Press release

Core Banking Solution Market: Banks End User Segment to Lead in Terms of Value Share

Branch Less Banking to Impact Core Banking Solution MarketIt is quite challenging for banks in emerging economies to establish a physical presence to cater to the immense needs of an underserved populations in rural areas. Branch less banking offers a good solution to this predicament and banks have invested in mobile banking, net banking, and email banking to be available to any customers with the tap of a button. Banks are now able to tap customers in far-flung rural areas and thereby increase banking frequency.

There is a strong likelihood of some customers avoiding the use of banks because of the difficulties faced in terms of travel and time with branch based transactions. Therefore, banks are providing their customers ample choice and easy access via smartphones and companies involved in the core banking solutions market should take this into account.

Obtain Report Details @

https://www.futuremarketinsights.com/reports/core-banking-solutions-market

Banks Dominate the Core Banking Solution Market by End Users

Banks have a commanding position in the core banking solutions market and are poised to gain massive BPS over the course of the forecast period. The banks segment is expected to have a value of just under US$ 7.6 billion in 2017 and exhibit the highest market attractiveness of 5.0 for the period from 2017 to 2027. The financial institution segment is roughly half the size of banks in the core banking solutions market.

Nonetheless, a CAGR of 4.6% from 2017 to 2027 makes it unwise to ignore financial institutions entirely in the core banking solutions market.

Banks Focussing on Consumer Analytics to Foster Loyalty

Nowadays, banks have begun to prioritize customer behavioural analysis through big data. This is one of the biggest trends in the core banking solutions market and customer data analytics is essentially studying the customer’s data provided to the respective bank. Customer data analytics functions as the base for modifying the core banking solution to cater to changing customer requirements.

Key stakeholders in the core banking solutions market are trying to develop new and innovative technologies that increase their customer base while entrenching loyalty amongst the current ones, primarily by way of exhaustive consumer analytics.

Request Sample Report@

https://www.futuremarketinsights.com/reports/sample/rep-gb-3395

Customer Satisfaction and Retention Critical in Core Banking Solution Market

As a result of cutthroat competition in the banking sector, retail banks now face the challenge of customer retention and core banking solutions are the link between banks and their customers in ensuring this is addressed. Core banking solutions allow banks to perform an effective customer analysis while simultaneously enabling customers to carry out their usual banking transactions. Customer satisfaction is improved with the core banking solutions and the latter go a long way in reducing customer effort.

North America and Europe have Well-Developed Financial Infrastructure

North America and Europe have a robust financial infrastructure in place with New York and London being the global capitals of financial transactions. The Western Europe banks segment is anticipated to have a value of almost US$ 3 billion by end 2027 that should make it roughly twice the size of financial institutions at that time. A similar potential exists in the North America banks segment as is it predicted to push past US$ 3.1 billion in end 2027.

About Us

Future Market Insights is the premier provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in London, the global financial capital, and has delivery centres in the U.S. and India.

FMI’s research and consulting services help businesses around the globe navigate the challenges in a rapidly evolving marketplace with confidence and clarity. Our customised and syndicated market research reports deliver actionable insights that drive sustainable growth. We continuously track emerging trends and events in a broad range of end industries to ensure our clients prepare for the evolving needs of their consumers.

FMI’s team of over 200 research analysts provides market intelligence at global, regional, and country level. Our analysts are committed to provide independent insights, relying on our cognitive defusion training module, which conditions them to look at data objectively and unbiasedly.

Contact

Future Market Insights

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email:sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Core Banking Solution Market: Banks End User Segment to Lead in Terms of Value Share here

News-ID: 817967 • Views: …

More Releases from Future Market Insights

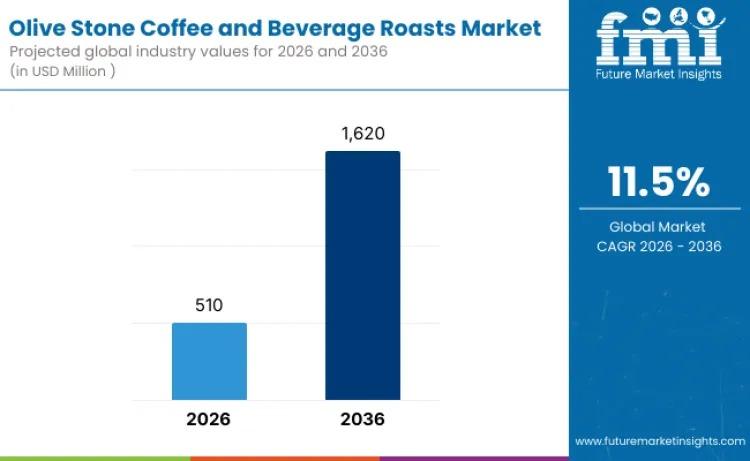

Global Olive Stone Coffee and Beverage Roasts Market to Reach USD 1,620 Million …

The global olive stone coffee and beverage roasts market is entering a high-growth decade, fueled by sustainability innovation and evolving specialty coffee culture. Valued at USD 510 million in 2026, the market is projected to reach USD 1,620 million by 2036, expanding at a compelling CAGR of 11.5%.

