Press release

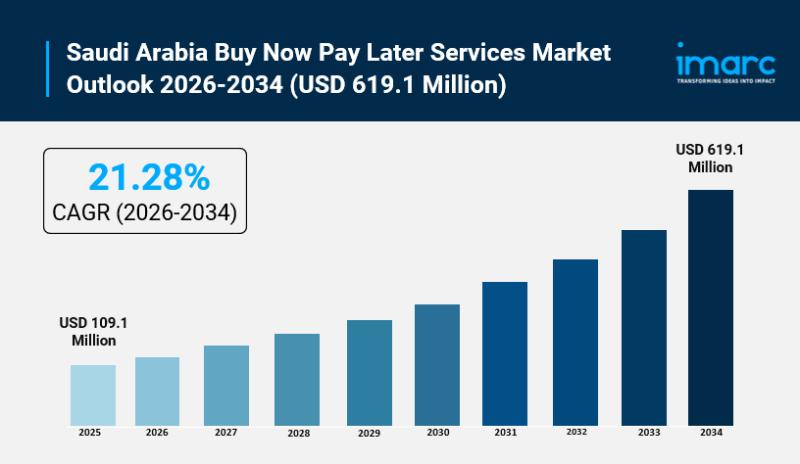

Saudi Arabia Buy Now Pay Later Services Market Explodes to USD 109.1 Million in 2025, Set to Hit USD 619.1 Million by 2034 at 21.28% CAGR

Saudi Arabia Buy Now Pay Later Services Market OverviewMarket Size in 2025: USD 109.1 Million

Market Forecast in 2034: USD 619.1 Million

Market Growth Rate 2026-2034: 21.28%

According to IMARC Group's latest research publication, "Saudi Arabia Buy Now Pay Later Services Market Report by Channel (Online, Point of Sale (POS)), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End Use (Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, and Others), and Region 2026-2034", the Saudi Arabia buy now pay later services market size reached USD 109.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 619.1 Million by 2034, exhibiting a growth rate (CAGR) of 21.28% during 2026-2034.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-buy-now-pay-later-services-market/requestsample

How AI and Digital Transformation is Reshaping the Future of Saudi Arabia Buy Now Pay Later Services Market

● Tabby's Saudi AI factory powered by NVIDIA delivers real-time fraud detection and shopping personalization, safeguarding transactions for over twenty million registered users across the Kingdom.

● AI risk scoring tools in Saudi BNPL approve purchases in seconds, cutting default risks and letting more families enjoy flexible payments without old-school credit barriers.

● Through SAMA guidelines and national data efforts, AI ensures every BNPL transaction stays secure and Sharia-compliant, building real confidence among users and businesses alike.

● Platforms like Tamara leverage AI for personalized repayment suggestions, making life easier for over twenty million customers while keeping merchants happy with fast reliable settlements.

● Advanced AI automation processes thousands of BNPL applications daily across Saudi, slashing wait times and costs to support hassle-free shopping experiences that everyone appreciates.

Saudi Arabia Buy Now Pay Later Services Market Trends & Drivers:

Saudi Arabias Buy Now Pay Later market is surging thanks to the explosion in e-commerce, where shoppers increasingly turn to flexible payments to snag fashion, electronics, and lifestyle goods without upfront costs. With smartphone penetration exceeding 95 percent and high-speed 5G rolling out nationwide, consumers shop seamlessly from anywhere, boosting platforms like Tamara and Tabby that now handle massive transaction volumes in retail sectors. Vision 2030 initiatives push digital transformation, helping small and medium enterprises integrate BNPL to lift checkout completion rates by up to 30 percent and draw in younger buyers who shun traditional credit. Real-world wins show retailers partnering with these services to spike sales, as seen in recent consolidations like Tamaras moves to streamline offerings, making spending feel effortless while fueling market momentum.

Young Saudis, especially Millennials and Gen Z who make up over 60 percent of the population, are hooked on BNPL for its no-interest, bite-sized installments that fit their on-the-go lifestyles and preference for cashless deals. This demographic shift drives adoption, with surveys showing these groups favoring transparent plans over cards, pushing providers to innovate via apps with AI-powered credit checks for quick approvals. Company news highlights this, like You Super Apps 2023 launch of BNPL features, blending payments into daily digital habits and expanding reach across urban hubs. Government nudges through SAMA regulations ensure safe growth, balancing innovation with consumer protection, which builds trust and encourages wider use in everything from groceries to gadgets.

