Press release

Life Insurance Policy Administration Systems Market Value Projected to Expand by 2027

The life insurance industry is witnessing shifting trends in the front-office, policy administration, and claims, the three core functions of the insurance value chain. Life insurance firms remain challenged by their inflexible legacy life insurance policy administration systems. Designing innovative products, faster time to market and leveraging modern technology for multi-channel distribution has become essential for life insurers. Hence insurers are looking for life insurance policy administration systems transformation to enhance their operational efficiency with a lower total cost of operations by consolidating their existing systems.A sample of this report is available upon request @ https://www.persistencemarketresearch.com/samples/14137

Life insurance policy administration software helps insurers manage life and annuity insurance policies. Life insurance policy administration systems allow insurers to develop and administer new life, annuity, pension, and health insurance products for clients. Using life insurance policy administration software systems, organizations can design new policies, calculate policy costs, and maintain a record of policies issued to clients. Some systems offer libraries of prebuilt insurance product features that reduce time to market. Life insurance policy administration software systems are commonly used by enterprise insurance organizations to manage existing policies and develop new insurance products. These systems can improve policy flexibility and administration. Life insurance policy administration software systems can be implemented either as a standalone solution or as part of an integrated insurance suite.

Life Insurance Policy Administration Systems Market: Drivers and Challenges

Below listed are few of the driving factors of life insurance policy administration systems market: Life insurers seek to launch new and innovative products, hence, they need faster speed-to-market for these products. Multiple life insurance policy administration systems offer different interfaces to business users, making it difficult to understand and interact with the process. Life insurers also face issues with the data consistency and redundancy due to the existence of information across multiple repositories in the organization. This lowers customer satisfaction since it results in customer service inefficiencies. The old legacy systems have limited flexibility, sometimes due to hard-coded logic, which results in a challenge in the case of any new requirement or change in business rules and processes. All these factors are encouraging consumers to shift to life insurance policy administration systems.

Life Insurance Policy Administration Systems Market: Segmentation

Segmentation on the basis of component:

Hardware

Software

Services

Segmentation on the basis of deployment type:

On-premises

Software-as-a-Service (SaaS)

Life Insurance Policy Administration Systems Market: Key Market Players

Few of the companies in Life Insurance Policy Administration Systems market are: Accenture, Andesa Services, Concentrix, CSC (CyberLife), CSC (Wealth Management Accelerator), EXL, FAST Technology, Infosys McCamish, InsPro Technologies, Majesco, MDI, Mphasis Wyde, Oracle, Sapiens and Vitech Systems Group.

To view TOC of this report is available upon request @ https://www.persistencemarketresearch.com/toc/14137

Life Insurance Policy Administration Systems Market: Regional Overview

Life insurance policy administration systems market is currently dominated by North America region owing to wide adoption of life insurance policy administration systems in order to improve efficiency and eradicate issues arising due to multiple administration systems. Europe Life Insurance Policy Administration Systems market follows next due to wide adoption of these kind of administration systems in this region. Asia Pacific life insurance policy administration systems market is gradually growing due to the presence of wide customer base in this region.

About Us

Persistence Market Research (PMR) is a third-platform research firm. Our research model is a unique collaboration of data analytics and market research methodology to help businesses achieve optimal performance.

To support companies in overcoming complex business challenges, we follow a multi-disciplinary approach. At PMR, we unite various data streams from multi-dimensional sources. By deploying real-time data collection, big data, and customer experience analytics, we deliver business intelligence for organizations of all sizes.

Contact Us

Persistence Market Research

305 Broadway

7th Floor, New York City,

NY 10007, United States,

USA – Canada Toll Free: 800-961-0353

Email: sales@persistencemarketresearch.com

Web: http://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Life Insurance Policy Administration Systems Market Value Projected to Expand by 2027 here

News-ID: 706650 • Views: …

More Releases from Persistence Market Research

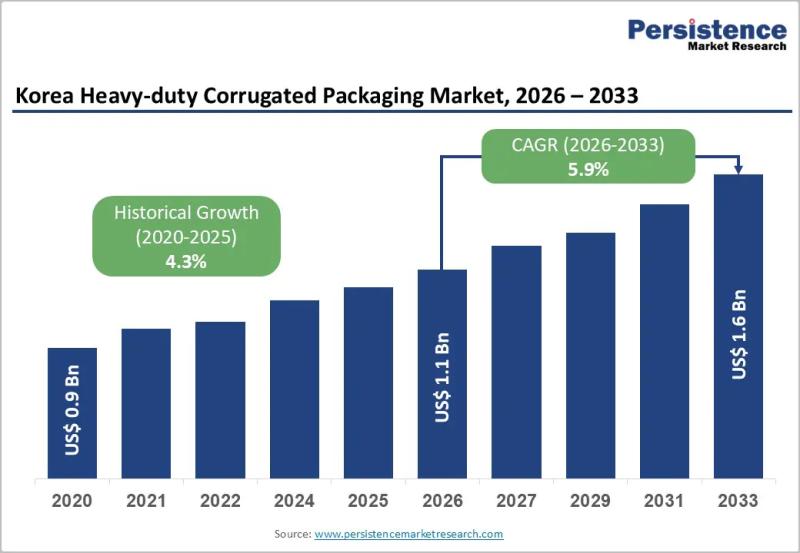

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…