Press release

M-Commerce Payments Market: Enhanced Security and Loyalty Integration to Drive Adoptability of M-Commerce

A fresh intelligence study by Transparency Market Research (TMR) has detected that the global m-commerce payments market has a highly prosperous future, with the demand projected to expand at a phenomenal CAGR of 46.9% during the forecast period of 2017 to 2022. The report identifies ACI Worldwide, Inc., Alphabet Inc., Apple Inc., DH Corporation, Fidelity National Information Services, Inc., Fiserv, Inc., Jack Henry & Associates Inc., Mastercard Incorporated, Paypal Holdings, Inc., Square, Inc., Visa, Inc., and Samsung Electronics Company Limited as some of the key companies currently operating in the global m-commerce payments market.As per the findings of the report, the global M-Commerce Payments Market is still in nascent stage, as neither the merchants nor the consumers have fully embraced the new technology. However, owing to the ubiquity of smartphones and technological advancements in terms of security and ease of usage, vast new opportunities will open up in the m-commerce payments market in the near future, and keep the pioneering companies in good stead. As per the evaluations of the TMR report, the global m-commerce payments market was worth merely US$1.11 bn in 2017, and estimates it to reach a valuation of US$7.55 bn by the end of 2022.

Sample With Latest Advancements @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=30728

Based on mode of payment, the global m-commerce payments market gains maximum demand for peer-to-peer transfer segment, which is projected for a CAGR of 45.1% during the forecast period of 2017 to 2022 to reach a valuation of US$2.7 bn by 2022. Region-wise, North America is estimated to increment the demand at most robust CAGR of 47.4% among all the regions studied under this report.

Enhanced Security and Loyalty Integration to Drive Adoptability of M-Commerce

Some of the key factors augmenting the demand in the global m-commerce payments market are: increasing penetration rate of smart devices such as smartphone and tablets, broader reach due to mobility, growing collaboration between online and offline activities, and improved bandwidth, which has helped easing out the transactions. The report observes that benefits such as enhanced security features, loyalty integration, and faster checkout are prompting the adoption of m-commerce. In addition to that, m-commerce has the potential to become cheaper than traditional services such as banking, marketing and advertising, and purchasing, which in turn will reflect positively on the global m-commerce payments market. Various social media platforms have also launched ‘buy’ bottons, which helps the marketers to generate sales leads in an instantaneous manner.

Browse Our Press Releases For More Information @ https://www.transparencymarketresearch.com/pressrelease/m-commerce-payments-market.htm

In the near future, the companies operating in the global m-commerce payments market are expected to spend additional focus on customer experience as a large percentage of them are seen to abandon the purchase on e-commerce websites mid-way. In-app payments such as Apple Pay and Walmart Pay not only helps the end-users to make swift transactions, it also helps the merchants to keep track of their buying habits and in turn offer lucrative discounts in order to increase sales during on and off seasons. Factors such as deliverance of new services to existing customers, vast potential to optimize the products, and utilization of device specific capabilities are expected to open new opportunities for the vendors operating in the global m-commerce payments market.

Security Issues Continues to Hinder the Growth Rate

On the other hand, the dearth of mobile friendly websites, limitations pertaining to internet connections in a number of emerging economies, security concerns, and slow adoptability rate of several retailers regarding credit card chip readers are some of the obstructions holding the global m-commerce payments market from attaining its true potential.

Browse Our Table of Content @ https://www.transparencymarketresearch.com/report-toc/30728

Apple Inc., Alphabet Inc., Mastercard Incorporated, ACI Worldwide, Inc., DH Corporation, Fidelity National Information Services, Inc., Fiserv, Inc., Paypal Holdings, Inc., Square, Inc., Visa, Inc., Jack Henry & Associates Inc., and Samsung Electronics Company Limited are some of the key companies currently operating in the global m-commerce payments market.

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. We have an experienced team of Analysts, Researchers, and Consultants, who us e proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Each TMR Syndicated Research report covers a different sector – such as pharmaceuticals, chemical, energy, food & beverages, semiconductors, med-devices, consumer goods and technology. These reports provide in-depth analysis and deep segmentation to possible micro levels. With wider scope and stratified research methodology, our syndicated reports thrive to provide clients to serve their overall research requirement.

Contact

Transparency Market Research

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release M-Commerce Payments Market: Enhanced Security and Loyalty Integration to Drive Adoptability of M-Commerce here

News-ID: 787716 • Views: …

More Releases from Transparency Market Research

Electric Wheelchair Market Expanding at 9.2% CAGR Through 2036 - By Control Type …

The global electric wheelchair market continues to demonstrate strong and sustained growth, fueled by demographic transitions, technological innovation, and expanding healthcare access worldwide. Valued at US$ 5.8 billion in 2025, the market is projected to reach US$ 15.3 billion by 2036, expanding at a compound annual growth rate (CAGR) of 9.2% from 2026 to 2036.

