Press release

Digital Banking Solution Market Set for Strong Growth to US$ 24.96 Billion by 2032, Led by North America's 40.6% Share | Key Players - Worldline S.A., Fiserv Inc., Finastra

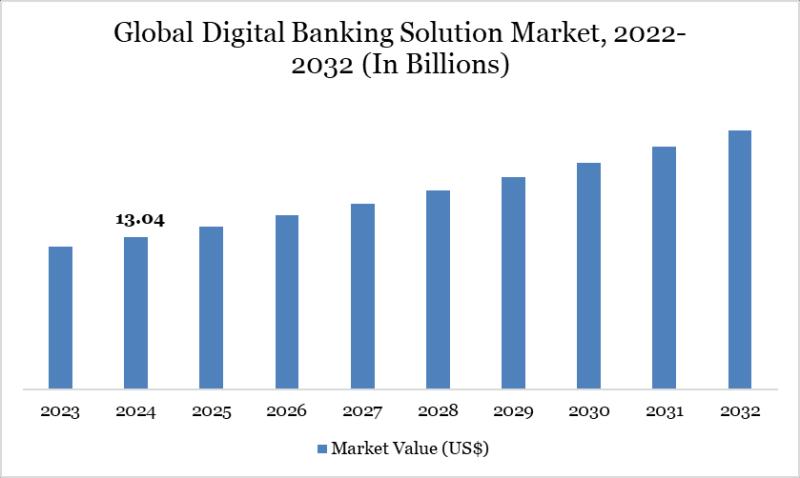

The Global Digital Banking Solution Market reached US$ 13.04 billion in 2024 and is expected to reach US$ 24.96 billion by 2032, growing at a CAGR of 8.62% during the forecast period 2025-2032.Market growth is driven by rapid digital transformation in banking, rising adoption of online and mobile platforms, and supportive regulatory initiatives like EU's PSD2, India's Digital India, and UPI. Additional accelerators include increasing smartphone penetration, AI-driven personalization, cloud-based deployments, and demand for seamless customer experiences amid cybersecurity enhancements.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/digital-banking-solution-market?ram

Key Industry Developments

United States:

✅ February 2026: Alkami Technology launched its full Digital Banking Platform for BankCherokee, featuring efficiency-focused design, advanced fraud protection via Positive Pay and ACH Reporting, and user-first interfaces tailored for both retail and business customers to enhance security and community service.

✅ November 2025: Lumin Digital successfully implemented its cloud-native digital banking solution for First Bank of Berne, enabling rapid feature deployment, seamless integrations, and adaptive responses to evolving customer needs for a future-ready experience.

✅ November 2025: Apiture released an AI-powered user interface for its Digital Banking Platform, delivering predictive personalization across online and mobile channels to deepen financial institutions' customer relationships through intelligent insights.

Asia Pacific / Japan:

✅ November 2025: MUFG partnered with OpenAI to develop an AI-based digital bank for Japan launching in 2026, integrating ChatGPT for automated account openings, customer service, savings advice, and daily money management to streamline traditional processes.

✅ October 2025: Mascoma Bank went live with Alkami's comprehensive Digital Banking Solution including Onboarding, Account Opening, and Data & Marketing tools, designed to anticipate customer needs and drive growth in the US market with APAC expansion potential.

✅ September 2025: Japan Post Bank announced plans to launch a digital yen by end of fiscal 2026, enhancing depositor convenience through digital payments and reducing reliance on physical transactions in line with Japan's digital transformation goals.

Key Mergers and Acquisitions:

✅ CSI acquired Apiture in August 2025, integrating premier business and consumer digital banking solutions to power the full account holder lifecycle for U.S. financial institutions, enhancing core banking, digital engagement, and lending capabilities.

✅ J. Safra Sarasin acquired Saxo Bank for €1.1 billion in 2025, bolstering digital banking platforms with advanced trading and wealth management tools to capture growing demand in the sector.

Key Players:

Worldline S.A. | Fiserv Inc. | Finastra | FIS | HSBC | J.P. Morgan | CSI | Capgemini | PwC

Strategic Leadership Report: Top 5 Players in Digital Banking Solution Market 2026

-Fiserv Inc.: Launched Experience Digital (XD), a cloud-native digital banking platform, enabling community banks and credit unions to deliver seamless, secure, and future-ready customer experiences with continuous innovation.

-Finastra: Deployed Finastra Essence, a next-generation cloud-native core banking solution, providing omnichannel convenience, improved digital experiences, and rapid rollout of personalized banking services for institutions like Belize Bank Group and Al Rayan Bank.

