Press release

Key Strategic Developments and Emerging Changes Shaping the Bank Connectivity Platform Market Landscape

The bank connectivity platform market is gaining significant momentum as financial institutions and corporates increasingly seek streamlined, real-time banking integrations. With rapid technological advancements and the growing importance of digital transformation in finance, the market is set for substantial growth and innovation in the coming years. Below is a detailed look at the market's valuation, key players, emerging trends, and segmentation.Projected Growth and Market Size of the Bank Connectivity Platform Market

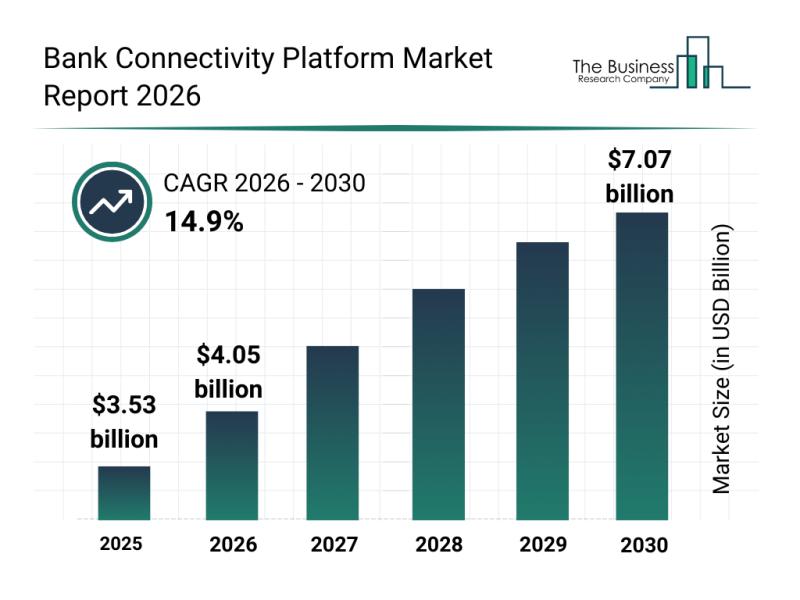

The bank connectivity platform market is poised for rapid expansion, expected to reach a valuation of $7.07 billion by 2030. This growth corresponds to a compound annual growth rate (CAGR) of 14.9% during the forecast period. Several factors contribute to this upward trajectory, including the broadening adoption of open banking, increased usage of real-time payments, the digitization of cross-border transactions, automation in regulatory compliance, and the rise of cloud-native financial platforms. Key trends shaping the market include API-based bank integrations, real-time payment connectivity, centralized cash management platforms, secure transaction monitoring, and multi-bank connectivity solutions.

Download a free sample of the bank connectivity platform market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=32490&type=smp&utm_source=OpenPR&utm_medium=Paid&utm_campaign=Feb_PR

Top Industry Players Driving the Bank Connectivity Platform Market

Leading companies that dominate the bank connectivity platform landscape include Coupa Software Incorporated, Treasury Intelligence Solutions GmbH, Jack Henry & Associates Inc., Finastra Group Holdings Limited, HighRadius Corporation, Kyriba Corporation, Yodlee Inc., MX Technologies Inc., Bellin S.A.S., Tink AB, Plaid Inc., Open Banking Solutions S.L., AccessPay Ltd., Nomentia Holdings Oy, FISPAN Services Inc., nCino Inc., ION Group Ltd., Yapily Limited, TrueLayer Limited, and Adenza Group Inc. These players are constantly innovating and expanding their service offerings to capture growing demand across different regions.

Significant Acquisition Enhancing Bank Connectivity Capabilities

In February 2025, nCino Inc., a US-based cloud banking software provider, acquired Sandbox Banking for $52.5 million. This strategic move is aimed at bolstering nCino's bank connectivity capabilities by integrating Sandbox Banking's low-code platform. This platform simplifies fintech integration workflows, reducing complexity for financial institutions. Sandbox Banking specializes in technology that enables banks and credit unions to seamlessly connect fintech products with core banking systems through pre-built adapters and workflows, streamlining integration efforts.

View the full bank connectivity platform market report:

https://www.thebusinessresearchcompany.com/report/bank-connectivity-platform-market-report?utm_source=OpenPR&utm_medium=Paid&utm_campaign=Feb_PR

Emerging Technological Trends Impacting the Bank Connectivity Platform Market

Market frontrunners are focusing on cloud-native multibank API connectivity platforms to meet the rising demand for real-time data access, seamless multi-bank integration, and cost-effective treasury operations. These platforms leverage cloud infrastructure combined with standardized APIs, replacing traditional slow and costly file-based or point-to-point integrations. This shift supports the increasing digital transformation and automation needs in corporate banking environments.

