Press release

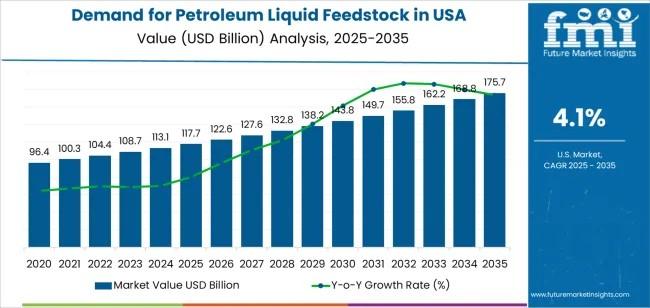

USA Petroleum Liquid Feedstock Demand Outlook 2025-2035: Market to Reach USD 175.7 Billion at 4.1% CAGR

The demand for petroleum liquid feedstock in the USA is projected to expand from USD 117.7 billion in 2025 to USD 175.7 billion by 2035, registering a CAGR of 4.1% over the forecast period. According to the latest analysis by Future Market Insights (FMI), growth is supported by strong refining capacity, expanding petrochemical investments, and continued reliance on liquid hydrocarbons for fuels and chemical manufacturing.Petroleum liquid feedstocks-including crude oil derivatives, naphtha, gas oil, condensates, and refinery recycled streams-remain foundational inputs for gasoline, diesel, jet fuel, aromatics, lubricants, and plastics production. While renewable energy adoption and alternative feedstocks are gradually influencing energy strategies, liquid petroleum streams continue to anchor U.S. refining and petrochemical supply chains.

Petroleum Liquid Feedstock Demand Snapshot (2025-2035)

• Market value in 2025: USD 117.7 billion

• Forecast value in 2035: USD 175.7 billion

• CAGR (2025-2035): 4.1%

• Leading source type: Crude oil-derived feedstock (~70% share)

• Leading application: Petroleum refining (~30% share)

• Fastest-growing region: West (4.7% CAGR)

• Key regions: West, South, Northeast, Midwest

Discover Growth Opportunities in the Market - Get Your Sample Report Now https://www.futuremarketinsights.com/reports/sample/rep-gb-28669

Market Momentum

Demand for petroleum liquid feedstock begins at USD 117.7 billion in 2025 and demonstrates consistent growth through 2035. Between 2025 and 2030, the market is projected to rise to USD 143.8 billion, supported by post-pandemic industrial normalization, strong transportation fuel demand, and petrochemical output expansion.

A moderate plateau phase may emerge around 2030 as renewable integration, fuel efficiency improvements, and feedstock substitution influence growth patterns. However, from 2030 to 2035, demand rebounds steadily, reaching USD 175.7 billion, driven by petrochemical exports, integrated refinery-chemical complexes, and sustained industrial production.

Why the Market Is Growing

Petroleum liquid feedstock demand in the United States is shaped by its essential role in refining, petrochemical production, and fuel blending operations. Refineries depend on liquid hydrocarbons to optimize output of high-value products, including gasoline, diesel, jet fuel, and chemical intermediates such as ethylene and propylene.

Integrated refinery-petrochemical complexes are increasing feedstock flexibility, enabling operators to shift between naphtha, gas oil, condensates, and alternative liquid streams based on margin optimization. Technological advancements in hydrocracking, catalytic cracking, and advanced reforming processes are also enhancing feedstock utilization efficiency.

Segment Spotlight

Source Type: Crude Oil-Derived Feedstock Leads with ~70% Share

Crude oil-derived feedstock dominates the market, accounting for approximately 70% of total demand. Refineries process crude oil into fuels and petrochemical intermediates, supporting transportation, manufacturing, and export markets.

Other source categories include natural gas-derived feedstock, coal- or biomass-to-liquids, and refinery recycled streams, which provide supplemental supply flexibility.

Application: Petroleum Refining Commands ~30% Share

Petroleum refining represents the largest application segment at roughly 30% of demand. Liquid feedstocks are converted into finished fuels and chemical feedstocks that support transportation systems, industrial manufacturing, and consumer goods production.

