International Finance Corporation (a part of the World Bank), the Development Bank of Kazakhstan, and the international investment company, the Macquarie Group. The fund will invest in the development of Russia's transport infrastructure, power engineering, municipal services, airports, ports, roads, etc.

Russia’s preparations for the Sochi 2014 Winter Olympics and the APEC Summit to be held in Vladivostok in 2012 are also serving to support the country’s construction industry. The total investment related to these two events may well eventually exceed $20bn, of which the lion’s share will be spent on the construction and modernisation of civil engineering structures, such as roads, railways, tunnels, airport facilities and power infrastructure, as well as sports venues (predominately stadiums).

This press release is based on information contained in the latest PMR report entitled “Construction sector in Russia 2009 – Development forecasts for 2009-2012”.

You are welcome to contact the author of the report:

Robert Obetkon, Senior Construction Analyst

tel. /48/ 12 618 90 56

e-mail: robert.obetkon@pmrpublications.com

For more information on the report please contact:

Marketing Department:

tel. /48/ 12 618 90 00

e-mail: marketing@pmrcorporate.com

About PMR

PMR Publications (www.pmrpublications.com) is a division of PMR, a company providing market information, advice and services to international businesses interested in Central and Eastern European countries and other emerging markets. PMR key areas of operation include market research (through PMR Research), consultancy (through PMR Consulting) and business publications (through PMR Publications). With over 13 years of experience, highly skilled international staff and coverage of over 20 countries, PMR is one of the largest companies of its type in the region.

PMR

ul. Supniewskiego 9, 31-527 Krakow, Poland

tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08

www.pmrcorporate.com

Ania Rojek

Marketing Department

pmr.marketing@pmrcorporate.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Light at the end of tunnel for the Russian construction industry here

News-ID: 104140 • Views: …

More Releases from PMR Publications

Russian retail market recovered after the economic slowdown

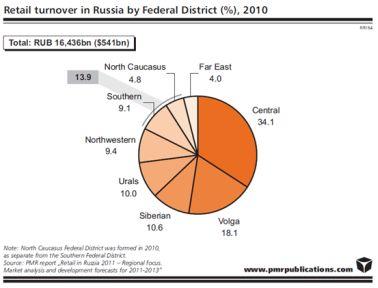

Retail markets in all Russian Federal Districts increased in 2010 by total $80bn

In 2010, Russian retail market recovered after the economic slowdown observed in the previous year and increased by 12.6% to RUB 16.4tr ($541bn). However, the latest PMR report „Retail in Russia 2011 – Regional focus. Market analysis and development forecasts for 2011-2013” shows that particular regional retail markets still reveal differences in their development due to their unique…

Construction output in Poland up by 10% in 2011

The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled "Construction sector in Poland, H2 2010 -…

Russian construction industry recovers after the downturn

For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions…

Retail market in Russia to grow by almost 10% in 2010

The growth rate of the Russian retail sector dropped severely last year due to worsening economic conditions, weakening purchasing power growth and the depreciating rouble. As a result, the retail market's value increased by only 5% in 2009 after several years of roughly 25% annual growth. Nevertheless, the situation has improved this year, and the retail market is expected to once again reach double-digit growth rates in subsequent years.

According to…

More Releases for Russia

Russia Agriculture Market, Russia Agriculture Industry, Russia Agriculture Lives …

The agriculture sector of Russia country is the most steadily developing sector of the national economy. Country’s most important crops are sunflower oil, grains and corn. Russia country is a world champion for the export of wheat & buckwheat and amongst the top ten in terms of the export of many other crops. The country has also exporting a variety of livestock products and value-added food products. Country also produces…

Russia General Insurance Market Next Big Thing | Major Giants Allianz - Russia, …

HTF Market Intelligence released a new research report of 77 pages on title 'Russia General Insurance - Key Trends and Opportunities to 2025’ with detailed analysis, forecast and strategies. The study covers key regions that includes North America, Europe or Asia and important players such as Reso-Garantia, Alfa Strakhovanie, Ingosstrakh, VSK, Rosgosstrakh, Sogaz, Soglasie Insurance Company Ltd, Renaissance Group Insurance, YUZHURAL - ASKO, NSG-ROSENERGO Ltd, Sberbank Insurance Company LLC, VTB…

Russia Analysis of Viscosupplementation Market: Russia Industry & Opportunity As …

The single injection viscosupplementation segment in the Russia Viscosupplementation Market is expected to expand at the fastest and highest CAGR of 6.0% over the forecast period, due to relatively less competition across the product type segments. The three injection viscosupplementation product type segment was estimated to account for more than 69.4% share of the Russia viscosupplementation market in 2016, which is projected to increase to over 68.8% by the end…

Consumer Electronics in Russia

Summary

After the collapse of retail volume sales of consumer electronics in 2015, the negative trend continued in 2016. Although prices of oil were partly restored, business investments and the real income of Russians continued to decline, making a fast recovery of Russia’s economy questionable. As a result, consumers in Russia became very cautious when making their purchasing decisions. Despite the strong overall decline in retail volume sales, the performances of…

Consumer Health in Russia

Summary

Russian consumers are becoming more restrained in terms of spending money on consumer health products. The trend towards economising has become more widespread due to an economic slowdown in Russia and the consequent decrease in consumers’ disposable incomes. Russians are showing a greater preference for cheaper remedies or refusing to purchase any in the case of mild ailments that can be cured by traditional medicines. This is particularly so for…

Russia Hotels – Best Hotels Available in Russia

Are you tired of searching for best hotels in Russia through search engines, now there is no need to waste your valuable time digging search engines, because we proudly announce besthotelsrussia.com here you get all details about hotels available in Russia. Russia is the largest country in the world this place covers almost the whole of Asia and 40% of Europe. It also has huge population ranking in ninth position…