An Example of Innovation in Bank Connectivity Platforms

For example, in June 2024, US fintech API provider Trovata Inc. introduced its Multibank Connector, an embeddable connectivity service offering the world's largest open network of direct-to-bank APIs. This platform gives access to account balances, transactions, and payment rails, featuring full management, low-code integration, automated reconciliation, and self-healing functions. It processes large volumes of banking data quickly, enabling finance teams and enterprise systems to automate workflows more effectively than legacy sFTP-based services.

Detailed Segment Breakdown of the Bank Connectivity Platform Market

The market can be segmented as follows:

1) By Component: Software and Services

2) By Deployment Mode: On-Premises and Cloud

3) By Organization Size: Large Enterprises and Small and Medium Enterprises

4) By Application: Cash Management, Payment Processing, Treasury Management, Compliance and Reporting, and Other Applications

5) By End-User: Banks, Corporates, Financial Institutions, and Other End-Users

Further subcategories include:

- Software types such as Core Banking Integration Software, API Management Software, Payment Processing Software, Data Transformation Software, Security and Encryption Software, and Compliance and Regulatory Reporting Software.

- Services like Implementation and Deployment, Consulting and Advisory, Managed Connectivity, Support and Maintenance, and Training and Change Management.

Together, these segments provide a comprehensive view of the evolving bank connectivity platform market, highlighting the diversity of offerings and the broad spectrum of applications across the financial industry.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Strategic Developments and Emerging Changes Shaping the Bank Connectivity Platform Market Landscape here

News-ID: 4392290 • Views: …

More Releases from The Business Research Company

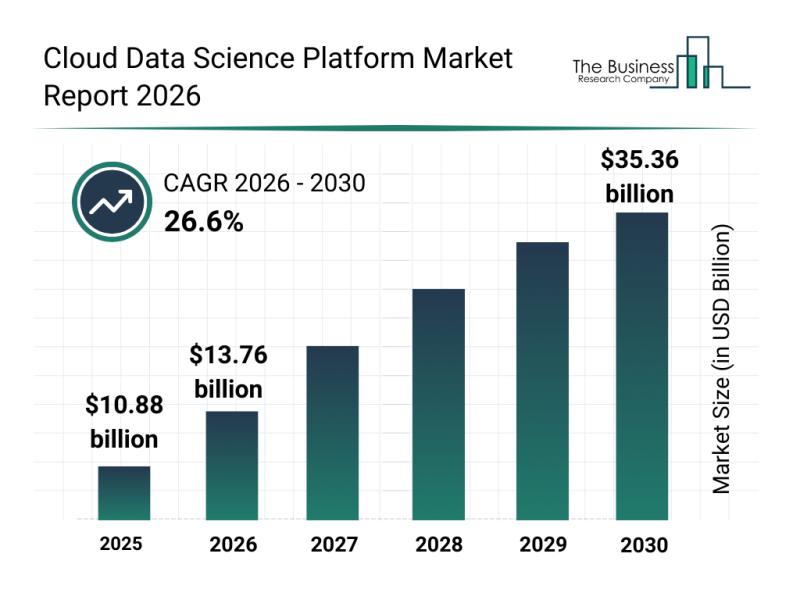

Emerging Growth Trends Driving Rapid Expansion in the Cloud Data Science Platfor …

The cloud data science platform sector is on the brink of remarkable expansion, driven by rapid technological advancements and increasing enterprise adoption. As businesses seek more efficient ways to handle data and extract actionable insights, this market is set to experience significant growth and transformation in the coming years. Here's an overview of the market size, key players, emerging trends, and primary segments shaping this dynamic industry.

Forecasted Market Growth and…

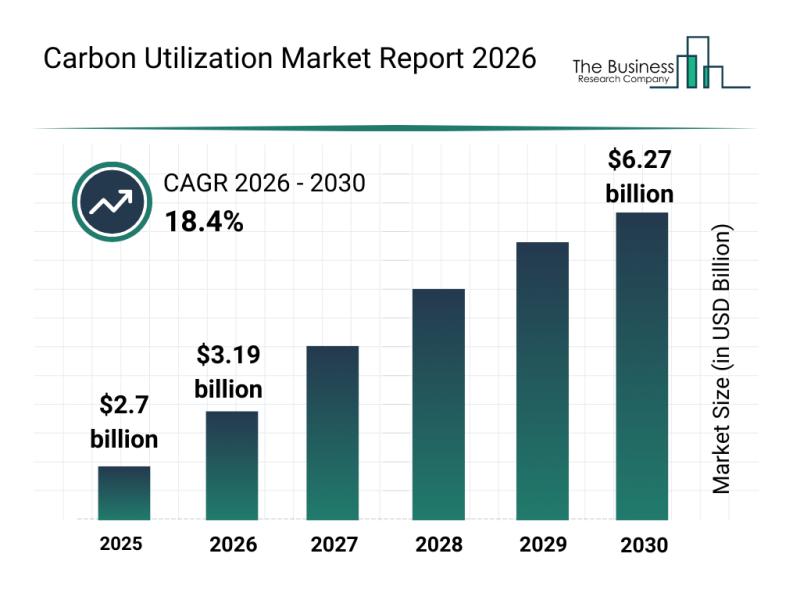

Segment Evaluation and Major Growth Areas in the Carbon Utilization Market

The carbon utilization sector is gaining significant traction as the world intensifies efforts to tackle climate change. With increasing commitments to reduce carbon footprints and advancements in technology, this market is set for impressive expansion. Let's explore the anticipated growth, leading companies, emerging trends, and key segments shaping this evolving industry.

