Press release

Critical Minerals Market to Reach US$ 586.63 Billion by 2032; Asia Pacific Leads with 35% Share | Key Players: Albemarle Corporation, China Northern Rare Earth, MP Materials

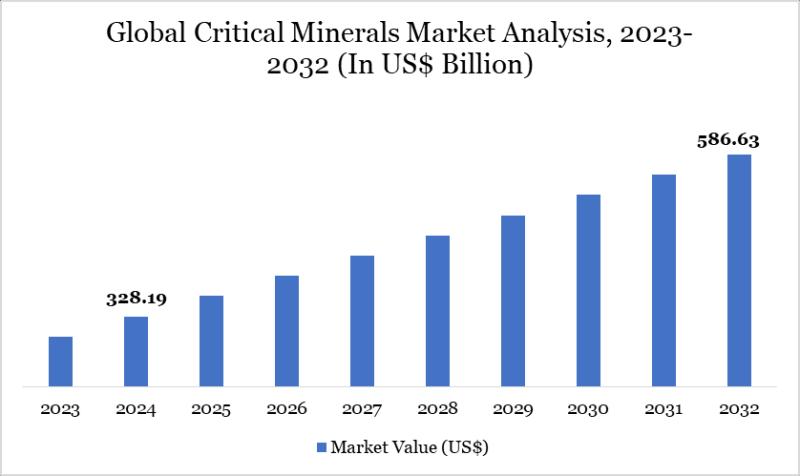

Market OverviewMarket Size (2024): USD 328.19 billion

Expected Market Size (2032): USD 586.63 billion

CAGR (2025-2032): 7.53%

The global critical minerals market is experiencing unprecedented growth, driven primarily by the accelerating transition to clean energy technologies. Key energy transition minerals including lithium, cobalt, and nickel have seen rapid demand growth: lithium demand has tripled, cobalt demand has risen by 70%, and nickel demand has increased by 40% between 2017 and 2022. Clean energy applications, such as electric vehicles (EVs), battery storage systems, and renewable energy technologies, account for significant portions of this demand.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/critical-minerals-market?Juli

In India, government initiatives have intensified, with the total number of critical mineral projects increasing from 59 in 2020 to 123 in 2023. However, geographical concentration of mineral processing, particularly in China which dominates 79% of graphite processing and 60% of rare earth element processing poses a strategic challenge. This concentration underscores the importance of securing stable supply chains for critical minerals, essential for the development of renewable energy infrastructure, battery manufacturing, and energy storage solutions.

Recent Key Developments:

✅ February 2026 - U.S.‐Uzbekistan Critical Minerals Pact: The United States and Uzbekistan signed a strategic joint investment framework to enhance cooperation in exploration, extraction, and processing of key critical minerals such as lithium, copper, and tungsten. This agreement aims to support new mineral infrastructure projects and strengthen supply chain resilience.

✅ January 2026 - U.S. Domestic Critical Minerals Support: The U.S. government committed major funding to bolster domestic critical mineral projects, including expanded rare earth processing capacity outside of China. This initiative is part of a broader strategy to secure supply chains for technology and defense applications.

✅ June 2025 - EU Mining Expansion in Africa: The European Union increased financial and technical support for critical mineral mining projects across Africa, including rare earths, graphite, and cobalt initiatives in multiple countries, under its Critical Raw Materials Act.

✅ July 2025 - U.S. Mineral Collaboration (MINAC): Lucid Group and domestic critical minerals producers launched the Minerals for National Automotive Competitiveness Collaboration (MINAC) to strengthen U.S. supply chains for minerals used in EV batteries and related manufacturing.

Latest Mergers & Acquisitions

✅ September 2025 - Europe: European Metals Holdings Ltd. acquired a lithium and cobalt extraction project in Portugal, aimed at increasing strategic reserves of energy transition minerals within the EU.

✅ August 2025 - Africa: A joint venture between Glencore and regional partners expanded cobalt and copper operations in the Democratic Republic of Congo, focusing on sustainable mining practices and improved logistics for global supply.

✅ June 2025 - Asia Pacific: Tata Chemicals and Japan Oil, Gas and Metals National Corporation (JOGMEC) formed a strategic partnership to acquire stakes in lithium and graphite projects in India, supporting the regional EV and energy storage ecosystem.

Key Players:

Albemarle Corporation - 12% Share: A leading global producer of lithium, providing battery-grade lithium compounds for EVs and energy storage systems.

Livent Corporation - 8% Share: Specializes in high-purity lithium products for rechargeable batteries and specialty chemical applications.

Lynas Rare Earths Limited - 7% Share: Major rare earth element producer outside China, supplying materials for magnets, electronics, and clean energy technologies.

