Press release

OfferMarket Method

The OfferMarket Method: Real Estate Investing Growth SystemEver feel like real estate investing involves juggling too many balls at once? You're hunting for deals on one platform, running numbers on another, chasing financing from yet another source, and somehow trying to keep it all straight in your head. It's exhausting, inefficient, and frankly, it's costing you money.

Enter the OfferMarket Method-a systematic, integrated approach that brings every piece of your investment puzzle under one roof. Think of it as your end-to-end ecosystem for building real estate wealth, designed specifically for investors who are serious about scaling their portfolios in the most streamlined way possible..

What Is the OfferMarket Method?

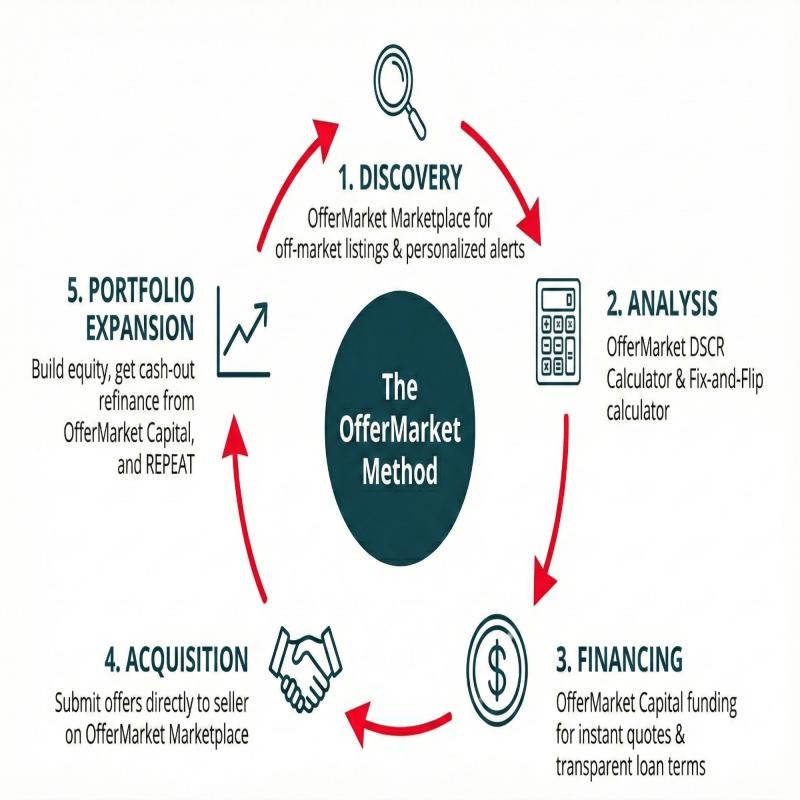

The OfferMarket Method is a five-stage cyclical framework that transforms how investors discover, analyze, finance, acquire, and scale their real estate portfolios. Unlike traditional approaches where you're constantly switching between platforms and providers, this method creates a seamless flow from initial property discovery through portfolio expansion.

Here's what makes it different: instead of treating each investment as a standalone transaction, the OfferMarket Method recognizes that smart real estate investing is cyclical. You acquire properties, build equity, extract that equity through strategic refinancing, and reinvest it into additional properties-all within an integrated ecosystem designed to maximize efficiency and profitability.

The OfferMarket Method: Low transaction costs and transparency create efficient markets

Think of the OfferMarket Method as the Swiss Army knife of real estate investing-a comprehensive, end-to-end ecosystem built for investors who are serious about growing their property portfolios without the usual headaches. At its heart, this method tackles a problem you're probably all too familiar with: the fragmented, piecemeal nature of traditional real estate investing, where you're constantly switching context, stitching together systems, and service providers just to close a single deal.

Here's the reality: real estate investing has gotten fiercely competitive, with investors now accounting for roughly 25% of total home sales according to market research from Cotality. That kind of competition means the old approach-juggling spreadsheets, chasing down sellers, title professionals, agents, lenders, appraisers, and hoping your deals don't fall through the cracks-simply doesn't cut it anymore.

The OfferMarket Method brings order to this chaos through a five-stage cyclical process:

Discovery: Tap into off-market deals through OfferMarket's property marketplace with personalized alerts tailored to your target zip codes

Analysis: Run the numbers like a pro using DSCR and fix-and-flip calculators that clearly breakdown the cash flowing potential of the property

Financing: Get transparent, competitive funding with instant quotes and pre-approvals-no guessing games about the amount of credit you will be able to access

Acquisition: Talk directly with sellers, cutting out the middlemen who slow things down

Portfolio Expansion: Put your built equity to work through cash-out refinancing to fund your next acquisition

The real magic here? Everything lives under one roof. Instead of cobbling together solutions from a dozen different sources, you navigate your entire investment journey within a single ecosystem.

