Press release

BFSI Security Market Value Share, Supply Demand, share and Value Chain 2016-2026

In past one decade, electronic banking platforms have been implemented as an efficient channel to process banking transactions remotely. These banking transactions are executed from web based applications over the internet network, thus creating security risk by exposing user’s data to hackers. Apart from this, the banking, financial and insurance industry is continuously witnessing threat from global terrorism, cyber-crimes, and espionage which are leveraging the loopholes in the critical infrastructure. With the increase in cyber-crimes activities, security of sensitive data including, personably identifiable information, personal banking details, commercial banking details, and confidential corporate information is at high risk, due to which, the demand for BFSI security solutions has witnessed traction in the past couple of years.Bank and financial institutions are operated in highly regulated environment. Data breach incidences in these cases occur mainly due to non-compliance to various operational standards.. Therefore, there is increasing need of BFSI security to ensure the long term visibility of banking and financial institutions and their data. BFSI security includes cyber security and physical security of banking and financial institutions.

Component and Technologies Used in BFSI Security

Access Control Systems

Cloud Based Services

Physical Security Software

Surveillance Systems

BFSI Security Market: Drivers and Restraints

In the current changing world of information technology, banking and financial institutions are facing privacy issues due to increased data theft and unauthorized accesses. In BFSI sector, there is always existence of both internal and external threats with increased adoptions of ATMs and online banking solutions. As security breach of customer’s financials can hamper brand image of a particular financial institution, there necessity of safeguarding physical assets and continuous monitoring of banking data driving the growth of the market. However, the initial investment required to set up the security infrastructure is one of the challenge for the growth of this market.

Request For Report sample: http://www.futuremarketinsights.com/reports/sample/rep-gb-1373

BFSI Security Market: Segmentation

Segmentation of business BFSI Security market on the basis of systems and components:

Video Surveillance:

Video surveillance is used for monitoring activities inside out of the organization. Physical security has become necessary for banking and financial institutions to combat pilferage to theft related activities. This has created increase in demand for video surveillance solutions in the BFSI industry.

Access Control :

Access control is deployed for both physical security as well as information security. Access control systems seamlessly work against any unauthorized access. Access control solutions includes web-based access control, managed access control, control panel, visitor management systems, readers, and credentials.

Intrusion and Fire Detection:

Intrusion detection systems inspect all the inner and outer network activities and identifies suspicious pattern to indicate data breach attempt in the system. Fire detection system is a combination of various devices which work seamlessly to counsel end-users from any threat of fire.

Physical Security Information Management (PSIM):

Physical security information management is a software that act as a standalone platform for integrating multiple unconnected security application and devices. It controls them using single user interface.

Request For TOC: http://www.futuremarketinsights.com/toc/rep-gb-1373

Regional Overview

Asia-Pacific is witnessing rapid growth in the adoption of BFSI security solutions. With respect to this trend, various security vendors such as Honeywell International Inc. and Cisco System Inc. are expanding their business in this region in order to increase its market share in this market. Besides, the Asia-Pacific market is world’s fastest growing economy and soon is expected to be largest wealth market with the increase in private banks and financial instructions in countries such as China and India. In India, according to the data released by The Reserve Bank of India (RBI), the total number of bank accounts in India are around 600 million, out of which 25 million bank accounts holder are active users for mobile banking applications. North America has observed increased data breach attacks against BFSI industries in the recent past. The banking and financial institutions are promoting the use of digital wallet which is in turn is raising the risk of security for consumer’s data.

Cisco Systems Inc., Honeywell International Inc., Computer Science Corporation (CSC), IBM Corporation, and Symantec Corporation are some of the key players of global BFSI security market.

About Us :

Future Market Insights is the premier provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in London, the global financial capital, and has delivery centers in the U.S. and India.

