Press release

Ongoing Forecast Study on Financial Fraud Detection Software Market to Reveal Key Insights Assessed for 2017-2027 Period

Fraud is an illegal act which involves unjustifiably claiming something valuable. Financial Fraud is an issue with widespread consequences in the financial service industry, government, and corporate sectors. Hence financial institutions need a real- time automated system to detect fraud across multiple channels and transactions every day. With the rise of big data analytics, traditional methods of fraud detection such as manual detection appear inaccurate and more importantly time consuming. Hence, enterprises today invest in financial fraud detection software which integrate statistical and computational methods and big data analytics. Fraud detection software is a solution which consists of a model built by machine learning methods and stream computing. This model analyses client’s past data to detect possible fraud patterns. Financial fraud detection software supports in minimizing losses by reducing detection time, manage massive data sets and use correlation to identify fraud patterns or unusual behaviors.Financial Fraud Detection Software Market: Drivers and Restraints

In recent years the development of new technologies has also provided numerous ways for criminals to commit fraud. Solutions such as cloud services, increased in preference of digital data make enterprises significantly vulnerable to fraud. This turns out to be a big driver for fraud detection software market. Frauds are majorly committed for monetary benefits, resulting in considerable depreciation in the revenue of the organization. This has magnified the demand of financial fraud detection software in the enterprises being one important driver for this market growth.

Request For Report Sample@ https://www.futuremarketinsights.com/reports/sample/rep-gb-3441

The high cost of various machine learning and statistical analytics solutions is a challenge for this market causing hindrance to the growth of market. The infrastructure demand before the deployment of these software and low level of awareness are also some restraints for this market.

Financial Fraud Detection Software Market: Segmentation

Financial Fraud Detection Software Market can be segmented on the basis of end user, deployment type, and region. On the basis of end user it can further segmented into financial enterprises, educational institutions, healthcare, government, and manufacturing sectors. Deployment type category includes money laundering, identity theft, credit/debit card fraud, wire transfer fraud, subscription frauds and claim frauds. Region wise, Financial Fraud Detection Software Market can be segmented into North America, Latin America, Asia Pacific, Japan, Eastern Europe, Western Europe, and Middle East & Africa.

Financial Fraud Detection Software Market: Regional Overview

North America emerges as the leader in the financial fraud detection software due to presence of large financial and healthcare enterprises in the countries such as USA and Canada. Companies such as Gemalto NV, SEKUR.me, CipherCloud, SIGNIFYD Inc., Riskified Ltd. are some of the majority software providers for financial fraud detection in USA.

European countries such as France, Greece and UK are also expanding their market and will see a good rate of growth in future in financial fraud detection software due to increase in crimes such as card fraud and identity fraud. Experian Information Solutions, Inc., AimBrain, ValidSoft, and Easy Solutions,Inc. are some key players in Europe’s fraud and authentication market.

Visit For TOC@ https://www.futuremarketinsights.com/toc/rep-gb-3441

Asia- Pacific is also expected to grow significantly in financial fraud detection software market at a considerable pace due increase in corporate fraud and corruption in government organizations followed by Latin America.

ABOUT US:

Future Market Insights (FMI) is a leading market intelligence and consulting firm. We deliver syndicated research reports, custom research reports and consulting services, which are personalized in nature. FMI delivers a complete packaged solution, which combines current market intelligence, statistical anecdotes, technology inputs, valuable growth insights, an aerial view of the competitive framework, and future market trends.

CONTACT

Future Market Insights

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Website: http.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ongoing Forecast Study on Financial Fraud Detection Software Market to Reveal Key Insights Assessed for 2017-2027 Period here

News-ID: 991608 • Views: …

More Releases from Future Market Insights

Ice Cream and Frozen Dessert Market Forecast 2025-2035: Market to Reach USD 306, …

The global ice cream and frozen dessert market is projected to grow significantly over the next decade, expanding from USD 148,672.5 million in 2025 to USD 306,418.7 million by 2035, registering a CAGR of 7.5%. According to the latest analysis by Future Market Insights (FMI), growth is fueled by evolving consumer preferences toward indulgent yet healthier dessert options, innovative product formulations, and expanding retail accessibility.

