Press release

Insurance Telematics Market Forecast and Analysis by Future Market Insights( 2017-2027)

Recently insurance industry is facing a huge technological shift in order to stay competitive in the market. Due to innovations in IoT and using them for insurance telematics products in order to connect insurance products and their offerings are in rise. The growth in investments in the IoT insurance technologies are enabling to develop innovative insurance telematics offerings.Insurance telematics devices are primarily used by automobile insurance companies in order to track driving behavior of the customer and based on their performance in driving there would be change in the insurance premiums.

Request For Report Sample@ https://www.futuremarketinsights.com/reports/sample/rep-gb-3219

Life insurance companies are incorporating health tracking devices in order to integrate change premiums and insurance plans based on the customer’s health change patterns. This smart life way of changing insurance offers is an example of how insurance companies are starting to make impact in the daily lives of their customers.

Market drivers & challenges:

These technology enabled products will become necessary across all segments of the insurance industry, as increase in the digital savvy customers. Growth in innovations like IoT and machine learning also increase the adoption of insurance telematics market.

Insurance telematics market is also driven by the growth in construction industry where insurance companies offer reduced premiums based on the building systems and also react and monitor utilities in order to understand water leakage, fire occupancy trends etc. Insurance companies can use this data findings and can do predictive maintenance by detecting potential problems prior to their occurrence, thereby reducing claims from the customers.

One of the major challenge faced insurance telematics market is lack of knowledge of these advanced technologies by the insurance companies and the huge task of designing the IoT applications based on company’s Policies and government regulations.

Global Insurance Telematics Market: Segmentation

Global Insurance telematics market is segmented based on the type of Deployment, by the size of the organisation, by region.

On the basis of the type of deployment Global Insurance telematics market is segmented to Cloud, On-premise.

On the basis of the size of organisation the Global Insurance telematics market is segmented to Small and Medium Enterprises (SMEs), Large Enterprises.

On basis of region global Insurance Telematics Market is segmented into North America, Latin America, Eastern Europe, Western Europe, Asia Pacific Excluding Japan (APEJ), Japan and The Middle East and Africa (MEA).

Market Overview:

Majority of the Insurance Telematics market is dominated by Europe as there are large number of insurance companies adopting to these change. Followed by North America and Asia pacific which also share a significant market due of growth of online retail.

Visit For TOC@ https://www.futuremarketinsights.com/toc/rep-gb-3219

Key Market Players:

Some of the key players in Global Insurance Telematics Market include, CoverBox Ltd., Hughes Telematics, Inc., Insure The Box, Liberty Mutual Insurance Company, MyDrive Solutions, Novatel Wireless, Numerex Corporation, , State Farm, TomTom, TRACKER Network, Travelers Indemnity Company, Trimble Insurance Agency, Inc., ViaSat, Inc., Zurich Financial Services Ltd.

ABOUT US:

Future Market Insights (FMI) is a leading market intelligence and consulting firm. We deliver syndicated research reports, custom research reports and consulting services, which are personalized in nature. FMI delivers a complete packaged solution, which combines current market intelligence, statistical anecdotes, technology inputs, valuable growth insights, an aerial view of the competitive framework, and future market trends.

CONTACT

Future Market Insights

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Website: www.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Telematics Market Forecast and Analysis by Future Market Insights( 2017-2027) here

News-ID: 723720 • Views: …

More Releases from Future Market Insights

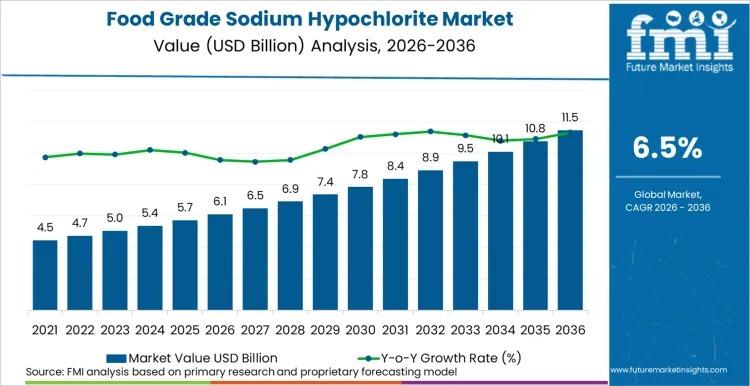

Food Grade Sodium Hypochlorite Market Outlook 2026-2036: Global Market to Reach …

