Press release

ersol presents 9-month results 2008

Revenue increases 101.5 percent year-on-year to € 214.6 million- Operating result (EBIT) increases by a significant 188.3 percent to € 46.1 million

- Revenue outlook for 2008 confirmed

Erfurt, 14 November 2008. In the first nine months of the current financial year ersol Solar Energy AG (ersol) increased its consolidated revenue to € 214.6 million. This corresponds to an increase of 101.5 percent compared with the corresponding period of the previous year (9M 2007: € 106.5 million). This considerable growth is mainly attributable to the planned additional supplies of silicon and wafers and to the successful utilisation of the newly created production capacities. The distribution of revenue illustrates the growing importance of international markets for the ersol Group. The export ratio was 63.1 percent, corresponding to an increase of 16.7 percentage points compared with the previous year (9M 2007: 46.4 percent). Compared quarter-over-quarter, the ersol Group increased its revenue from € 36.7 million in Q3 2007 to € 84.8 million in 2008, corresponding to an increase of 131.1%.

At € 46.1 million the operating result (EBIT) almost tripled (9M 2007: € 16.0 million). EBIT as of 30 September 2008 was thus more than double the EBIT generated in financial year 2007 as a whole. The EBIT margin therefore increased to 21.5 percent year-on-year (9M 2007: 15.0 percent), or 43.3 percent in relative terms, with the result that the ersol Group exceeded its target EBIT margin of 20 percent in the first nine months of 2008. This positive trend is attributable, among other things, to lower pre-production costs in the Wafers and Solar Cells segments, economies of scale and to the revenue generated for the first time in the reporting period by ersol Thin Film GmbH.

Earnings after taxes (net profit) amounted to € 27.4 million in the first nine months of 2008 and were thus up by 294.7 percent compared with the same period of the previous year (9M 2007: € 6.9 million). The achievement of the target EBIT margin and the substantial growth-related improvement in earnings make the first three quarters of 2008 the most successful reporting period in ersol's history.

Cash flow from operating activities amounted to € 13.4 million after the first nine months of 2008, thus increasing by € 25.9 million in the third quarter of 2008 compared with € -12.5 million in the first six months. Year-on-year cash flow from operating activities increased by 113.2 percent (9M 2007: € 6.3 million). The change from the previous year is mainly due to the expansion of business with a disproportionate increase in revenue compared with material and personnel expenses, and thus to an improvement in the operating result.

Basic earnings per share amounted to € 2.69 in the reporting period; diluted earnings per share amounted to € 2.68. The corresponding results for the previous year thus increased by 289.9 percent and 288.4 percent, respectively (9M 2007: basic earnings per share € 0.69; diluted earnings per share € 0.69).

Outlook

In the first nine months of 2008, and over the remaining course of the current financial year, capacities in the Wafers and Solar Cells segments shall be expanded further. At the end of the year Wafers will have a nominal capacity of 180 MWp; crystalline solar cell production will have 220 MWp and ersol Thin Film will have a capacity of 40 MWp.

There has been no real change to the overall forecast for the year after the first three quarters of 2008. "Revenue and profit grew continuously in the previous quarters due to the planned increases in raw materials supplies and the rise in production volumes. We are anticipating another slight increase in the fourth quarter. The expansions of capacity currently underway in all segments and the start of production of thin-film technology progressed well. Due to delays in customer projects as a result of the financial market crisis, among other things, the sale of thin-film modules slowed down in the third quarter. In spite of this effect, we are holding fast to our sales target of over € 300 million for the whole of 2008," says Holger von Hebel, CEO of ersol Solar Energy AG, speaking about the further development of business. "We are anticipating an operating result (EBIT) of around € 70 million, which is within the bounds of our previous forecast," continued von Hebel.

For further information on our figures for the first nine months of 2008, please see our Interim report as of 30 September 2008, published today, on the ersol website at: http://www.ersol.de/en/investorrelations/reportspresentations/.

ersol Solar Energy AG

Wilhelm-Wolff-Str. 23

99099 Erfurt

Further information:

Janina Broscheit

Phone: +49 361 2195-1181

Fax: +49 361 2195-1133

presse@ersol.de

www.ersol.de

About ersol

ersol Solar Energy AG, a company of the Bosch Group, produces and markets high-quality silicon-based photovoltaic products. The ersol Group comprises the segments Silicon, Wafers, Solar Cells and Modules. With revenue of € 160 million in financial year 2007, the Thuringia-based company is one of the leading players in the solar industry. The ersol share has been listed on the Prime Standard of the Frankfurt stock exchange since 30 September 2005. The ersol Group currently has more than 1,200 employees.

The Company’s main objective is to establish itself even more firmly as a manufacturer of high-quality silicon solar cells and thin-film solar modules, and to account for a disproportionate share of the anticipated growth in the photovoltaic industry. To achieve this, ersol currently focuses on technologically demanding stages of the value chain for crystalline photovoltaic plants, and in particular on the production of wafers and solar cells, as well as silicon-based thin-film modules. There are a number of pillars to the Company’s supply of the raw material it needs: silicon. It is primarily secured by long-term supply agreements with leading polysilicon manufacturers. In addition to this, the Company’s internal recycling capacities in the silicon area also make an important contribution. Silicon is processed in the Wafers segment. The monocrystalline wafers manufactured there are preliminary products for the manufacture of highly-efficient silicon solar cells in the Solar Cells segment. Since early 2006 the company has been delivering a portion of its solar cells for the production of solar modules to the joint venture Shanghai Electric Solar Energy Co. Ltd. (SESE) in which the ersol Group has a 35% holding. The distribution of these and other photovoltaic modules is handled in part by the Modules business segment. In the same segment ersol is driving forward the development of silicon-based thin-film modules.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ersol presents 9-month results 2008 here

