Press release

Electronic Bill Presentment and Payment (EBPP) Market Will Reflect Significant Growth Prospects during 2014-20

Electronic Bill Presentment and Payment (EBPP) is a process of electronically delivering the bills to the individuals and receiving the bill payment via the internet or through an electronic network. For instance, a customer receives the telephone bill via an e-mail. This e-mail also has a hyperlink mentioned by the service provider for the payment options. After reviewing the entire bill, the customer clicks on the hyperlink, selects the mode of payment and initiates the transfer of funds. The electronic bills delivery and receipt of payments can also be conducted via two separate networks. For example, in business to consumer transactions such as payment of utilities, the bills are received at the site in the form of paper and payment is done using debit or credit cards.Obtain Report Details @https://www.transparencymarketresearch.com/electronic-bill-presentment-payment-market.html

Implementing the system of EBPP by business establishments automates, streamlines and manages processes that involve payments. The benefits of implementing EBPP technology is that it reduces the time and costs associated with processing by eliminating the need to print and post paper mails, optimize working capital, improves marketing capabilities and be ahead in the competitive environment. Also, the customer service costs tend to drop due to lesser errors in electronic transactions than in paper transactions. Further, EBPP technology enables settling of disputes electronically by presenting interactive bills and eliminating lengthy telephone conversations.

The increasing use of smart phones with high-speed internet access is the major factor that drives the EBPP market. Mobile internet enables on-the-go access to various payment portals and enables customers to carry out various transactions such as payments using debit card and credit card, online bank transfer and access latest e-bills via e-mails instantaneously. Enterprises are also promoting the use of mobile devices by providing their employees with smart phones and tablets so that they can increase their revenue by boosting employee productivity. The strong penetration of laptops and notebooks, gaining trend of BYOD (Bring Your Own Devices), growth of mobile internet networks and increase in internet enabled smart phones drives the EBPP market.

One of the major factors that is contributing to the growth of EBPP market is the stiff competition among the vendors that enables launching of converged communication services such as 4G mobile network deployments leading to rapid growth in broadband internet systems. The continuously increasing speed, storage capacity, bandwidth and on-demand computing power of internet is driving the business establishments to migrate to online business models wherein payments are done through credit cards and third party services such as PayPal. However, the presence of coordination problems in the EBPP systems is adversely affecting the growth of this market.

Implementation of EBPP systems involves certain amount of initial costs for the billers and customers. In such a case, if customers refuse to use the EBPP system, the billers may not be able to recover their initial costs. Also, billers need to be confident that they are able to eliminate the paper-based system by convincing their customers to switch to the new technology. Moreover, due to difficulties in predicting the adoption rates; there is no accurate way to estimate the return on investment. Further, the billers are reluctant to invest on the time needed to train their customers/staff with such a technology thereby delaying its adoption. Another challenge is the possibility that a mobile device could be stolen or lost. In such cases, there are chances of unauthorized usage of the device leading to frauds and thefts. For the same reason, demand for customized solutions is expected to see rise during the forecast period. The electronic billing platforms are customized to leave an electronic audit trail for securing the internet transactions thereby giving customer’s confidence a major boost.

Request a PDF Sample for this Research Report @https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=3564

The EBPP market can be segmented on the basis of the end-user industries such as banking and financial services, insurance, health care, telecommunication, retail, education, media, manufacturing and government. The retail segment majorly contributes to the EBPP market due to the growing number of customers opting for online shopping and payments.

Some of the major players in the market include ACI Worldwide, Inc., CSG Systems International, Inc and Monitise Group Limited, among others. Some of these vendors are consistently acquiring companies to enhance the quality of their services. For instance, Mastercard Incorporated, on Sep 6, 2012, acquired Truaxis, Inc. with a view to enhance the quality of personalized shopping offers and the rewarding system to customers.

Transparency Market Research (TMR) is a next-generation provider of syndicated research, customized research, and consulting services. TMR’s global and regional market intelligence coverage includes industries such as pharmaceutical, chemicals and materials, technology and media, food and beverages, and consumer goods, among others. Each TMR research report provides clients with a 360-degree view of the market with statistical forecasts, competitive landscape, detailed segmentation, key trends, and strategic recommendations

Transparency Market Research

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Electronic Bill Presentment and Payment (EBPP) Market Will Reflect Significant Growth Prospects during 2014-20 here

News-ID: 836556 • Views: …

More Releases from Transparency Market Research

RF Chip Inductor Market Size to Reach over USD 1.8 billion by 2031 - Transparenc …

RF Chip Inductor Market are essential components in various electronic devices, providing inductance and functioning as filters, oscillators, and transformers. They play a crucial role in ensuring the efficiency and performance of RF circuits. With the rapid advancement in telecommunications, consumer electronics, and automotive industries, the demand for RF chip inductors has seen a significant rise. These components are integral in applications such as smartphones, IoT devices, and automotive electronics,…

Solid Tires Market Expected to Witness Impressive Growth at a 8.1% CAGR by 2031

The latest research study released by Transparency Market Research on "Solid Tires Market Forecast to 2023-2031 ″ research provides accurate economic, global, and country-level predictions and analyses.