This integration delivers benefits you can actually measure:

Time savings by eliminating redundant steps and streamlining your workflow

Cost reduction through competitive financing and direct seller communication

Sharper decision-making powered by professional-grade analytical tools

True scalability via systematic reinvestment strategies that compound your growth

As the real estate landscape keeps shifting, with investor activity maintaining strong momentum according to Bankrate's 2025 analysis), the OfferMarket Method provides investors with a competitive advantage through technological innovation and process integration.

In the sections ahead, we'll unpack each component of the OfferMarket Method, showing you how this approach equips investors to do more than just survive market turbulence-it positions them to genuinely thrive.

The OfferMarket Marketplace: Finding Off-Market Deals

Every great investment journey starts with access, and the OfferMarket Method kicks off with something most investors dream about: exclusive off-market real estate deals through OfferMarket's specialized marketplace.

Visit our marketplace: https://www.offermarket.us/listings

While everyone else is scouring the same MLS listings, you're getting a first look at properties that never hit the public radar. Keep in mind, these off market deals go extremely fast. Best investors jump on a newly posted opportunity with fervor. From our data at OfferMarket, we can see that the best real estate investors immediately reach out to the seller on the listings to schedule a showing.

Accessing Off-Market Opportunities

Think of OfferMarket's platform as your direct line to property sellers-no middlemen, no gatekeepers, just a transparent marketplace where you can discover, analyze, and lock down deals efficiently. By cutting out the agents and brokers who typically stand between you and opportunity, you're playing a different game entirely. We believe that lowering barriers and transaction costs is the best way to increase efficiency of the real estate market thus lowering fees to all of its participants.

So why do off-market properties deserve your attention? Here's the breakdown:

Less competition: Fewer eyeballs on the listing means fewer bidding wars. As Marsh Partners puts it, "Off-market deals are heavily marketed, but there will be less competition amongst a smaller buyer pool."

Better pricing potential: Without retail investors driving up the price, you've got real leverage to negotiate favorable terms.

Streamlined negotiations: When you're talking directly to sellers, deals move faster and with far less friction. We've seen deals closed in less then 24 hours from initial listing of the property, where an investor reached out to see the property within the first 10 minutes of listings creation.

Privacy advantages: Both buyers and sellers benefit from confidentiality. According to Forbes, "An off-market deal allows you to maintain privacy, which can protect tenant relationships or prevent speculation about your financial standing" .

Setting Up Customized Deal Flow Alerts

Here's where the OfferMarket Method gets proactive-think of it as training a very diligent assistant to hunt for exactly what you want:

1.Configure[deal flow notification settings so you're pinged the moment a matching property surfaces.

2. Receive real-time notifications via email when properties in your zipcode hit the marketplace.

The beauty of this system? You're not refreshing listings at 2 AM hoping to catch something good. The alerts do the heavy lifting, positioning you at the front of the line before most investors even know an opportunity exists.

Direct Seller Communication

If you've ever played telephone through agents, attorneys, and assistants, you know how much gets lost in translation. The OfferMarket Method cuts through that noise:

Message sellers directly through the platform's messaging system

Ask detailed questions about property condition, tenant status, and seller motivation

Negotiate terms without your intentions being filtered or diluted

Submit offers directly to the decision-maker

This direct line not only speeds things up but often produces better outcomes for everyone involved. Plus, the platform keeps a transparent record of all communications-no more "he said, she said" moments when it's time to close.

By leveraging OfferMarket's marketplace as your launching pad, you're gaining access to exclusive inventory, intelligent alerts, and unfiltered seller conversations-the trifecta that separates opportunistic investors from strategic ones in today's competitive landscape.

Professional-Grade Investment Analysis Tools

Let's be honest-real estate investing without solid financial analysis is like navigating without a compass. OfferMarket equips savvy investors with professional-grade tools built specifically for investment property analysis, so you can move from gut feelings to data-driven confidence.

Introduction to OfferMarket's Proprietary Calculators

OfferMarket's platform features specialized calculators that take the guesswork out of investment analysis. These aren't your run-of-the-mill number crunchers-they're designed to deliver accurate, comprehensive financial projections tailored to different investment strategies. While generic calculators miss the nuances, OfferMarket's tools incorporate real-world variables specific to investment properties, giving you forecasts you can actually rely on.