The global food grade sodium hypochlorite market is projected to expand steadily over the next decade, increasing from USD 6,160.5 million in 2026 to USD 11,564.2 million by 2036, registering a CAGR of 6.5%. According to the latest analysis by Future Market Insights (FMI), market expansion is structurally underpinned by the non-discretionary nature of food safety disinfection, where sodium hypochlorite demand remains directly proportional to food processing throughput rather than…

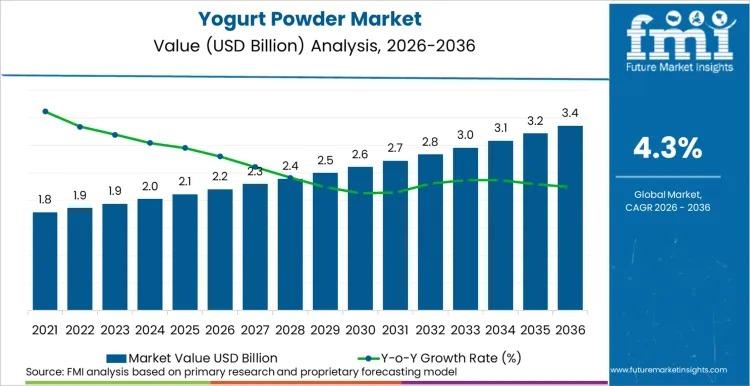

Yogurt Powder Market Forecast 2026-2036: Market to Reach USD 3.40 Billion by 203 …

The global yogurt powder market is projected to expand steadily over the next decade, increasing from USD 2.20 billion in 2026 to USD 3.40 billion by 2036, registering a CAGR of 4.30%. According to the latest analysis by Future Market Insights (FMI), growth is being driven by supply chain modernization, capital expenditure in drying infrastructure, and a structural shift toward ambient functional nutrition.

Manufacturers are increasingly replacing liquid dairy inputs with…

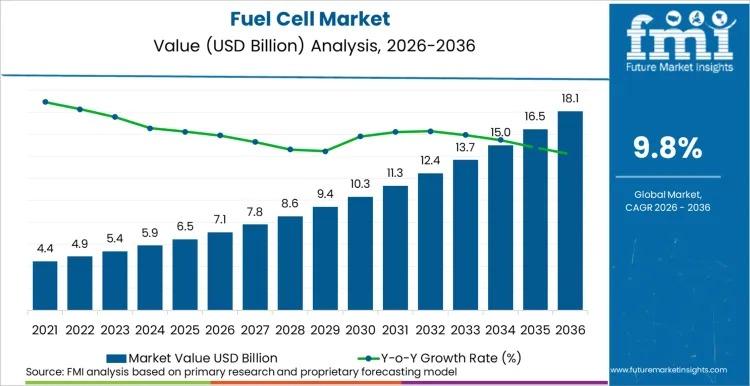

Fuel Cell Market Forecast 2026-2036: Global Market to Reach USD 18.2 Billion by …

The global fuel cell market is projected to expand from USD 7.1 billion in 2026 to USD 18.2 billion by 2036, registering a CAGR of 9.8% over the forecast period, according to the latest analysis by Future Market Insights (FMI). FMI positions the category as policy-executed through bankable offtake and infrastructure alignment, where adoption scales when hydrogen supply, permitting, and fleet duty cycles converge with total cost of ownership rather…

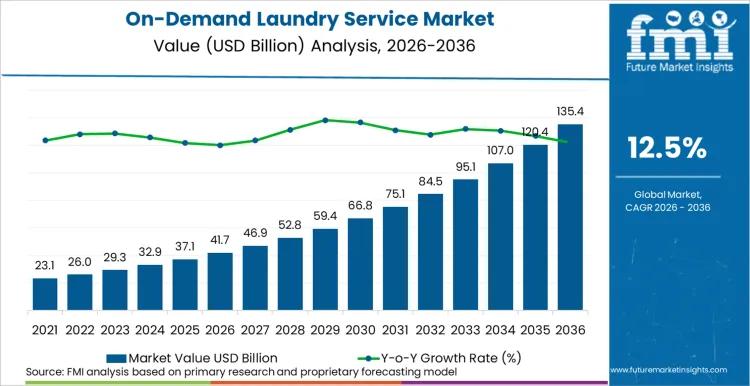

On-Demand Laundry Service Market Forecast 2026-2036: Market to Reach USD 135,438 …

The global on-demand laundry service market stood at USD 41,707.8 million in 2026 and is projected to expand significantly to USD 135,438.6 million by 2036, reflecting a robust compound annual growth rate (CAGR) of 12.5% during the forecast period. This structural expansion is propelled by shifting urban lifestyles, widespread adoption of app-based booking platforms offering real-time tracking and express delivery, and rising B2B demand from hotels, serviced apartments, and coworking…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…