Press release

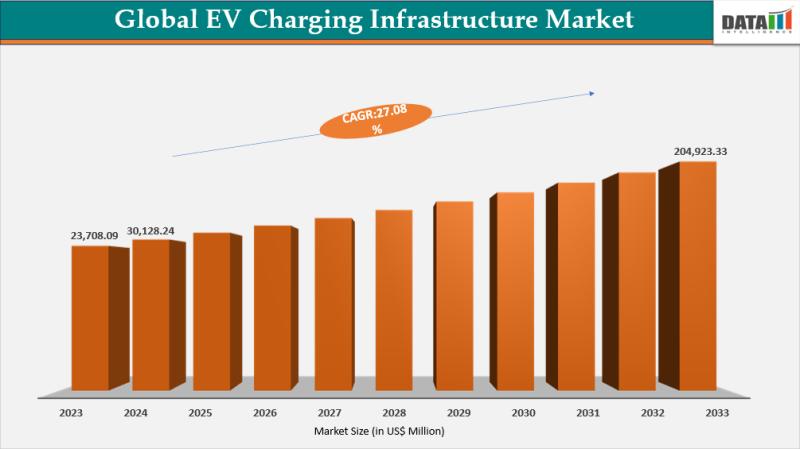

EV Charging Infrastructure Market Set for Explosive Growth to US$204.92 Billion by 2032, Led by Asia Pacific's 68.2% Share

The Global EV Charging Infrastructure market reached US$30,128.24 million in 2024 and is expected to reach US$204,923.33 million by 2032, growing at a CAGR of 27.08% from 2025 to 2032.Market expansion is propelled by surging electric vehicle adoption worldwide, with over 30 million EVs on roads by 2025, alongside massive government investments exceeding US$120 billion in Europe, China, and India for charging networks. Advancements in DC fast-charging (growing 33% annually) and grid-interactive technologies like V2G enable utilities to cut grid costs by 25% while creating new revenue from demand-response. Rising renewable energy integration, now over 28% of global electricity, supports sustainable hubs and reduces carbon intensity in charging infrastructure.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/ev-charging-infrastructure-market?ram

Key Industry Developments

United States:

✅ January 2026: Tesla activated its first V4 Supercharger stations featuring 500 kW output capability, enhanced non-Tesla EV compatibility with longer cables, and future-proofing for high-voltage platforms to deliver faster and smarter charging experiences for American drivers. This marks a significant technological advancement in public DC fast charging infrastructure, building on prior V4 post deployments.

✅ October 2025: ChargePoint announced the development of Express Grid ultrafast chargers capable of 10-minute charging sessions, with component deliveries starting in late 2026 to revolutionize EV infrastructure efficiency and accessibility across the US. The initiative focuses on megawatt-class DC fast charging architectures up to 600 kW for passenger vehicles.

✅ September 2025: Tesla expanded deployment of V4 Supercharger stations supporting 500 kW ultra-fast charging, one of the most powerful installations in the US tailored for newer high-power EV platforms and broader network growth.

Japan:

✅ September 2025: ROHM launched the 2-in-1 SiC molded DOT-247 power module optimized for EV charging stations and off-board chargers, achieving high power density, design flexibility, and efficiency improvements for next-generation infrastructure. Mass production began in September 2025, with AEC-Q101 automotive-grade samples available from October.

✅ September 2025: Toyota announced plans to expand high-speed EV chargers at dealerships from 390 to 500 units by March 2026, advancing Japan's national EV infrastructure goals and supporting faster adoption despite slower-than-expected rollout. This initiative aligns with Toyota's commitment to electrified mobility and half of dealerships featuring fast chargers by 2030.

✅ January 2026: Mitsubishi Motors began production of advanced plug-in hybrid components at its Okazaki Plant, incorporating optimized power systems that enhance EV charging compatibility and performance for future infrastructure integration in the Japanese market.

Key Mergers and Acquisitions:

✅ JBM Group acquired Glida Fortum India's EV charging network in December 2025, gaining control of approximately 850 chargers at key public and commercial locations to bolster its electric mobility ecosystem and accelerate nationwide expansion.

✅ EDF Energy completed the full acquisition of Pod Point in August 2025 for £10.6 million, taking 100% ownership of the UK EV charging network with over 250,000 points to enhance integration with its energy services and support net-zero goals.

