Press release

Financial Technology Market Key Growth Drivers 2017 - 2025

Financial Technology is a term used to assist those companies operating in the financial technology sector. The Financial Technology is the integration of financial services with information technology. This integration assists in reshaping finance services by facilitating easy and smart management of financial activities. Another advantage associated with this technology is it improves the quality of financial services and reduce overall operational cost, and thus contributing to creating a more diverse and stable financial landscape.Request for Table of Contents @ https://www.persistencemarketresearch.com/toc/21112

Increase in inclination towards new technology solution such as online, mobile payments, big data, alternative finance and financial management, surges the need for simple technology that assists in efficient financial management, which is positively influencing the demand for Financial Technology market. Also, growing dependence of technology in every sector to facilitate ease and flexibility in maintaining records act as major parameters backing the adoption of financial technology, which is the other driver for the growth Financial Technology solution during the forecast period.

The legacy financial system is projected to witness serious threat from developing technologies such as BlockChain technology, therefore to exclude the demand for an intermediary trust agent for payments settlements is another factor contributing to the growth of the market during the forthcoming years.

Also, increase in digitization in the financial sector is the important parameter due to which the demand for Financial Technology solution is likely to surge.

North America market is expected to be largest markets with respect to the financial technology market, due to which, the market is expected to exhibit the significant growth rate with respect to the respective region during the forecast period.

Owing to the escalating in penetration of technology-driven workflow at the organizations in emerging economies such as China and India is the major reason, positively impacting the growth of the financial technology market. Also raising awareness about the financial software advantages such as accuracy and efficiency is another reason for the growth of the market in forthcoming years in Asia Pacific region.

Request to View Sample of Research Report @ https://www.persistencemarketresearch.com/samples/21112

The major player operating in Financial Technology market includes Social Finance, Inc. (SoFi), Stripe, YapStone, Inc., Braintree (PayPal), Adyen, Lending Club, Addepar, Commonbond, Inc., Robinhood, and Wealthfront, Inc.

In 2015 BillGuard; a financial technology services provider was acquired by a California-based company in the peer-to-peer lending industry; Prosper Marketplace. The acquisition cost approximately US$30 million. The objective of the acquisition is to scale business operation and to extract new business opportunities.

About Us

Persistence Market Research (PMR) is a third-platform research firm. Our research model is a unique collaboration of data analytics and market research methodology to help businesses achieve optimal performance.

To support companies in overcoming complex business challenges, we follow a multi-disciplinary approach. At PMR, we unite various data streams from multi-dimensional sources. By deploying real-time data collection, big data, and customer experience analytics, we deliver business intelligence for organizations of all sizes.

Contact Us

Persistence Market Research

305 Broadway

7th Floor, New York City,

NY 10007, United States,

Telephone - +1-646-568-7751

USA – Canada Toll Free: 800-961-0353

Email: sales@persistencemarketresearch.com

Web: http://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Technology Market Key Growth Drivers 2017 - 2025 here

News-ID: 906740 • Views: …

More Releases from Persistence Market Research

Active Modified Atmospheric Packaging Market to Surpass US$ 37.9 Bn by 2033, Dri …

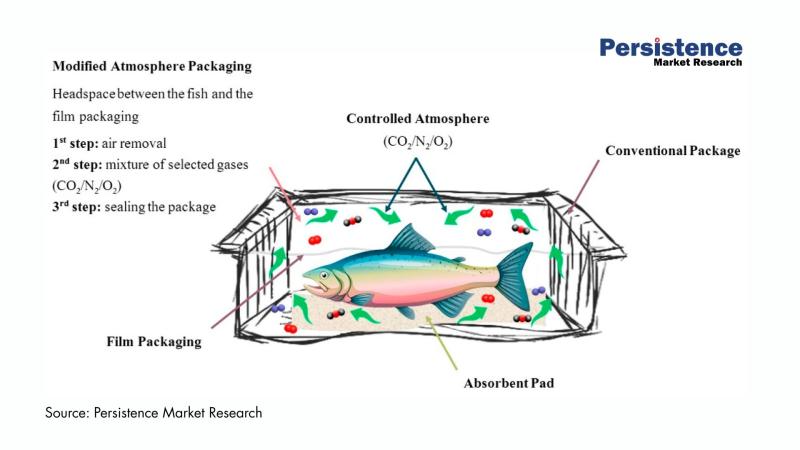

The global active modified atmospheric packaging market is entering a dynamic growth phase as food manufacturers, healthcare suppliers, and logistics companies intensify their focus on extending product freshness, minimizing waste, and improving supply chain resilience. Active modified atmospheric packaging (AMAP) integrates advanced gas control technologies, moisture regulators, and antimicrobial features to create optimal internal environments for perishable products.

According to the latest study by Persistence Market Research, the global active modified…

Shunt Capacitor Market Expected to Reach US$2.0 Bn by 2033 Driven by Grid Modern …

The global shunt capacitor market is set for sustained growth as power grids worldwide undergo modernization to meet rising electricity demand and improve energy efficiency. According to the latest study by Persistence Market Research, the global shunt capacitor market size is likely to be valued at US$ 1.3 billion in 2026 and is projected to reach US$ 2.0 billion by 2033, expanding at a CAGR of 6% during the forecast…

Tire Cord & Tire Fabrics Market Set to Hit US$9.0 Bn by 2032 Driven by Radializa …

The global tire cord & tire fabrics market is entering a dynamic growth phase as automotive production rebounds, mobility patterns evolve, and manufacturers prioritize high-performance reinforcement materials. Tire cords and fabrics form the structural backbone of tires, providing dimensional stability, strength, and resistance to wear under demanding operating conditions.

According to the latest study by Persistence Market Research, the market is valued at US$5.9 billion in 2025 and is projected to…

Event Tourism Market Set for Exponential Growth through 2032 - PMR Research

The global Event Tourism Market is poised for remarkable expansion, driven by sustained demand for live experiences, increased business travel, hybrid event adoption, and a rebound in international tourism. According to industry projections, the market is expected to grow from an estimated US$1,538.3 billion in 2025 to US$2,631.5 billion by 2032, registering a CAGR of 7.3% over the forecast period.

This robust growth underscores the evolution of event tourism into one…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…