How to Use the DSCR Calculator to Evaluate Rental Property Cash Flow

You already know the [Debt Service Coverage Ratio DSCR is the heartbeat of rental property analysis-it tells you whether a property can carry its own weight financially.

Calculate your DSCR here: https://www.offermarket.us/blog/dscr-calculator

OfferMarket's DSCR calculator helps you:

Calculate monthly rental income against mortgage payments

Factor in property taxes, insurance, and maintenance costs

Determine if a property meets lender requirements for DSCR loans

Identify properties with the strongest cash flow potential

Simply plug in your property details, purchase price, expected rent, and financing terms, and the calculator delivers your projected DSCR instantly. Most lenders want to see at least 1.25-meaning the property generates 25% more income than its debt obligations require. Higher DSCR? That's your signal for stronger cash flow margins and a more resilient investment. However, OfferMarket's DSCR is at 1.1, so more deals qualify for our funding.

How to Use the Fix-and-Flip Calculator to Estimate Renovation ROI

If you're playing the fix-and-flip game, you know that miscalculating renovation costs can turn a promising deal into an expensive lesson.

OfferMarket's Fix-and-Flip calculator helps you:

Project total acquisition costs including purchase price and closing costs

Estimate renovation expenses based on property condition

Calculate holding costs during the renovation period

Determine potential sale price based on comparable properties

Project net profit and return on investment

As Harvard Business School Online points out in their comprehensive guide, successful real estate investment analysis hinges on evaluating four key factors: property value, rental income, expenses, and financing-all of which OfferMarket's calculators weave together for a complete picture.

Use our Fix and Flip Calculator: https://www.offermarket.us/blog/fix-and-flip-calculator

Why Solid Financial Analysis Matters Before You Make That Offer

Here's the thing: jumping into investment decisions without thorough financial analysis is like navigating without a map-you might get somewhere, but probably not where you intended. Financial analysis tools have become the savvy investor's secret weapon, and the data backs this up: they genuinely sharpen your decision-making game.

Real estate tech insider Robert Weiler put it well: "Financial analysis apps offer real estate investors a huge advantage, enabling the user to conduct more business on the go and in real-time, without having to wait until they're back at their desk".

OfferMarket's calculators put this power in your hands, letting you:

Run the numbers on multiple properties side-by-side

Spot red flags before you're emotionally invested

Anchor your offers in projected returns, not wishful thinking

Move forward with confidence backed by real data

Keep your head when the market gets exciting

Weaving these professional-grade tools into your strategy means you'll zero in on the winners while steering clear of the duds-and that's really the heart of the OfferMarket Method.

Getting to Know OfferMarket's Financing Solutions

Smart investors know that the right financing can make or break a deal.

OfferMarket offers a full toolkit of financing options built specifically for investors who are serious about growing wealth through real estate.

DSCR Loans: Why Investors Are Paying Attention

Debt Service Coverage Ratio DSCR loans have earned their spot in the investor spotlight for a compelling reason: qualification hinges on what the property can earn, not what shows up on your personal tax returns.

Get instant loan quote: https://www.offermarke.us/dscr-loan

OfferMarket's DSCR loans offer:

No personal income verification required

Qualification based on property's cash flow

Competitive interest rates for investment properties

Loan amounts up to $2 million

Options for both purchase and refinance

Here's where it gets interesting for seasoned investors: DSCR loans shine brightest when your portfolio is growing faster than your W-2 can explain, or when your income structure would make a traditional underwriter's head spin.

Industry experts put it well: "DSCR loans are among the most flexible investment property loan types for real estate investors looking to scale their portfolios"..

Fix-and-Flip Financing

For those of you who see potential where others see problems, OfferMarket's fix-and-flip loans come with some thoughtful features:

Short-term financing options (6-24 months)

Funding for both acquisition and renovation costs

Interest-only payment options

Higher LTV ratios compared to traditional lenders

Fast closing timelines to secure competitive deals

The Instant Quote Advantage

Let's talk about what really sets OfferMarket apart-the instant quote system that

changes the financing game entirely:

Real-time pricing: Receive accurate loan terms and rates within minutes, not days

Transparent fee structure: All costs are clearly outlined upfront

Multiple scenario analysis: Compare different loan options side-by-side

No credit impact: Get quotes without affecting your credit score

Mobile-friendly interface: Access quotes anywhere, anytime

You already know that in competitive markets, the investor who moves fastest often wins. As industry analyst Swiftlane reminds, "Interest rates are a key factor to consider when comparing loan options. These rates can significantly impact the overall cost of the loan". OfferMarket's instant quote system puts that critical analysis at your fingertips-exactly when you need it.