MP Materials Corp. - 10% Share: Focused on rare earth mining and processing in North America, strengthening domestic supply chains for high-demand minerals.

China Northern Rare Earth (Group) High-Tech Co., Ltd. - 15% Share: One of the largest rare earth producers globally, dominating supply of critical minerals such as neodymium and praseodymium.

Glencore plc - 9% Share: Diversified miner producing cobalt, copper, and other critical minerals, with a strong presence in Africa and global trading networks.

Iluka Resources Limited - 6% Share: Produces titanium, zirconium, and specialty minerals for industrial and energy applications.

Rio Tinto Group - 8% Share: Major producer of lithium, titanium, and other critical minerals, supporting EV battery supply chains.

Pilbara Minerals Limited - 6% Share: Focused on lithium extraction in Australia, supplying spodumene for battery-grade lithium production.

Canada Nickel Company Inc. - 3% Share: Developer of nickel projects in Canada, aimed at supporting clean energy and battery applications.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=critical-minerals-market?Juli

Market Segmentation:

By Mineral Type

Lithium - 30% Share: Driven by EV battery demand, energy storage systems, and portable electronics.

Cobalt - 15% Share: Primarily used in lithium-ion batteries, superalloys, and high-performance applications.

Nickel - 12% Share: Key component in battery cathodes, stainless steel, and clean energy technologies.

Rare Earth Elements (REEs) - 20% Share: Includes neodymium, praseodymium, and dysprosium, used in magnets, electronics, and renewable energy systems.

Graphite - 10% Share: Used in anodes for lithium-ion batteries and various industrial applications.

Others (Copper, Manganese, Titanium, etc.) - 13% Share: Supporting renewable energy infrastructure, EV production, and industrial uses.

By Extraction Method

Open-Pit Mining - 45% Share: Predominantly used for lithium, nickel, and cobalt, offering high production volumes at lower costs.

Underground Mining - 25% Share: Applied for high-value critical minerals, including cobalt and rare earths, often in geologically complex areas.

Hydrometallurgical & Chemical Extraction - 20% Share: Used for lithium brine processing, rare earth extraction, and refining high-purity minerals.

Others (Recycling & Secondary Processing) - 10% Share: Increasingly important for sustainable recovery of critical minerals from electronic waste and spent batteries.

By Application

Electric Vehicles (EVs) & Battery Storage - 40% Share: Largest driver for lithium, cobalt, nickel, and graphite consumption.

Renewable Energy Technologies - 25% Share: Wind turbines, solar panels, and energy storage systems require rare earths, lithium, and other minerals.

Electronics & Industrial Applications - 20% Share: Includes consumer electronics, magnets, catalysts, and specialty alloys.

Defense & Aerospace - 10% Share: Use of rare earths, titanium, and other critical minerals for high-performance components.

Others - 5% Share: Miscellaneous applications in healthcare, automotive, and infrastructure projects.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/critical-minerals-market?Juli

Regional Insights

North America - 28% Share: North America holds a significant portion of the critical minerals market, driven by domestic lithium, nickel, and rare earth production projects. Strong government support, investments in EV battery manufacturing, and strategic initiatives to reduce reliance on imported minerals bolster market growth.

Asia Pacific - 35% Share: The Asia Pacific region dominates the market due to large-scale mining and processing of lithium, cobalt, nickel, and rare earth elements in countries like China, Australia, and India. Rapid adoption of EVs, renewable energy projects, and battery manufacturing capacity fuels high demand for critical minerals.

Europe - 15% Share: Europe's market growth is supported by EU policies promoting strategic autonomy in critical minerals, investments in rare earth and lithium projects, and expansion of renewable energy and EV battery production facilities.

Latin America - 12% Share: Latin America contributes through lithium-rich countries such as Chile, Argentina, and Bolivia, with expanding mining projects for lithium brines, nickel, and cobalt aimed at global EV supply chains.

Market Drivers:

Drivers

Rising Demand for Energy Transition Technologies (EVs and Renewables)

The global critical minerals market is being driven by the accelerating adoption of energy transition technologies, including electric vehicles (EVs), battery storage systems, and renewable energy infrastructure. According to industry projections, mineral demand for clean energy technologies is expected to nearly quadruple by 2040, reaching close to 40 million tonnes annually.

Lithium demand is projected to increase ninefold to support EV batteries and grid storage solutions.

Copper demand is expected to see the largest absolute growth, given its critical role in electrification and renewable energy systems.

Currently, clean energy applications account for over 40% of total demand for copper and rare earth elements, 60-70% for nickel and cobalt, and nearly 90% for lithium.

