Press release

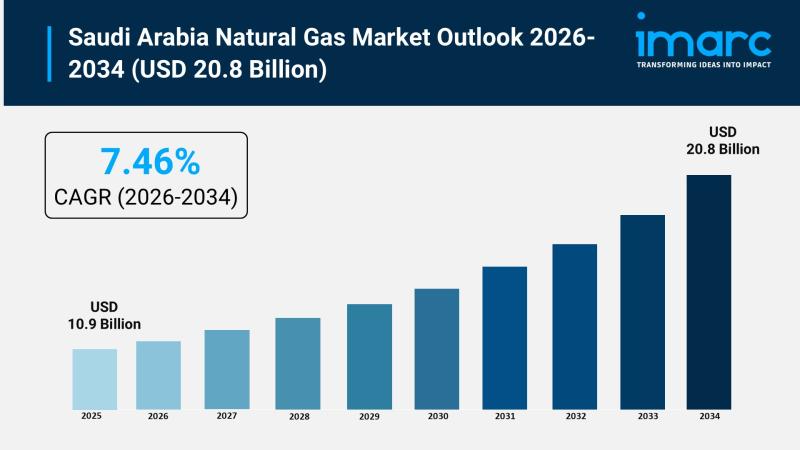

Saudi Arabia Natural Gas Market Size To Worth USD 20.8 Billion By 2034 | CAGR of 7.46%

Saudi Arabia Natural Gas Market OverviewMarket Size in 2025: USD 10.9 Billion

Market Size in 2034: USD 20.8 Billion

Market Growth Rate 2026-2034: 7.46%

According to IMARC Group's latest research publication, "Saudi Arabia Natural Gas Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia natural gas market size reached USD 10.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 20.8 Billion by 2034, exhibiting a growth rate (CAGR) of 7.46% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Natural Gas Market

● AI-powered predictive analytics optimize natural gas exploration and drilling operations, enabling companies to identify high-yield reserves with greater precision while reducing exploration costs across Saudi Arabia.

● Machine learning algorithms enhance pipeline monitoring and leak detection systems, improving operational safety and minimizing gas losses across the Kingdom's extensive natural gas distribution infrastructure.

● AI-driven demand forecasting tools assist utilities and industrial consumers in managing gas consumption efficiently, reducing wastage and aligning supply with real-time domestic and industrial demand patterns.

● Smart sensor networks integrated with artificial intelligence continuously monitor gas processing facilities, detecting equipment anomalies early and enabling predictive maintenance to minimize unplanned downtime.

● AI-based trading and pricing models support Saudi Aramco and other market participants in optimizing natural gas procurement strategies, improving revenue realization across domestic and international markets.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-natural-gas-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Natural Gas Industry

Saudi Arabia's Vision 2030 is fundamentally reshaping the natural gas industry by positioning the Kingdom as a global energy diversification leader and reducing its historic dependence on crude oil revenues. The initiative places natural gas at the heart of the country's sustainable energy strategy, driving massive investments in gas exploration, production, processing, and distribution infrastructure. With the government's ambitious goal to eliminate oil burning in power generation by the end of the decade, natural gas is emerging as the primary transitional fuel, bridging the gap between conventional hydrocarbons and renewables. Vision 2030's emphasis on industrial diversification is accelerating gas demand from petrochemical clusters, fertilizer producers, and manufacturing hubs in Jubail and Yanbu, cementing natural gas as the backbone of the Kingdom's economic transformation. Mega-projects such as the Jafurah unconventional gas field development and the Master Gas System expansion reflect the government's commitment to scaling up gas production capacity to world-class levels. The initiative also actively promotes foreign partnerships and technology transfer, attracting global energy giants and infrastructure investors to co-develop Saudi Arabia's vast gas reserves. Vision 2030's clean energy transition targets further support natural gas adoption as a cleaner alternative to oil across power generation and industrial sectors. Ultimately, Vision 2030 elevates the natural gas sector as a critical pillar of the Kingdom's economic future, establishing Saudi Arabia as a leading player in regional and global gas markets.

