Press release

Credit Processing Solution Market to Observe Strong Development By 2025

The term credit is incorporated in almost every organisation while doing business to prevent on losing out their customers and sales. Considering business credit, availability of credit can maintain an organisation’s cash flow and hence can be crucial to a customer. From a business point of view, credit processing is a measure a business or an individual must undergo to become eligible for a loan or to pay for goods and services over a protracted period by assessing respective credit factors. Credit processing solution, is functionally opulent, that empowers financial enterprises to transform their credit proposal management right from sourcing to on-board by functional inclusion of sourcing, assessment, decision making, and pre and post disbursement. Credit processing solution integrates financial services systems from the supply side as well as the demand side perspective. These systems include risk scoring tools, CRM, loan management, and collateral management, meeting expectations of all stakeholders involved in the process.Credit processing solutions are beneficial as the market is changing rapidly right down to the ways of doing transactions by customers. Credit processing solutions give a competitive advantage and helps in delivering most value to the business by realizing potential of each transaction.

Read Report Overview @ https://www.persistencemarketresearch.com/market-research/credit-processing-solution-market.asp

Credit Processing Solution Market: Drivers and Restraints

In Financial enterprises, for corporate lending there are too many variants for loan approval processes as each customer segment and their product line demands a customized approach. Here traditional business process models appear futile being one of the major driver for credit processing solutions market. Increased financial complexity and increased financial risks and frauds are also some drivers for the credit processing solution market. These solutions also assist end-users to do ad-hoc analysis of their financial transactions data, solving specific business problems at present and future.

Rising transaction volumes and its record keeping which leads to performance snag, reliability on legacy systems and management practices causing enterprises to overlook the benefits of such solutions, are some challenges in credit processing solutions market.

Request Report For TOC @ https://www.persistencemarketresearch.com/toc/17950

Credit Processing Solution Market: Segmentation

Credit processing solutions market is mainly segmented on the basis of platform, end-user vertical, end-user volume and geography. On the basis of platform, the credit processing solutions market is further segmented into In-store, Online and Mobile.

In the end user vertical it is categorized into BSFI, Government, Retail and E-commerce, Travel and hospitality, and others, while in the end user volume it is further segmented into high volume and low volume.

Region wise, Credit processing solutions market can be segmented into North America, Latin America, Asia Pacific, Japan, Eastern Europe, Western Europe, and Middle East & Africa.

Credit Processing Solution Market: Regional Overview

North America leads the Credit processing solutions market due to presence of large financial and enterprises in the countries such as USA and Canada. European credit processing solution market will see a good growth rate in the future along with Asia-pacific.

Credit Processing Solution Market: Key Players

Some of the prominent players in credit processing solution market are First Data Corporation., Square, Inc., Digital River, Inc., Leap Payments, Inc., 2Checkout.com, Inc., Wirecard AG and PayAnywhere LLC, among others.

Request To Sample Of Report @ https://www.persistencemarketresearch.com/samples/17950

About Us

Persistence Market Research (PMR) is a third-platform research firm. Our research model is a unique collaboration of data analytics and market research methodology to help businesses achieve optimal performance.

To support companies in overcoming complex business challenges, we follow a multi-disciplinary approach. At PMR, we unite various data streams from multi-dimensional sources. By deploying real-time data collection, big data, and customer experience analytics, we deliver business intelligence for organizations of all sizes.

Contact Us

Persistence Market Research

305 Broadway

7th Floor, New York City,

NY 10007, United States,

USA,Canada Toll Free: 800-961-0353

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Processing Solution Market to Observe Strong Development By 2025 here

News-ID: 907261 • Views: …

More Releases from Persistence Market Research

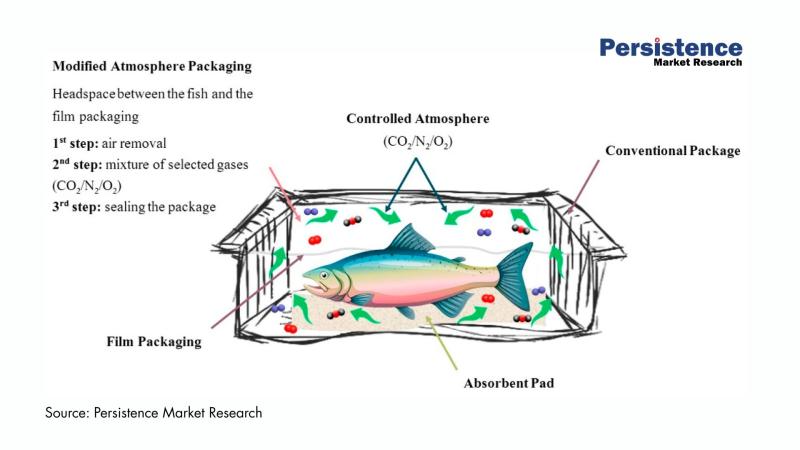

Active Modified Atmospheric Packaging Market to Surpass US$ 37.9 Bn by 2033, Dri …

The global active modified atmospheric packaging market is entering a dynamic growth phase as food manufacturers, healthcare suppliers, and logistics companies intensify their focus on extending product freshness, minimizing waste, and improving supply chain resilience. Active modified atmospheric packaging (AMAP) integrates advanced gas control technologies, moisture regulators, and antimicrobial features to create optimal internal environments for perishable products.

According to the latest study by Persistence Market Research, the global active modified…

Shunt Capacitor Market Expected to Reach US$2.0 Bn by 2033 Driven by Grid Modern …

The global shunt capacitor market is set for sustained growth as power grids worldwide undergo modernization to meet rising electricity demand and improve energy efficiency. According to the latest study by Persistence Market Research, the global shunt capacitor market size is likely to be valued at US$ 1.3 billion in 2026 and is projected to reach US$ 2.0 billion by 2033, expanding at a CAGR of 6% during the forecast…

Tire Cord & Tire Fabrics Market Set to Hit US$9.0 Bn by 2032 Driven by Radializa …

The global tire cord & tire fabrics market is entering a dynamic growth phase as automotive production rebounds, mobility patterns evolve, and manufacturers prioritize high-performance reinforcement materials. Tire cords and fabrics form the structural backbone of tires, providing dimensional stability, strength, and resistance to wear under demanding operating conditions.

According to the latest study by Persistence Market Research, the market is valued at US$5.9 billion in 2025 and is projected to…

Event Tourism Market Set for Exponential Growth through 2032 - PMR Research

The global Event Tourism Market is poised for remarkable expansion, driven by sustained demand for live experiences, increased business travel, hybrid event adoption, and a rebound in international tourism. According to industry projections, the market is expected to grow from an estimated US$1,538.3 billion in 2025 to US$2,631.5 billion by 2032, registering a CAGR of 7.3% over the forecast period.

This robust growth underscores the evolution of event tourism into one…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…