Additional applications include fuel blending, hydrocracking, aromatics production, lubricant manufacturing, and specialty chemical processing.

Regional Growth Outlook

West - Fastest Growing Region (4.7% CAGR)

The West leads growth due to strong refining and petrochemical clusters, particularly along the Pacific Coast. Advanced processing technologies and export-oriented production support steady feedstock intake.

South - 4.2% CAGR

The South remains a refining powerhouse, supported by Gulf Coast infrastructure and extensive petrochemical capacity. Export facilities and integrated complexes drive sustained demand.

Northeast - 3.8% CAGR

The Northeast benefits from chemical manufacturing, pharmaceuticals, and packaging industries that rely on petroleum-derived intermediates.

Midwest - 3.3% CAGR

Industrial manufacturing and agriculture-related processing underpin stable feedstock demand in the Midwest.

Drivers, Opportunities, Trends, and Challenges

Drivers:

• Expanding petrochemical and refining capacity

• Strong domestic and export fuel demand

• Technological improvements in cracking and conversion processes

Opportunities:

• Integrated refinery-petrochemical operations

• Feedstock flexibility strategies

• Advanced catalyst and hydroprocessing innovations

Trends:

• Greater feedstock slate optimization

• Increased use of recycled and blended liquid streams

• Investments in lower-emission refining technologies

Challenges:

• Crude oil price volatility

• Growth of electric vehicles and alternative energy sources

• Environmental compliance and carbon cost pressures

Key industry participants include:

• ExxonMobil Corporation

• Saudi Aramco

• Shell plc

• TotalEnergies SE

• Reliance Industries Limited

These companies compete through diversified crude sourcing strategies, advanced refining technologies, hydrocarbon conversion efficiency, and investments in cleaner production systems. Marketing strategies emphasize grade variety, supply chain resilience, and regulatory compliance to align with evolving environmental and operational standards.

Find Out More-Read the Complete Report for Full Insights https://www.futuremarketinsights.com/reports/united-states-petroleum-liquid-feedstock-market

Frequently Asked Questions

1. How large is the U.S. petroleum liquid feedstock market in 2025?

It is valued at USD 117.7 billion in 2025.

2. What is the projected market size by 2035?

The market is expected to reach USD 175.7 billion by 2035.

3. What is the forecast CAGR (2025-2035)?

The market is projected to grow at 4.1% CAGR.

4. Which source type dominates the market?

Crude oil-derived feedstock leads with about 70% share.

5. Which application holds the largest share?

Petroleum refining accounts for approximately 30% of total demand.

Browse More Insights

Ram BOP Market: https://www.futuremarketinsights.com/reports/ram-bop-market

Rock Duster Market: https://www.futuremarketinsights.com/reports/rock-duster-market

Gas Delivery Systems Market: https://www.futuremarketinsights.com/reports/gas-delivery-systems-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release USA Petroleum Liquid Feedstock Demand Outlook 2025-2035: Market to Reach USD 175.7 Billion at 4.1% CAGR here

News-ID: 4398613 • Views: …

More Releases from Future Market Insights Inc

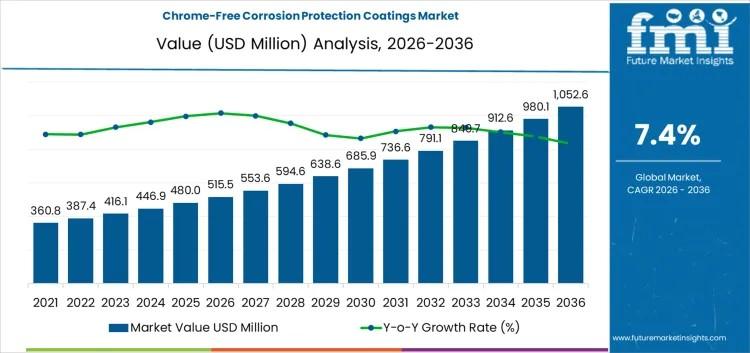

Chrome-Free Corrosion Protection Coatings Market to Surpass USD 1,052.6 million …