The market has evolved far beyond…

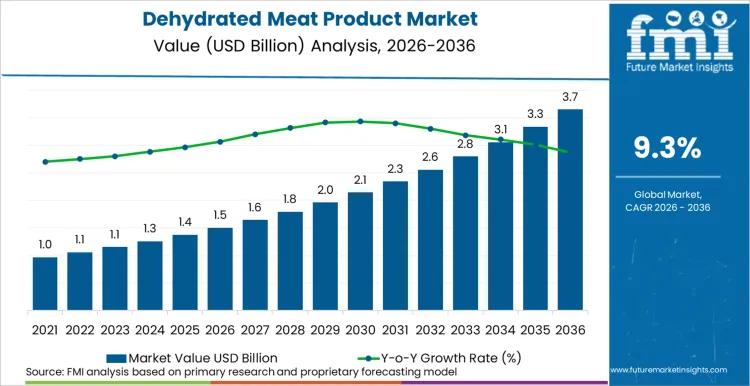

Dehydrated Meat Product Market Forecast 2026-2036: Market to Reach USD 3,784.7 M …

The global dehydrated meat product market was valued at USD 1,423.0 million in 2025 and is projected to grow to USD 1,555.3 million in 2026, reaching USD 3,784.7 million by 2036. According to the latest analysis by Future Market Insights (FMI), the market is set to register a CAGR of 9.3% during the forecast period.

Absolute dollar growth of USD 2,229.3 million over the decade reflects an accelerating shift in snacking…

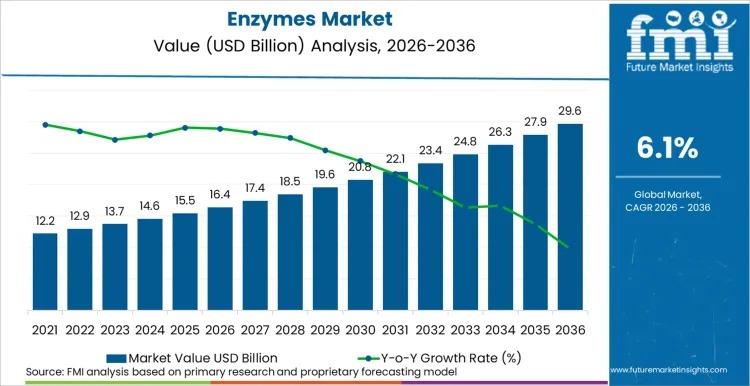

Enzymes Market Forecast 2026-2036: Market to Reach USD 29.7 Billion by 2036 at 6 …

The global enzymes market is projected to grow steadily over the next decade, expanding from USD 16.4 billion in 2026 to USD 29.7 billion by 2036, registering a CAGR of 6.1%. According to the latest analysis by Future Market Insights (FMI), growth is fueled by expanding industrial biotechnology integration, energy-efficient detergent formulations, and increasing demand for clean-label food processing solutions.

In 2025, the global enzymes market was valued at USD 15.4…

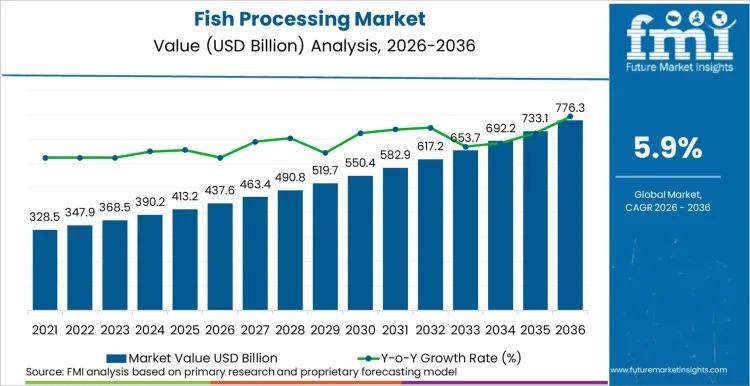

Fish Processing Market Forecast 2026-2036: Market to Reach USD 776.3 Billion by …

The global fish processing market was valued at USD 413.2 billion in 2025 and is projected to expand from USD 437.6 billion in 2026 to USD 776.3 billion by 2036, registering a CAGR of 5.9% during the forecast period, according to the latest analysis by Future Market Insights (FMI).

Absolute dollar growth of USD 338.7 billion over the decade reflects both volume expansion in developing economies and premiumization trends in mature…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…