Pre-Approval: Your Competitive Edge

Getting pre-approved through OfferMarket before making offers is like showing up to a chess match having already studied your opponent's playbook. Here's why it matters:

Stronger negotiating position: Sellers gravitate toward buyers who've already sorted their financing-it signals you mean business

Faster closing timeline: You've front-loaded the paperwork, so the finish line comes into view much sooner

Clear budget parameters: No more guessing games-you know your numbers cold through your Loan File's Loan Terms.

Reduced stress: Take financing anxiety off the table so you can focus on the deal itself

Seller confidence: Nothing says "serious buyer" quite like having your ducks in a row

Transparent Pricing Philosophy

Here's where OfferMarket parts ways with the old guard. While traditional lenders often play hide-and-seek with fees, OfferMarket lays all its cards on the table:

All fees disclosed upfront-no excavation required right in your Loan File's Loan Terms

Zero hidden costs or eleventh-hour surprises

Competitive rates you can actually see and compare

Apples-to-apples loan product comparisons

Regular updates on the progress of your loan from a dedicated processing team which includes an onboarder, a processor, an underwriter and a closer, all working diligently to keep you in the know

This transparency holds true whether you're exploring short-term private money solutions or long-term rental debt-giving you the clarity to make confident financing decisions that align with your investment timeline and strategy.

Once you got your quote with clear and transparent terms, you will align all the ducks in a row that you need to submit a solid offer on your target property.

Streamlining Transactions: The Direct Offer Approach

The OfferMarket Method reimagines real estate investing by cutting out the middlemen and connecting buyers directly with sellers. The result? A cleaner process and more money staying in your pocket.

Direct Offer Submission Process on OfferMarket

OfferMarket's platform makes submitting offers directly to sellers refreshingly straightforward. Spot a promising investment property in the marketplace? You can craft and send your offer without looping in an agent. This direct line to sellers means fewer communication bottlenecks and more control over your investment strategy.

Negotiating Directly with Sellers

Here's where the OfferMarket Method really shines. You have a direct line ot the seller so nothing gets lost in transalation. OfferMarket staff will inform you if the seller has accepted or rejected your offer with any comments or notes that they might pass back to you.

Avoiding Agent Commissions and Intermediary Costs

Let's talk numbers, because this is where things get interesting. Skipping the typical 5-6% agent commission means you can:

Funnel more cash into making the property shine

Sharpen your offers without sacrificing your margins

Trim those closing costs down to size

Watch your ROI climb with each deal you close

OC Home Buyers makes an excellent point: "A direct sale eliminates monthly costs such as property taxes and utilities typically associated with lengthy listing processes, creating immediate savings for both parties" . Multiply these savings across your portfolio, and you're looking at serious money staying in your pocket rather than disappearing into transaction fees.

Tips for Crafting Competitive Offers

The OfferMarket Method gives you the tools to build offers that sellers actually want to accept:

Do thorough market research - Leverage OfferMarket's DSCR or Fix and Flip calculators to nail down offer prices grounded in realistic rental projections and renovation estimates

Highlight your financing readiness - Drop that OfferMarket pre-approval into the conversation to signal you're ready to move and capable of closing fast

Be flexible with contingencies - Consider which inspection items are truly deal-breakers versus negotiation points

Personalize your communication - Explain your investment approach and how it aligns with the seller's goals

Consider creative terms - Offer flexible closing timelines or other non-monetary terms that might appeal to the seller's specific situation

By leveraging OfferMarket's direct offer capabilities, investors can create a more efficient acquisition process while preserving capital for what matters most-building a profitable real estate portfolio.

Leveraging Equity: The Cash-Out Refinance Phase of The OfferMarket Method

You've done the hard work-acquired a solid property through OfferMarket and established steady rental income. Now comes the fun part: putting that built-up equity to work. The cash-out refinance phase lets you tap into your property's value without parting ways with your income-producing asset. Think of it as your portfolio's growth engine.

How to Evaluate When a Property Has Built Sufficient Equity

Timing matters here. Before you pull the trigger on a cash-out refinance, make sure your property has genuinely earned its stripes. Here's what to look for:

At least 25-30% equity position in the property

Stable or increasing property value since acquisition

Consistent rental income that proves the property can perform

Positive cash flow that holds up even with higher debt service

Here's the math that matters: most DSCR lenders cap cash-out refinancing at 75% of appraised value. That 25% equity cushion isn't just lender caution-it's your buffer against market hiccups. Smart investors appreciate this guardrail.