Intense competition among fintechs like Spotti, Postpay, and Cashew is sparking fresh trends such as retailer collaborations and AI-driven risk tools, helping providers scale while keeping defaults low. Major banks and global players like Mastercard are jumping in, rolling out hybrid BNPL options that blend with existing cards, as evidenced by recent partnerships lifting merchant participation beyond big chains into SMEs. Vision 2030s financial inclusion goals amplify this, with schemes enabling easier access for underserved segments and driving gross merchandise value through innovative products. On the ground, this means more pop-up BNPL at events and malls, where real-time analytics tailor plans to shoppers, turning casual browsers into loyal customers.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=16921&flag=E

Saudi Arabia Buy Now Pay Later Services Industry Segmentation:

The report has segmented the market into the following categories:

Channel Insights:

● Online

● Point of Sale (POS)

Enterprise Size Insights:

● Large Enterprises

● Small and Medium Enterprises

End Use Insights:

● Consumer Electronics

● Fashion and Garment

● Healthcare

● Leisure and Entertainment

● Retail

● Others

Regional Insights:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Buy Now Pay Later Services Market

● January 2026: Madfu secures twenty five point five million dollars in pre-Series A funding to scale Sharia-compliant BNPL with seamless six-installment options for Saudi shoppers nationwide.

● December 2025: Tamara gains full consumer finance license from SAMA expanding beyond short-term BNPL to offer higher ticket sizes and broader credit products across the Kingdom.

● October 2025: Tabby partners with Checkout.com integrating BNPL services for merchants reaching forty two percent of Saudi consumers through flexible installment payment solutions.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Buy Now Pay Later Services Market Explodes to USD 109.1 Million in 2025, Set to Hit USD 619.1 Million by 2034 at 21.28% CAGR here

News-ID: 4393201 • Views: …

More Releases from IMARC Group

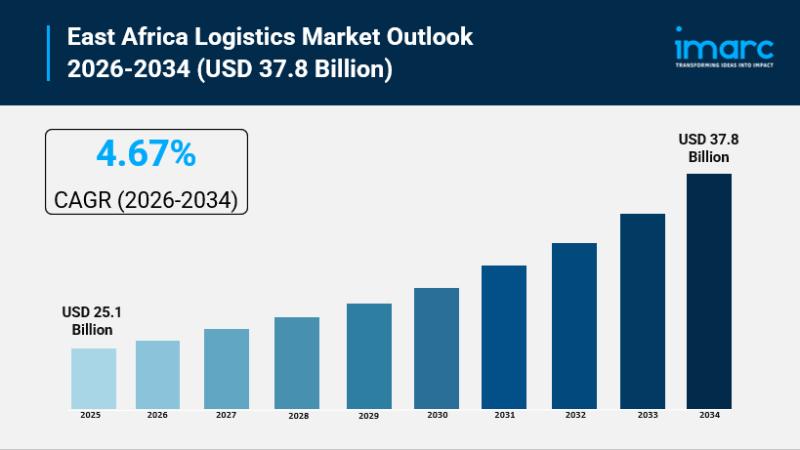

East Africa Logistics Market Size to Hit USD 37.8 Billion by 2034 | Grow CAGR by …

East Africa Logistics Market Overview

Market Size in 2025: USD 25.1 Billion

Market Size in 2034: USD 37.8 Billion

Market Growth Rate 2026-2034: 4.67%

According to IMARC Group's latest research publication, "East Africa Logistics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The East Africa logistics market size reached USD 25.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 37.8 Billion by 2034, exhibiting a growth rate…

