Press release

Atm Market

The ATM Industry Association estimates that there are more than 3 million ATM machines spread across the world. ATM machines have enabled customers to withdraw cash and conduct financial transactions instantaneously without the need of human interaction in the form of a bank teller, cashier or clerk. Persistence Market Research felt the time was ripe to study the ATM market in a new report titled ‘Automated Teller Machine (ATM) Market: Global Industry Analysis 2012 – 2016 and Forecast 2017 – 2025’. The ATM market is predicted to cross a value of more than more than US$ 30 billion by the end of the forecast period in 2025 and record a robust CAGR of 7.9% during that period.Request Sample: https://www.persistencemarketresearch.com/samples/8368

APAC – The Present and Future of the Global ATM Market

The APAC region has a market share touching 47% of the ATM market in 2017 and this is likely to rise in the days ahead. The improvement of rural banking networks in this populous continent has led to a major focus on financial inclusion. Therefore, the ATM market has made its presence felt in rural and far-flung reaches across APAC nations. In the year 2016, a fifth of the total ATM card holders residing in rural areas were from the APAC region. In addition to this, regional governments are working overtime to simplify rules and regulations pertaining to financial markets. Several policies have been set up with the explicit purpose of increasing ATM use. For e.g. – Banks provide ATM cards to all people having an account with them.

15” and Below Segment to Dominate but Higher Growth Projected in the Above 15” Segment

The 15” and below screen size segment is more than three times the size of the above 15” screen segment at present and is unlikely to cede this commanding lead anytime soon. Nonetheless, a higher CAGR of 8.5% is predicted to be in the above 15” segment and key stakeholders in the ATM market are advised to take this into account. The above 15” segment is anticipated to push past US$ 7.5 billion by end 2022.

Off-site ATMs More Popular than Onsite ATMs

Offsite ATM machines are more desired than onsite ATM’s in the ATM market as they are conveniently located in multiplexes, shopping malls, and entertainment centers, making access easy and convenient. They serve the purpose of an ATM much better than onsite ATM’s located at or near a bank premises. The offsite ATM segment is estimated to be worth just under US$ 22 billion by the end of the study period. Nonetheless, companies must not overlook onsite ATM’s entirely in favor of offsite machines.

Global ATM Market: Competition Dashboard

The companies profiled in the PMR report on the ATM market are NCR Corporation, Dibold Nixdorf, Hitachi-Omron Terminal Solutions, GRG Banking, Fujitsu Frontech, Triton Systems of Delaware, Nautilus Hyosung Corp., HESS Cash Systems GmbH, Oki Electric Industry Co., Intertech Bilgi, AU Optronics Corp., KYOCERA Corporation, Mitsubishi Electric Corporation, Sharp Electronics Corporation, and Tianma Micro-electronics Co.

Download TOC: https://www.persistencemarketresearch.com/market-research/atm-market/toc

Global ATM Market: Key Insights

Global ATM providers can focus their energy on the dynamic APAC region led by the economic powerhouses of China and India as both their economic growth rates and that of the overall ATM market there is very high. In addition, ATM manufacturers can try to strengthen their distribution channels and technology support services to improve their market shares here. Lastly, banks and financial institutions should work on multivendor application and middleware software and develop ATM machines compatible with multi-vendor ATM software.

About Us:

Persistence Market Research (PMR) is a third-platform research firm. Our research model is a unique collaboration of data analytics and market research methodology to help businesses achieve optimal performance.

To support companies in overcoming complex business challenges, we follow a multi-disciplinary approach. At PMR, we unite various data streams from multi-dimensional sources. By deploying real-time data collection, big data, and customer experience analytics, we deliver business intelligence for organizations of all sizes.

Contact Us:

305 Broadway,7th Floor

New York City, NY 10007

United States

+1-646-568-7751

+1 800-961-0353 (USA-Canada Toll free)

Email: sales@persistencemarketresearch.com

Website: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Atm Market here

News-ID: 791736 • Views: …

More Releases from Persistence Market Research

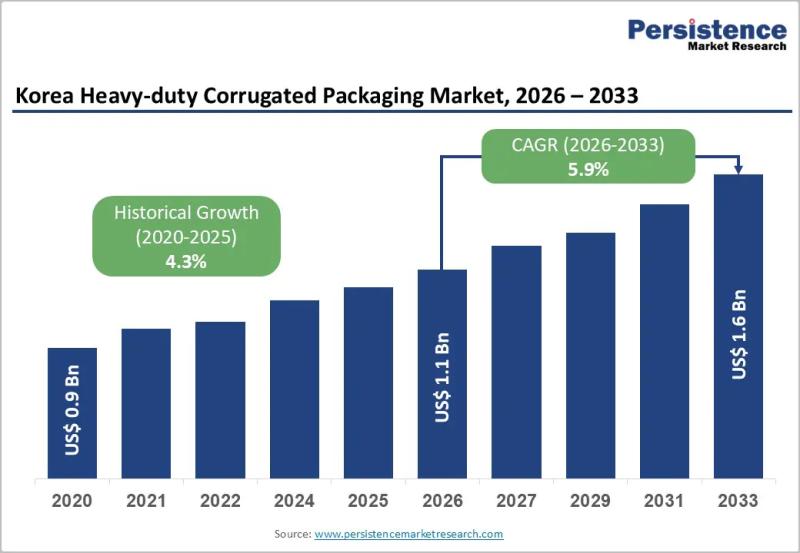

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for ATM

ATM Managed Services Market Expands: AI, Cloud & ATM-as-a-Service Drive Transfor …

ATM Managed Services Market size was valued at USD 10.5 Billion in 2024 and is projected to reach USD 16.2 Billion by 2033, exhibiting a CAGR of 5.2% from 2026 to 2033.

What are the potential factors contributing to the growth of the ATM Managed Services Market?

The ATM Managed Services Market is experiencing growth due to several key factors. The increasing demand for cost-effective banking operations is a major driver, as…

Prominent Automatic Teller Machine (ATM) Security Market Trend for 2025: Innovat …

"Which drivers are expected to have the greatest impact on the over the automatic teller machine (atm) security market's growth?

The surge in automated teller machine (ATM) fraud incidents is projected to fuel the expansion of the automated teller machine (ATM) security market in the future. An ATM is a specific type of computerized device that allows individuals to conduct a range of banking activities without requiring human assistance or a…

Global ATM Market by Types(On-site ATM,Off-site ATM,Work Site ATM,Mobile Site AT …

The global ATM market has the potential to grow with xx million USD with growing CAGR in the forecast period from 2021f to 2026f.

Global ATM Market Overview

This market research report consists of a number of sections that provide data on the current state of the market, industry trends, and future prospects. It also includes analysis of key players and their positions in the market. The increasing adoption…

Contactless ATM (Cardless ATM) Market: Industry Future Developments, Competitive …

The Contactless ATM (Cardless ATM) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Global Contactless ATM (Cardless ATM) Industry Professional Market Size Survey b …

This report also researches and evaluates the impact of Covid-19 outbreak on the Contactless ATM (Cardless ATM)�industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Contactless ATM (Cardless ATM)�and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

�

Scope of the Report:

The report presents the market outlook for the Indian Phospho Gypsum product from the year 2019…

Global Contactless ATM (Cardless ATM) Market Expected to Witness a Sustainable G …

LP INFORMATION offers a latest published report on Contactless ATM (Cardless ATM) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Contactless ATM (Cardless ATM) Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have been scrutinized…