Saudi Arabia Natural Gas Market Trends & Drivers:

Saudi Arabia's natural gas market is experiencing strong growth, driven by rapidly rising domestic energy demand fuelled by population growth, urbanization, and expanding industrial activity. As per the General Authority for Statistics, Saudi Arabia's total population of Saudi nationals surpassed 19.6 Million in 2024, and with a broadening urban base and increasing industrialization, electricity consumption continues to surge, making natural gas the preferred fuel for power generation owing to its cost-effectiveness and environmental advantages over crude oil. The government's strategic push to replace oil burning in power plants with natural gas is a defining trend, as natural gas-fired combined-cycle plants offer significantly higher energy efficiency and align with Saudi Arabia's sustainability commitments. The Jafurah unconventional gas field, one of the largest non-associated gas developments in the Kingdom, is a landmark project set to dramatically scale up the country's gas production capacity and supply security over the coming years.

The expansion of the petrochemical and industrial sectors is further propelling market growth, with natural gas serving both as a fuel and as a critical feedstock for ammonia, methanol, and a wide range of chemical derivatives. Industrial clusters in Jubail and Yanbu depend on reliable, affordable gas supplies to maintain international competitiveness and support growing export activities. Investment in gas infrastructure, including pipelines, processing plants, and liquefied natural gas terminals, is enhancing supply reliability and unlocking new market opportunities. Additionally, Saudi Arabia's ambition to become a global blue hydrogen producer is creating a new and significant demand avenue for natural gas, as blue hydrogen production using natural gas with carbon capture is gaining prominence in the country's long-term clean energy strategy.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=36793&flag=E

Saudi Arabia Natural Gas Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Compressed Natural Gas

● Piped Natural Gas

● Liquified Petroleum Gas

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Natural Gas Market

● February 2026: Saudi Arabia prequalified multiple domestic and international companies and consortia for its natural gas distribution network projects, with qualified firms required to submit technical bids by April 2026, reflecting the Kingdom's accelerating push to expand gas distribution infrastructure across the country.

● December 2025: Saudi Arabia launched production at the Jafurah Gas Plant's first phase, completing the facility's initial construction and commencing output operations, marking a significant milestone in the Kingdom's strategy to boost non-associated gas production and reduce domestic dependence on oil for power generation.

● August 2025: Saudi Aramco entered into a major lease-and-leaseback deal with a consortium led by Global Infrastructure Partners, a part of BlackRock, for midstream assets related to its Jafurah gas project, with the newly established Jafurah Midstream Gas Co. set to acquire rights for the development and use of the Jafurah Field Gas Plant and the Riyas NGL Fractionation Facility, and subsequently lease them back to Aramco for a period of years.

● May 2025: Saudi Arabia granted a contract to a joint venture between Spanish and Egyptian companies to construct a combined cycle natural gas-fired power plant in the Eastern Province, supporting the Kingdom's goals of rising electricity production from natural gas and advancing its clean energy transition agenda.

● February 2025: Baker Hughes was awarded a contract by Tecnicas Reunidas to supply gas compression trains and propane compressors for the third expansion phase of Aramco's Jafurah gas field, further strengthening the Kingdom's unconventional gas development programme.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Natural Gas Market Size To Worth USD 20.8 Billion By 2034 | CAGR of 7.46% here

News-ID: 4393019 • Views: …

More Releases from IMARC Group

Print On Demand Market Size to Surpass USD 61.8 Billion by 2034 | With a 20.06% …

Market Overview:

According to IMARC Group's latest research publication, "Print On Demand Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The global print on demand market size reached USD 11.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 61.8 Billion by 2034, exhibiting a growth rate (CAGR) of 20.06% during 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth…

