Press release

Financial Services Operational Risk Management Solution Market Shares, Strategies and Forecast Worldwide, 2017 to 2027

Operational risk management has always been a vital function for financial services. Operational risk management abbreviated as ORM, is a cyclic process which includes factors such as risk assessment, risk decision making, and implementation of risk controls to recognize, mitigate and avoid risk. Operational Risk Management in Financial Services is evolving as a dynamic business promoter, focusing on operational risk arising from internal business model, enterprise workforce, customer preferences, regulatory compliance both at regional and global level and fraud risk. Here comes the ORM solution in picture which includes promoting a risk aware culture in the enterprise, identifying and reporting operational risk information, reduce unexpected losses by regulatory compliance at all levels, holistic understanding of risk and its possible losses and finally establishing a consolidated view of risks, controls and workflow processes. Financial Services Operational Risk Management Solutions is all about creating a link between operational risk and risk- related solutions that reinforce technology with deep expertise of financial risk solutions.Financial Services Operational Risk Management Solution Market: Drivers and Restraints

The biggest driver for financial services operational risk management solution market is that it confirms that enterprises are optimally insured at all levels of operations. Continuous increase in the scale and complexity of financial institutions along with fast paced financial transactions is another driver of operational risk management solution in financial services. Risk management solution also helps in assessing the position of the financial institution in the market with a single and wide view of business processes such as cash flow analysis while lending loans. Growth in number of cyber-attacks on business models and critical data of the financial enterprises is also a driving factor for this market.

Request For Report Sample@ http://www.futuremarketinsights.com/reports/sample/rep-gb-3419

Despite the benefits of operational risk management solutions, financial institutions struggle in identifying the key parameters for risk identification and also suffer due to fluctuating regulatory policies. Hence they are inefficient in extracting full potential of operational risk management solutions. This causes hindrance in the growth of market. Dramatic change in customer expectations, demands the need of innovation in operational risk management solutions. If this is lacking it results in the lack of vision in overall strategy of the organization which is also one restraint in this market.

Financial Services Operational Risk Management Solution Market: Segmentation

Financial services operational risk management solution market can be segmented on the basis of end user, type and region. End user category includes banking, insurance, stock market, wealth management, mutual funds and tax consultants. On the basis of type it can be further segmented as fraud risk, human resource risk, model risk and legal risk. Region wise, Financial Services Operational Risk Management Solution Market can be segmented into North America, Latin America, Asia Pacific, Japan, Eastern Europe, Western Europe, and Middle East & Africa.

Financial Services Operational Risk Management Solution Market: Regional Overview

North America and European market is on top and is expected to dominate the market in the future due to presence of big financial enterprises in these regions. Asia Pacific is identified as the fastest growing market due to growing economy, fast pace of transactions, and huge customer base. Latin America and Middle East is also catching up with this market at a considerable pace.

Visit For TOC@ http://www.futuremarketinsights.com/reports/sample/rep-gb-3419

Financial Services Operational Risk Management Solution Market: Key Players

The key vendors offering operational risk management solutions for financial services include Oracle, SAP SE, SAS Institute Inc., MetricStream Inc., Thomson Reuters, eFront, Enablon, Fair Isaac Corporation, Wolters Kluwer Financial Services, ClusterSeven, Chase Cooper Limited, and BWise.

ABOUT US:

Future Market Insights (FMI) is a leading market intelligence and consulting firm. We deliver syndicated research reports, custom research reports and consulting services, which are personalized in nature. FMI delivers a complete packaged solution, which combines current market intelligence, statistical anecdotes, technology inputs, valuable growth insights, an aerial view of the competitive framework, and future market trends.

