Press release

Anti-Money Laundering Software Market - Top Players (Accenture Inc., SAS Institute Inc., Fiserv, Inc., Opentext) Forecast 2017 - 2026

Companies, especially in the financial services industry are investing in the anti-money laundering software to effectively track the transactions and eliminate the risk of fraudulent. Companies offering anti-money laundering software are also focusing on providing effective and efficient software including currency transaction reporting software, transaction monitoring software, compliance management software, customer identity management software in order to meet critical business requirements and simplify complex operations, thereby minimizing the risk associated with the business.Increasing adoption of anti-money laundering software in developing countries and robotic process automation in anti-money laundering software and KYC are some of the factors fueling the market growth. Anti-money laundering software predictive models are also helping banks to manage risk by using advanced features. Banks are also increasingly adopting anti-money laundering software with KYC analytics in order to properly understand, manage the flow of data. Money worth of approx. 2-5% of the global GDP is laundered in a year, ranging between $800 billion to $2 trillion, according to the United Nations Office on Drugs and Crime (UNODC).

Request Sample: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38105

Key players in the global anti-money laundering software are NameScan, a member of the Neurocom group, Siron, Verafin Inc., NICE, BAE Systems, ACI Worldwide, Inc., Trulioo, Ascent Technology Consulting, EastNets, FICO TONBELLER, Experian, Oracle Corp, Opentext, SAS Institute Inc., Accenture Inc., and Fiserv, Inc.

Global Anti-Money Laundering Software to Witness Robust Growth during the Forecast Period 2017-2026

As per the latest report by Transparency Market Research (TMR), the global anti-money laundering software market is expected to witness robust growth. The market is also projected to record an exponential CAGR of 12.1% throughout the forecast period. The global anti-money laundering market is also expected to generate the revenue of US$ 4,262.0 million by the end of 2026.

The global anti-money laundering software market is segmented into deployment type, solution type, end-user type, product type, and region.

On the basis of product type, the market is further divided into Compliance Management Software, Transaction Monitoring Systems, Customer Identity Management Systems, and Currency Transaction Reporting (CTR) Systems. Transaction monitoring systems is expected to witness the highest growth during the forecast period.

Browse Our Report: https://www.transparencymarketresearch.com/anti-money-laundering-software-market.html

By end-users, retail banking is anticipated to be the largest user of anti-money laundering software during 2017-2026. Based on the solution type, among various solution types, transactional monitoring is likely to witness significant growth in the coming years.

Deployment type is further segmented into on-premise, and cloud-based. From these two segments, on-premise is expected to be the most preferred deployment type during 2017-2026.

North America to Dominate the Global Anti-Money Laundering Software Market through 2026

North America is expected to remain dominant in the global anti-money laundering software market. The financial institutions in the U.S. strictly follow customer identification program to verify each customer, thus reducing the money laundering. Owing to the technological advancements the use of anti-money laundering software with advanced features has increased in North America. Also, the laws regarding anti-money laundering require financial institutions to have the customer identification and anti-money laundering program. Hence, leading companies are developing software that can help financial institutions to meet anti-money laundering and Bank Secrecy Act requirements.

View TOC: https://www.transparencymarketresearch.com/report-toc/38105

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants, use proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

US Office

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Money Laundering Software Market - Top Players (Accenture Inc., SAS Institute Inc., Fiserv, Inc., Opentext) Forecast 2017 - 2026 here