Solid Tires market is estimated to attain a valuation of US$ 760.0 Mn by the end of 2031, states a study by Transparency Market Research (TMR). Besides, the report notes that the market is prognosticated to expand at a CAGR of 8.1% during…

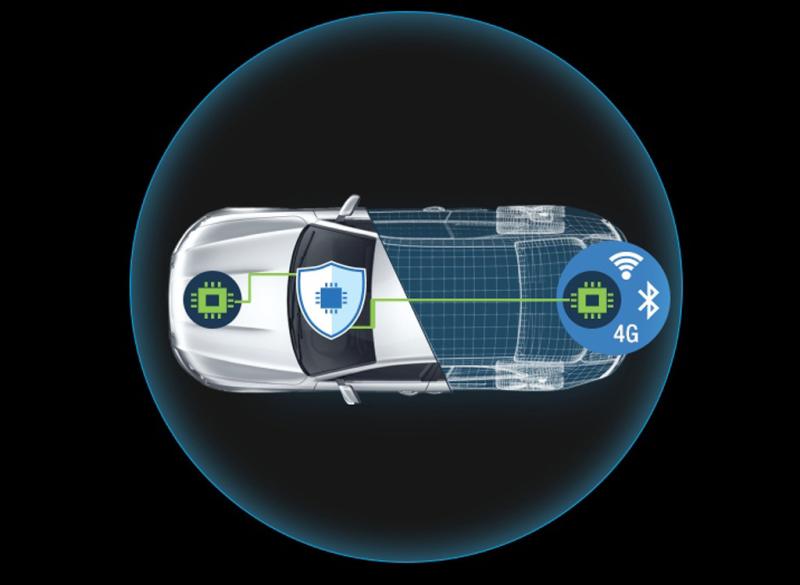

Automotive Cyber security Market Sales Estimated to Hit USD 10.5 Billion by 2031 …

The latest research study released by Transparency Market Research on "𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐂𝐲𝐛𝐞𝐫 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Automotive Cyber security industry, as…

Ready-mix Concrete Market to Witness Exponential Growth with a CAGR of 6.1% from …

The latest research study released by Transparency Market Research on "𝐑𝐞𝐚𝐝𝐲-𝐦𝐢𝐱 𝐂𝐨𝐧𝐜𝐫𝐞𝐭𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Ready-mix Concrete industry, as well as…

More Releases for EBPP

Electronic Bill Presentment Payment (EBPP) Market to See Drastic Growth - Post 2 …

HTF MI recently introduced Global Electronic Bill Presentment Payment (EBPP) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study ACI Worldwide, Fiserv, Billtrust, PayPal, Mastercard, Intuit, Oracle, FIS, InvoiceCloud, Experian,…

Electronic Bill Presentment and Payment (EBPP) Market Set for Explosive Growth w …

Electronic Bill Presentment and Payment (EBPP) Market - Global Trends, Insights to 2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Electronic Bill Presentment and Payment (EBPP) Market. Some of the key players profiled in…

Electronic Bill Presentment and Payment (EBPP) Market | Opportunities, Business …

The global electronic bill presentment and payment market size valued USD 17.9 billion in 2021 and expected to grow at a CAGR of 7.5% during the forecast period 2022-2028. Companies employ the electronic bill payment and presentment (EBPP) procedure to obtain payments online using resources like the Internet, direct dial access, and automated teller machines (ATMs). It is now an essential part of many financial organisations' online banking services. The…

Electronic Bill Presentment and Payment (EBPP) Market: Industry Trends, Regional …

The Electronic Bill Presentment and Payment (EBPP) research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Electronic Bill Presentment and Payment (EBPP) market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs…

Electronic Bill Presentment and Payment (EBPP) Market to Witness Robust Expansio …

LP INFORMATION offers a latest published report on Electronic Bill Presentment and Payment (EBPP) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

According to this study, over the next five years the Electronic Bill Presentment and Payment (EBPP) market will register a 1.1% CAGR in terms of revenue, the global market size will reach US$ 445.9 million…

Electronic Bill Presentment and Payment (EBPP) Market Technology, Applications, …

Electronic Bill Presentment and Payment (EBPP) is a process of electronically delivering the bills to the individuals and receiving the bill payment via the internet or through an electronic network. For instance, a customer receives the telephone bill via an e-mail. This e-mail also has a hyperlink mentioned by the service provider for the payment options. After reviewing the entire bill, the customer clicks on the hyperlink, selects the mode…