Using OfferMarket's DSCR Cash-Out Loans to Access Built Equity

OfferMarket's DSCR Cash-Out loans are purpose-built for investors like you-designed to unlock equity while keeping your loan terms investor-friendly. These loans offer several advantages:

No personal income verification - qualification based on the property's income

Instant quotes showing real-time pricing for various loan options

Higher LTV options than many traditional lenders

Flexible underwriting criteria tailored to investors

Here's where things get interesting: the cash-out refinance market is gearing up for a serious growth spurt. Industry watchers are calling 2026 the year of the refi boom as rates find their footing and property owners start unlocking record equity reserves. The numbers tell the story-recent data shows the average cash-out refinance puts roughly $94,000 back in homeowners' pockets, which is no small chunk of change to redeploy.

Calculating the Optimal Time for Cash-Out Refinancing

Timing isn't everything, but it's close. Getting your cash-out refinance window right can meaningfully juice your returns. Keep these variables on your radar:

Interest rate environment - refinancing pencils out better when rates are steady or trending down

Equity appreciation threshold - most investors wait until they've built 25-30% equity cushion

Market conditions - local real estate dynamics will shape your property's appraised value

Debt service coverage ratio - make sure the property holds a DSCR of at least 1.25 after refinancing

Investment pipeline - having identified potential acquisitions for the extracted capital

OfferMarket's refinance calculator gives you the dashboard view you need to track these variables, helping you nail the timing on your refinance to supercharge portfolio growth while keeping risk in check. Master this systematic approach to cash-out refinancing, and you've essentially built yourself a perpetual motion machine for portfolio expansion using the OfferMarket Method.

Case Study: From Single Property to Portfolio Growth

Let's talk about James, a seasoned investor ready to scale beyond his initial three rental properties. His frustrations will sound familiar: juggling multiple platforms, competing against retail buyers, and explaining investment property nuances to traditional lenders who just didn't get it.

The Complete OfferMarket Method Timeline

Month 1: Property Discovery and Analysis

James signed up for OfferMarket's deal flow alerts, dialing in his criteria for multi-family properties in emerging markets

Within two weeks, an off-market duplex with value-add potential landed in his inbox

A quick run through OfferMarket's DSCR calculator confirmed a healthy 1.4 DSCR post-renovation

Month 2: Financing and Acquisition

James tapped OfferMarket's instant quote tool and locked in a pre-approval for a fix-and-flip loan

Direct seller communication through the platform meant no agent commissions eating into his margins

That transparency? It helped him negotiate terms aligned with his renovation timeline

Months 3-5: Renovation and Stabilization

Financing in hand, James executed targeted renovations to boost rental value

OfferMarket's insurance review service ensured proper coverage during construction

Post-renovation, he secured quality tenants and established steady cash flow

Month 6: Portfolio Scaling

Six months of solid performance history unlocked OfferMarket's cash-out refinance option

James extracted 75% of the newly appreciated equity while keeping cash flow positive

That capital? Already earmarked for his next acquisition, keeping the OfferMarket Method cycle spinning

Financial Outcomes and ROI Analysis

Here's where the rubber meets the road:

Initial investment: $50,000 down payment plus $30,000 renovation budget

Post-renovation property value: $320,000 (up from the original $250,000 purchase price)

Cash-out refinance: Extracted $65,000 while maintaining positive monthly cash flow

Annual cash-on-cash return: Jumped from a projected 8% to an actual 12% after renovations

Time saved: An estimated 40+ hours by consolidating everything on a single platform

As research from the Federal Reserve Bank of New York. suggests, strategic real estate investment approaches like this can significantly outperform traditional investment vehicles, particularly when investors have access to specialized expertise and strong borrower relationships.

Lessons Learned and Best Practices

James's journey offers some valuable insights for investors eyeing the OfferMarket Method:

Speed matters: Being able to quickly analyze deals and lock down financing gave him a real edge over the competition

Integration saves money: Sticking to one ecosystem meant dodging multiple fees and commissions

Data-driven decisions: The DSCR and fix-and-flip calculators delivered projections he could actually trust

Relationship leverage: Going direct with sellers opened doors to better acquisition terms

Capital efficiency: That strategic cash-out refinance kept cash flowing while freeing up capital to grow

Here's a number worth noting: a 2025 study on alternative financing models found that investors using integrated platforms like OfferMarket can slash transaction costs by up to 23% compared to traditional financing routes.

