Press release

Solar Module Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, ROI, Raw Materials

The global renewable energy and clean technology sector is experiencing transformative growth driven by accelerating renewable energy adoption, supportive government policies, declining photovoltaic technology costs, grid decarbonization targets, and rising electricity demand from industrial and residential sectors. At the forefront of this solar energy revolution stands the solar module-a photovoltaic assembly valued for its ability to convert sunlight directly into electricity, durability across diverse climatic conditions, and scalable deployment across residential, commercial, and utility-scale installations. As governments worldwide commit to reducing greenhouse gas emissions and electricity demand surges in emerging economies, establishing a solar module manufacturing plant presents a strategically compelling business opportunity for renewable energy investors, photovoltaic technology manufacturers, and clean energy developers seeking to capitalize on the expanding market for reliable, high-efficiency solar power solutions with long operational lifespans and consistent energy output across multiple applications and geographies.IMARC Group's report, "Solar Module Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The solar module manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for a Sample Report: https://www.imarcgroup.com/solar-module-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global solar module market demonstrates robust growth trajectory, valued at USD 185.40 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 290.09 Billion by 2034, exhibiting a solid CAGR of 5.1% from 2026-2034. This sustained expansion is fueled by accelerating renewable energy adoption, supportive government policies, declining photovoltaic technology costs, grid decarbonization targets, and rising electricity demand from industrial and residential sectors across global markets.

A solar module is a photovoltaic (PV) module, an integrated assembly of interconnected solar cells that is designed to convert sunlight directly into electricity through the photovoltaic effect. The modules usually consist of crystalline silicon or thin-film semiconductor cells encapsulated between tempered glass, polymer back sheets, and aluminum frames for providing mechanical strength and environmental protection. Solar modules are engineered for consistent electrical output in different climatic conditions, offering durability, weather resistance, and long operational lifespans. Their modular nature allows scalability across residential, commercial, and utility-scale installations, hence forming the cornerstone technology in modern renewable energy systems.

The solar module market is primarily driven by the global shift toward renewable energy and commitments to reduce greenhouse gas emissions. Increasing electricity demand, particularly in emerging economies, is accelerating investments in solar infrastructure. According to the Ministry of Power, the generation of electricity during 2022-23 was 1624.158 BU as compared to 1491.859 BU generated during 2021-22, representing a growth of about 8.87%. Government-backed incentives, feed-in tariffs, and renewable energy targets continue to stimulate solar installations worldwide. Additionally, declining production costs, improvements in photovoltaic efficiency, and growing corporate sustainability initiatives are supporting higher adoption rates. Grid modernization efforts and rising demand for decentralized power generation further reinforce the need for large-scale solar module manufacturing capacity.

Plant Capacity and Production Scale

The proposed solar module manufacturing facility is designed with an annual production capacity ranging between 500 MW - 1 GW per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve diverse market segments-from solar module manufacturing applications for interconnect ribbons and busbars to inverters and electronics, mounting and structural systems, and energy storage and distribution-ensuring steady demand and consistent revenue streams across multiple distribution channels serving the expanding global solar energy market.

Financial Viability and Profitability Analysis

The solar module manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal favorable margins supported by stable demand and value-added applications:

• Gross Profit Margins: 15-25%

• Net Profit Margins: 5-10%

These margins position solar module manufacturing as an attractive venture with favorable return on investment (ROI) potential, supported by growing global renewable energy demand, megatrend alignment with solar and clean energy sector growth, policy and infrastructure support through government incentives and domestic manufacturing programs, localization and supply chain dependability benefits, and scalable production technology enabling capacity expansion to meet rising installation targets worldwide.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a solar module manufacturing plant reflects very high raw material intensity:

• Raw Materials: 80-85% of total OpEx

• Utilities: 5-10% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, quality control, depreciation, and taxes

Glass constitutes the primary raw material cost driver at 80-85% of operating expenses, representing very high intensity compared to other manufacturing sectors. Additional key inputs include solar cells, EVA (ethylene-vinyl acetate) encapsulant sheets, back sheets, aluminum frames, junction boxes, and silver paste. The cost structure requires careful management of raw material pricing, positioning solar module manufacturing as a venture requiring strong supply chain management, long-term supplier contracts, and efficient operational practices to maintain favorable profit margins across residential, commercial, and utility-scale solar installation markets.

