Press release

“Poland: More banking market growing but”

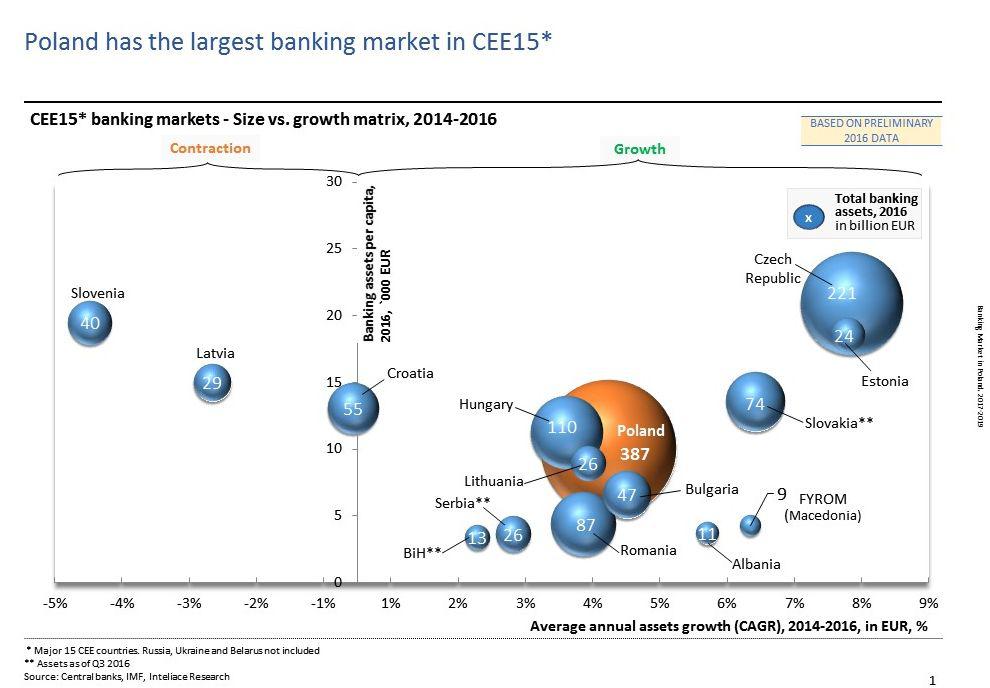

“Banking sector in Poland benefits from a stable economy, however, taxation and regulatory constraints prevent the sector from growing faster,” said Marcin Mazurek, director of Inteliace Research, during a presentation of Inteliace's latest report, Banking Market in Poland, 2017-2019.Banking volumes have continued to grow fast in Poland during 2016, despite relatively unfavourable regulatory environment. Deposits of non-financial clients at banks recorded a strong 11% YoY increase to nearly PLN 1.1 trillion while lending increased a bit slower, at 5% YoY to PLN 1.11 trillion. The growth of volumes was balanced across all client segments. As a consequence, total banking assets increased by 7% YoY to a record PLN 1.71 trillion as of December 2016.

In our base-case scenario, we see Poland's economy growing faster in 2017 but decelerating in 2018 and 2019. Faster growth in consumer prices and increasing salaries and wages are likely to further benefit key banking volumes. We expect total banking assets to advance at 6% through 2019. As far as banks’ profitability is concerned, the banking industry is likely to see reduction in profits in 2017 as revenues are not expected to keep pace with accelerating operating costs. While automation will support higher efficiency at banks, it will require significant investments outlays in a rapidly changing environment.

For more information on recent developments in the Polish banking sector, please refer to the publication “Banking Market in Poland, 2017–2019” at: http://www.inteliace.com/en/00153_Banking_market_in_Poland_2017-2019.html

Inteliace Research is an independent consulting company that focuses on the financial markets in Central and Eastern Europe. Inteliace Research specializes in management consulting and custom research services, including market-entry strategies, product launches, and performance and benchmarking analyses.

During 2005–2017, Inteliace Research provided its products and services to more than 60 clients, including major CEE banks and several “The Banker” top world banks. To learn more about the company, visit Inteliace Research’s webpage: www.inteliace.com.