Projected Growth Trajectory of the Carbon Utilization Market by 2030

The carbon utilization market is forecasted to experience rapid…

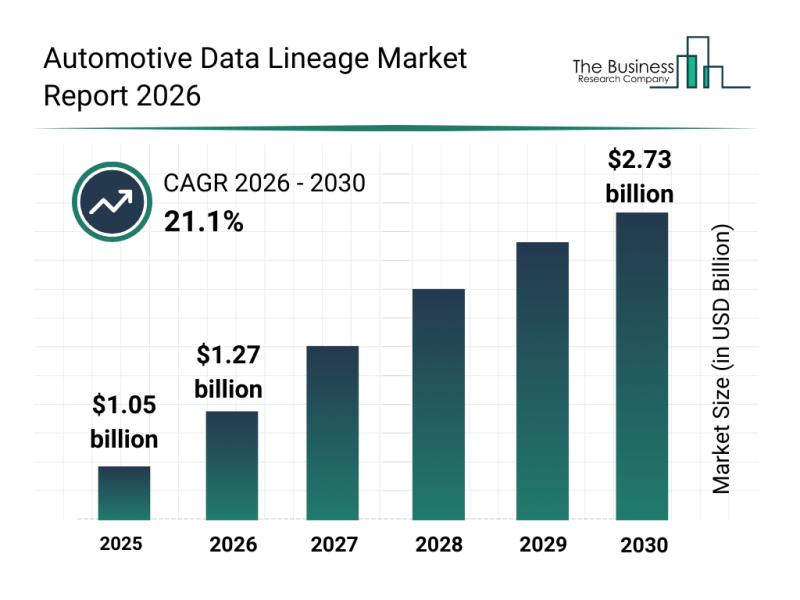

Emerging Sub-Segments Transforming the Automotive Data Lineage Market Landscape

The automotive data lineage market is rapidly evolving as data-driven technologies become increasingly central to vehicle development and management. This market is set to experience significant growth in the coming years, driven by innovations in autonomous driving, data regulation, and cloud computing. Let's explore the current market valuation, leading players, key trends, and segment breakdowns shaping this dynamic industry.

Automotive Data Lineage Market Growth Forecast

The automotive data lineage market…

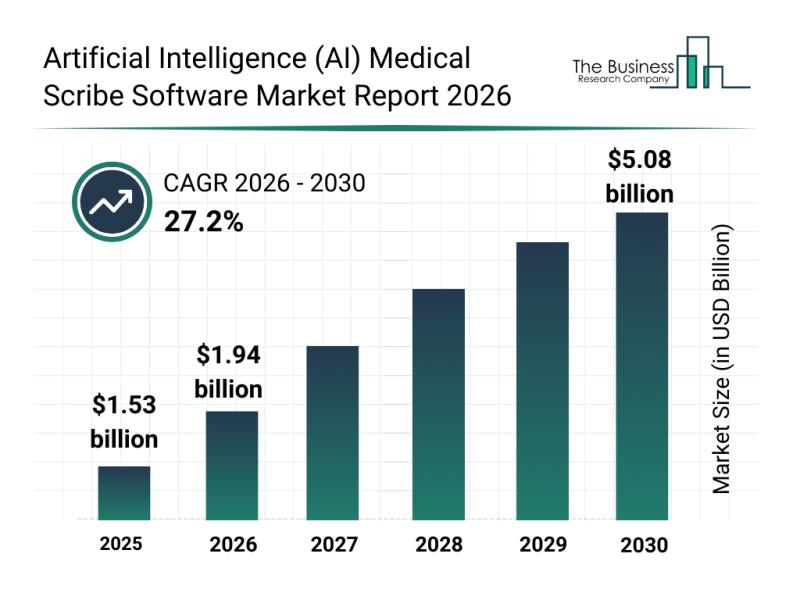

Emerging Growth Patterns Driving the Expansion of the Artificial Intelligence (A …

The artificial intelligence (AI) medical scribe software market is poised for remarkable growth in the coming years, driven by advancements in healthcare technology and increasing demand for streamlined clinical operations. As healthcare providers continue to embrace digital transformation, this sector is set to experience significant expansion by 2030.

Projected Market Growth and Size of the AI Medical Scribe Software Market

The AI medical scribe software market is expected to grow…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…