Press release

Robo-Advisors Market Dynamics, Segments and Supply Demand -2025

Robo advisors are financial adviser class that offers portfolio management or financial advice online with least intervention of human. They offers digital financial advice depending on mathematical algorithms or rules. The algorithms are executed by software and hence financial advice essentially do not require any human advisors. Moreover, the software uses the algorithms to automatically manage, allocate and optimize client’s assets. In 2008, the robo advisors emerged with higher acceleration in U.S. and later in 2011 in other countries.Request Sample Copy of the Report@

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=25337

The global robo advisors market is primarily driven by the low fee robo advisory in the market during the forecast period. The robo advisory industries is likely to witness expansion continuously as the robo advisors attend to broader range of customers. With the increase in number of robo advisors, it is expected to see robo advisory requiring very less account minimums to take the benefits of their services. As of now, the minimum investment amount for robo advisors starts at a minimum of USD 500. Robo advisors are reducing the distance between client and wealth management products. They are removing the middle men and fee collectors out of the value chain thereby creating a simple fee structure that is directly related to the cost of the robots and products. Another major drivers in the global robo advisors market is the increasing integration of artificial intelligence. With the integration of artificial intelligence in the robo advisory system it is likely to help the robots to act more like human. For instance, Wealthfront has integrated artificial intelligence capabilities into its services. This is likely to track account activity on its products so as to understand and analyze the way the account holders are taking their financial decisions, spending and investing in an effort to provide more custom-made advices to the customers. With the entry of banks in the robo advisor market, the market is witnessing major driving factors in the global market of robo advisors market during the forecast period. Banks are now partnering with various robo advisor companies to provide various services directly to it customers. Banks like UBS, Schwab and Bank of Montreal has already launched their own robo advisor services.

The robo advisors market is facing challenges despite of various driving factors. One of the major factors restraining the market growth is due to the lack of direct communication with the client. The risk profile is continuously changing and is different due to various factors like retirement, income and job. These robo advisors lack the capability of direct communication with the clients and familiarize to the changing situations. Since the robo advisor system are based on single moment in time that is likely to be greatly influenced by the short term emotions or events. Moreover, the algorithms that are considered are based on previous market assumptions and data that is not likely to be correct in the future because of the changing financial market and products.

Continuous advancement in technology is one of the major opportunities in the global robo advisors market. Increasing advancement is likely to attract further attention since it is approaching the top of the hype cycle that shows in a phase of high public awareness and exaggerated interests.

The robo advisors market based on automation is bifurcated into semi-automated and fully automated. Based on the services, the market has been bifurcated into retirement planning, tax loss harvesting and investment advisors, B2B robo advisors, wealth management, personal financial advisors and others. The regional split of the market encompasses North America, Europe, Asia Pacific, Middle East and Africa and Latin America.

Some of the top players in the global robo advisors market encompasses Bambu (Singapore), Betterment Holdings Inc. (U.S.), Hedgeable, Inc. (U.S.), WiseBanyan, Inc.(U.S.), Wealthfront Inc.(U.S.), Ally Financial Inc. (U.S.), SigFig Wealth Management (U.S.), Charles Schwab & Co.(U.S.)., AssetBuilder Inc.(U.S.) and blooom, Inc. (U.S.) among others.

Request TOC of the Report@

https://www.transparencymarketresearch.com/sample/sample.php?flag=T&rep_id=25337

The report offers a comprehensive evaluation of the market. It does so via in-depth qualitative insights, historical data, and verifiable projections about market size. The projections featured in the report have been derived using proven research methodologies and assumptions. By doing so, the research report serves as a repository of analysis and information for every facet of the market, including but not limited to: Regional markets, technology, types, and applications.

The study is a source of reliable data on:

Market segments and sub-segments

Market trends and dynamics

Supply and demand

Market size

Current trends/opportunities/challenges

Competitive landscape

Technological breakthroughs

Value chain and stakeholder analysis

The regional analysis covers:

North America (U.S. and Canada)

Latin America (Mexico, Brazil, Peru, Chile, and others)

Western Europe (Germany, U.K., France, Spain, Italy, Nordic countries, Belgium, Netherlands, and Luxembourg)

Eastern Europe (Poland and Russia)

Asia Pacific (China, India, Japan, ASEAN, Australia, and New Zealand)

Middle East and Africa (GCC, Southern Africa, and North Africa)

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of Analysts, Researchers, and Consultants, use proprietary data sources and various tools and techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact Us

Transparency Market Research

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: www.transparencymarketresearch.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Robo-Advisors Market Dynamics, Segments and Supply Demand -2025 here

News-ID: 753173 • Views: …

More Releases from Transparency Market Research

Hobs Market Projected to Reach USD 50.1 Billion by 3036 amid Rising Adoption of …

The Hobs Market is witnessing steady growth as modern households increasingly adopt advanced kitchen appliances that offer convenience, efficiency, and aesthetic appeal. Hobs, also known as cooktops, have become an essential component of modular kitchens, replacing traditional freestanding stoves due to their space-saving design and enhanced functionality. Rising urbanization, changing lifestyles, and growing disposable income are playing a pivotal role in expanding the global hobs market.