Foksal 17B/31

00-372 Warszawa

POLAND

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release “Poland: More banking market growing but” here

News-ID: 551858 • Views: …

More Releases from Inteliace

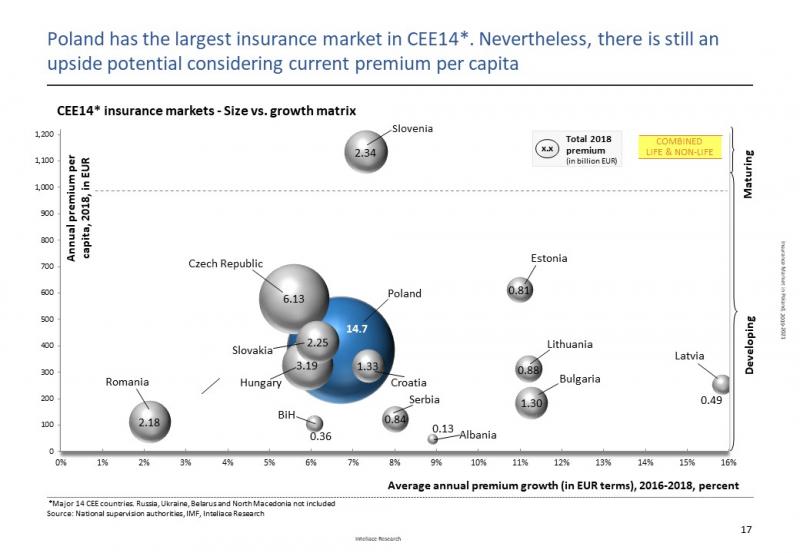

Poland's insurance sector 2020 – Growing profitability and positive outlook

“The profitability of insurers operating in Poland has been growing steadily for a few years with ROAE exceeding 20% in 1H 2019 in both life and non-life segments” said Marcin Mazurek, director of Inteliace Research, during a presentation of Inteliace's latest report, Insurance Market in Poland, 2019-2021.

Poland has the largest insurance sector in the CEE with nearly € 15 billion in premium written p.a. and a 40 % share in…

