Press release

700-times around the World with the EXPO-Roof

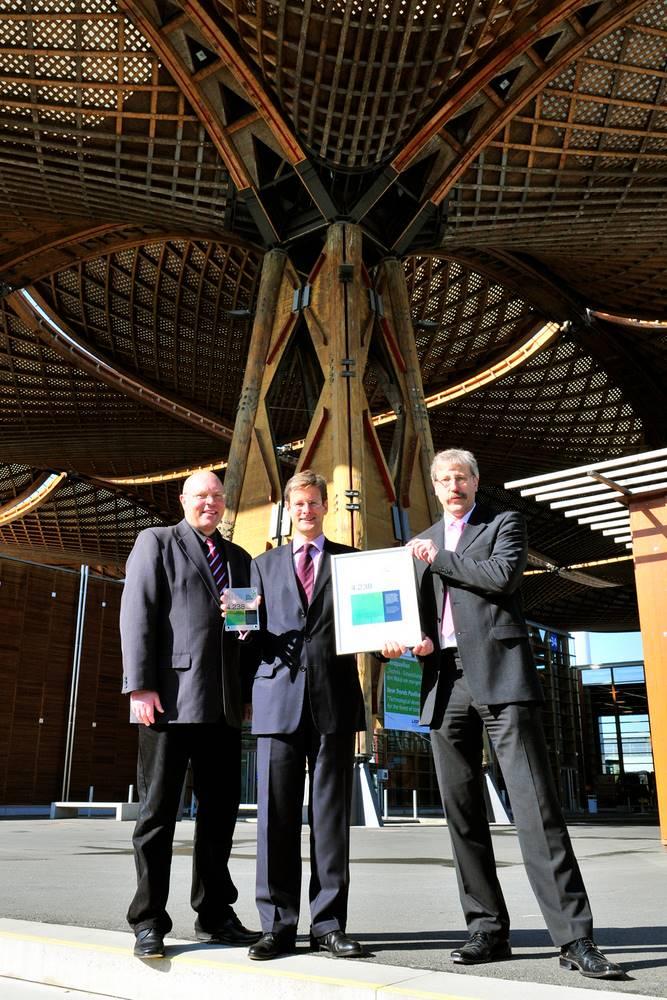

EXPO-roof saves 4238 tons of carbonDeutsche Messe AG has decided consciously to realize its EXPO-roof with timber. Thereby an active contribution to climate protection was made. On LIGNA HANNOVER 2009, world fair for the forestry and wood industries, a statement and a documentary sign were given to Deutsche Messe AG by the director of the Landesbeirat Holz Nordrhein-Westfalen (Advisory board for timber of North Rhine-Westphalia), Matthias Eisfeld.

The amount of carbon saved by timber is for “wood-laymen” often surprisingly. To emit this amount of carbon saved by the EXPO-roof, a car has to cover a distance of about 22 million km, that would be 700 times around the world. By way of comparison: a person in Germany produces in the annual average about 10 tons of carbon. This amount is essentially made up of fumes by car-driving, heating-up the apartment and consume of electricity.

[ Timber saves carbon dioxide ]

Carbon dioxide is split during the process of photosynthesis in the leaf. The carbon C remains in the wood while the oxygen O is released into the atmosphere. Through this process the amount of carbon in the atmosphere is reduced for the period of use and the carbon is deposited in the wood. Sustainable forestry is, of course, a precondition. As it is complied in Germany for several centuries. For every tree felled, a new one is planted. And it is not allowed to take more wood out of the forest as grows again in the same time. That´s why the use of timber is active climate protection!

Consequently the increased use of timber agrees the personal carbon-balance and the environment is intensified disburdens.

[ General information about the Carbon Bank ]

The Carbon Bank is an initiative of the forestry and woodworking industry and is represented by the Landesbeirat Holz NRW (Advisory board for timber of North Rhine-Westphalia). The Carbon Bank is an international data bank, which documents the quality and quantity of the reduction of carbon by buildings and performances of the forestry and woodworking industry.

[ Landesbeirat Holz NRW (Advisory board for timber of North Rhine-Westphalia) ]

The Landesbeirat Holz NRW consults the government relating to the forestry and woodworking industry. Further it plays a part in regional and national communion activities and develops own initiatives. The association has more than 100 members.

Contact the Carbon Bank via:

Landesbeirat Holz Nordrhein-Westfalen

Herr Matthias Eisfeld

Poststraße 7 | D-57392 Schmallenberg

Phone: +49 29 72 - 96 25 40

Fax: +49 29 72 – 96 25 42

E-Mail: info@co2-bank.de

Internet: www.co2-bank.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 700-times around the World with the EXPO-Roof here

News-ID: 81722 • Views: …

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…