Explore the Sample Report -…

Commercial Refrigeration Equipment Market to Reach US$ 103.9 Billion by 2036, Dr …

The global commercial refrigeration equipment market is poised for significant expansion over the next decade, driven by rapid technological advancements and the growing need for robust cold chain infrastructure worldwide. With increasing global demand for temperature-controlled storage across food, healthcare, and logistics sectors, the industry is entering a new phase of innovation-led growth.

Access key findings and insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=723

Market Size

The global commercial refrigeration equipment…

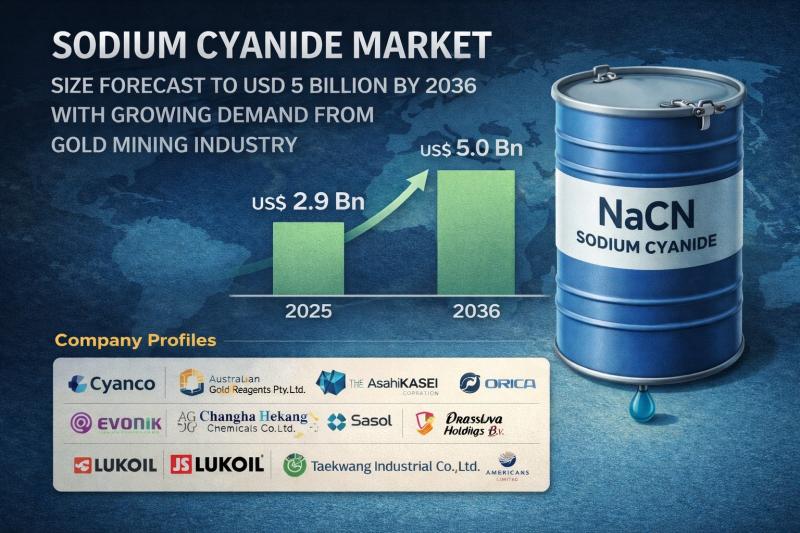

Sodium Cyanide Market Size Forecast to USD 5 Billion by 2036 with Growing Demand …

Sodium Cyanide Market Outlook 2036

The global sodium cyanide market was valued at US$ 2.9 Bn in 2025 and is projected to reach US$ 5 Bn by 2036, expanding at a CAGR of 5.2% from 2026 to 2036. Market growth is driven by increasing demand for gold extraction, rising mining activities, and technological advancements in cyanidation processes.

👉 Get your sample market research report copy today@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=46848

Market Overview

Sodium cyanide is a highly…

Ion Implanter Market Size Forecast to USD 3.7 Billion by 2036 with Growing Semic …

Ion Implanter Market Outlook 2036

The global ion implanter market was valued at US$ 2.1 Bn in 2025 and is projected to reach US$ 3.7 Bn by 2036, expanding at a steady CAGR of 5.0% from 2026 to 2036. Market growth is driven by increasing demand for advanced semiconductor devices, expansion of consumer electronics production, and rapid developments in automotive electronics and power devices.

👉 Get your sample market research report copy…

More Releases for Robo

Robo Advisory Market is Rising

According to the latest research report published by Market Data Forecast, the global robo advisory market is expected to grow at a CAGR of 54.2% from 2024 to 2029, and the global market size is anticipated to be worth USD 154.6 billion by 2029 from USD 17.73 billion in 2024.

The robo advising market is expanding rapidly, fueled by technical developments and rising demand for automated financial solutions. These platforms use…

Global Robo-Advisory Market, Global Robo-Advisory Industry, Covid-19 Impact Glob …

The Robo-advisory market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Robo-Advisory Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Robo-advisory market. The report focuses on well-known providers in the global Robo-advisory industry, market…

Global Robo-Advisory Market (2015-2023)

Global robo-advisory market

Robo-advisors are independent financial planning services driven by algorithms and supported by a digital platform with no human intervention. They collect information from their customers at first through an online survey to understand their financial situations and ultimate goals. With this information they make portfolios of investments by calculating their risk and returns along with profits for long-term. The global robo-advisory market is expected to grow at an…

Global Robo-advisory Market (2015-2023)

Market Research Report Store offers a latest published report on Robo-advisory Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Robo-advisory players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.To analyze the Robo-advisory with respect to individual growth trends, future…

Robo-Advisors: Mapping The Competitive Landscape

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…

Robo-Advisors: Mapping the Competitive Landscape

Summary

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…