Restraints

Geopolitical Risks and Supply Chain Concentration

The critical minerals market faces constraints due to geopolitical risks and concentrated supply chains. China dominates the processing of several key minerals, refining 70% of global cobalt and nearly 60% of lithium and manganese, while the Democratic Republic of the Congo (DRC) supplies 70% of global cobalt.

Such heavy reliance on a few countries creates vulnerability to supply disruptions, including:

Export restrictions and trade disputes

Political instability in mineral-producing regions

Price volatility and market manipulation

Future Outlook

The global critical minerals market is expected to experience strong growth, reaching approximately USD 586.63 billion by 2032, growing at a CAGR of 7.53% from 2025 to 2032. This growth will be primarily driven by the expansion of electric vehicles (EVs), renewable energy projects, and battery storage systems worldwide.

Key trends shaping the market's future include:

Rising EV and Battery Demand: The increasing adoption of EVs and grid storage systems will continue to fuel demand for lithium, cobalt, nickel, and graphite, supporting a robust market trajectory.

Expansion of Renewable Energy Projects: Wind, solar, and other renewable infrastructure require rare earth elements, copper, and other critical minerals, further driving regional and global demand.

Technological Advancements in Mining and Processing: Innovations such as low-carbon smelting, hydrometallurgical extraction, and recycling of spent batteries will improve efficiency, reduce environmental impact, and enhance supply reliability.

Diversification of Supply Chains: Countries like India, the U.S., and EU members are investing in domestic mining, processing, and strategic partnerships to reduce reliance on concentrated sources like China and the DRC.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Minerals Market to Reach US$ 586.63 Billion by 2032; Asia Pacific Leads with 35% Share | Key Players: Albemarle Corporation, China Northern Rare Earth, MP Materials here

News-ID: 4397673 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Drug of Abuse Testing Market to Reach US$ 12.31 Billion by 2033; North America L …

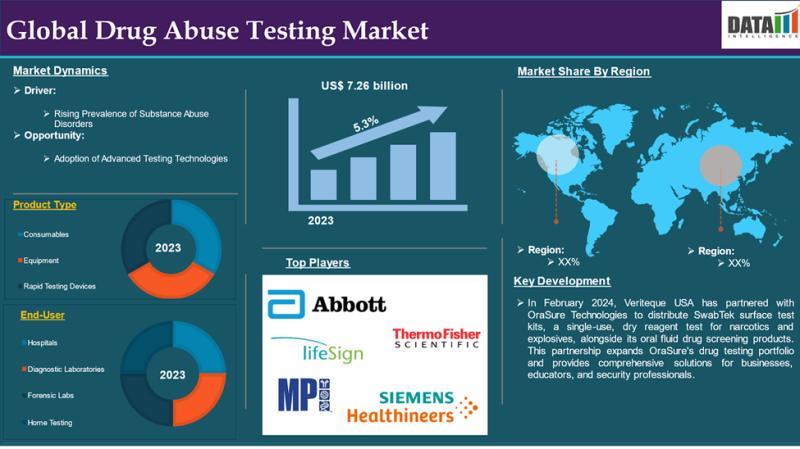

Market Overview

Market Size (2023): USD 7.26 billion

Expected Market Size (2033): USD 12.31 billion

CAGR (2025-2033): 5.3%

Drug abuse testing is a critical process for detecting prescription and illicit substances in an individual's system, ensuring safety, regulatory compliance, and medical evaluation. It is widely used across workplace screening, forensic investigations, sports anti-doping programs, and clinical diagnostics.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/drug-of-abuse-testing-market?Juli

Advancements in rapid detection…

United States Aesthetic Lasers and Energy Devices Market 2026 | Growth Drivers, …

Market Size and Growth

Aesthetic Lasers and Energy Devices Market is estimated to reach at a CAGR of 6.40% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/aesthetic-lasers-and-energy-devices-market?sb

Key Development:

United States: Recent Industry Developments

✅ In November 2025, Venus Concept Inc. secured FDA 510(k) clearance for its Venus NOVATM platform, a next‐generation multi‐application device combining radiofrequency, EMS, and electromagnetic technologies for non‐invasive…

Orphan Drugs Market to Reach US$ 486.51 Billion by 2032; North America Leads wit …