News-ID: 973600 • Views: …

More Releases from Transparency Market Research

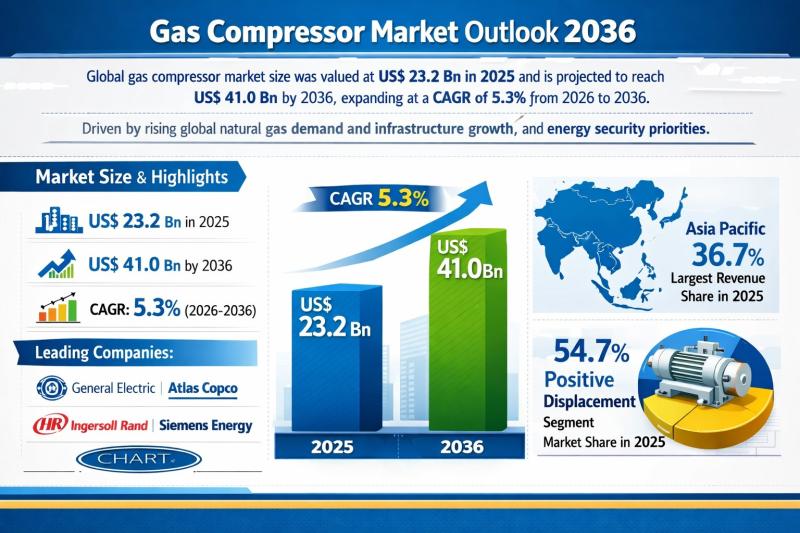

Gas Compressor Market Outlook 2036: Global Industry Expected to Reach US$ 41.0 B …

The global gas compressor market was valued at US$ 23.2 Bn in 2025 and is projected to reach US$ 41.0 Bn by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. This steady growth trajectory reflects the structural importance of gas compression systems across upstream, midstream, and downstream gas value chains. Rising natural gas consumption, expansion of pipeline and LNG infrastructure, and national energy…

Anesthesia Drugs Market to be Worth USD 12.6 Bn by 2036 - By Drug / By Applicati …

The global anesthesia drugs market was valued at US$ 7.6 billion in 2025 and is projected to reach US$ 12.6 billion by 2036, expanding at a compound annual growth rate (CAGR) of 4.7% from 2026 to 2036. This steady growth trajectory reflects the essential and non-substitutable role of anesthesia drugs in modern healthcare systems. As surgical interventions continue to rise globally-across both elective and emergency procedures-the demand for safe, effective,…

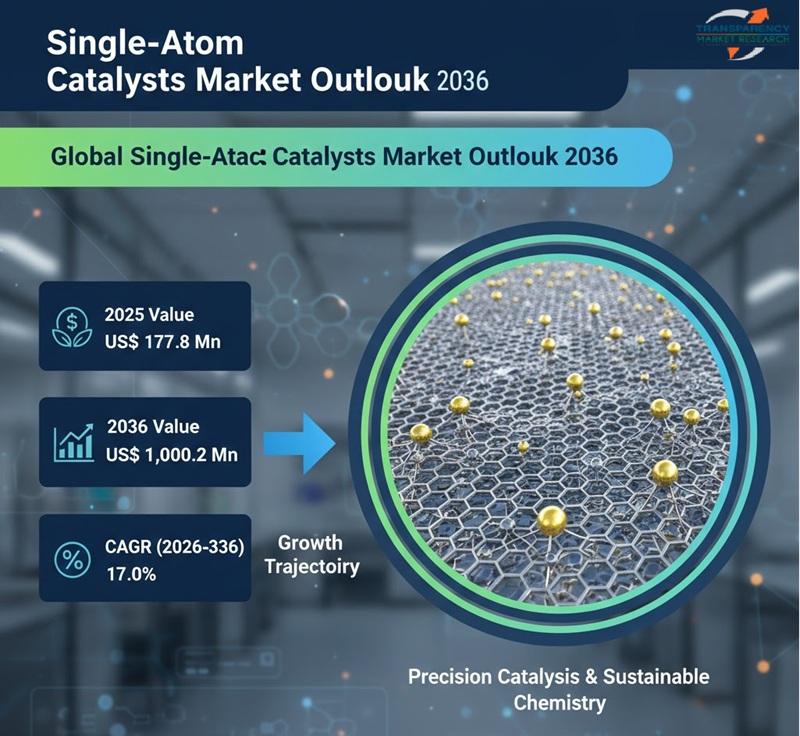

Single-Atom Catalysts Market Size is Expected to Expand from US$ 177.8 Million t …