Discover essential conclusions and data from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4198

This robust trajectory reflects rising…

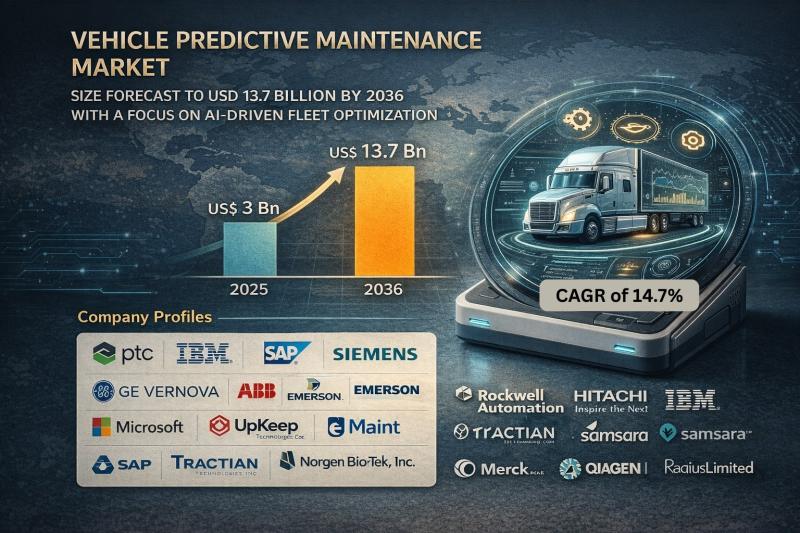

Vehicle Predictive Maintenance Market Size Forecast to USD 13.7 Billion by 2036 …

Vehicle Predictive Maintenance Market Outlook 2036

The global vehicle predictive maintenance market was valued at USD 3 Billion in 2025 and is projected to reach USD 13.7 Billion by 2036, expanding at a robust CAGR of 14.7% from 2026 to 2036. Market growth is driven by increasing adoption of connected vehicles, rising fleet digitalization, advancements in AI-driven analytics, and growing emphasis on minimizing vehicle downtime and maintenance costs.

👉 Get your sample…

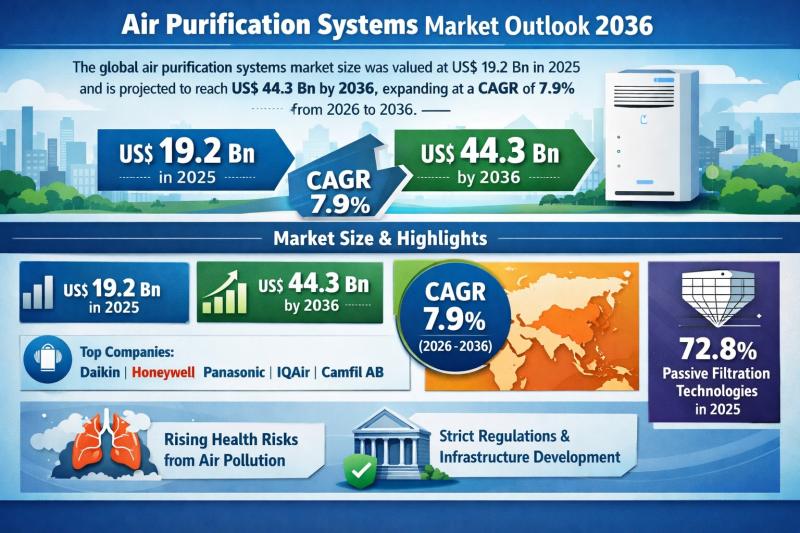

Global Air Purification Systems Market to Reach USD 44.3 Billion by 2036 at 7.9% …

The global Air Purification Systems Market was valued at US$ 19.2 Bn in 2025 and is projected to expand to US$ 44.3 Bn by 2036, registering a compound annual growth rate (CAGR) of 7.9% from 2026 to 2036. The market's upward trajectory reflects the structural shift in indoor air quality (IAQ) management, moving from discretionary consumer spending to mission-critical infrastructure investment.

With historical data available from 2021 to 2024, the industry…

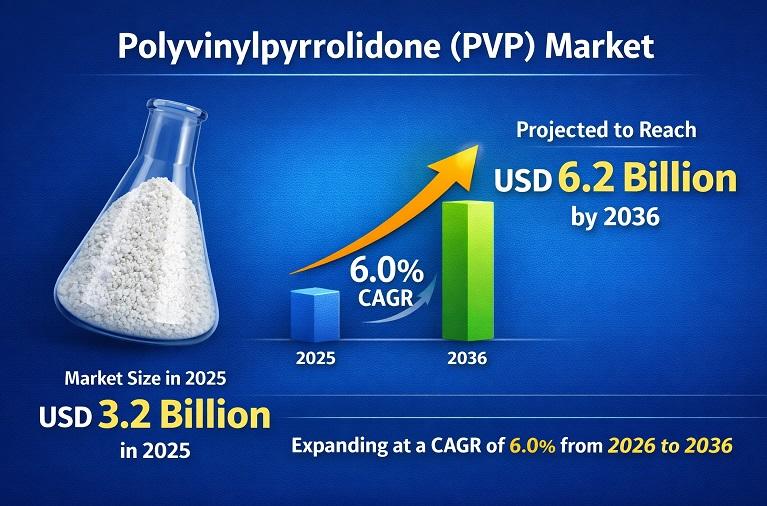

Polyvinylpyrrolidone (PVP) Market to Reach USD 6.2 Billion by 2036 Driven by Pha …

The Polyvinylpyrrolidone (PVP) Market was valued at around US$ 3.2 billion in 2025 and is projected to reach approximately US$ 6.2 billion by 2036, expanding at a steady CAGR of about 6.0% during the forecast period. This growth is primarily driven by rising demand from the pharmaceutical industry, where PVP is widely used as a tablet binder, solubilizer, and stabilizer, along with increasing consumption in cosmetics and personal care products…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…