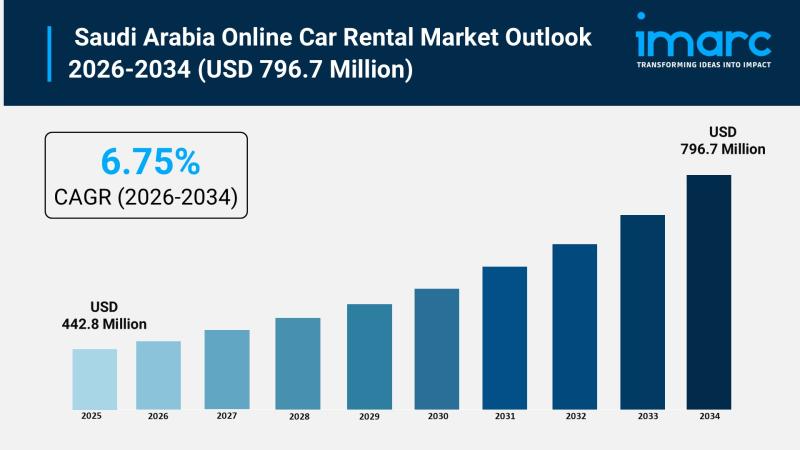

Saudi Arabia Online Car Rental Market Size to Surpass USD 796.7 Million by 2034, …

Saudi Arabia Online Car Rental Market Overview

Market Size in 2025: USD 442.8 Million

Market Size in 2034: USD 796.7 Million

Market Growth Rate 2026-2034: 6.75%

According to IMARC Group's latest research publication, "Saudi Arabia Online Car Rental Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia online car rental market size reached USD 442.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 796.7 Million…

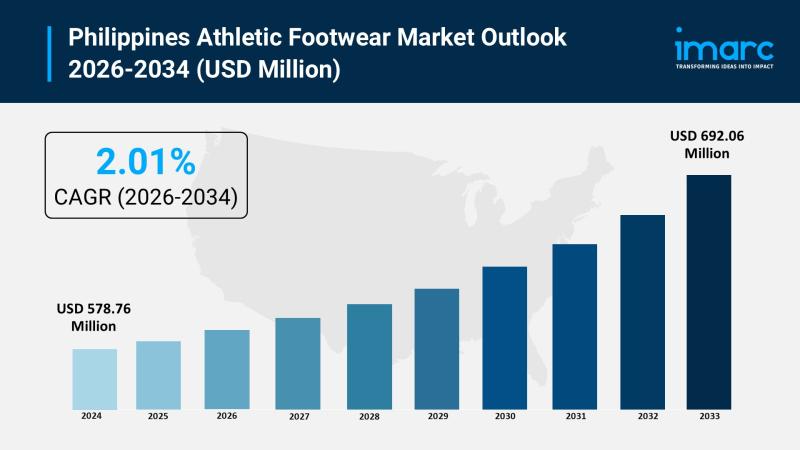

Philippines Athletic Footwear Market 2026 to Reach USD 692.06 Million by 2034 Am …

Market Overview

The Philippines athletic footwear market size was valued at USD 578.76 Million in 2025 and is projected to reach USD 692.06 Million by 2034, growing at a compound annual growth rate of 2.01% from 2026-2034. The market is expanding rapidly, driven by increasing health consciousness, fitness trends, and demand for stylish yet functional shoes. With a growing middle class and a focus on performance and comfort, the Philippines athletic…

IMARC Group: Philippines Lingerie Market 2026 | Poised for Rapid Growth at 6.70% …

Market Overview

The Philippines lingerie market size was valued at USD 433.27 Million in 2025 and is projected to reach USD 776.72 Million by 2034, growing at a compound annual growth rate (CAGR) of 6.70% during 2026-2034. The market is experiencing robust expansion driven by evolving consumer preferences, rising disposable incomes, and increasing emphasis on comfort and personal expression in intimate apparel. Urbanization and expanding retail infrastructure are reshaping purchasing patterns…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…