The global single-atom catalysts (SACs) market is poised for remarkable growth as industries seek highly efficient, cost-effective, and sustainable catalytic solutions. Valued at US$ 177.8 million in 2025, the market is projected to reach US$ 1,000.2 million by 2036, expanding at a robust compound annual growth rate (CAGR) of 17.0% from 2026 to 2036. This rapid expansion reflects the growing importance of advanced catalysis in energy, chemicals, environmental protection, and…

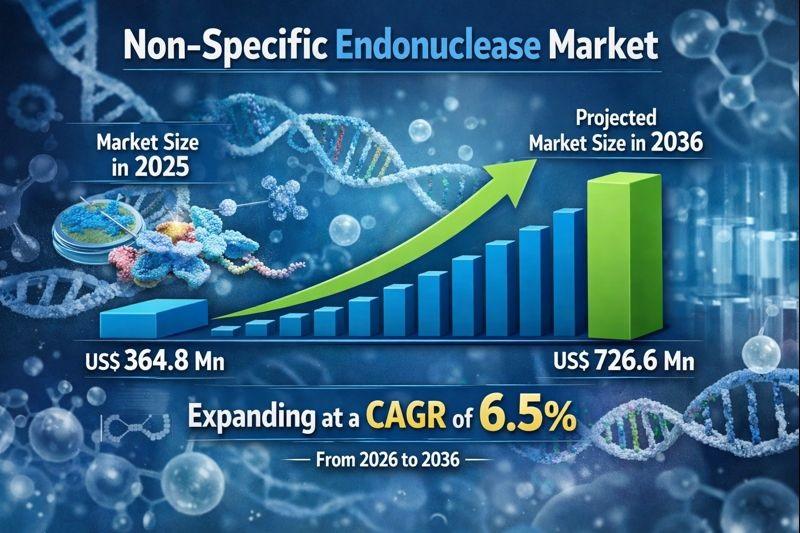

Non-specific Endonuclease Market to Reach USD 726.6 Million by 2036, Supported b …

The non-specific endonuclease market is witnessing steady growth, driven by the expanding use of molecular biology tools across biotechnology, pharmaceuticals, diagnostics, and academic research. Non-specific endonucleases are enzymes that cleave nucleic acids without requiring a specific recognition sequence, making them highly valuable for applications such as DNA/RNA degradation, sample preparation, viscosity reduction, and contamination control. Their broad activity profile differentiates them from restriction enzymes and enables versatile usage across multiple…

More Releases for Money

Miracle Money Magnets Review: Reprogram Your Money Vibration for Lasting Wealth

Miracle Money Magnets is a mindset transformation program created by Croix Sather that focuses on raising your personal money vibration to attract financial abundance effortlessly. The course teaches how subconscious beliefs, emotional resistance, and daily language patterns create blocks that repel wealth, and provides simple steps to reset them for consistent money flow. Priced accessibly at an introductory $7, it promises to shift users from financial struggle to prosperity by…

Just Between Friends Can Help Save Money & Make Money

Image: https://www.getnews.info/uploads/314b3c2c783a4157e147efd33935356f.jpg

Kids are expensive. Just Between Friends can help you save money and make money.

At Just Between Friends, we understand that children grow fast, which can quickly become expensive for parents.

That's why we host a community event twice a year, where families can sell the things their children no longer use and buy what they need at 50-90% below retail.

Discover a sense of Pride and Purpose when participating at Just…

The Money Wave Reviews (Controversial Or Fake 2023) The Money Wave Price Legitim …

Self-improvement and wealth promotion the The Money Wave has come to light as an innovative concept drawing the attention of thousands around the world. This revolutionary approach, grounded in the latest neuroscience research and antiquated wisdom, will unlock the potential hidden within our brains and allow our brains to generate prosperity and wealth effortlessly. It was developed in the lab of the Dr. Thomas Summers, a top neuroscientist who is…

Mobile Money Market to Witness Huge Growth by 2029 | Orange Money, Epress Union, …

The Latest research study released by HTF MI "Global Mobile Money Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are MTN…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…