Press release

Research Offers 10-Year Forecast on Financial Fraud Detection Software Market

Fraud is an illegal act which involves unjustifiably claiming something valuable. Financial Fraud is an issue with widespread consequences in the financial service industry, government, and corporate sectors. Hence financial institutions need a real- time automated system to detect fraud across multiple channels and transactions every day. With the rise of big data analytics, traditional methods of fraud detection such as manual detection appear inaccurate and more importantly time consuming. Hence, enterprises today invest in financial fraud detection software which integrate statistical and computational methods and big data analytics. Fraud detection software is a solution which consists of a model built by machine learning methods and stream computing. This model analyses client’s past data to detect possible fraud patterns. Financial fraud detection software supports in minimizing losses by reducing detection time, manage massive data sets and use correlation to identify fraud patterns or unusual behaviors.Financial Fraud Detection Software Market: Drivers and Restraints

In recent years the development of new technologies has also provided numerous ways for criminals to commit fraud. Solutions such as cloud services, increased in preference of digital data make enterprises significantly vulnerable to fraud. This turns out to be a big driver for fraud detection software market. Frauds are majorly committed for monetary benefits, resulting in considerable depreciation in the revenue of the organization. This has magnified the demand of financial fraud detection software in the enterprises being one important driver for this market growth.

Request Report Sample@ https://www.futuremarketinsights.com/reports/sample/rep-gb-3441

The high cost of various machine learning and statistical analytics solutions is a challenge for this market causing hindrance to the growth of market. The infrastructure demand before the deployment of these software and low level of awareness are also some restraints for this market.

Financial Fraud Detection Software Market: Segmentation

Financial Fraud Detection Software Market can be segmented on the basis of end user, deployment type, and region. On the basis of end user it can further segmented into financial enterprises, educational institutions, healthcare, government, and manufacturing sectors. Deployment type category includes money laundering, identity theft, credit/debit card fraud, wire transfer fraud, subscription frauds and claim frauds. Region wise, Financial Fraud Detection Software Market can be segmented into North America, Latin America, Asia Pacific, Japan, Eastern Europe, Western Europe, and Middle East & Africa.

Visit For TOC@ https://www.futuremarketinsights.com/toc/rep-gb-3441

Financial Fraud Detection Software Market: Regional Overview

North America emerges as the leader in the financial fraud detection software due to presence of large financial and healthcare enterprises in the countries such as USA and Canada. Companies such as Gemalto NV, SEKUR.me, CipherCloud, SIGNIFYD Inc., Riskified Ltd. are some of the majority software providers for financial fraud detection in USA.

European countries such as France, Greece and UK are also expanding their market and will see a good rate of growth in future in financial fraud detection software due to increase in crimes such as card fraud and identity fraud. Experian Information Solutions, Inc., AimBrain, ValidSoft, and Easy Solutions,Inc. are some key players in Europe’s fraud and authentication market.

ABOUT US:

Future Market Insights (FMI) is a leading market intelligence and consulting firm. We deliver syndicated research reports, custom research reports and consulting services, which are personalized in nature. FMI delivers a complete packaged solution, which combines current market intelligence, statistical anecdotes, technology inputs, valuable growth insights, an aerial view of the competitive framework, and future market trends.

CONTACT:

Future Market Insights

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Website: www.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Research Offers 10-Year Forecast on Financial Fraud Detection Software Market here

News-ID: 752464 • Views: …

More Releases from Future Market Insights

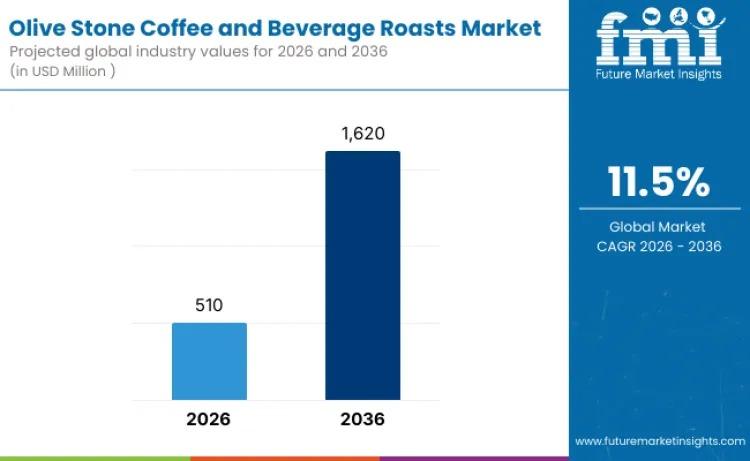

Global Olive Stone Coffee and Beverage Roasts Market to Reach USD 1,620 Million …

The global olive stone coffee and beverage roasts market is entering a high-growth decade, fueled by sustainability innovation and evolving specialty coffee culture. Valued at USD 510 million in 2026, the market is projected to reach USD 1,620 million by 2036, expanding at a compelling CAGR of 11.5%.

