Press release

Financial Cards and Payments Market Emerging Trends, Analysis, Growth & Forecast 2016 - 2024

Electronic payment through financial cards and payment systems is on the rise across the world. On account of the convenience and higher availability offered, financial cards and payment systems have witnessed higher penetration in numerous economies across the world. Traditional payment systems such as cash payments, demand drafts and other payment certificates have become obsolete due to technological advancements in financial cards and payment systems. Through financial cards and payment systems, numerous financial transactions can be executed between entities located anywhere in the world. Financial cards including debit cards, credit cards, charge cards, ATM cards, fleet cards and stored value cards are widely used for different types of financial transactions. Other types of financial cards including Scrip, gift cards and electronic purse have gained popularity and serve to a very niche market. Financial cards are deployed using numerous technologies such as embossing, magnetic stripe cards, smart cards, proximity cards and re-programmable magnetic stripe cards. Magnetic stripe were highly adopted in the global credit and debit cards due to inefficiencies in the embossing technology. However, due to factors such as magnetic interference and possibility of damage to the magnetic stripe, the magnetic stripe cards were replaced by other technologies such as smart cards and proximity cards.Request Sample: https://www.persistencemarketresearch.com/samples/10882

The smart card technology uses an integrated circuit chip (ICC) which can process financial transactions with higher efficiency as compared to magnetic stripe cards. Proximity cards are contactless integrated circuit devices which make use of radio frequency identification (RFID) technology and are powered by resonant energy transfer. Proximity cards are gaining immense popularity in private payment systems and public transit payments. Financial payment systems include various types of payment methods such as bank transfers, E-wallets, direct debit and other mobile payment solutions. Users across the world make use of such payment systems to electronically transfer cash directly to merchant’s account. Unlike financial cards where the payments takes place through point of sale (PoS) systems, payment systems enable users to authenticate and execute financial transactions over the internet.

One of the major factors driving the growth of financial cards and payments market is the rise of ecommerce. Increasing penetration of online stores for numerous products and services has offered higher accessibility and availability of market places to consumers. Such factors have driven the growth of financial cards and payments systems across the world. Moreover, benefits such as convenience, security and privacy have further driven the growth of financial cards and payments market. In addition, ongoing collaboration between numerous payment industry participants including merchants’ banks, card issuers and card association network providers has led to development of comprehensive financial payment and transfer solutions.

Browse Our Report: https://www.persistencemarketresearch.com/market-research/financial-cards-and-payments-market.asp

Increasing penetration of ecommerce and mobile phones across the world has made the financial cards and payment systems lucrative in recent years. Numerous players in these markets seek to reap maximum profits in the developing economies especially in countries such as Brazil, Russia, India and China (BRIC). Some of the key financial cards and payment system providers include Visa, MasterCard, PayPal, RuPay, Amazon Payments, Google Wallet, Apple Pay, PayPoint, TransferWise, DigiCash and 2C2P.

Persistence Market Research (PMR) is a third-platform research firm. Our research model is a unique collaboration of data analytics and market research methodology to help businesses achieve optimal performance. To support companies in overcoming complex business challenges, we follow a multi-disciplinary approach. At PMR, we unite various data streams from multi-dimensional sources. By deploying real-time data collection, big data, and customer experience analytics, we deliver business intelligence for organizations of all sizes.

305 Broadway,7th Floor

New York City, NY 10007

United States

+1-646-568-7751

+1 800-961-0353 (USA-Canada Toll free)

Email: sales@persistencemarketresearch.com

Website: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Cards and Payments Market Emerging Trends, Analysis, Growth & Forecast 2016 - 2024 here

News-ID: 861821 • Views: …

More Releases from Persistence Market Research

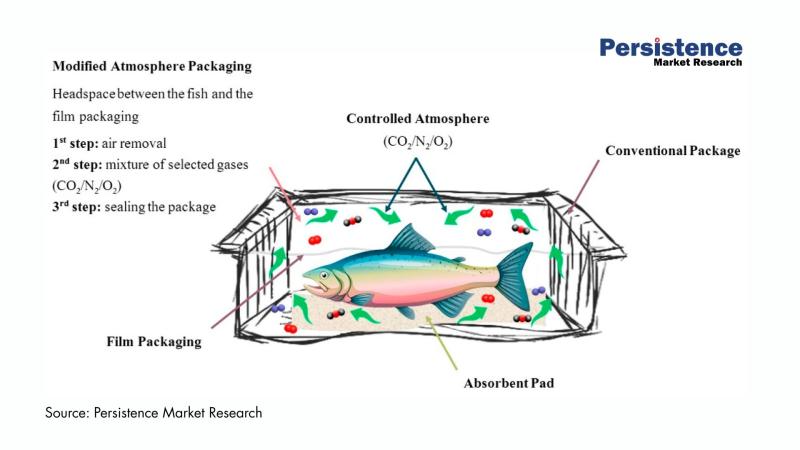

Active Modified Atmospheric Packaging Market to Surpass US$ 37.9 Bn by 2033, Dri …

The global active modified atmospheric packaging market is entering a dynamic growth phase as food manufacturers, healthcare suppliers, and logistics companies intensify their focus on extending product freshness, minimizing waste, and improving supply chain resilience. Active modified atmospheric packaging (AMAP) integrates advanced gas control technologies, moisture regulators, and antimicrobial features to create optimal internal environments for perishable products.

According to the latest study by Persistence Market Research, the global active modified…

Shunt Capacitor Market Expected to Reach US$2.0 Bn by 2033 Driven by Grid Modern …

The global shunt capacitor market is set for sustained growth as power grids worldwide undergo modernization to meet rising electricity demand and improve energy efficiency. According to the latest study by Persistence Market Research, the global shunt capacitor market size is likely to be valued at US$ 1.3 billion in 2026 and is projected to reach US$ 2.0 billion by 2033, expanding at a CAGR of 6% during the forecast…

Tire Cord & Tire Fabrics Market Set to Hit US$9.0 Bn by 2032 Driven by Radializa …

The global tire cord & tire fabrics market is entering a dynamic growth phase as automotive production rebounds, mobility patterns evolve, and manufacturers prioritize high-performance reinforcement materials. Tire cords and fabrics form the structural backbone of tires, providing dimensional stability, strength, and resistance to wear under demanding operating conditions.

According to the latest study by Persistence Market Research, the market is valued at US$5.9 billion in 2025 and is projected to…

Event Tourism Market Set for Exponential Growth through 2032 - PMR Research

The global Event Tourism Market is poised for remarkable expansion, driven by sustained demand for live experiences, increased business travel, hybrid event adoption, and a rebound in international tourism. According to industry projections, the market is expected to grow from an estimated US$1,538.3 billion in 2025 to US$2,631.5 billion by 2032, registering a CAGR of 7.3% over the forecast period.

This robust growth underscores the evolution of event tourism into one…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…