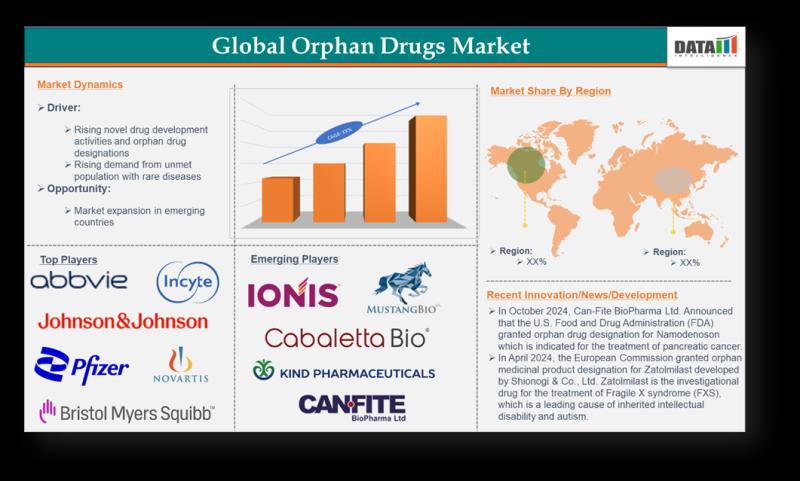

Market Overview

The Global Orphan Drugs Market reached US$ 223.76 billion in 2023 and is projected to reach US$ 486.51 billion by 2032, growing at a CAGR of 9.1% during the forecast period 2024-2032. Orphan drugs are medications specifically developed to treat, prevent, or diagnose rare (orphan) diseases. According to the U.S. Food and Drug Administration (FDA), an orphan disease affects fewer than 200,000 patients in the U.S. Similarly, the European…

United States Animal Tracking Market 2026 | Growth Drivers, Trends & Market Fore …

Market Size and Growth

The Global Animal Tracking Market Reached USD 2.1 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 4.9 billion by 2030. The global animal tracking market is expected to exhibit a CAGR of 11.5% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/animal-tracking-market?sb

Key Development:

United States: Recent Industry & Technology…

More Releases for Share:

DevSecOps Market Share Outlook 2025-2034: Key Trends, Growth Drivers, and Market …

What industry-specific factors are fueling the growth of the devsecops Market Share?

The escalation in cybercriminal activities is anticipated to spur the expansion of the DevSecOps Market Share. Cybercrime includes illegal activities that involve the use of computers, networks, and digital advancements. The increasing interconnectivity of devices and systems, which is made possible by the general use of the internet, has provided more chances for cybercriminals to exploit any vulnerabilities. DevSecOps…

Baler Market Share Outlook 2025-2034: Key Trends, Growth Drivers, and Market Sha …

Which drivers are expected to have the greatest impact on the over the baler market's growth?

The baler market is witnessing growth fueled by increasing interest in livestock farming. This farming method, which involves raising and domesticating animals, is being anticipated to witness escalating popularity. Consequently, it would enhance the demand for balers throughout the projected period, primarily due to the expected rise in meat consumption. For example, as per an…

Surging Wearable Device Demand Boosts Piezoelectric Devices Market Share Share D …

What combination of drivers is leading to accelerated growth in the piezoelectric devices Market Share Share?

The growth of the piezoelectric devices Market Share Share is expected to be driven by the escalating demand for wearable devices. These are electronic tools based around the body, often in the form of clothes or accessories, and are designed to monitor health and fitness, deliver information and entertain consumers. Devices with piezoelectric…

Prominent Phosphoric Acid Market Share Share Trend for 2025: Technological Advan …

What industry-specific factors are fueling the growth of the phosphoric acid Market Share Share?

The phosphoric acid Market Share Share is experiencing substantial growth because of the escalating need for Di-ammonium Phosphate (DAP) fertilizers. DAP, a type of soluble ammonium phosphate salt, is produced when ammonia reacts with phosphoric acid. A major component of fertilizer production, phosphoric acid, mixed with finely ground phosphate, generates triple superphosphate (TSP), monoammonium phosphate…

Nanophotonics Market Share Outlook 2025-2034: Key Trends, Growth Drivers, and Ma …

What combination of drivers is leading to accelerated growth in the nanophotonics Market Share?

The nanophotonic Market Share is experiencing growth due to the escalating demand for optical fibers and other related telecommunication devices. The incorporation of nanoparticles into optical fibers has enabled the development of newer, cutting-edge features such as enhanced refractive index, sensing, and computation capacities. IEEE, an organization for electronic and electrical engineering professionals, has reported that India…

Digital Assurance Market Share Outlook 2025-2034: Key Trends, Growth Drivers, an …

How Are the key drivers contributing to the expansion of the digital assurance market?

The surge in digital transformation efforts by IT firms will boost the market for digital assurance. Digital transformation involves employing digital technologies to create new or modify present business operations, culture, and client experiences to meet evolving business and market demands. Almost every organization is implementing it due to the increased necessity for digitalization. Digital assurance, a…