Press release

SME Insurance Market 2018 It Includes Top Key Players like Including AXA, Allianz, AIG, Tokio Marine, ACE&Chubb

“SME Insurance Market - Global Trends, Market Share, Industry Size, Growth, Opportunities, and Market Forecast - 2018 – 2025”, a new addition to the huge research repertoire of Acute Market Research offers insights on the SME Insurance Market for different segments and companies involved worldwide over the forecast period 2018 – 2025.Browse full Report with Toc: http://www.acutemarketreports.com/report/sme-insurance-market

The report titled “SME Insurance Market - Global Trends, Market Share, Industry Size, Growth, Opportunities, and Market Forecast - 2018 – 2025. The qualitative and quantitative information for the global SME Insurance Market is offered considering key critical success factors (CSFs), development trends, and competitive landscape prevailing in the SME Insurance Market industry. In addition, the research report provides a holistic view of the SME Insurance Market industry with statistical forecast across different geographic regions. The SME Insurance Market in a particular region has been assessed after taking into account factors such as gross domestic product (GDP), demographics, and inflation rate among others.

Report Coverage:

Geographic regions covered in the SME Insurance Market

North America

The U.S.

Rest of North America

Europe

The U.K.

Germany

France

Rest of Europe

Asia-Pacific (APAC)

China

Japan

India

Rest of APAC

Rest of the World

Latin America

Middle-East and Africa

This report studies the global SME Insurance market, analyzes and researches the SME Insurance development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

AXA

Allianz

AIG

Tokio Marine

ACE&Chubb

China Life

XL Group

Argo Group

PICC

Munich Re

Hanover Insurance

Nationwide

CPIC

Assurant

Sompo Japan Nipponkoa

Zurich

Hudson

Ironshore

Hiscox

Manulife

RenaissanceRe Holdings

Mapfre

Prudential plc

Aviva plc

Aon

Market segment by Type, the product can be split into

Insurance for Non-employing

Insurance for 1-9 Employees

Insurance for 10-49 Employees

Insurance for 50-249 Employees

Market segment by Application, SME Insurance can be split into

Agency

Broker

Bancassurance

Direct Writing

Download Free Sample: http://www.acutemarketreports.com/request-free-sample/113928

Key Questions Answered by the SME Insurance Market Report

SME Insurance Market size in 2016 and 2017

Expected CAGR (Compound Annual Growth Rate) of the SME Insurance Market during the forecast period 2018 – 2025

Which segments (product type/applications/end-use/technology, etc.) were favorable of investment in 2016?

Market leader in the Industrial Fans and Blowers Market in 2016

Browse full Report with Toc: http://www.acutemarketreports.com/report/sme-insurance-market

Latest Reports:

ITO Target Sales Market: http://www.acutemarketreports.com/report/ito-target-sales-market

Steer Axle Sales Market: http://www.acutemarketreports.com/report/steer-axle-sales-market

About Us

Acute Market Reports is the most sufficient collection of market intelligence services online. It is your only source that can fulfill all your market research requirements. We provide online reports from over 100 best publishers and upgrade our collection regularly to offer you direct online access to the world’s most comprehensive and recent database with expert perceptions on worldwide industries, products, establishments and trends. Our database consists of 200,000+ market research reports with detailed & minute market research.

Contact us

Name: Chris Paul

Designation: Global Sales Manager

Address: 105 N 1st ST #429, SAN JOSE, CA 95103, United States

Email:- sales@acutemarketreports.com

Toll Free (US/CANADA): +1-855-455-8662

Website: - http://www.acutemarketreports.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release SME Insurance Market 2018 It Includes Top Key Players like Including AXA, Allianz, AIG, Tokio Marine, ACE&Chubb here

News-ID: 960141 • Views: …

More Releases from Acute Market Reports

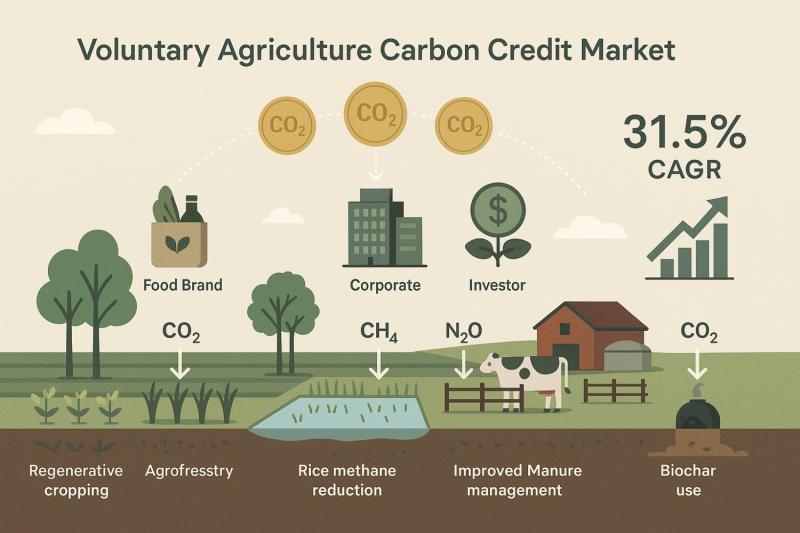

Voluntary Agriculture Carbon Credit Market Poised to Grow at 31.5% CAGR as Clima …

[New York], [USA] - December 9, 2025 - The voluntary agriculture carbon credit market is set for strong expansion, growing at a 31.5% compound annual growth rate (CAGR) as food companies, corporates and investors turn to climate-smart farming as a practical source of verified carbon reductions and removals. Farms are emerging as key climate assets, with new projects turning improved practices into tradable carbon credits.

Access Complete Report from https://www.acutemarketreports.com/report/voluntary-agriculture-carbon-credit-market

Agriculture offers…

Pediatric Allergy Treatment Market Set to Soar: Projected to Reach $13.9 Billion …

The pediatric allergy treatment market is experiencing significant growth, driven by the rising prevalence of allergic conditions among children. Allergies, including food allergies, allergic rhinitis, asthma, and skin allergies, are becoming increasingly common in the pediatric population. This trend has led to a growing demand for effective treatment options that can provide relief and improve the quality of life for children affected by these conditions. The market for pediatric allergy…

Strippable Coatings Market Is Expected To Expand At A CAGR Of 7.1% From 2024 To …

Strippable coatings, also referred to as peelable coatings, are a type of non-flammable, water-based protective solution that can be easily removed from surfaces without the need for harsh chemical strippers or cleaners. Composed of water-based acrylic polymers, vapor phase corrosion inhibitors, and a thixotropic thickener, these coatings enhance barrier and surface protection properties. They can be applied via brush, spray, dip, or roll and are primarily utilized on bare metal…

Bakeware Market | Global Industry Size, Development Strategy, Revenue Analysis, …

The market for bakeware is a dynamic and evolving sector that serves both commercial and residential consumers. In 2023, the bakeware market was valued at $3,850.0 million and is projected to reach $6,462.2 million by the end of 2032. This market is anticipated to grow at a compound annual growth rate (CAGR) of 5.91% during the forecast period from 2024 to 2032. The growth is largely driven by a resurgence…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…