Press release

Global Corporate Travel Insurance Market (2017-2024)- Research Nester

Corporate travel insurance is an insurance that is meant to cover medical expenses and others losses incurred while doing business travel. Corporate travel insurance includes an extensive range of benefits for various events such as trip cancellation, loss of baggage, evacuation due to medical conditions and others.Market Size and Forecast

The corporate travel insurance market is showcased to witness a robust growth during the forecast period 2017-2024. The market is anticipated to flourish at a CAGR of 8.6% over the forecast period. Increase in business travels is expected to foster the growth of corporate travel insurance market across the globe.

Geographically, Europe region accounts for the largest market share in global corporate travel insurance market followed by Asia-Pacific.

For Sample Pages please go through link below: http://www.researchnester.com/sample-request/2/rep-id-326

Moreover, Europe is anticipated to continue its dominance over the forecast period owing to recent terror attacks in France, Germany, and other European countries. Moreover, rise in number of business travelers with high travel spending is expected to garner the growth of corporate travel insurance market in this region. Germany and France is likely to capture the largest market share in European corporate travel insurance market.

Asia-pacific is anticipated to maintain second position over the forecast period. The major countries witnessing the increased demand for corporate travel insurance include China, Korea and Japan. North America region is also witnessing a positive corporate travel insurance growth and is expected to witness the significant growth over the forecast period. Further, in North America, enhanced travel options and advanced technological access have made business traveler’s access to insurance companies easier, thereby escalating the adoption rate of corporate travel insurance.

Market Segmentation

Our in-depth analysis segmented the global corporate travel insurance market in the following segments:

By Insurance

Single trip travel insurance

Annual multi-trip travel insurance

Long-stay travel insurance

By Distribution Channel

Bank

Insurance company

Insurance intermediaries

Insurance broker

Others

By Region

Global corporate travel insurance market is further classified on the basis of region as follows:

North America (U.S. & Canada) Market size, Y-O-Y growth & Opportunity Analysis

Latin America (Brazil, Mexico, Rest of Latin America) Market size, Y-O-Y growth & Opportunity Analysis

Western and Eastern Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, Rest of Western Europe) Market size, Y-O-Y growth & Opportunity Analysis

Asia-Pacific (China, India, Japan, Singapore, Australia, New Zealand, South Korea &Rest of Asia-Pacific) Market size, Y-O-Y growth & Opportunity Analysis

Middle East and North Africa (MENA) Market Size and Y-O-Y Growth Analysis

Growth Drivers and Challenges

Increase in expansion of business across the globe coupled with rising business travelers is anticipated to foster the demand for corporate travel insurance. Further, rising awareness among business travelers is anticipated to be the dynamic factor behind the rapid growth of corporate travel insurance market. Also, government regulation of several countries have made travel insurance mandatory, which is envisioned to bolster the growth of corporate travel insurance market.

Request For TOC Here: http://www.researchnester.com/toc-request/1/rep-id-326

However, lack of awareness about insurance policies is believed to dampen the growth of corporate travel insurance market. Moreover, this can be attributed to various factors such as low percentage level of economic development of countries, extent of saving in financials and the reach of insurance sector.

Key players

The major key players for corporate travel insurance market are as follows

CSA Travel Protection

Company Overview

Key Product Offerings

Business Strategy

SWOT Analysis

Seven Corners

TravelSafe Insurance

USI Affinity

ACE Asia Pacific

Allianz Global Assistance

American International Group Inc.

AXA

Scope and Context

Overview of the Parent Market

Analyst View

Segmentation

The global corporate travel insurance market is segmented as follows:

By Insurance Market Size & Y-O-Y Growth Analysis

By Distribution Channel Market Size & Y-O-Y Growth Analysis

By Region Market Size & Y-O-Y Growth Analysis

Market Dynamics

Supply & Demand Risk

Competitive Landscape

Porter’s Five Force Model

Geographical Economic Activity

Key Players (respective SWOT Analysis) and their Strategies and Product Portfolio

Recent Trends and Developments

Industry Growth Drivers and Challenges

Key Information for Players to establish themselves in current dynamic environment

To know more about this research, kindly visit: http://www.researchnester.com/reports/corporate-travel-insurance-market-global-demand-analysis-opportunity-outlook-2024/326

For Table of Content & Free Sample Report Contact:

Ajay Daniel

Email: ajay.daniel@researchnester.com

U.S. +1 646 586 9123

U.K. +44 203 608 5919

Web: www.researchnester.com

Research Nester is a global market research and consulting firm helping organizations, private entities, governments undertaking, non-legislative associations and non-profit organizations. With our decades of experience in the market research, we help our clients to gain a competitive edge over other players. Thus, helping them making strategic yet dynamic decisions for the future investments.

Ajay Daniel

Email: ajay.daniel@researchnester.com

U.S. +1 646 586 9123

U.K. +44 203 608 5919

1820 Avenue M, Suite# 1113,

Brooklyn, New York 11230

web : www.researchnester.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Corporate Travel Insurance Market (2017-2024)- Research Nester here

News-ID: 643209 • Views: …

More Releases from Research Nester Pvt Ltd

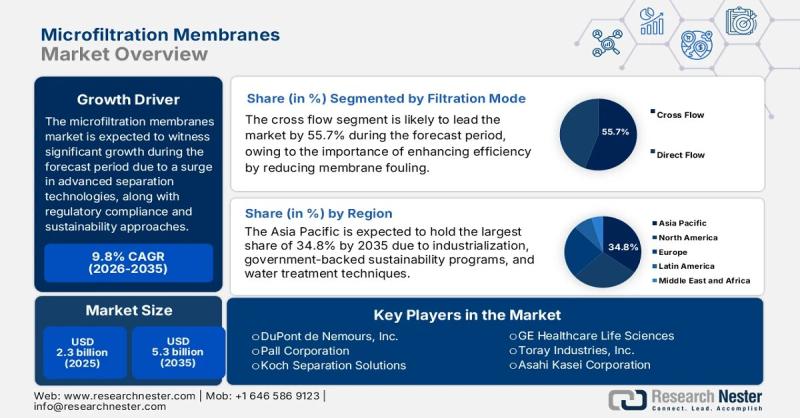

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…