Buy Now: https://www.imarcgroup.com/checkout?id=18596&method=2175

Capital Investment and Project Economics

Establishing a solar module manufacturing plant requires comprehensive capital investment covering land acquisition, site preparation, civil works, machinery procurement, and working capital. Machinery costs account for the largest portion of total capital expenditure, with essential equipment including tabber-stringers, layup stations, laminators, EL (electroluminescence) testers, frame assembly machines, curing ovens, IV curve testers, and automated packaging lines. Operating costs in the first year cover raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, total operational costs are expected to increase substantially due to factors such as inflation, market fluctuations, potential rises in the cost of key materials, supply chain disruptions, rising consumer demand, and shifts in the global economy.

The capital investment depends on plant capacity, technology selection, and location. This investment covers land acquisition, site preparation, and necessary infrastructure. Equipment costs represent a significant portion of capital expenditure. The scale of production and automation level will determine the total cost of machinery. Raw material expenses, including cells, glass, and EVA, are a major part of operating costs. Long-term contracts with reliable suppliers help mitigate price volatility and ensure consistent material supply. Costs associated with land acquisition, construction, and utilities (electricity, water, steam) must be considered in the financial plan. Ongoing expenses for labor, maintenance, quality control, and environmental compliance must be accounted for. A detailed financial analysis, including income projections, expenditures, and break-even points, must be conducted to secure funding and formulate a clear financial strategy.

Major Applications and End-Use Industries

Solar modules serve multiple critical applications across diverse sectors:

• Solar Modules: Interconnect ribbons, busbars, and electrical connections between solar cells enabling efficient energy conversion and transmission

• Inverters & Electronics: DC/AC wiring, connectors, and cabling systems supporting power conversion infrastructure

• Mounting & Structural Systems: Grounding straps, bonding jumpers, and flexible connectors for frames ensuring structural integrity and electrical safety

• Energy Storage & Distribution: High-efficiency transmission lines and flexible cabling for solar arrays supporting grid integration and energy storage systems

Why Invest in Solar Module Manufacturing?

Several compelling factors make solar module manufacturing an attractive investment opportunity:

• Crucial Electrical Infrastructure Component: Copper braided wires and flexible conductors are essential for interconnecting solar cells, grounding, bonding, and managing current flow in solar modules. Their role in ensuring electrical reliability, durability, and EMI/RFI protection makes them a key component in solar power systems and broader renewable energy infrastructure

• Moderate but Justifiable Entry Barriers: While capital-intensive compared to simple wiring, the precise braiding techniques, strict conductivity standards, quality certifications, and extended OEM approvals create barriers that favor experienced manufacturers capable of delivering consistent quality and reliable pricing

• Megatrend Alignment: The global push for renewable energy, expansion of solar installations, growth in energy storage, and modernization of power grids are driving rising demand for flexible, vibration-resistant copper conductors. The solar and clean energy sectors are experiencing sustained double-digit growth worldwide

• Policy & Infrastructure Support: Government initiatives in renewable energy deployment, grid modernization, solar parks, and domestic manufacturing incentives indirectly boost demand for solar module manufacturing

• Localization and Supply Chain Dependability: Solar EPC contractors and module manufacturers increasingly prefer local, reliable suppliers to reduce lead times, mitigate copper price volatility, and ensure uninterrupted supply-creating opportunities for regional producers with efficient sourcing and operations