By methodically applying the OfferMarket Method, James turned a single property purchase into the launchpad for a growing portfolio-a testament to what this integrated approach can do for your real estate game. Now we will go over the 2 main loan products that are used as the main tools for perpetuating the OfferMarket Method's cycle to grow your real estate portfolio.

Navigating DSCR Loans: The Investor's Guide to Property Financing

DSCR (Debt Service Coverage Ratio) loans have been a game-changer for real estate investment financing, and they're a key pillar of the OfferMarket Method for scaling your portfolio. These loans look at what the property earns rather than your personal income.What Makes DSCR Loans Special

Here's the beauty of DSCR loans: they focus on whether the property can pay its own bills.

The stronger your DSCR ratio, the more lenders want to work with you. And here's a number worth noting-properties with robust DSCRs are locking in rates as low as 5.99%, which adds up to serious savings over your loan term .

The math is refreshingly simple:

DSCR = Gross Rental Income ÷ PITIA

A DSCR of 1.0 means you're breaking even-the property covers its debt, nothing more. Lenders typically want to see 1.25 or higher, giving you breathing room for those inevitable surprises like vacancies or that water heater that picks the worst time to quit. OfferMarket's DSCR requirement on residential real estate goes as low as 1.1, thus increasing the number of deals that qualify.

Eligibility Requirements for Real Estate Investors

DSCR loans have opened doors that conventional financing kept firmly shut, offering flexibility that savvy investors appreciate:

Reduced Down Payment Requirements: Some DSCR programs let you get in with just 15% down, versus the 25% conventional lenders typically demand for investment properties-that's a meaningful difference when you're deploying capital strategically

Credit Score Flexibility: While prime rates typically require scores of 720+, many DSCR programs accept scores as low as 680

No Income Verification: Unlike traditional loans, DSCR financing doesn't require tax returns, W-2s, or employment verification

Entity Ownership: Properties can be purchased under LLCs or other business entities, providing liability protection

Portfolio Expansion: No limits on the number of properties in your portfolio, unlike conventional financing

DSCR Loans vs. Traditional Financing

DSCR loans let you scale your portfolio based on what your properties earn, not what your W-2 says. For investors playing the long game, that's a meaningful distinction.

The DSCR Loan Boom

DSCR loans aren't just having a moment-they're having the movement. Originations have jumped nearly 35% according to industry reports . That kind of growth signals something important: both investors and lenders are betting on rental market stability.

The big players have noticed too. Rocket Pro recently rolled out DSCR products to meet surging investor demand, and the American Association of Private Lenders confirms these loans have become one of the fastest-growing segments in mortgage lending.

Within the OfferMarket Method, DSCR loans pull double duty-they're your ticket into new acquisitions and your lever for pulling equity out through cash-out refinancing. Think of it as a self-sustaining growth engine that sidesteps the red tape of conventional financing.

Fix-and-Flip Loans: The Engine Behind Smart Real Estate Plays

Fix-and-flip remains a cornerstone strategy for savvy investors, even as the market throws curveballs. ATTOM Data Solutions reports that home flipping dipped to 297,885 properties in 2024 (down 7.7% from 2023), but here's the interesting part: investors aren't retreating-they're getting sharper, prioritizing efficiency and profitability over volume.

The Nuts and Bolts of Fix-and-Flip Loan Terms

OfferMarket's fix-and-flip loans are built for the sprint, not the marathon-buy, renovate, sell, repeat. Here's what you're working with:

Loan Terms: 6-24 months, with extension options when projects need breathing room

Loan-to-Value (LTV): Up to 90% of purchase price and up to 100% of renovation costs

Interest Rates: Calibrated to your project scope and track record

Loan Amounts: $25,000 to $2 million

Property Types: Single-family homes, multi-family (2-4 units), condos, and townhomes

Closing Costs: What you see is what you pay-no surprises lurking in the fine print

Here's a number worth noting: the average flip took roughly 161 days to complete in late 2023. That's why financing flexibility isn't a luxury-it's essential for keeping carrying costs from eating your margins.

Where OfferMarket Changes the Game

OfferMarket's fix-and-flip loans aren't just competitive-they're connected to something bigger, the complete OfferMarket Method ecosystem:

Direct Access to Off-Market Properties: Lending plus the OfferMarket property marketplace means you're seeing deals others aren't-and better margins often live in those hidden corners.

Data-Driven Decision Making: The platform's fix-and-flip calculator crunches local market data to give you projections you can actually trust-so you're making moves based on numbers, not hunches.