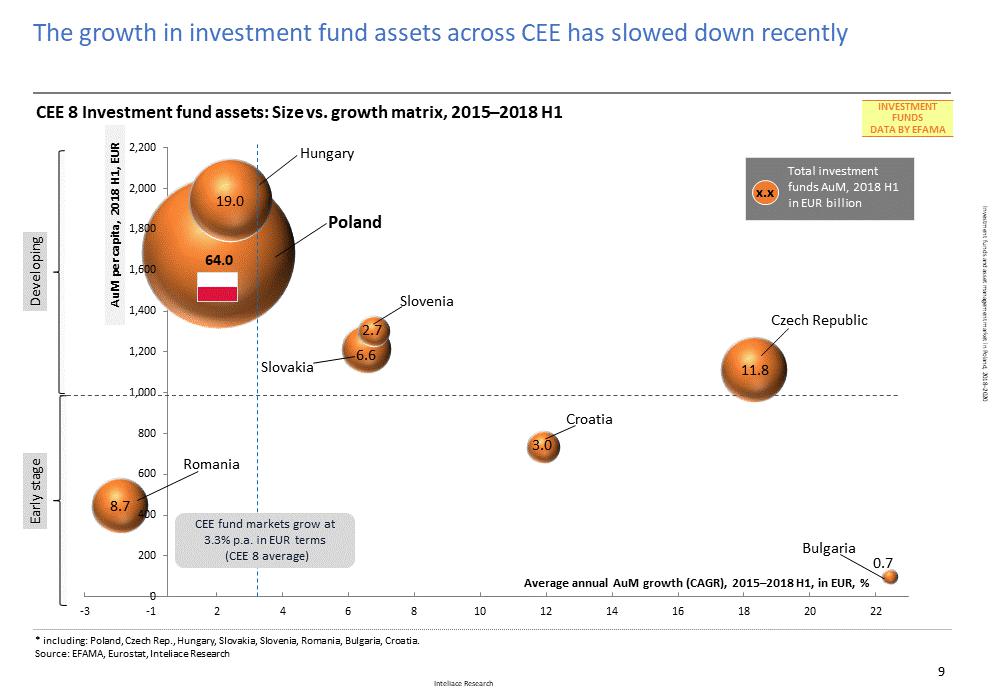

Independent players to disrupt investment funds distribution in Poland

A group of independent players offering innovative online platforms e.g. F-trust, Star Funds, KupFundusz.pl or IQ Money is attempting to disrupt investment fund distribution – a business traditionally controlled by large banks in Poland, says Marcin Mazurek, director of Inteliace Research, during a presentation of Inteliace's latest report, “Asset Management and Investment Funds Market in Poland, 2018–2020.”

The current state of the market: Total assets under management (AuM) in Poland across…

Inteliace Research starts accepting Bitcoins on Nov.2, 2017

Warsaw, November 2, 2017

Marcin Mazurek, Director of Inteliace Research announced today the decision to accept bitcoin payments for all services offered by Inteliace Research. For more details please contact the company directly at: http://www.inteliace.com/en/contact.php

Inteliace Research is an independent consulting company that focuses on the financial markets in Central and Eastern Europe. Inteliace Research specializes in management consulting and custom research services, including market-entry strategies, product launches, and performance and benchmarking…

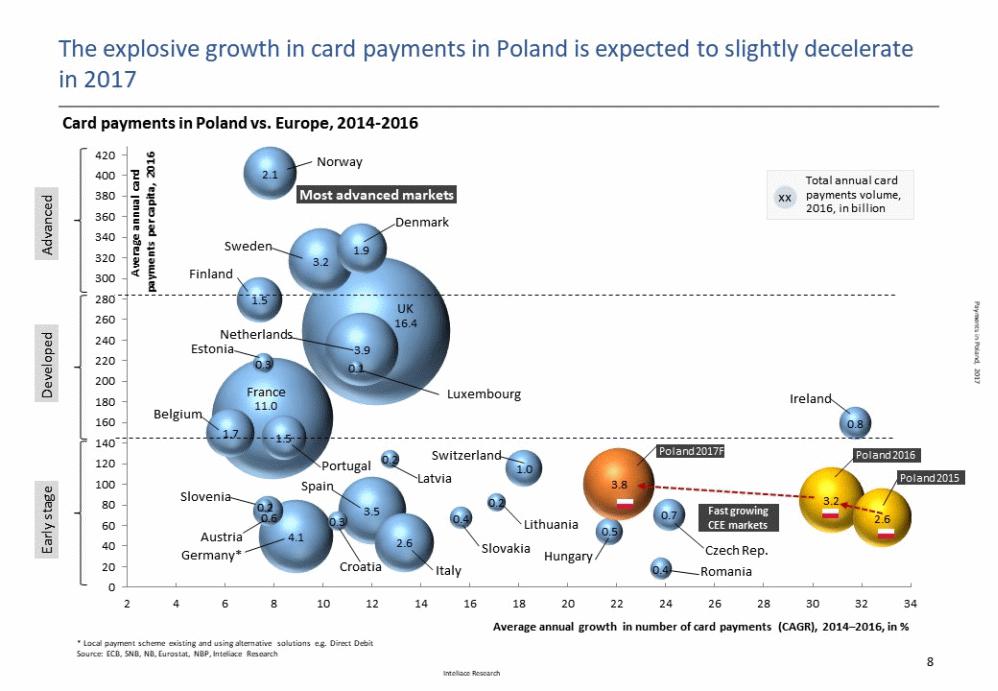

How HCE technology, BLIK, Android Pay, Masterpass and Visa Checkout change the p …

Consumers embrace card and mobile payments in Poland. Total volume of payments is expected to surpass 10 billion within next 5 years, said Marcin Mazurek, Director of Inteliace Research, a consultancy specialized in financial sector research.

Surging payments industry in Poland

Poland's payment market is growing rapidly. The total number of payments exceeded 5.6 billion as of 2016 and it is estimated to top 6.4 million in 2017. Most transactions executed in…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…