✅ Eaton Corporation acquired Resilient Power Systems in August 2025, securing solid-state transformer technology for high-power DC EV charging to modernize infrastructure, streamline grid connections, and expand into fleet and data center applications.

✅ EVSE acquired ENGIE's EV charging assets in Australia and New Zealand in April 2025, adding 200 high-traffic locations to its Exploren network and strengthening its position as a leading regional provider amid rapid EV adoption.

Key Players:

ABB | ChargePoint | Tesla, Inc. | Siemens AG | Schneider Electric | EVgo | Blink Charging | IONITY | Alfen N.V.

Strategic Leadership Analysis: Top 5 Players in EV Charging Infrastructure Market 2026

-ABB: Launched the A200/300 All-in-One chargers, MCS1200 Megawatt Charging System for heavy-duty vehicles, and ChargeDock Dispenser, expanding its portfolio with field-upgradable solutions for scalable EV infrastructure.

-ChargePoint: Released the next-generation ChargePoint Platform with AI data assistant and ultrafast DC V2G chargers up to 600kW via ChargePoint Express Grid, enhancing fleet management and real-world charging adaptability.

-Tesla: Deployed the first true V4 Supercharger cabinets with 500kW for passenger vehicles and 1,200kW for Tesla Semi, featuring 3x power density and 2x stalls per cabinet for faster, more efficient network expansion.

-Siemens AG: Introduced the SICHARGE FLEX distributed charging system delivering up to 1.68 MW, with modularity for fleet depots and en-route hubs, incorporating cybersecurity for reliable e-mobility scaling.

-Schneider Electric: Launched Schneider Charge Pro for simplified fleet and multifamily charging with remote monitoring, alongside StarCharge Fast 720, delivering up to 720kW for mixed fleets using dynamic load management.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=ev-charging-infrastructure-market?ram

Market Drivers and Key Trends:

-EV Adoption Surge: Rapid growth in electric vehicle sales worldwide, driven by falling battery costs and extended vehicle ranges, is fueling demand for widespread charging networks.

-Government Support: Policies like subsidies, tax incentives, and mandates for charging stations such as India's approval of over 2,600 sites are accelerating infrastructure deployment.

-Tech Advancements: Innovations in fast/ultra-fast chargers, wireless charging, smart grids, and vehicle-to-grid (V2G) systems enhance efficiency and reduce range anxiety.

-Sustainability Push: Rising environmental concerns and carbon reduction goals promote solar-integrated and renewable-powered stations for greener energy ecosystems.

-Market Hurdles: High installation costs, grid capacity limitations, and standardization challenges across regions constrain scalability and uniform growth.

Regional Insights:

-Asia Pacific: 68.2% (Largest share, dominated by heavy investments in China, Japan, and South Korea).

-North America: 40.01% (Strong second, driven by rapid EV adoption, government incentives like NEVI, and over 180,000 public chargers in the US).

-Europe: 21% (Supported by EU regulations like AFIR, steady policy-driven investments, and cross-border fast-charging networks).

Market Opportunities & Challenges: EV Charging Infrastructure Market 2026

EV charging infrastructure is expanding rapidly due to global EV adoption and supportive policies.

-Opportunities

A "Smart Grid Synergy" push integrates V2G (Vehicle-to-Grid) tech with renewables, unlocking bidirectional energy trading for fleet operators and utilities.

DC ultra-fast chargers (350kW+) alongside wireless charging pilots de-risk highway corridor builds via public-private partnerships.

"Workplace Wellness" stations with solar canopies attract ESG investors targeting corporate fleets in urban hubs.

-Challenges

Grid overload risks from clustered fast-charging demand inflate upgrade costs amid aging infrastructure.

Standardization gaps across CCS, CHAdeMO, and NACS protocols fragment interoperability for cross-border fleets.

Range anxiety persists in rural zones, forcing reliance on slow Level 2 networks vulnerable to permitting delays.

-Strategic Verdict

Ultra-fast DC networks and V2G-enabled fleets emerge as dominant 2026 growth vectors for scalable, revenue-diverse infrastructure.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/ev-charging-infrastructure-market?ram

Market Segmentation Analysis:

-By Charger Type: Fast Chargers Dominate Amid Rapid Deployment

Fast chargers hold the largest share at 73% in 2025, driven by government initiatives for public fast-charging networks reducing dwell times for highways and fleets.

Slow chargers account for 27%, favored for overnight residential use and bundled with EV purchases by manufacturers like BMW and GM.