CONTACT:

Future Market Insights

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Website: www.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Services Operational Risk Management Solution Market Shares, Strategies and Forecast Worldwide, 2017 to 2027 here

News-ID: 552532 • Views: …

More Releases from Future Market Insights

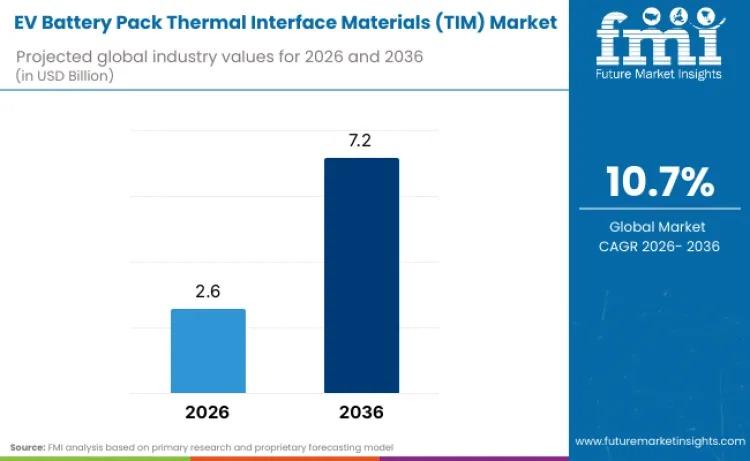

Global EV Battery Thermal Interface Materials Market to Reach USD 7.2 Billion by …

The global EV battery pack thermal interface materials (TIM) market is projected to grow from USD 2.6 billion in 2026 to USD 7.2 billion by 2036, advancing at a robust CAGR of 10.7%, according to recent analysis by Future Market Insights. This expansion reflects the accelerating electrification of transportation, rising energy density in battery systems, and increasingly stringent safety requirements that position thermal management as a critical determinant of vehicle…

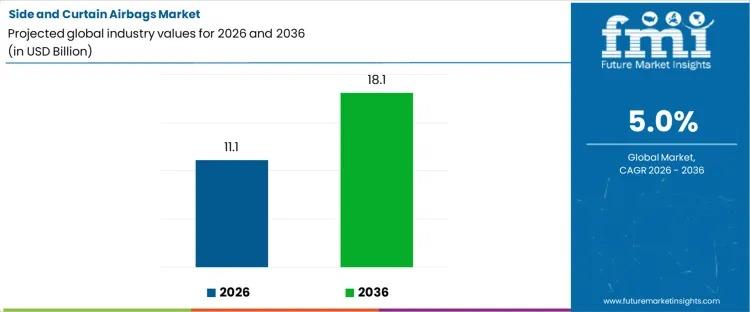

Global Side and Curtain Airbags Market to Reach USD 18.2 Billion by 2036 as Safe …

The global side and curtain airbags market is poised for sustained expansion as automotive manufacturers prioritize occupant protection and compliance with stringent crash safety regulations. According to the latest analysis by Future Market Insights, the market is projected to grow from USD 11.1 billion in 2026 to USD 18.2 billion by 2036, advancing at a CAGR of 5.0% during the forecast period.

This growth reflects the automotive industry's increasing emphasis on…

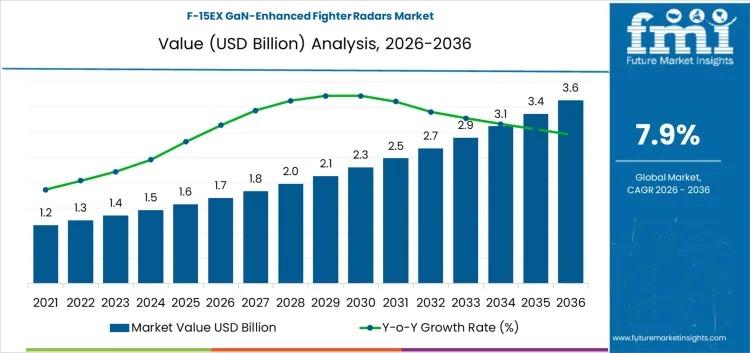

F-15EX GaN-Enhanced Fighter Radars Market to Reach USD 3.6 Billion by 2036 as De …

The global F-15EX GaN-enhanced fighter radars market is projected to grow from USD 1.7 billion in 2026 to USD 3.6 billion by 2036, registering a compound annual growth rate (CAGR) of 7.9% during the forecast period. This growth trajectory reflects the increasing integration of Gallium Nitride (GaN) semiconductor technology into advanced airborne radar systems, enabling superior detection, tracking, and electronic warfare resistance for modern fighter aircraft such as the F-15EX.