As consumers increasingly seek beverages that combine sustainability, functionality, and distinctive taste, olive stone-based roasting solutions are transitioning from niche experimentation to structured…

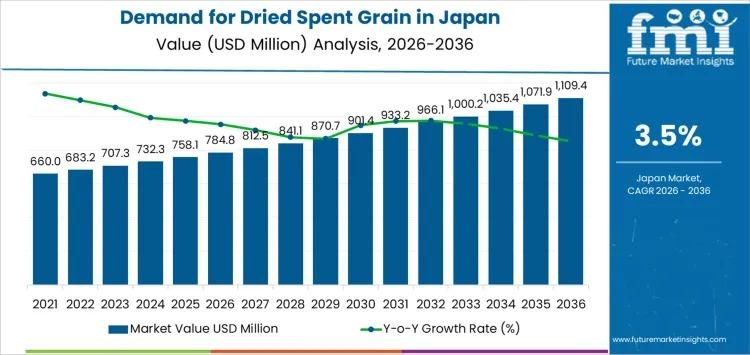

Japan Dried Spent Grain Market to Surpass USD 1.1 Billion by 2036 as Feed Optimi …

Japan's dried spent grain market is entering a decade of steady, value-driven expansion, supported by structured feed demand, brewery byproduct utilization, and rising integration of fiber-rich ingredients into food manufacturing. Industry estimates place the market at USD 784.8 million in 2026, with projections indicating growth to USD 1,109.4 million by 2036, reflecting a CAGR of 3.5%.

Between 2020 and 2026, demand increased from USD 637.5 million to USD 784.8 million, shaped…

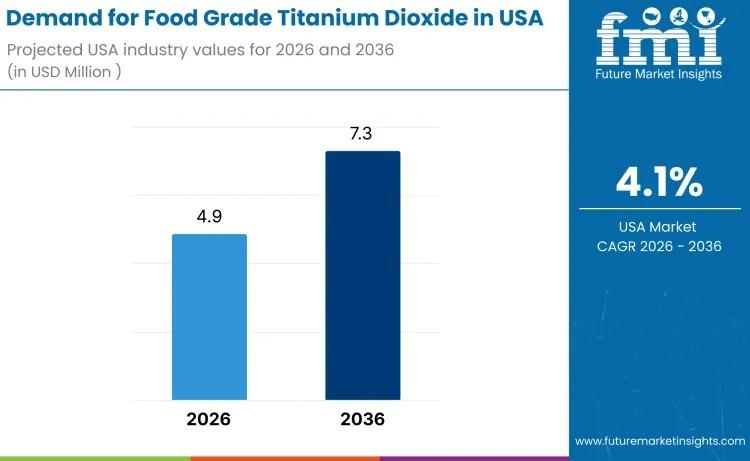

USA Food Grade Titanium Dioxide Market to Reach USD 7.3 Million by 2036 Amid Ste …

The demand for food grade titanium dioxide in the USA is valued at USD 4.9 million in 2026 and is projected to reach USD 7.3 million by 2036, expanding at a CAGR of 4.1%. Growth remains moderate yet stable, supported by continued use of titanium dioxide as a whitening and opacifying agent across confectionery coatings, bakery decorations, sauces, dairy analogues, and processed food matrices.

Despite heightened regulatory scrutiny and evolving clean-label…

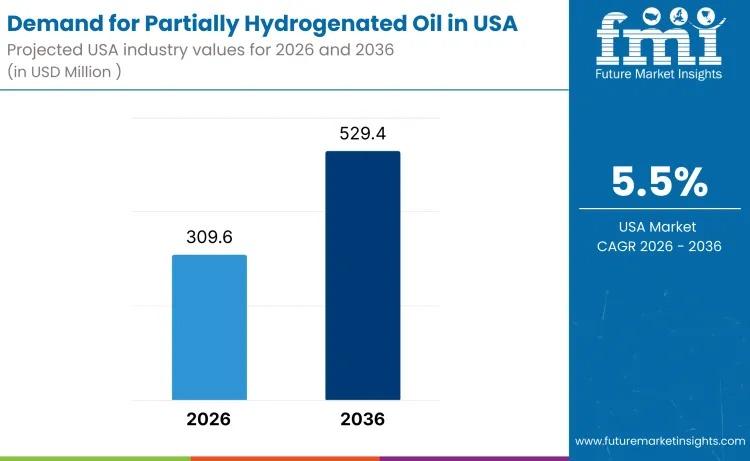

USA Partially Hydrogenated Oil Market to Reach USD 529.4 Million by 2036 Amid Me …

The demand for partially hydrogenated oil in the USA is projected to rise from USD 309.6 million in 2026 to USD 529.4 million by 2036, expanding at a steady CAGR of 5.5%. While edible applications remain tightly regulated, demand persists across specialty industrial and permitted food-related segments where oxidative stability, viscosity control, and texture performance remain critical.

Despite regulatory constraints on trans fats in conventional food manufacturing, PHOs continue to serve…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…