-By Charging Type: ACs Lead with Widespread Adoption

ACs command 61% market share in 2024, preferred for cost-effective home/workplace installations supporting daily commutes.

DCs capture 39%, growing fastest for ultra-fast public and fleet charging along high-traffic corridors.

-By Connector Type: CCS Prevails in Key Regions

CCS leads at 42% share in 2024, backed by North America/Europe mandates and OEMs like Ford and VW.

CHAdeMO takes 20%, focused on Japan/legacy fleets; others (GB/T, Tesla) split 38%, boosted by China's GB/T dominance.

-By Connectivity: Non-Connected Stations Hold Majority

Non-connected stations dominate at 65% in 2025, valued for standalone simplicity without network fees in private/residential setups.

Connected stations claim 35%, rising for smart features like app reservation and analytics in public networks.

-By End-User: Commercial Drives Public Expansion

Commercial holds 90% share in 2024, fueled by public stations, highways, and fleets amid EV sales surge.

Residential takes 10%, essential for home overnight charging but limited by space/costs in apartments.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTW

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release EV Charging Infrastructure Market Set for Explosive Growth to US$204.92 Billion by 2032, Led by Asia Pacific's 68.2% Share here

News-ID: 4398902 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

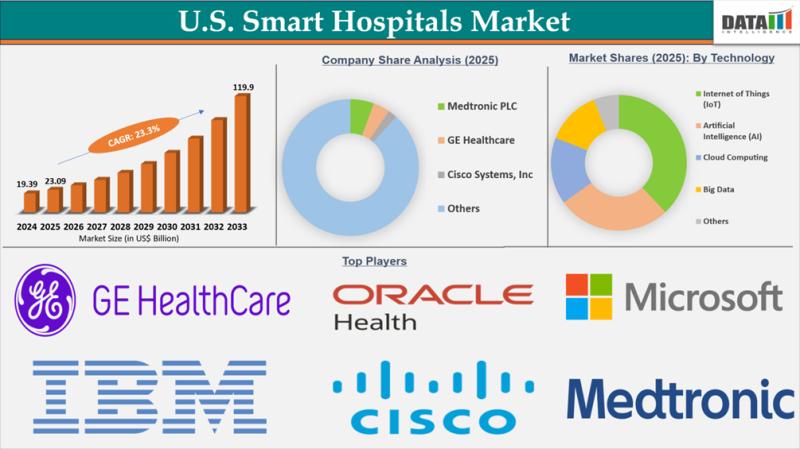

U.S. Smart Hospitals Market to hit US$ 119.9 Billion by 2033: Growth Drivers, In …

Market Size and Growth

U.S. Smart Hospitals Market reached US$ 19.39 Billion in 2024, rising to US$ 23.09 Billion in 2025 and is expected to reach US$ 119.9 Billion by 2033, growing at a CAGR of 23.3% from 2026 to 2033.

Download Free Sample PDF Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/u-s-smart-hospitals-market?kb

Recent Industry Developments

✅ October 2025: Leading hospital networks expanded AI-powered patient monitoring systems to enhance real-time clinical decision-making and…

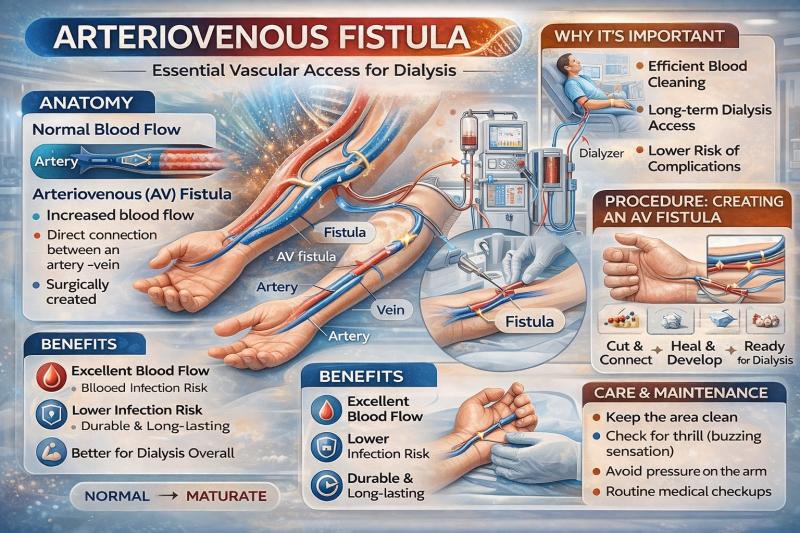

Arteriovenous Fistula Market Size to Reach US$ 2.12 Billion by 2033 | Growing at …

The Arteriovenous Fistula Market was valued at approximately US$ 1.62 billion in 2024 and is projected to reach around US$ 2.12 billion by 2033, expanding at a CAGR of 8.0% during the forecast period 2025 to 2033. Market growth is primarily driven by the rising prevalence of chronic kidney disease and end stage renal disease, leading to a growing number of patients requiring long term hemodialysis access.