Manufacturing Process Overview

The solar module manufacturing process involves several critical stages ensuring product quality and electrical performance. The process begins with sourcing and preparing raw materials including solar cells, glass, and EVA sheets. Cell tabbing and stringing connects individual solar cells using interconnect ribbons. Layup station assembly arranges cells, encapsulants, and back sheets in precise configuration. Lamination fuses all layers under heat and pressure to create a durable, weatherproof unit. Frame assembly attaches aluminum frames for structural support and ease of installation. Junction box installation enables electrical connections to external wiring. IV curve testing and EL testing verify electrical performance and detect any defects. Finally, automated packaging lines prepare finished modules for distribution, with comprehensive quality inspection throughout ensuring consistent power output, durability, and regulatory compliance across all solar installation applications.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=18596&flag=C

Industry Leadership and Key Players

The global solar module industry features several established multinational companies with extensive production capacities and diverse application portfolios. Leading manufacturers include JinkoSolar Holding Co., Ltd., LONGi Green Energy Technology Co., Ltd., Trina Solar Limited, First Solar, Inc., and Canadian Solar Inc., all serving end-use sectors across solar module manufacturing markets. These industry leaders demonstrate the viability and scalability of solar module manufacturing operations serving global residential, commercial, and utility-scale solar installation markets with consistent efficiency, proven durability, and regulatory compliance.

Recent Developments and Market Dynamics

Recent industry developments highlight growing market momentum. In December 2025, Waaree Solar Americas Inc. announced that it had secured a 288 MWp solar module order from Sabancı Renewables, a leading developer and owner-operator of utility-scale renewable projects in the United States. In October 2025, TOYO Co., Ltd. announced that the City of Houston had issued a Certificate of Occupancy for its new solar module manufacturing plant in the Houston metropolitan region. With this milestone, TOYO has begun full commercial operations at the Houston Facility, further demonstrating its dedication to growing its manufacturing footprint in the United States.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Solar Module Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, ROI, Raw Materials here

News-ID: 4393693 • Views: …

More Releases from IMARC Group

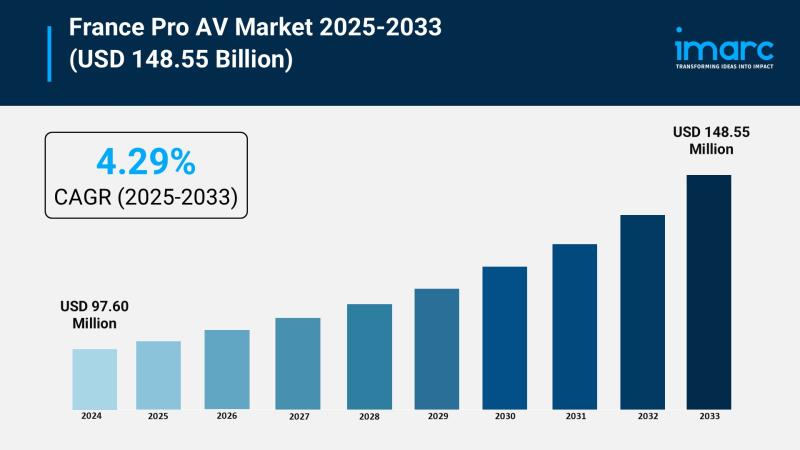

France Pro AV Market to Reach USD 148.55 Million by 2033, Growing at 4.29% CAGR

Market Overview

The France Pro AV market size reached USD 97.60 Million in 2024 and is forecasted to grow to USD 148.55 Million by 2033, registering a CAGR of 4.29% during the 2025-2033 period. This growth is driven by increased adoption of advanced audio-visual solutions in hybrid workplaces and public infrastructure, alongside rising investments in digital displays, conferencing tools, and AV integration supporting sectors like corporate, education, and government.

