Press release

Data Center IT Asset Disposition Market: Technological Growth Map Over Time To Understand The Industry Growth Rate

A recent market intelligence study by Transparency Market Research (TMR) detects that the global Data Center IT Asset Disposition Market is in development phase with a highly prosperous future, owing to the ubiquity of electronic devices that need proper disposing in order to preserve the environment. There are plenty of opportunities for the existing players, with most of them implementing aggressive remarketing strategies to add to their enterprise level customers as well as focusing on incrementing their output in terms of remarketed products sold. For instance, CCS providers such as Facebook Inc., Amazon Web Services Inc., Google Inc., Microsoft Corporation, and Apple Inc. have employed ITAD programs and procedures to dispose discarded assets in order to efficiently manage their unusable IT assets. This strategy enables them to comply with the regulatory policies pertaining to the environment and increase their returns.As per the projections of the TMR report, the demand in the global data center IT asset disposition market will increase at an impressive CAGR of 6.8% during the forecast period of 2017 to 2025, estimating it to reach a valuation of US$13.87 bn by the end of 2025, substantially up from its evaluated worth of US$7.74 bn in 2016. Some of the key companies currently operating in the global data center IT asset disposition market are: Dell Inc., Hewlett Packard Enterprise Company (HPE), Arrow Electronics, Inc., Apto Solutions, Inc., CloudBlue Technologies, Inc (Ingram Micro, Inc.), LifeSpan International, Inc., Iron Mountain Incorporated., ITRenew Inc., TES-AMM Pte Ltd., and Sims Recycling Ltd.

Sample With Latest Advancements @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=29720

Servers Emerge as Highly Profitable Asset-type Segment

Based on asset type, the report segments the global data center IT asset disposition market into memory modules, servers, CPU, HDD, GBIC, desktops, line cards, laptops, and SSD, and rates serve as the most in-demand segment, gaining traction from the proliferation of cloud computing, growing number of data centers, and growing big data applications. On the basis of service, the market has been bifurcated into data sanitation or destruction, remarketing or resale, and recycling, with data sanitation of destruction providing maximum demand, as a result of compliance with the National Institute of Standards and Technology (NIST) and Department of Defense (DoD) guidelines.

Geographically, the report takes stock of the potential of data center IT asset disposition market in the regions of North America, Europe, Asia Pacific, the Middle East and Africa (MEA), and South America, with North America currently being the most lucrative region, serving 34% of the demand in 2015. On the other hand, Asia Pacific is anticipated to increment the demand at most prominent growth rate among all the regions, driven by high adoption rate of cloud services by numerous enterprises in the a number of emerging economies such as Japan, Singapore, China, India, and South Korea.

Browse Our Press Releases For More Information @ https://www.transparencymarketresearch.com/pressrelease/data-center-it-asset-disposition-market.htm

Regulatory for Eco-friendly Practices Driving Demand

Regulatory compliances in several countries to preserve the environment, growing need of information, escalating data security concerns from old assets, and increasing adoption of new technology and Byod are some of the key factors driving the demand in the global data center IT asset disposition market. On the other hand, lack of awareness, high service cost, and limitation of comprehensive IT asset disposition policies are a few challenges obstructing the global data center IT asset disposition market from attaining its true potential. Nevertheless, the vendors of this market are expected to gain new opportunities from value recover from obsolete assets as well as strategic partnerships and acquisitions of promising new entrants.

Browse Our Report @ https://www.transparencymarketresearch.com/data-center-it-asset-disposition-market.html

Some of the key companies currently operating in the global data center IT asset disposition market are: Hewlett Packard Enterprise Company (HPE), Dell Inc., Arrow Electronics, Inc., CloudBlue Technologies, Inc., Apto Solutions, Inc., LifeSpan International, Inc., ITRenew Inc., Iron Mountain Incorporated., and Sims Recycling Ltd. In the near future, as the government policies get stricter, vast opportunities will arise, which will lure new players and intensify the competitive landscape of the global data center IT asset disposition market.

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. We have an experienced team of Analysts, Researchers, and Consultants, who us e proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Each TMR Syndicated Research report covers a different sector – such as pharmaceuticals, chemical, energy, food & beverages, semiconductors, med-devices, consumer goods and technology. These reports provide in-depth analysis and deep segmentation to possible micro levels. With wider scope and stratified research methodology, our syndicated reports thrive to provide clients to serve their overall research requirement.

Contact

Transparency Market Research

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Data Center IT Asset Disposition Market: Technological Growth Map Over Time To Understand The Industry Growth Rate here

News-ID: 824855 • Views: …

More Releases from Transparency Market Research

Electric Wheelchair Market Expanding at 9.2% CAGR Through 2036 - By Control Type …

The global electric wheelchair market continues to demonstrate strong and sustained growth, fueled by demographic transitions, technological innovation, and expanding healthcare access worldwide. Valued at US$ 5.8 billion in 2025, the market is projected to reach US$ 15.3 billion by 2036, expanding at a compound annual growth rate (CAGR) of 9.2% from 2026 to 2036.

