Press release

Contactless Payment Transaction Market: Demand for Speedy Counter Sales Processes Boosts Adoption

Global Contactless Payment Transaction Market: SnapshotStiff competition prevails in the global contactless payment transaction market. This is because there are a sizeable number of small and large service providers and entry into the market is quite easy. Of late, the entry of banks, card companies, telecom companies, and payment companies that are foraying into contactless payment services has further intensified competition in the market.

Fill the form to gain deeper insights on this market @ http://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=2566

In order to ensure sustainable returns, service providers are focused on crafting innovative marketing strategies for a higher rate of conversion. For example, Samsung developed magnetic secure transmission, which releases a magnetic signal that imitates the magnetic strip on traditional payment cards.

The key factor driving the contactless payment transaction market is the increasing demand for speedy transactions, especially in the retail and transport sectors underpinned by the rising use of smartphones. Proving to be a hindrance, on the flip side, is the high installation cost of point-of-sale (PoS) machines for contactless payment as compared to normal PoS machines.

As per a report by Transparency Market Research, the global contactless payment transaction market is projected to rise at a whopping 55.5% CAGR from 2017 to 2025 for the market’s valuation to reach US$801.44 bn by 2025.

Retail Leading End-use Segment due to Demand for Speedy Counter Sales Processes

In terms of mode of payment, the segments of the market are wearable devices, contactless card (RFID/NFC), and contactless mobile payment. The segment of contactless card (NFC/RFID) is estimated to contribute the leading revenue to the global contactless payment transaction market over the forecast period. The segment of wearable devices comprise transactions carried out over smart watch or smart band. The segment of wearable devices is anticipated to rise at a substantial rate in the upcoming years. Contactless mobile payment segment includes payments made via smartphones.

The global contactless payment transaction market is classified into hospitality, media and entertainment, transport, retail, healthcare, and others depending upon end use. Among these, the segment of retail is anticipated to contribute the leading revenue to the global market for contactless payment transaction followed by the transport and hospitality sectors in the coming years.

Europe to Remain at the Global Market’s Forefront

The global contactless payment market, based on geography, has been segmented into North America, Asia Pacific, Europe, the Middle East and Africa, and South America. Powered by the increasing adoption of NFC-enabled smart wearable devices and growing use of contactless cards, Europe is anticipated to display relatively speedy growth amongst other key regional segments. In the region, contactless cards is projected to contribute the leading revenue backed by growth in retail and transport end-use industries in the U.K., Poland, and Germany. According to the data published by the U.K. card association, the number of contactless cards issued in the U.K. was 857 million in 2015.

Obtain Report Details @ http://www.transparencymarketresearch.com/contactless-payments-market.html

Asia Pacific is expected to display relatively fast adoption of NFC-enabled contactless devices and wearable devices with the launch of apps such as Samsung Pay. The region is expected to display higher growth rate over other regions and second after Europe. Within Asia Pacific, retail/e-commerce, hospitality, and transportation sectors are expected to contribute significant revenues backed by economic development in India, China, and South Korea.

North America contactless payment transaction market is displaying sound growth backed by a large consumer base of mobile phone users.

Some of the prominent names operating in the global contactless payment transaction market profiled in this report are Apple Inc., Barclays, Ingenico Group, Heartland Payment Systems Inc., Giesecke & Devrient GmbH, Inside Secure, Samsung Electronics Ltd., On Track Innovations Ltd., Verifone Systems Inc., Gemalto N.V., and Wirecard AG.

About TMR

TMR is a global market intelligence company providing business information reports and services. The company’s exclusive blend of quantitative forecasting and trend analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information.

Contact TMR

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: http://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Contactless Payment Transaction Market: Demand for Speedy Counter Sales Processes Boosts Adoption here

News-ID: 691770 • Views: …

More Releases from Transparency Market Research

Leisure Boat Market Size Forecast to USD 77.6 Billion by 2036 with Growing Deman …

Leisure Boat Market Outlook 2036

The global leisure boat market was valued at USD 54.1 Billion in 2025 and is projected to reach USD 77.6 Billion by 2036, expanding at a steady CAGR of 3.3% from 2026 to 2036. Market growth is driven by rising recreational boating activities, increasing disposable incomes, expanding marine tourism, and growing interest in water sports and luxury lifestyles.