CONTACT:

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Website: www.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release BFSI Security Market Value Share, Supply Demand, share and Value Chain 2016-2026 here

News-ID: 656991 • Views: …

More Releases from Future Market Insights

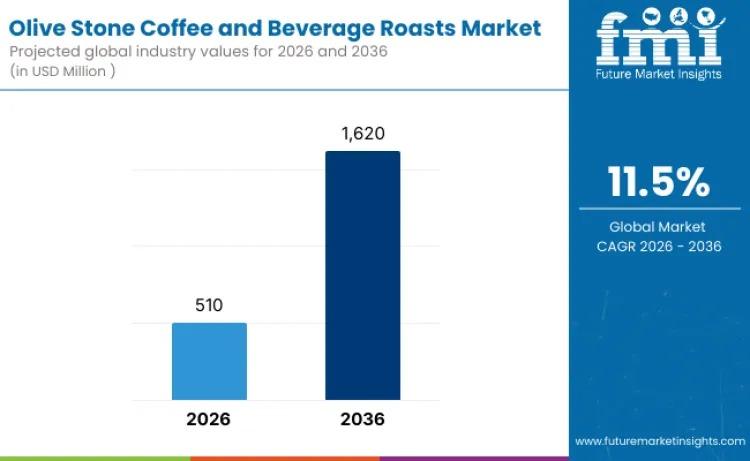

Global Olive Stone Coffee and Beverage Roasts Market to Reach USD 1,620 Million …

The global olive stone coffee and beverage roasts market is entering a high-growth decade, fueled by sustainability innovation and evolving specialty coffee culture. Valued at USD 510 million in 2026, the market is projected to reach USD 1,620 million by 2036, expanding at a compelling CAGR of 11.5%.

As consumers increasingly seek beverages that combine sustainability, functionality, and distinctive taste, olive stone-based roasting solutions are transitioning from niche experimentation to structured…

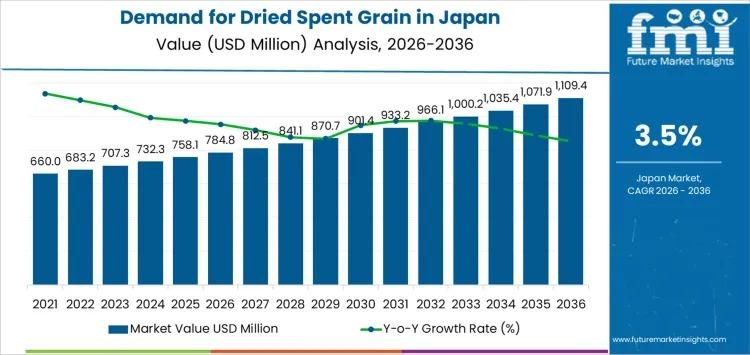

Japan Dried Spent Grain Market to Surpass USD 1.1 Billion by 2036 as Feed Optimi …

Japan's dried spent grain market is entering a decade of steady, value-driven expansion, supported by structured feed demand, brewery byproduct utilization, and rising integration of fiber-rich ingredients into food manufacturing. Industry estimates place the market at USD 784.8 million in 2026, with projections indicating growth to USD 1,109.4 million by 2036, reflecting a CAGR of 3.5%.

Between 2020 and 2026, demand increased from USD 637.5 million to USD 784.8 million, shaped…

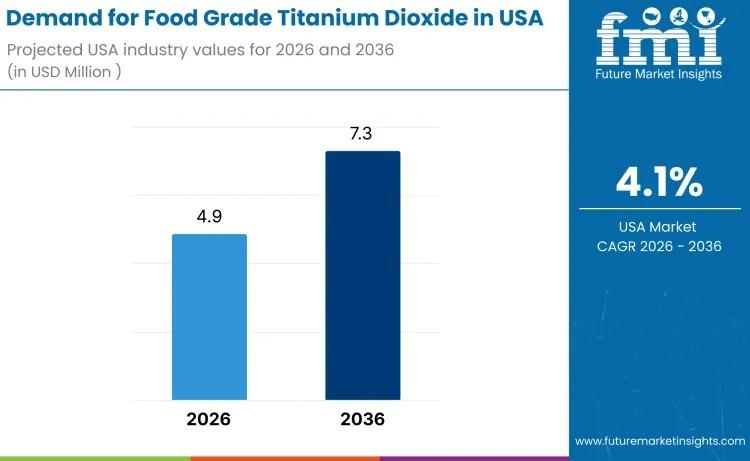

USA Food Grade Titanium Dioxide Market to Reach USD 7.3 Million by 2036 Amid Ste …

The demand for food grade titanium dioxide in the USA is valued at USD 4.9 million in 2026 and is projected to reach USD 7.3 million by 2036, expanding at a CAGR of 4.1%. Growth remains moderate yet stable, supported by continued use of titanium dioxide as a whitening and opacifying agent across confectionery coatings, bakery decorations, sauces, dairy analogues, and processed food matrices.