Streamlined Process: Application, approval, funding-it all happens in one place. No more juggling phone calls with five different providers or playing email tag across platforms.

Specialized Insurance Options: Builder's risk insurance designed specifically for renovation projects means your investment stays protected while the dust is still settling.

Funding Timeline and Process

OfferMarket has fine-tuned their funding process to match the speed fix-and-flip investors actually need:

Instant Quote: Preliminary loan terms land in your inbox within minutes through the online platform

Application Submission: Fully digital application with all required documentation

Property Evaluation: Professional assessment of current value and after-repair value (ARV)

Underwriting: 24-48 hour review of project viability and borrower qualifications

Approval and Closing: As quick as 7-10 business days from complete application

Renovation Fund Distribution: Draw schedule tied to project milestones and verification is done through an online App instead of costly inspector site visits.

Why does this speed matter? Consider this: industry data shows all-cash purchases made up 63.2% of flipped properties in 2024. Having rapid access to capital isn't just convenient-it's your competitive edge.

Maximizing Fix-and-Flip Profits with OfferMarket

To squeeze the best returns out of today's market conditions, OfferMarket suggests these proven approaches:

Target the Right Properties: Leverage OfferMarket's listing alerts to spot properties with the strongest ROI potential in up-and-coming neighborhoods.

Accurate Budgeting: Put the fix-and-flip calculator to work creating comprehensive budgets that capture every expense-carrying costs, permits, and yes, those inevitable delays that somehow always surprise us.

Renovation Prioritization: Channel your resources toward improvements that actually move the needle on ROI-kitchens, bathrooms, and curb appeal remain the tried-and-true trifecta.

Timeline Management: Here's a number worth remembering: 161 days. That's your average flip duration, and every extra day chips away at profitability through carrying costs. Tight project management isn't optional-it's essential.

Exit Strategy Flexibility: Markets shift, and smart investors shift with them. If selling isn't delivering the returns you projected, pivoting to a rental strategy via DSCR loan refinancing keeps your options open.

Insurance Protection: Don't overlook builder's risk coverage-OfferMarket's insurance review service helps you secure the right protection against those renovation curveballs nobody sees coming.

By tapping into OfferMarket's comprehensive ecosystem, you're better equipped to navigate today's fix-and-flip landscape, even as national trends point toward squeezed margins and stiffer competition.

Insurance Protection: Safeguarding Your Real Estate Investments

Let's talk about something that doesn't get nearly enough attention: insurance. Real estate investing means serious capital on the line, which makes proper coverage a non-negotiable pillar of the OfferMarket Method. Too many investors discover coverage gaps only after they've become expensive lessons.

The Insurance Challenge for Real Estate Investors

The data here is eye-opening, frankly. Mortgage Professional America reports that over 90% of fix-and-flip investors in Florida and 83% in California have walked away from deals because of insurance headaches. Nearly half of investors across these markets have hit similar roadblocks.

And that's before we factor in the cost trajectory. The Federal Reserve notes that the average monthly insurance cost for apartment buildings increased from $39 per unit in 2019 to $68 per unit in 2024-a staggering 75% increase in real terms.

OfferMarket's Insurance Review Services

With these market headwinds in mind, OfferMarket has woven comprehensive insurance review services into its method.

Submit your insurance review request: https://www.offermarket.us/insurance

Think of it as your portfolio's safety net-here's what it brings to the table:

Identify Coverage Gaps: It's surprisingly easy to overlook critical coverage areas like renovation risks, water losses, income disruption, and liability protection. We help you spot what's missing.

Access Specialized Policies: OfferMarket helps you understand investment properties protection, offering tailored solutions including:

Builder's Risk Insurance: Your essential shield during property renovations

Landlord Insurance: Robust coverage designed specifically for rental properties

Umbrella Policies: Extra liability protection when standard limits just won't cut it

Optimize Insurance Costs: Through our strategic partner relationships, we help you secure the right coverage without bleeding money unnecessarily.

Ensure Portfolio-Wide Protection: As your portfolio grows using the OfferMarket Method, your insurance needs evolve too-we make sure your protection scales right alongside your success.

By making insurance review a cornerstone of the method, OfferMarket helps you sidestep the pitfalls tripping up many real estate professionals in today's tricky insurance landscape, keeping your investments protected through every phase of ownership.

Getting Started with the OfferMarket Method

Ready to put this into action? It all starts with getting properly set up on the OfferMarket platform. Think of this as laying the groundwork-once your foundation is solid, you'll have seamless access to every tool and resource you need to execute the OfferMarket Method like a pro.