Study Assumption Years

• Base…

Pet Food Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx …

The global pet food manufacturing industry is witnessing robust growth driven by rising pet ownership, increased spending on premium products, and a growing preference for healthy, natural ingredients in pet food. At the heart of this expansion lies a critical consumer product-pet food. As pet owners across the world increasingly humanize their pets and demand higher-quality, nutritionally balanced food products for dogs, cats, and other companion animals, establishing a pet…

Baby Wipe Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with Profitability F …

The global baby wipe manufacturing industry is witnessing robust growth driven by the rapidly expanding personal care sector and increasing demand for high-quality hygiene products. At the heart of this expansion lies a critical consumer essential-baby wipes. As parenting practices transition toward premium hygiene solutions and convenient personal care applications, establishing a baby wipe manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and consumer goods investors seeking to…

Green Ammonia Prices Q4 2025: Global Index, Trend Analysis & Forecast Report

The green ammonia price trend has gained strong attention as industries shift toward low-carbon fuels and sustainable fertilizers. Rising investments in renewable hydrogen infrastructure, policy incentives, and global decarbonization targets are influencing Green Ammonia Prices worldwide. Businesses are actively tracking the Green Ammonia price index, price chart, and Green Ammonia historical price data to assess procurement strategies and long-term contracts. This report outlines recent movements, regional insights, and the Green…

More Releases for Solar

Biohybrid Solar Cell Market Professional Survey Report 2022 - Jinko Solar, JA SO …

The Biohybrid Solar Cell Market Report 2022 provides a comprehensive analysis of observable trends and projections. This research shows how to attract a large number of customers. Our certified crew of economists, researchers, and advisers has made further attempts in projecting the global industry by utilising accredited global Biohybrid Solar Cell market information tools as well as various instruments and ways to successfully review and get information. The research argues…

Home Solar Power System Market Size, Share, Trends, Growth - Tesla, Panasonic So …

The Global Home Solar Power System Market study includes new innovations, market dynamics, strategic profiling in terms of the future market strategies and shares for the subsectors of the industry. This research consists of details related to the size of the industries, the major players, markets, sales volume and value. This study offers a detail data on the historical data pointers as well as forecasts by region/country for the sectors…

Solar PV Module Market Outlook To 2024 - Trina Solar, Canadian Solar Inc., JA So …

Solar PV module market from utility sector has witnessed a substantial growth globally in recent years. In the first quarter of the year, Vietnam's Ministry of Industry and Trade have talked about their FiT scheme related to utility-based solar power projects. Ongoing electrification programs and incentives benefit pertaining to grid connected power generation is surging the demand for on-grid solar PV modules. On-grid connection represented 55% of the overall solar…

Solar Simulator Market Distribution Channel 2019: Spire Solar, Solar Energy Inte …

Solar Simulator Market report aims to examine the developments of market including its market improvements, developments, positions and others.

This report on the Solar Simulator market offers explanatory knowledge on the market parts like dominating players, drivers and restraints, production, revenue, consumption, import and export, and the most effective development within the organization size, deployment type, inside, segmentation comprised throughout this analysis, also major the players have used various strategies such…

Solar PV Module Market By Key Vendors: Trina Solar, Canadian Solar Inc., JA Sola …

UK solar PV module market is set to expand owing to government initiatives towards sustainable energy integration. The export tariff introduced by the UK government facilitates USD 0.06 per unit for the surplus electricity injected back to the grid by the generator. Favorable government reforms with ambitious plan towards carbon footprint reduction will further boost the business outlook.

Request for a sample of this research report @

https://www.gminsights.com/request-sample/detail/1563

Solar PV Module Market size…

Global Solar Thermal Market 2016 Abengoa Solar, SUPCON Solar, Solar Euromed

Global Solar Thermal Market Research Report

The MRS Research Group Solar Thermal report by QY Research represents an inclusive evaluation of the Solar Thermal Market and comprises considerable insights, historical data, facts,and statistical and industry-validated data of the global market.Additionally,it consists of estimated data that is evaluated with the help of suitable set of methodologies and assumptions.The MRS Research Group report research highlights informative data and in-depth analysis of Solar Thermal…