Press release

Digital Asset Custody Market to Reach USD 6,067.7 Billion by 2036 | CAGR 22.6%

Digital asset custody grows from USD 793.1B in 2026 to USD 6,067.7B by 2036 as institutions adopt at 22.6%.

Market Overview

Digital asset custody solutions are the infrastructure that makes secure blockchain-based asset management possible at institutional scale. These platforms provide the kind of security that large financial institutions require, including cold storage vaults that keep private keys completely offline, hardware security modules that protect cryptographic operations, multi-signature authentication that requires multiple parties to approve transactions, and distributed key management systems that ensure no single point of failure.

Download Sample Report. Here: https://www.meticulousresearch.com/download-sample-report/cp_id=6412

As traditional financial institutions bring cryptocurrencies, tokenized assets, and blockchain-based instruments into their portfolio strategies, secure and regulatory-compliant custody has shifted from a nice-to-have service to mission-critical infrastructure. The ability to protect assets reliably, maintain operational resilience under stress, and provide audit-ready compliance documentation has become central to whether institutions can participate in digital asset markets at all.

Institutional Adoption Driving Market Expansion

The flow of institutional capital into digital assets is transforming what custody providers need to deliver. Hedge funds, asset managers, banks, and cryptocurrency exchanges are all demanding custody solutions that meet much higher standards than what retail users typically require. This includes insurance-backed custody frameworks that provide recourse if something goes wrong, regulatory-compliant asset segregation that keeps customer funds separate from operational funds, enterprise-grade multi-signature systems that distribute control appropriately, and real-time compliance monitoring that catches potential issues before they become violations. Cold storage remains the dominant custody solution in 2026, and this reflects the institutional preference for air-gapped security architecture that provides superior protection against cyber threats by keeping private keys physically disconnected from any network.

Key Market Trends

Proliferation of Institutional Multi-Signature Systems

Advanced multi-party computation and threshold signature schemes are improving transaction security in high-frequency institutional environments. These cryptographic techniques allow multiple parties to jointly control assets without any single party ever having complete access to the private keys, which addresses both security and governance concerns simultaneously.

Quantum-Resistant Cryptography & Zero-Knowledge Proofs

Looking further ahead, emerging cryptographic innovations are being developed to strengthen long-term security against evolving cyber threats and the potential future risk posed by quantum computing. Zero-knowledge proofs are also gaining traction as a way to prove things about assets or transactions without revealing unnecessary information, which is valuable for privacy and compliance.

Integration with Tokenized Securities & DeFi

Custody providers are expanding beyond holding cryptocurrencies into supporting tokenized bonds, equities, real estate, and liquid staking solutions that allow assets to earn yield while remaining in custody. This diversification is creating new revenue streams and expanding the overall scope of what custody services cover.

Browse in Depth: https://www.meticulousresearch.com/product/digital-asset-custody-market-6412

Segment Insights

By Asset Type

Cryptocurrencies hold the largest market share in 2026, driven by institutional trading activity, their role in portfolio diversification strategies, and the sheer volume of activity on global exchanges. Security tokens are projected to grow at the fastest rate through 2036 as more traditional assets are tokenized and moved onto blockchain infrastructure.

By Custody Solution

Cold storage dominates in 2026 because it meets the security standards that institutions require for long-term holdings. Warm storage solutions, which maintain some network connectivity to enable faster access while still providing strong security, are expected to grow rapidly as they become essential for supporting active trading strategies and DeFi integration.

By Service Model

Third-party custody leads the market, and this reflects institutional preference for working with specialized providers that offer regulatory compliance frameworks, insurance coverage, and the kind of operational track record that builds trust. Self-custody is expected to grow steadily as well, particularly in retail markets and decentralized ecosystems where users value direct control over their assets.

Regional Insights

North America holds the largest share of the global market in 2026. Strong institutional participation, relatively clear regulatory frameworks compared to other regions, and the presence of major qualified custodians all support the region's market leadership. The United States in particular has seen significant institutional adoption despite ongoing regulatory uncertainty.

Asia-Pacific is projected to see significant growth, driven by expanding cryptocurrency exchange ecosystems and blockchain innovation initiatives across countries like Singapore, Hong Kong, Japan, and South Korea.

Europe is gaining traction through regulatory harmonization efforts, particularly the Markets in Crypto-Assets regulation that is creating structured compliance frameworks and making it clearer how institutions can participate in digital asset markets legally.