Creating Your OfferMarket Account

Think of account setup as your handshake with the OfferMarket ecosystem-quick, purposeful, and the start of something productive. Here's how to get yourself in the door:

Head to the OfferMarket website and hit the log in button in top right corner

Fill in the essentials-just your email and a password

Define your geographic sweet spots so only for your targeted zips you will get our instant alerts

Here's the thing: a thorough profile isn't just busywork. It's how OfferMarket learns to speak your language-whether you're all about long-term rentals, chasing fix-and-flip margins, or mixing strategies like a seasoned pro.

Getting Your First Instant Quote

This is where OfferMarket flexes its transparency muscles. Real-time loan pricing, no smoke and mirrors:

Navigate to the instant quote page

Pick your loan flavor-DSCR, fix-and-flip, whatever fits the deal

Punch in the property specifics: address, purchase price, estimated value, and a few other data points

Share some financial context like your credit score ballpark and investment experience

See your instant quote with interest rates. Click submit and sign up to see detailed terms, ,monthly payment estimates and get an instant online pre-approval.

No more waiting by the phone wondering what the lender gods will decree. As real estate technology experts have observed, "A smooth onboarding process reassures clients that they are in capable hands, increasing the likelihood of long-term relationships"

Phone: (443) 492-9941

Email: hello@offermarket.us

Office Hours: Monday-Friday, 8:00 AM - 6:00 PM EST

Postal Address : OfferMarket, 627 S Hanover St Baltimore, MD 21230

OfferMarket is a leading real estate technology and private lending platform dedicated to the success of residential real estate investors. By providing a transparent marketplace and institutional-quality financing, OfferMarket empowers both new and seasoned landlords to build wealth through real estate.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release OfferMarket Method here

News-ID: 4394566 • Views: …

More Releases for Offer

Mumbai Pune Taxi Discount Offer

MumbaiPuneTaxi.in Announces Special Discount Offers on Mumbai-Pune Cab Services

Mumbai, Maharashtra - 28th June 2025 - To make intercity travel more affordable and accessible, MumbaiPuneTaxi.in, a leading provider of cab services between Mumbai and Pune, has announced exciting discount offers for new and regular customers. This initiative aims to enhance customer satisfaction and encourage safe, convenient travel between the two bustling cities.

With increasing demand for reliable intercity transportation, especially among business…

Grab Our Relaunch Offer

As they say, "Christmas came early" for physical therapists; it might actually be true with this new-age physical therapy software. We know you must have a lot on your plate, and this software is designed for you, keeping in mind the hassles you face on a daily basis.

Both physical therapists and occupational therapists can use the software to manage their day-to-day processes like scheduling, digital patient intake, documentation, and so…

Product Launch Offer Date Duration

Almost every homeowner is locked out of their house at some point. Some people keep a spare key hidden outside their homes, but most have to call an emergency locksmith to regain access to their houses.

At Locksmith Hemel Hempstead, visitors will learn about a Hemel Hempstead, Hertfordshire, England-based locksmith that aims to offer superior locksmith services to area residents. In addition to providing 24/7 emergency locksmith services, Locksmith Hemel Hempstead…

TestingWhiz Introduces Christmas Offer

New Jersey, USA, December 21, 2016 – TestingWhiz, a leading test automation solution provider rolls out Christmas offer on TestingWhiz license purchase as a part of Christmas celebration and holiday season.

Under this offer, TestingWhiz licenses will now be available at 10% discount, adding fervor to the festive season. This offer aims to kick off sales and boost customer excitement to use TestingWhiz for any kind of test automation requirements.

The…

Solid offer: Stratis Global to offer clients automatic management of information

At the start of this year, Stratis Global, consulting company for business software, became the representative for the DocLogix document- and process-management system in North America. As a result, Stratis Global will be able to offer its clients an effective document-management solution based on the automation of processes.

Don Geddes, who is president of Stratis Global and has more than 30 years of consulting experience, emphasised the benefits of this partnership…

Merlin 2 Websharing Bundle Offer

Merlin 2 Websharing Bundle

combines a Merlin for Mac OS X licence and the Merlin for Web Browsers Module.

Leverage the power of the leading professional project management software for Mac OS X and share your projects with Mac, Windows, and Linux users via Web access.

Price: $260.00 USD (195.- Euro / 170,00 GBP ) + VAT

Period of sale/offer: until March 31, 2013

Shop: http://projectwizards.net/bundle

Merlin is intuitive, easy to use…