👉 Get your sample market research report copy today@…

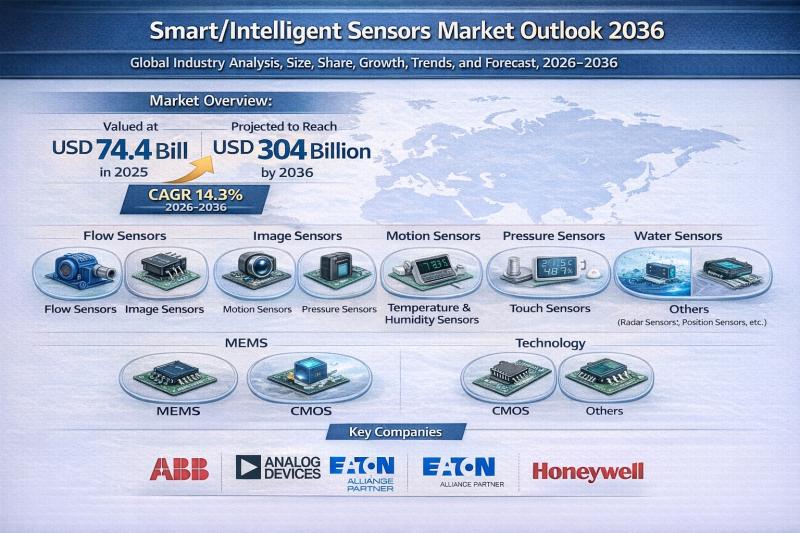

Smart/Intelligent Sensors Market to Reach USD 304 Billion by 2036, Expanding at …

The global smart/intelligent sensors market is witnessing robust expansion as connected ecosystems, automation technologies, and edge computing redefine digital infrastructure worldwide. Valued at USD 74.4 Billion in 2025, the market is projected to surge to USD 304 Billion by 2036, registering a strong CAGR of 14.3% from 2026 to 2036.

Smart or intelligent sensors go beyond conventional sensing capabilities by integrating embedded processing, data analytics, wireless connectivity, and decision-making intelligence directly…

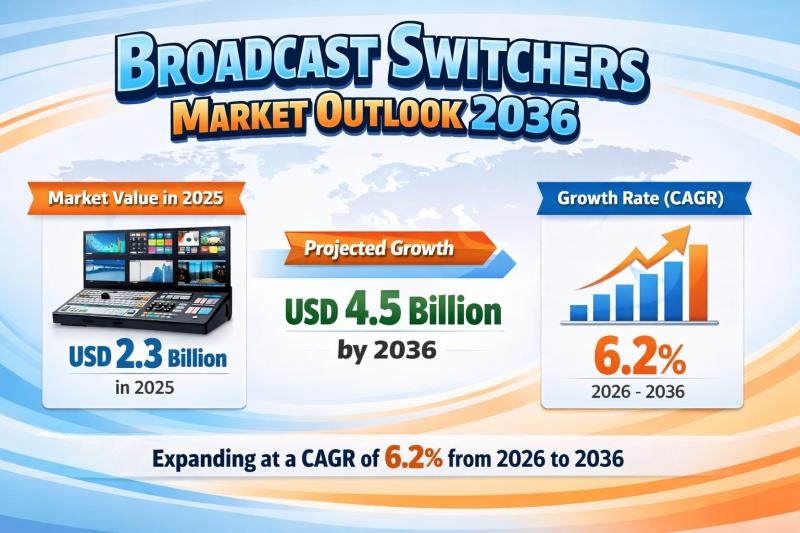

Broadcast Switchers Market to be Worth USD 4.5 Bn by 2036 - By Production, Routi …

The global Broadcast Switchers Market is poised for sustained expansion over the next decade, driven by technological innovation and rising global demand for high-quality live content production. Valued at USD 2.3 Billion in 2025, the market is projected to grow to USD 4.5 Billion by 2036, expanding at a compound annual growth rate (CAGR) of 6.2% from 2026 to 2036.

Review critical insights and findings from our Report in this sample…

Global Tablet Coatings Market Outlook 2031: Projected to Surpass USD 1,543 Milli …

The global tablet coatings market was valued at US$ 824 Mn in 2021 and is projected to expand at a steady CAGR of 5.3% from 2022 to 2031, reaching more than US$ 1,543 Mn by 2031. This consistent growth trajectory reflects the rising consumption of coated pharmaceutical and nutraceutical tablets across developed and emerging markets.

Between 2017 and 2020, the market experienced moderate expansion driven by generics penetration and increasing oral…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…