Arteriovenous fistula procedures are…

Electrical Digital Twin Market Set for Explosive Growth to US$ 3.57 Billion by 2 …

The Global Electrical Digital Twin Market reached US$ 1.21 billion in 2024 and is expected to reach US$ 3.57 billion by 2032, growing at a CAGR of 14.50% during the forecast period 2025-2032.

Market growth is driven by increasing adoption in power utilities, industrial automation, and smart grids for real-time monitoring, predictive maintenance, and system optimization. Rising investments in renewable energy integration, grid modernization, and Industrial Internet of Things (IIoT) are…

Bug Tracking Software Market (2026): Growth in IT & Telecom Companies

Market Size and Growth

Bug Tracking Software market is accelerating with Agile, AI, and cloud adoption, enabling faster releases, smarter issue resolution, and stronger compliance.

United States: Recent Industry Developments

✅ October 2025: Leading SaaS providers enhanced AI-powered bug tracking tools to automate issue classification and prioritization.

✅ September 2025: Integration upgrades enabled seamless connectivity between bug tracking platforms and DevOps pipelines.

✅ August 2025: Growing cybersecurity concerns accelerated adoption of secure, cloud-based bug tracking…

More Releases for Charging

Is it better to choose AC charging piles or DC charging piles for home charging …

Choosing between AC and DC charging piles for home charging piles requires comprehensive consideration of charging needs, installation conditions, cost budgets and usage scenarios and other factors. Here's a breakdown:

Image: https://www.beihaipower.com/uploads/4c61b8bc1.jpg

1. Charging speed

* AC charging piles: The power is usually between 3.5kW and 22kW, and the charging speed is relatively slow, suitable for long-term parking and charging, such as night charging.

* DC charging piles: The power is usually…

800V system challenge: charging pile for charging system

800V Charging pile "Charging Basics"

This article mainly talks about some preliminary requirements for 800V charging piles [https://www.beihaipower.com/products/], first let's take a look at the principle of charging: When the charging tip is connected to the vehicle end, the charging pile will provide (1) low-voltage auxiliary DC power to the vehicle end to activate the built-in BMS (battery management system) of the electric vehicle After activation, (2) connect the car end…

What is dynamic mode of EV Charging? Dynamic EV Charging vs Traditional EV Charg …

A dynamic charging system is a technology that allows electric vehicles to charge while in motion. This system typically involves embedding charging infrastructure into the road surface, which enables the vehicle to charge its battery as it travels along the road. This can potentially extend the range and operational capabilities of electric vehicles, as they can receive continuous power while on the move. Dynamic charging systems have the potential to…

Electric Bus Charging Infrastructure Market Forecast to 2028 - COVID-19 Impact a …

In every region, electrification appears as a clear alternative to increase urban growth and to care for the city environment simultaneously, using electric buses. With the right charging technology, the advantages of electric buses can be used, such as the use of renewable energy, less energy consumption, less noise, lower particle emissions, reliable service, and others. The severe emission standards across the globe are expected to drive more electric bus…

Global Automotive Electric Recharging Point Market Size, by Type (Home Charging …

Global Automotive Electric Recharging Point Market research report provides complete intelligence about the global Automotive Electric Recharging Point industry, including market growth factors and prominent competitors in the market. The report also enfolds insightful analysis of competition intensity, segments, environment, trade regulations, and product innovations to render deep comprehension of the complete Automotive Electric Recharging Point market structure. Recent developments, technology diffusion, and important events of the market are also…

Electric Vehicle Charging Equipment Market Report 2018: Segmentation by Type (AC …

Global Electric Vehicle Charging Equipment market research report provides company profile for Fortum, Fuji Electric, Leviton, Shell, Qualcomm, Bosch, Schneider Electric, Siemens, ABB, AeroVironment, Chargemaster, ClipperCreek, DBT-CEV, Engie and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018…