Discover essential conclusions and data from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4198

This robust trajectory reflects rising…

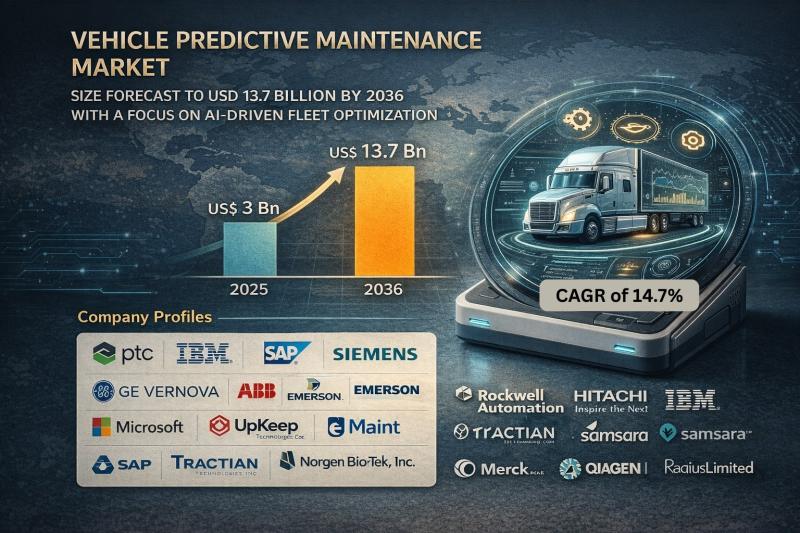

Vehicle Predictive Maintenance Market Size Forecast to USD 13.7 Billion by 2036 …

Vehicle Predictive Maintenance Market Outlook 2036

The global vehicle predictive maintenance market was valued at USD 3 Billion in 2025 and is projected to reach USD 13.7 Billion by 2036, expanding at a robust CAGR of 14.7% from 2026 to 2036. Market growth is driven by increasing adoption of connected vehicles, rising fleet digitalization, advancements in AI-driven analytics, and growing emphasis on minimizing vehicle downtime and maintenance costs.

👉 Get your sample…

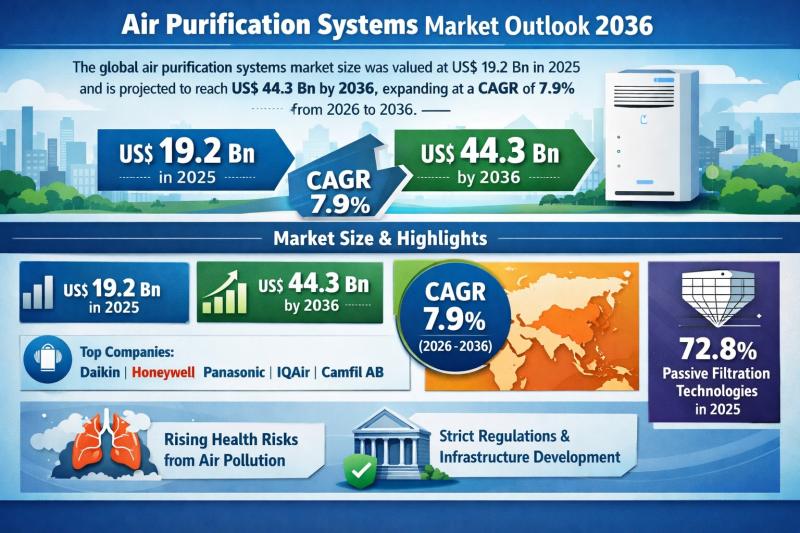

Global Air Purification Systems Market to Reach USD 44.3 Billion by 2036 at 7.9% …

The global Air Purification Systems Market was valued at US$ 19.2 Bn in 2025 and is projected to expand to US$ 44.3 Bn by 2036, registering a compound annual growth rate (CAGR) of 7.9% from 2026 to 2036. The market's upward trajectory reflects the structural shift in indoor air quality (IAQ) management, moving from discretionary consumer spending to mission-critical infrastructure investment.

With historical data available from 2021 to 2024, the industry…

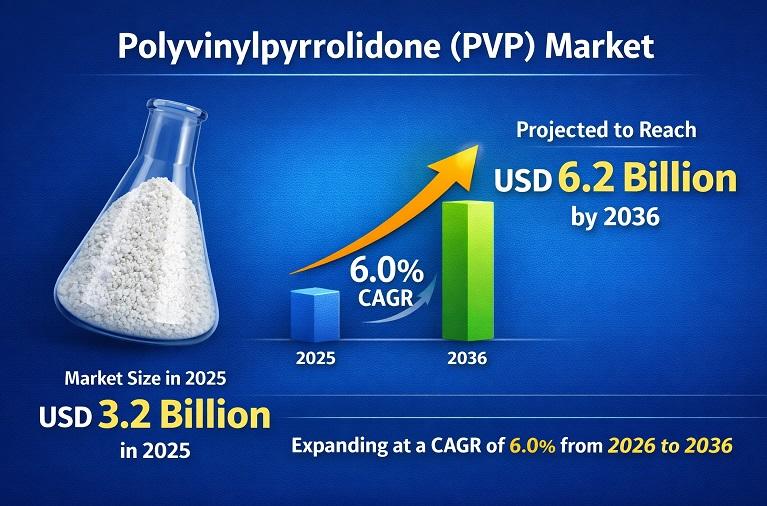

Polyvinylpyrrolidone (PVP) Market to Reach USD 6.2 Billion by 2036 Driven by Pha …

The Polyvinylpyrrolidone (PVP) Market was valued at around US$ 3.2 billion in 2025 and is projected to reach approximately US$ 6.2 billion by 2036, expanding at a steady CAGR of about 6.0% during the forecast period. This growth is primarily driven by rising demand from the pharmaceutical industry, where PVP is widely used as a tablet binder, solubilizer, and stabilizer, along with increasing consumption in cosmetics and personal care products…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…