The…

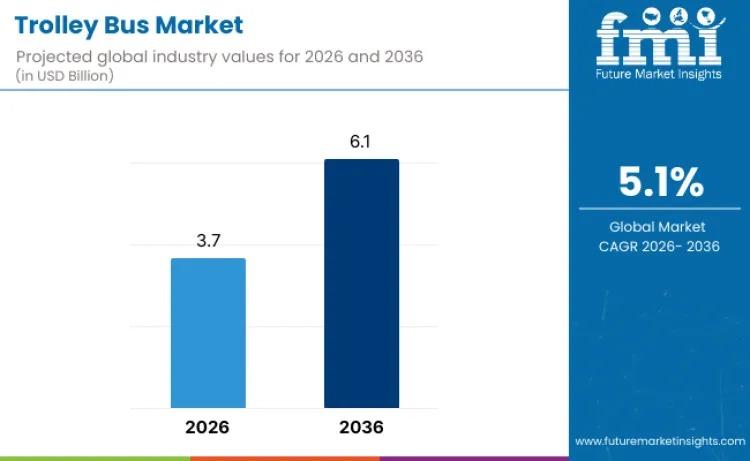

Global Trolley Bus Industry to Reach USD 6.1 Billion by 2036 as Urban Electrific …

The global trolley bus industry is entering a phase of sustained expansion, with market valuation projected to grow from USD 3.7 billion in 2026 to USD 6.1 billion by 2036, reflecting a steady compound annual growth rate (CAGR) of 5.1%. This upward trajectory is being driven by accelerating urban electrification programs, stringent zero-emission mandates, and mounting investment in sustainable public transportation infrastructure across major metropolitan regions worldwide.

As cities confront escalating…

More Releases for Operational

Operational Analytics Market: Driving Data-Driven Decisions for Operational Exce …

In recent years, the global Operational Analytics Market has transformed significantly, driven by evolving consumer preferences, rapid technological advancements, and an increasing focus on sustainability. Our comprehensive Operational Analytics Market Research Report is your essential guide to navigate this dynamic landscape, offering actionable insights into emerging trends, growth drivers, and key opportunities for your business.

Unlock in-depth analyses of the competitive supplier landscape, demand dynamics, and market projections with…

Operational Analytics Market: Driving Data-Driven Decisions for Operational Exce …

In recent years, the global Operational Analytics Market has transformed significantly, driven by evolving consumer preferences, rapid technological advancements, and an increasing focus on sustainability. Our comprehensive Operational Analytics Market Research Report is your essential guide to navigate this dynamic landscape, offering actionable insights into emerging trends, growth drivers, and key opportunities for your business.

Unlock in-depth analyses of the competitive supplier landscape, demand dynamics, and market projections with…

Operational Risk Management Solution Market Report 2024 - Operational Risk Manag …

"The Business Research Company recently released a comprehensive report on the Global Operational Risk Management Solution Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The operational…

Industrial Maintenance Services in Operational Improvement and Operational Maint …

Data Bridge Market Research analyses that the Industrial Maintenance Services in Operational Improvement and Operational Maintenance Market valued at USD 51.77 billion in 2022, will reach USD 80.36 billion by 2030, growing at a CAGR of 5.65% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by…

Operational Technology Market

Market Overview

The Global Operational Technology Market size is growing at a high CAGR during the forecast period (2022-2029).

Operational Technology (OT) is technology and software that detects or induces changes in industrial equipment, assets, processes, and events through direct monitoring and control. Operational technology refers to systems that process operational data (including electronic, telecommunications, computer systems, and technical components). OT systems may be required to control valves, engines, conveyors, and other…

Automotive Blockchain Market Thrives With Operational Efficacy, Robust Investmen …

The automotive blockchain market is projected to demonstrate a tremendous growth by the end of the projection period. Incessant investments in autonomous and connected vehicles and the operational efficacy that blockchain technology provides are steering the demand for automotive blockchain technology across the globe. During the outbreak of COVID-19, the automotive industry has witnessed steep declines in production as well as sales of vehicles. This led to subsequent deceleration in…