Despite heightened regulatory scrutiny and evolving clean-label…

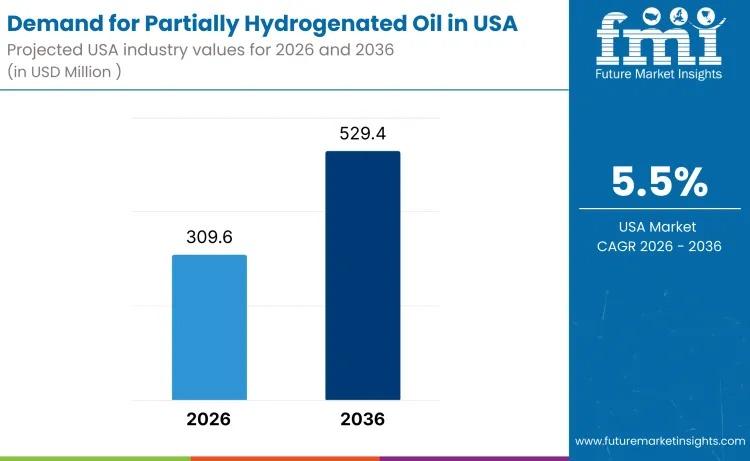

USA Partially Hydrogenated Oil Market to Reach USD 529.4 Million by 2036 Amid Me …

The demand for partially hydrogenated oil in the USA is projected to rise from USD 309.6 million in 2026 to USD 529.4 million by 2036, expanding at a steady CAGR of 5.5%. While edible applications remain tightly regulated, demand persists across specialty industrial and permitted food-related segments where oxidative stability, viscosity control, and texture performance remain critical.

Despite regulatory constraints on trans fats in conventional food manufacturing, PHOs continue to serve…

More Releases for BFSI

Evolving Market Trends In The Robotic Process Automation In BFSI Industry: Advan …

The Robotic Process Automation In BFSI Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Robotic Process Automation In BFSI Market Size During the Forecast Period?

In recent times, the market size for robotic process automation in bfsi has witnessed a significant surge.…

Evolving Market Trends In The Banking, Financial Services and Insurance (BFSI) S …

The Banking, Financial Services and Insurance (BFSI) Security Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Banking, Financial Services and Insurance (BFSI) Security Market Size During the Forecast Period?

The market size for security within the banking, financial services and insurance (BFSI)…

Key Trend Reshaping the AI in BFSI Market in 2025: Transforming The BFSI Sector …

What combination of drivers is leading to accelerated growth in the ai in bfsi market?

The anticipated surge in the AI in BFSI market may be traced back to the mounting use of AI in improving efficiency. Artificial intelligence (AI) comprises various technologies and algorithms that simulate human intelligence, including problem-solving, drawing insights from data, and making effective decisions. This growing usage of AI for enhancing efficiency could be attributed to…

Mumbai's BFSI Sector Gears Up for Transformation at the 24th Edition of BFSI IT …

Mumbai: The banking, financial services, and insurance (BFSI) sector in Mumbai is currently undergoing a profound transformation, fueled by rapid technological advancements and a significant increase in digital adoption. Emphasizing a strong commitment to digitalization, key stakeholders in Mumbai are championing initiatives akin to advancements in digital payments and the establishment of the Digital Banking Transformation Office. These efforts are propelling the BFSI landscape forward, fostering innovation and paving the…

Empowering BFSI Security: Safeguarding Futures Amid Evolving Threats, BFSI Secu …

Guarding the financial backbone against evolving cyber threats fuels the burgeoning, emergence of tailored solutions, biometrics, and IoT-based cybersecurity solutions significantly enhancing online banking Opportunities for the market.

The BFSI Security Market, valued at USD 61.6 billion in 2022, is poised to witness exponential growth, reaching USD 166.2 billion by 2030, reflecting a robust CAGR of 13.2%. This escalating trajectory is primarily attributed to the stringent regulatory environment governing the banking,…

IoT in BFSI Market : How the Business Will Grow in 2026?�Top Players in IoT in B …

The global internet of things (IoT) in banking, financial services, and insurance (BFSI) market is predicted to reach USD 116.27 billion by 2026, exhibiting a CAGR of 26.5% during the forecast period. The increasing investment of banks and financial institutions in IoT technologies will stimulate the growth of the market in the foreseeable future. According to the studies conducted by Tata consultancy services, financial institutions spend an average IoT budget…