The global chrome-free corrosion protection coatings market is projected to expand from USD 515.5 million in 2026 to USD 1,052.6 million by 2036, registering a CAGR of 7.4% during the forecast period. According to the latest analysis by Future Market Insights (FMI), growth is being driven by regulatory restrictions on hexavalent chromium, increasing fleet modernization programs, and rising demand for certified, environmentally compliant aerospace coatings.

Traditional chromium-based primers, while effective in…

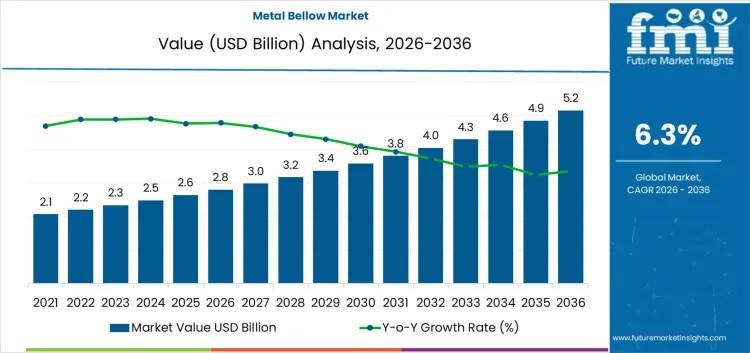

Global Metal Bellow Market Outlook 2026-2036: Industrial Automation and Aerospac …

The global metal bellow market is projected to grow from USD 2.8 billion in 2026 to USD 5.1 billion by 2036, registering a CAGR of 6.30% during the forecast period. According to the latest analysis by Future Market Insights (FMI), growth is driven by expanding industrial automation, infrastructure modernization, and rising demand for high-performance sealing solutions capable of withstanding extreme pressure, temperature, and mechanical stress.

Metal bellows are critical components used…

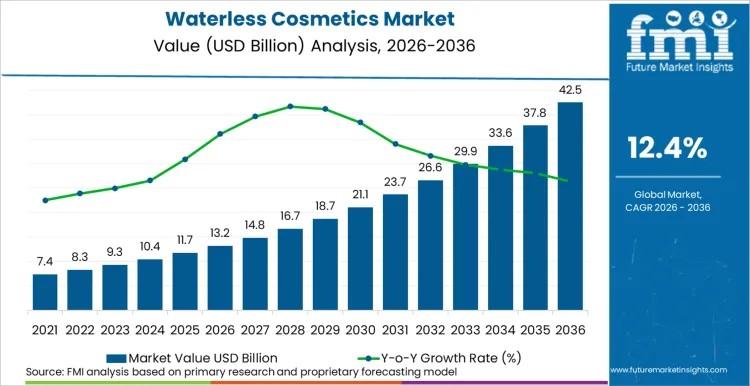

Waterless Beauty Market Forecast 2026-2036: Strong Double-Digit Growth Driven by …

The global waterless cosmetics market is projected to expand significantly over the next decade, growing from USD 13.26 billion in 2026 to USD 42.60 billion by 2036, registering a robust CAGR of 12.40%. According to the latest analysis by Future Market Insights (FMI), the market's strong upward trajectory reflects a structural shift toward high-density concentrates, solid formats, and water-positive manufacturing strategies.