Market Drivers

Several forces are converging to drive this market forward. Institutional cryptocurrency adoption continues to accelerate as digital assets become a more accepted part of diversified portfolios. Regulatory clarity, where it exists, is enabling participation by institutions that were previously sitting on the sidelines. The growth of tokenized securities is creating entirely new categories of assets that need custody solutions. Decentralized finance is expanding and maturing, bringing with it new custody challenges and opportunities. Throughout all of this, there is rising demand for enterprise-grade cold storage that can protect large asset positions with institutional-quality security.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1729

Competitive Landscape

The leading players operating in this market include Coinbase Custody, BitGo Holdings, Fireblocks, Anchorage Digital Bank, Gemini Trust Company, Fidelity Digital Assets, Copper Technologies, Ledger Enterprise, Paxos Trust Company, Bakkt Holdings, and Komainu.

Market Outlook

As blockchain infrastructure continues to mature and tokenization spreads across more asset classes, digital asset custody is evolving from a niche service into a foundational component of global financial architecture. With regulatory frameworks becoming more standardized and security innovations reaching institutional quality, the market is positioned for sustained double-digit growth through 2036. The custody providers that can balance security, compliance, and operational flexibility will be the ones that capture the largest share of institutional capital flowing into digital assets over the coming decade.

Related Reports:

Digital Signage Market: https://www.meticulousresearch.com/product/digital-signage-market-5090

Media Asset Management Market: https://www.meticulousresearch.com/product/media-asset-management-market-6195

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Asset Custody Market to Reach USD 6,067.7 Billion by 2036 | CAGR 22.6% here

News-ID: 4396449 • Views: …

More Releases from Meticulous Research®

Global Antiviral & Antimicrobial Coatings Market Analysis 2026-2036: Trends, App …

The antiviral and antimicrobial coatings market has seen remarkable growth in recent years, reflecting the world's heightened focus on hygiene and disease prevention. In 2025, the market was valued at around USD 6.4 billion, and it is projected to reach nearly USD 18.94 billion by 2036, expanding at an annual growth rate of 10.5%. This growth is being driven by several factors, including the rising occurrence of healthcare-associated infections, increasing…

Global Activated Alumina Market Outlook 2026-2036: Growth, Trends, Applications, …

The global activated alumina market has experienced steady growth over the past several years and is expected to continue on a positive trajectory in the coming decade. Valued at USD 1.2 billion in 2025, the market is projected to reach USD 1.3 billion in 2026 and expand to approximately USD 2.22 billion by 2036, representing a compound annual growth rate of 5.5% from 2026 to 2036. This growth is largely…

Global Adaptogenic Beverages Market Analysis 2026-2036: Trends, Growth Drivers, …

The global adaptogenic beverages market has been experiencing significant growth, driven by the rising consumer focus on holistic wellness and the expanding functional food and beverage industry. Valued at approximately USD 1.18 billion in 2025, the market is projected to reach around USD 2.89 billion by 2036, growing at a compound annual growth rate (CAGR) of 8.5% from 2026 to 2036. This growth is fueled by consumers' increasing desire to…

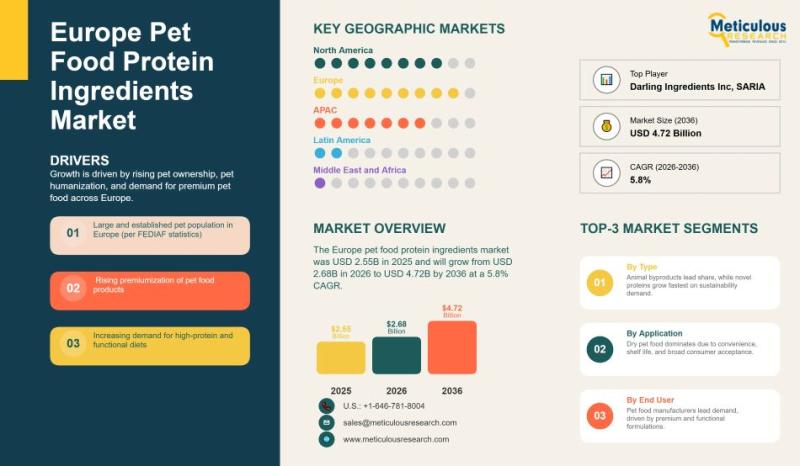

Europe Pet Food Protein Ingredients Market Analysis 2026-2036: Trends, Growth Dr …

The Europe pet food protein ingredients market has been witnessing steady growth over the past few years, driven primarily by an increase in pet ownership across the region, the humanization of pets, and a rising demand for premium and specialized pet food products. In 2025, the market was valued at approximately USD 2.55 billion and is projected to grow to about USD 4.72 billion by 2036. The market is expected…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…