-FIS: Integrated Glia's AI-powered interactions into Digital One platforms, delivering personalized digital banking experiences, virtual workforce capabilities, and support for open banking within the Banking Modernization Framework.

CSI: Introduced My Credit Manager within its digital banking platform, offering integrated credit scoring, analytics, and over 20 embedded tools for financial wellness, alongside the acquisition of Apiture to enhance business and consumer digital banking capabilities.

-Worldline S.A.: Launched cloud-native Instant Payments Back Office Processing solution on Google Cloud Marketplace, enabling seamless EU regulation compliance, scalability, and rapid time-to-market for instant payments in digital banking.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=digital-banking-solution-market?ram

Market Drivers and Key Trends:

-Digital Transformation: Accelerated adoption of cloud-native platforms and AI-driven personalization boosts customer engagement and operational efficiency in banking.

-Regulatory Compliance: Evolving open banking mandates (e.g., PSD2 in Europe, similar frameworks in Asia-Pacific) drive secure API integrations and data-sharing innovations.

-Mobile-First Banking: Surge in smartphone penetration and 5G rollout enables seamless real-time transactions, neo-banking apps, and embedded finance services.

-Cybersecurity Imperative: Rising cyber threats propel investments in blockchain, biometrics, and zero-trust architectures for fraud prevention and trust-building.

-Financial Inclusion Push: Low-cost digital solutions expand access in emerging markets like India and Africa, targeting unbanked populations via micro-lending and wallet apps.

-Market Hurdles: Data privacy concerns (e.g., GDPR, CCPA), legacy system integration challenges, and talent shortages in fintech expertise constrain rapid scaling.

Regional Insights:

-North America holds the largest share in the Digital Banking Solution Market at 40.6% in 2024 (largest share, driven by mature fintech ecosystems and high mobile banking adoption in the US).

-Asia Pacific: 25.3% (fastest growing, fueled by smartphone penetration and digital initiatives in India and China).

-Europe: 31.9% (supported by open banking regulations like PSD2 and steady digital investments).

-Latin America: 9.1% (emerging growth from mobile-first adoption in Brazil and Mexico).

-Middle East & Africa: 6.9% (boosted by financial inclusion efforts and neo-bank expansions).

Market Opportunities & Challenges: Digital Banking Solution Market 2026

Digital Banking Solution Market continues rapid evolution amid rising demand for seamless financial services.

-Opportunities

Banks prioritize embedded finance integrations, partnering with non-financial platforms for instant payments and lending via open APIs.

AI-powered personalization engines enable hyper-targeted offers, boosting retention through predictive analytics on spending patterns.

Regulatory sandboxes in Asia-Pacific accelerate neobank licensing, drawing venture capital for underserved segments like gig workers.

-Challenges

Escalating cybersecurity breaches demand zero-trust architectures, straining legacy systems amid quantum computing threats.

Interoperability gaps between platforms fragment user experiences, complicating cross-border transactions.

Stringent data privacy laws like evolving GDPR variants slow innovation, requiring costly compliance overhauls.

-Strategic Verdict

Composable banking platforms and agentic AI advisors emerge as dominant growth drivers for 2026.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/digital-banking-solution-market?ram

Market Segmentation Analysis:

-By Component: Software Leads Platform Innovation

Software dominates with 65% market share in 2024, powering core platforms for mobile payments, AI fraud detection, and digital lending across retail and corporate banks.

Services account for 35%, offering essential implementation, maintenance, and consulting to ensure seamless integration and compliance.

-By Banking Type: Retail Banking Holds Majority

Retail banking commands 66% share, driven by massive consumer shift to convenient online personal finance and account management amid rising internet users.

Corporate banking takes 20%, focusing on cash management and trade finance for enterprises.

Investment banking has 14%, leveraging AI for portfolio and risk tools.

-By Deployment: Cloud Dominates Scalability

Cloud-based solutions lead at 65% share in 2025, favored for 50% cost reductions, rapid scalability, and AI integration over legacy systems.

On-premises holds 35%, preferred by regulated banks for data control.

-By Mode: Web-Based Still Prevails

Web-based platforms capture 55% share, due to high adoption for versatile browser access and transaction ease.