As consumers increasingly seek beverages that combine sustainability, functionality, and distinctive taste, olive stone-based roasting solutions are transitioning from niche experimentation to structured…

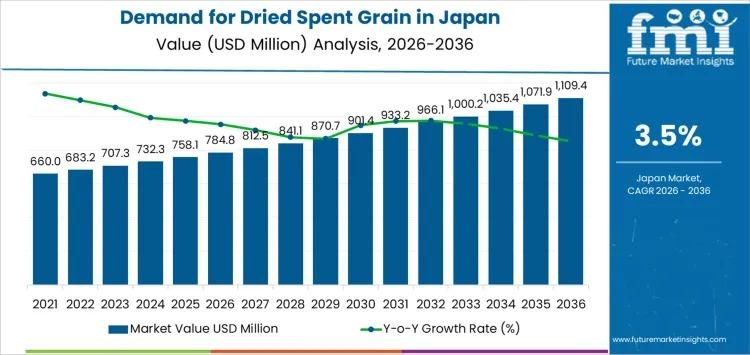

Japan Dried Spent Grain Market to Surpass USD 1.1 Billion by 2036 as Feed Optimi …

Japan's dried spent grain market is entering a decade of steady, value-driven expansion, supported by structured feed demand, brewery byproduct utilization, and rising integration of fiber-rich ingredients into food manufacturing. Industry estimates place the market at USD 784.8 million in 2026, with projections indicating growth to USD 1,109.4 million by 2036, reflecting a CAGR of 3.5%.

Between 2020 and 2026, demand increased from USD 637.5 million to USD 784.8 million, shaped…

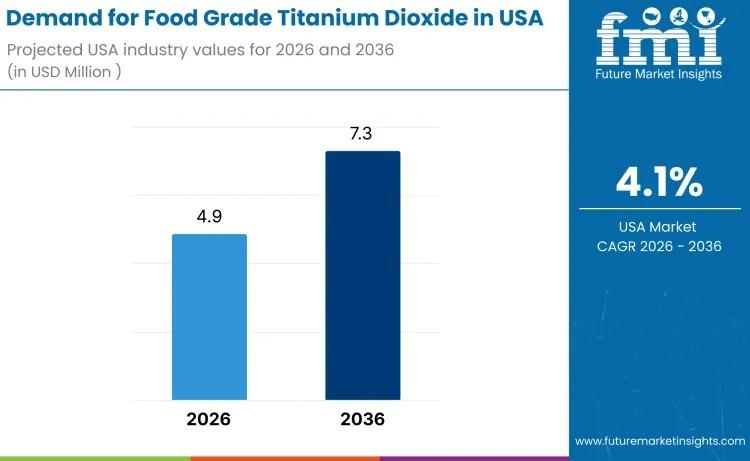

USA Food Grade Titanium Dioxide Market to Reach USD 7.3 Million by 2036 Amid Ste …

The demand for food grade titanium dioxide in the USA is valued at USD 4.9 million in 2026 and is projected to reach USD 7.3 million by 2036, expanding at a CAGR of 4.1%. Growth remains moderate yet stable, supported by continued use of titanium dioxide as a whitening and opacifying agent across confectionery coatings, bakery decorations, sauces, dairy analogues, and processed food matrices.

Despite heightened regulatory scrutiny and evolving clean-label…

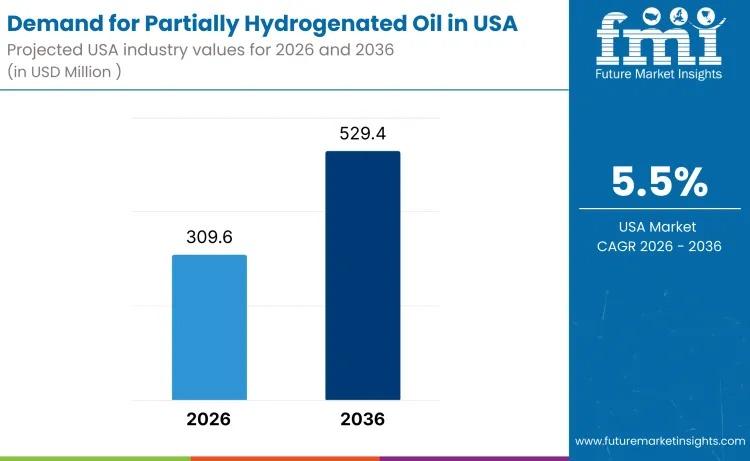

USA Partially Hydrogenated Oil Market to Reach USD 529.4 Million by 2036 Amid Me …

The demand for partially hydrogenated oil in the USA is projected to rise from USD 309.6 million in 2026 to USD 529.4 million by 2036, expanding at a steady CAGR of 5.5%. While edible applications remain tightly regulated, demand persists across specialty industrial and permitted food-related segments where oxidative stability, viscosity control, and texture performance remain critical.

Despite regulatory constraints on trans fats in conventional food manufacturing, PHOs continue to serve…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…