Press release

Mobile Banking Software Solution Market Grows Owning To Innovations In Technology 2017 - 2025

Mobile banking software solutions allow the banking institutions to build customized mobile banking applications according to the requirement. Mobile banking software serves as a self-service banking platforms. Mobile banking software enables customers to do financial transactions and manage their financials by accessing their bank account through mobiles or tablets. By using mobile banking software banking institutions, credit unions, and financial institutions can send targeted push messages to the customers. Mobile banking software solutions provide personalized customer experience using various mobile channels like Mobile App, Mobile Browser, SMS, and USSD. Mobile banking software solutions support mobile operating systems like IOS, android, and windows. Mobile banking software solutions provide insights into the data related to financial institutions so that organizations can fill the gaps related to the operations and improve their performance. Mobile banking software solutions help the customers to track and analyze their spending. Mobile banking software solutions allow the customers to deposit their cheque also. Mobile banking software solutions allow customers to use payment options including QR code and pay-to-phone payments.A sample of this report is available upon request @ http://www.persistencemarketresearch.com/samples/17359

Mobile banking software solution market: Drivers and Challenges

Increased usage of smartphones and tablets are driving the mobile banking software solutions market. Mobile banking software solutions allow the customers to access their accounts from any remote locations. Mobile banking software solutions allow the organizations to develop native or hybrid applications according to the convenience. Mobile banking software solutions, when deployed through the cloud, reduces the cost associated with in-house infrastructure.

Request to view table of content @ http://www.persistencemarketresearch.com/toc/17359

Lack of awareness among the users is the primary challenge for mobile banking software solutions. Reluctant to change from traditional banking methods to mobile banking also challenges the market. Data security and privacy are also one of the challenges for mobile banking software solutions market.

Mobile banking software solution market: Regional Outlook

North America and Western Europe Mobile banking software solution market is predominantly mature as compared to the other regional market as they are fast in the adoption of technology. Mobile banking software solution market in Asia Pacific excluding Japan and Japan are expected to possess maximum potential in the forecast period. Mobile banking software solution market in Latin America and Middle East and Africa are also projected to witness positive growth during the forecast period.

Mobile banking software solution market: competition landscape

Key Vendors for Mobile banking software solution market are CR2 Ltd., SAB Group, Fiserv Inc, Temenos Group AG, Infosys Limited, Neptune Software Group B.V.I, Apex Softwares Ltd, Capital Banking Solutions group, EBANQ Holdings BV, and Dais Software Ltd.

Buy Now: You can now buy a single user license of the report @

http://www.persistencemarketresearch.com/checkout/17359

About Us

Persistence Market Research (PMR) is a U.S.-based full-service market intelligence firm specializing in syndicated research, custom research, and consulting services. PMR boasts market research expertise across the Healthcare, Chemicals and Materials, Technology and Media, Energy and Mining, Food and Beverages, Semiconductor and Electronics, Consumer Goods, and Shipping and Transportation industries. The company draws from its multi-disciplinary capabilities and high-pedigree team of analysts to share data that precisely corresponds to clients’ business needs.

PMR stands committed to bringing more accuracy and speed to clients’ business decisions. From ready-to-purchase market research reports to customized research solutions, PMR’s engagement models are highly flexible without compromising on its deep-seated research values.

Contact

Persistence Market Research Pvt. Ltd

305 Broadway

7th Floor, New York City,

NY 10007, United States,

USA – Canada Toll Free: 800-961-0353

Email: sales@persistencemarketresearch.com

media@persistencemarketresearch.com

Web: www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Banking Software Solution Market Grows Owning To Innovations In Technology 2017 - 2025 here

News-ID: 675709 • Views: …

More Releases from Persistence Market Research

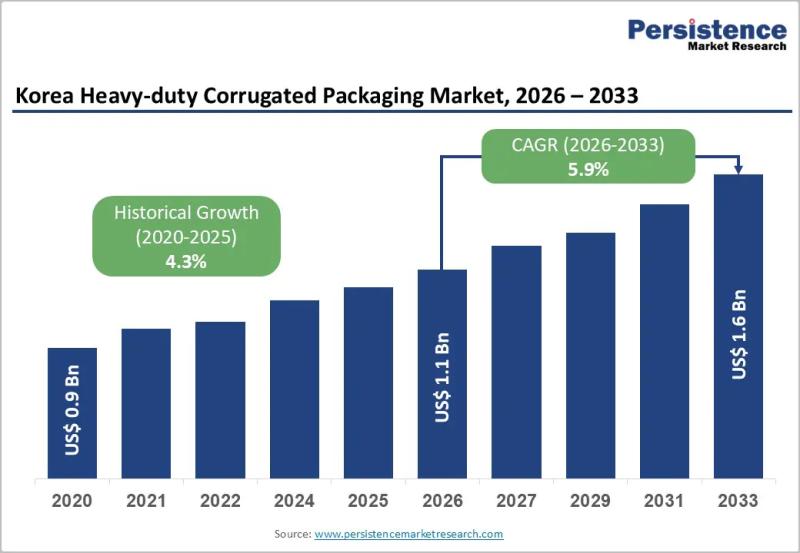

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…