App-based follows at 45%, surging with mobile-first users but trailing in overall revenue.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTW

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Solution Market Set for Strong Growth to US$ 24.96 Billion by 2032, Led by North America's 40.6% Share | Key Players - Worldline S.A., Fiserv Inc., Finastra here

News-ID: 4396849 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

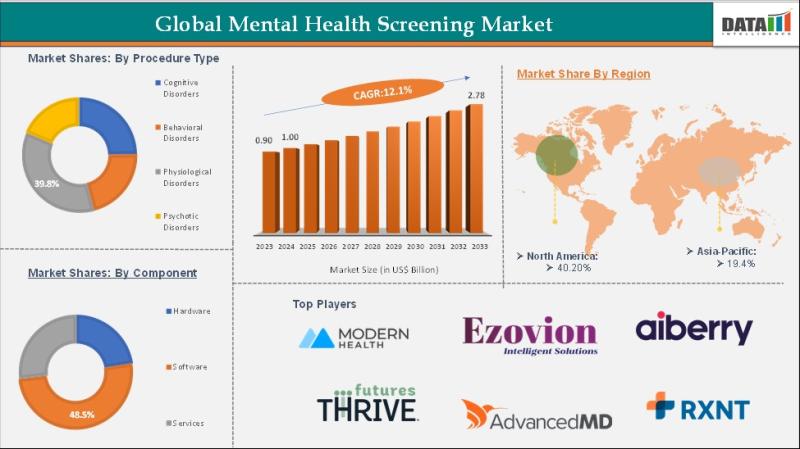

Mental Health Screening Market to Reach USD 2.78 Billion by 2033 at 12.1% CAGR | …

The Mental Health Screening Market reached USD 0.90 billion in 2023, rising to USD 1.00 billion in 2024, and is projected to grow to USD 2.78 billion by 2033, expanding at a CAGR of 12.1% during the forecast period from 2025 to 2033. Market growth is being driven by increasing global awareness of mental health conditions, rising prevalence of anxiety, depression, and stress related disorders, and expanding adoption of early…

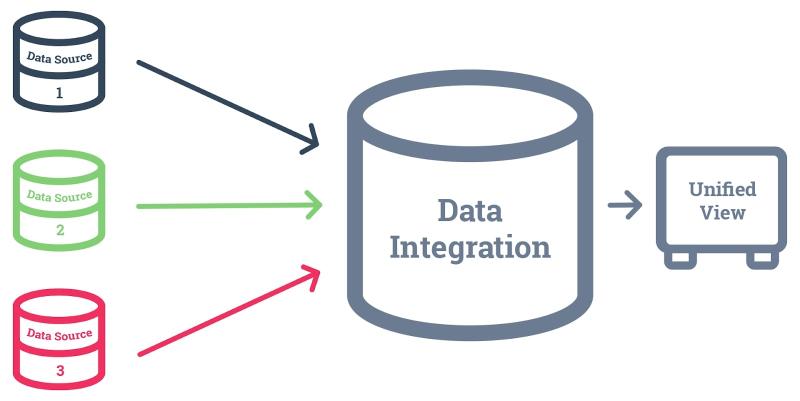

Data Integration Market Set for Explosive Growth to US$ 26.3 Billion by 2031, Le …

The Global Data Integration Market reached US$ 11.6 billion in 2022 and is expected to reach US$ 26.3 billion by 2031, growing with a CAGR of 10.8% during the forecast period 2024-2031.

Market growth is driven by the rising adoption of hybrid and cloud-based data integration, surging demand for real-time data synchronization in multi-cloud environments, and the integration of AI/ML for automated data cleansing and transformation. Advancements in data virtualization,…

Data Integration Market to Reach USD 35.8 Billion by 2033 at 15.6% CAGR | North …

The Data Integration Market was valued at approximately USD 14.8 billion in 2024 and is projected to reach around USD 35.8 billion by 2033, expanding at a CAGR of about 15.6% during the forecast period from 2025 to 2033. This strong growth reflects the ever-increasing need for organizations to unify data from disparate sources, enable real-time analytics, support digital transformation initiatives, and drive data-centric decision making across enterprise ecosystems. As…

Building Materials Market Set for Steady Expansion to USD 1.7 Trillion by 2031 a …

The Global Building Materials Market reached USD 1.3 trillion in 2022 and is expected to reach USD 1.7 trillion by 2031, growing with a CAGR of 3.9% during the forecast period 2024-2031.

Market growth is driven by government investments in infrastructure such as public buildings, utilities, and transportation systems, alongside expansions in highways, railways, tunnels, non-residential buildings, and mining. Urbanization, industrialization, and demand for innovative, cost-effective materials like ready-mix concrete and…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…