Growth is fundamentally driven by a dual-engine model: large-scale capital…

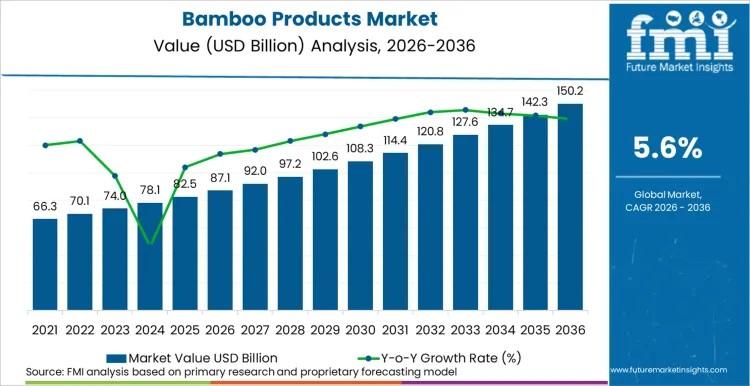

Bamboo Products Market Outlook 2026-2036: Industry to Surpass USD 150.36 Billion …

The global bamboo products market is projected to expand from USD 87.12 billion in 2026 to USD 150.36 billion by 2036, registering a CAGR of 5.6% over the forecast period, according to the latest analysis by Future Market Insights (FMI). Growth is being driven by increasing preference for renewable materials, tightening sustainability mandates across consumer and industrial supply chains, and rising substitution of wood- and plastic-based products with bamboo-derived alternatives.

Bamboo-based…

More Releases for Petroleum

Green Petroleum Coke and Calcined Petroleum Coke Market : An Overview

Introduction:

Green petroleum coke (GPC) and calcined petroleum coke (CPC) are key by-products of the oil refining process. GPC, a carbon-rich material, is used primarily as a fuel in industries such as power generation and cement manufacturing. When subjected to high temperatures, GPC is transformed into CPC, which finds applications in aluminum smelting, steel manufacturing, and titanium dioxide production. Both materials are critical in various industrial processes due to their high…

Green Petroleum Coke and Calcined Petroleum Coke Market : An Overview

Introduction:

The green petroleum coke (GPC) and calcined petroleum coke (CPC) market is a critical segment of the global energy and materials industries. Green petroleum coke, a byproduct of crude oil refining, is an unprocessed carbon material used in various industrial applications. Calcined petroleum coke, produced by heating GPC at high temperatures, is primarily used in aluminum smelting, steel manufacturing, and chemical processes. With increasing demand for energy and industrial materials,…

Petroleum Jelly Petroleum Jelly Market Innovative Strategy by 2031 | Major Giant …

Petroleum Jelly Market: Introduction

Transparency Market Research delivers key insights on the global petroleum jelly market. In terms of value, the global petroleum jelly market is expected to expand at a CAGR of 4.26% during the forecast period, owing to numerous factors regarding which TMR offers thorough insights and forecasts in its report on the global petroleum jelly market.

Get a Sample Copy of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=72726

Petroleum jelly is used in the…

Global Liquefied Petroleum Gas Market 2020 Business Strategies – Chevron Corpo …

The market report titled “Liquefied Petroleum Gas Market By Source (Refinery, Associated Gas, and Non-Associated Gas) and By End-User (Residential & Commercial, Petrochemical & Refineries, Industrial, and Transportation): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018–2025” and published by Zion Market Research will put forth a systematizedevaluation of the vital facets of the global Liquefied Petroleum Gas Market market. The report willfunction as a medium for the better assessment of…

Natural Gas Market to Witness Huge Growth by 2025 | Qatar Petroleum, Sempra Ener …

The Global Natural Gas Market has witnessed continuous growth in the past few years and may grow further during the forecast period (2019-2025). The assessment provides a 360° view and insights, outlining the key outcomes of the industry, current scenario witnesses a slowdown and study aims to unique strategies followed by key players. These insights also help the business decision-makers to formulate better business plans and make informed decisions for…

Petroleum Coke Market Players British Petroleum, Marathon Petroleum Corporation

Introduction:

Petroleum coke or petcoke, a solid rock material is a byproduct of crude oil refining and other cracking processes. Although a refining byproduct, petroleum coke is considered as a valued commodity since 2008, all over the world. Crude oil remained after separating other valuable petroleum products from refining process such as diesel, lubricants, waxes, etc. can be processed further in cokers or other cracking processes to produce petroleum coke. Different…