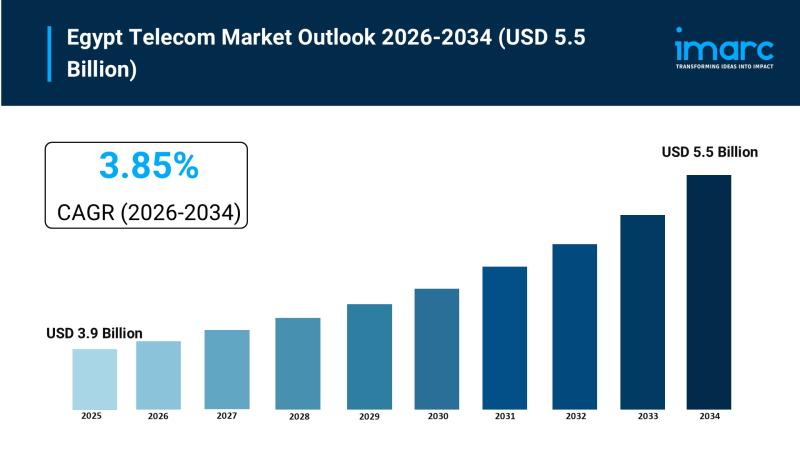

Egypt Telecom Market Size to Hit USD 5.5 Billion by 2034 | With a 3.85% CAGR

Egypt Telecom Market Overview

Market Size in 2025: USD 3.9 Billion

Market Size in 2034: USD 5.5 Billion

Market Growth Rate 2026-2034: 3.85%

According to IMARC Group's latest research publication, "Egypt Telecom Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Egypt telecom market size reached USD 3.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.85%…

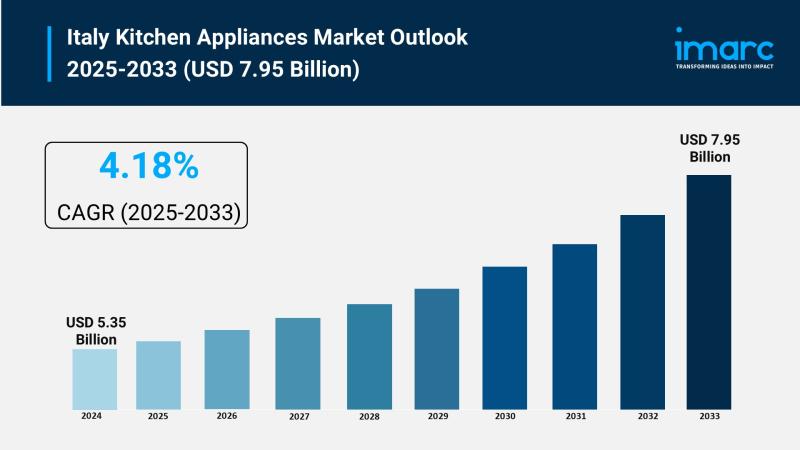

Italy Kitchen Appliances Market Size to Hit USD 7.95 Billion by 2033 | With a 4. …

Italy Kitchen Appliances Market Overview

Market Size in 2024: USD 5.35 Billion

Market Size in 2033: USD 7.95 Billion

Market Growth Rate 2025-2033: 4.18%

According to IMARC Group's latest research publication, "Italy Kitchen Appliances Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Italy kitchen appliances market size was valued at USD 5.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.95 Billion by 2033, exhibiting a…

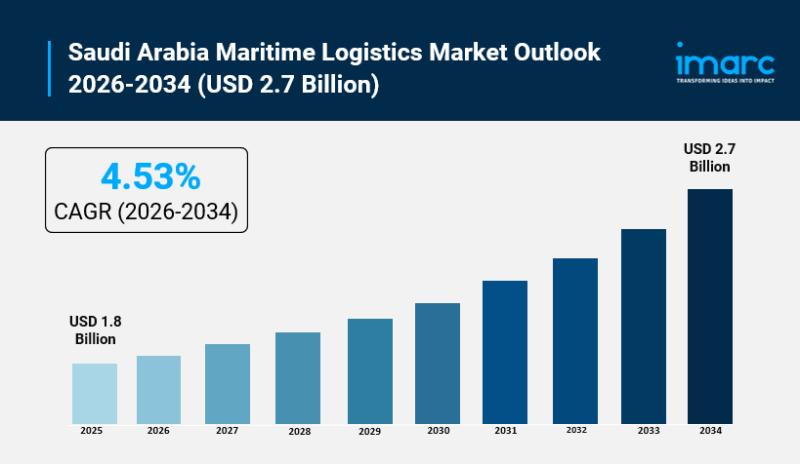

Saudi Arabia Maritime Logistics Market Hits USD 1.8 Billion Milestone in 2025, E …

Saudi Arabia Maritime Logistics Market Overview

Market Size in 2025: USD 1.8 Billion

Market Forecast in 2034: USD 2.7 Billion

Market Growth Rate 2026-2034: 4.53%

According to IMARC Group's latest research publication, "Saudi Arabia Maritime Logistics Market Size, Share, Trends and Forecast by Service Type, Application, Mode of Transport, End-User, and Region, 2026-2034", The Saudi Arabia maritime logistics market size reached USD 1.8 Billion in 2025. Looking forward, IMARC Group expects the market to…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…