News-ID: 59587 • Views: …

More Releases from ersol Solar Energy AG

Agreement between Ventizz and Bosch regarding sale of majority stake in ersol

Erfurt, 2 June 2008. Ventizz Capital Fund II LP, Wilmington/Delaware, USA, and its subsidiary Ventizz II Jersey Holding LP, Jersey, Channel Islands, (Ventizz) have informed the Management Board of ersol Solar Energy AG (ersol) that they have signed agreements with Robert Bosch GmbH (Bosch) regarding the sale of its holdings in ersol amounting to 50.45% of the share capital. The purchase price for the shares immediately sold, to be paid…

ersol signs solar cell supply contract with new major customer aleo solar

Erfurt, 27 May 2008. ersol Solar Energy AG (ersol) today concluded a cell supply contract with aleo solar AG (aleo solar). The contract volume amounts to about 250 MWp. Crystalline silicon solar cells are to be supplied to Prenzlau module producer aleo solar over a period of 12 years starting in 2008. The conclusion of this latest contract marked an increase in ersol\'s order volume for solar cells to well…

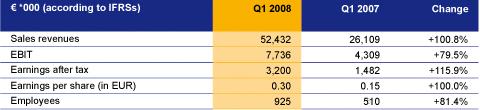

ersol presents strong first quarter and confirms overall forecast for the year

Revenues double year-on-year to € 52.4 million

- Operating result (EBIT) rises 79.5 percent to € 7.7 million

- Outlook for 2008 confirmed

ersol Solar Energy AG (ersol) generated consolidated revenue of € 52.4 million in the first quarter of 2008, thus almost doubling its revenue compared with last year’s period (Q1 2007: € 26.1 million). ersol achieved this impressive growth through the successful start-up of the newly created production capacities and through…

ersol signs supply contract with leading Japanese wafer producer

Six-year contract concluded for the supply of multicrystalline silicon wafers

- Wafers enable total production volume of 90 MWp

Erfurt, 4 April 2008. ersol Solar Energy AG (ersol) today signed a contract for the supply of multicrystalline silicon wafers by one of the world’s leading wafer manufacturers which is located in Japan. Deliveries are due to start in 2009 and will generate a total production volume of at least 90 MWp at…

More Releases for EBIT

Positive business development at ERICH JAEGER in the first quarter of 2023

Erich Jaeger GmbH + Co KG announces that the first quarter of 2023 has shown a positive business development. This fits in well with the general trend within its sister companies: On May 11, 2023, the parent company AdCapital AG reported a positive business development of its subsidiaries in an AdHoc release. AdCapital was able to report positive EBIT for this period, thus reaching EBIT break-even. This pleasing development is…

Electro Optical Targeting System Market Size, Growth Analysis, Trend, Competitiv …

LOS ANGELES, United States: The global Electro Optical Targeting System market is carefully analyzed in the report with large focus on market dynamics including key issues and challenges, drivers, trends, and opportunities. The report provides deep analysis of important market participants to help understand the use of leading strategies adopted in the global Electro Optical Targeting System market. It also sheds light on the industrial value chain and its expected…

Pioneering collaboration between eBit - ESAOTE Group and Angio Consult confirmed

„With the eBit - ESAOTE Group Company, we have gained an influential partner in the area of imaging and IT in medical technology” tells Hanns-Joachim Rieck – CEO of the Angio Consult GmbH – business consulting for the healthcare scope - , located in Speyer, Germany. “We´re looking forward to intensify our collaboration.”

eBit - ESAOTE Group Company is the leading specialist in the diagnostic imaging software for installed IT in…

Trading update as per 30th September 2008

The Executive Committee of EXMAR NV today reported its trading update for the 3rd quarter 2008. The key figures

are:

For full press release please go to Exmar corporate website: www.exmar.be

LPG

During the 3rd quarter an operating result (EBIT) of USD 6.2 million was recorded by the LPG fleet (USD 7.1 million for the 3rd quarter of 2007). The EBIT for the first 9 months of the current year amounts to USD 18.3…

direct/ ASSA ABLOY (SE) - Strong finish to 2006 for ASSA ABLOY

Sales for the fourth quarter increased by 7% to SEK 8,059 M (7,530), with 9% organic growth, 5% acquired growth and -7% exchange-rate effects. Operating income (EBIT), excluding restructuring costs, increased by 20% to SEK 1,274 M (1,063). Earnings per share, excluding restructuring costs, increased by 16% to SEK 2.14 (1.84).

- Sales for 2006 increased by 12% to SEK 31,137 M (27,802), with 9% organic growth, 3% acquired growth…

direct/ ASSA ABLOY (SE) - ASSA ABLOY reports continued strong sales

Sales for the second quarter increased by 10% to SEK 7,689 M (6,984), including 7% organic growth.

- The operating margin (EBIT) for the second quarter, excluding restructuring costs, amounted to 15.0% (14.6).

- Restructuring costs during the quarter totaled SEK 520 M.

- Net income for the second quarter amounted to SEK 297 M (657).

- Earnings per share for the second quarter amounted to SEK 0.80 (1.75), or…