Press release

Soybean Oil Prices Rise in Q4 2025: Trend Analysis & Forecast

Soybean Oil Price Trend Analysis is essential for understanding how global supply conditions, trade flows, and policy decisions influence pricing movements across major regions. In 2025-2026, prices have remained sensitive to crop output, biodiesel blending requirements, freight costs, and changing procurement strategies. Seasonal harvest cycles and export competitiveness continue to shape short-term fluctuations. This report delivers a structured overview of recent developments, historical performance, and forward-looking price expectations to support informed business decisions.Soybean Oil Current Price Movements:

According to the latest updates from IMARC Group's pricing intelligence platform, Soybean Oil Prices continue to show region-specific volatility across Asia, North America, South America, and Europe during Q4 2025. Market sentiment remains cautiously stable, supported by balanced supply fundamentals and measured downstream procurement.

🌎 Q4 2025 Soybean Oil Prices Outlook

• USA: USD 1097/MT

• South Korea: USD 1206/MT

• China: USD 906/MT

• Brazil: USD 1139/MT

• Argentina: USD 1183/MT

Regional Market Highlights

Asia-Pacific: Soybean Oil Prices in Asia remained moderately firm. China recorded USD 906/MT, reflecting adequate domestic supply and competitive imports, while South Korea stood higher at USD 1206/MT due to stronger import reliance and higher freight exposure.

North America: In the United States, Soybean Oil Prices were assessed at USD 1097/MT. Price movements were influenced by soybean crushing margins and biodiesel blending mandates, which continue to provide structural demand support.

South America: Brazil (USD 1139/MT) and Argentina (USD 1183/MT) showed mixed pricing trends, largely shaped by harvest conditions, export activity, and currency fluctuations. Export competitiveness remains a key pricing determinant in the region.

Europe: European markets observed moderate corrections amid improved supply chains and easing import pressures, contributing to relatively balanced procurement activity.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/soybean-oil-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Soybean Oil Price Snapshot (2026):

As we enter 2026, the Soybean Oil price index indicates moderate stabilization following earlier volatility. Key highlights include

• Controlled crushing rates in major producing nations

• Stable feedstock soybean supply

• Measured biodiesel sector offtake

• Gradual normalization in freight costs

The Soybean Oil price chart suggests that markets are transitioning from sharp corrections toward steady movement, supported by predictable supply patterns and moderate demand recovery.

Soybean Oil Price Trend Analysis:

The broader Soybean Oil Price Trend Analysis indicates that global markets are shifting toward equilibrium. Throughout late 2025, price swings were largely influenced by climatic uncertainties and fluctuating energy markets.

Demand from the food processing sector remains stable, while biofuel demand continues to act as a structural support factor. However, export competitiveness and currency fluctuations have influenced regional differences in Soybean Oil Prices.

Market participants monitor the Soybean Oil price index closely to identify short-term buying opportunities and hedge against potential supply disruptions.

Soybean Oil Price Chart & Index - What It Suggests:

The Soybean Oil price chart reveals cyclical fluctuations rather than long-term structural decline. Short-term corrections were followed by steady recoveries, indicating strong underlying consumption fundamentals.

Meanwhile, the Soybean Oil price index highlights

• Stable long-term growth trajectory

• Short-term seasonal volatility

• Sensitivity to soybean crop output

• Correlation with crude oil and biodiesel markets

For buyers and procurement managers, the Soybean Oil price chart & forecast tools provide critical visibility into cost planning and budget allocation.

Soybean Oil Price Historical Analysis Data:

An evaluation of Soybean Oil price history shows that prices typically react strongly to crop yield variations, export policies, and global trade tensions. Historical data indicates

• Price spikes during poor harvest seasons

• Declines during surplus production cycles

• Strong alignment with soybean futures markets

• Increased volatility during energy price surges

Access to Soybean Oil historical price data enables manufacturers and traders to analyze long-term cycles and identify seasonal buying windows.

Factors Driving Recent Soybean Oil Price Trend Increases:

Recent increases in Soybean Oil Prices have been driven by several structural and short-term factors

1. Strong biodiesel blending mandates in major economies

2. Weather-related production concerns

3. Rising soybean procurement costs

4. Export demand from emerging markets

5. Supply chain adjustments and freight variations

Additionally, currency movements and government trade policies have played a supportive role in shaping the price of Soybean Oil across regions.

Soybean Oil Price Forecast - Next 12 Months:

The Soybean Oil future price outlook over the next 12 months suggests moderate volatility with an upward bias, provided biodiesel demand remains stable.

Key forecast indicators include

• Crop output projections in Brazil and the United States

• Global vegetable oil consumption growth

• Energy price stability

• Trade policy developments

The Soybean Oil price forecast indicates steady demand support, with potential upside risk during adverse weather or supply disruptions.

Regional Price Differences for Soybean Oil:

Regional differences in Soybean Oil Prices are primarily influenced by production capacity, domestic demand, trade tariffs, and currency exchange rates.

• North America: Influenced by soybean crushing margins and renewable fuel policies.

• South America: Export-driven pricing linked to harvest cycles.

• Asia-Pacific: Import-dependent markets sensitive to freight costs.

• Europe: Moderately balanced due to diversified edible oil sourcing.

Monitoring the Soybean Oil price today across regions helps global buyers optimize sourcing strategies.

Current & Near-Term Prices (Late 2025 - Early 2026):

In late 2025 and early 2026, the price of Soybean Oil reflects steady procurement behavior. Buyers remain cautious but active, especially in food manufacturing and biofuel blending segments.

Short-term projections suggest

• Limited downside risk

• Gradual price stabilization

• Balanced supply-demand conditions

• Seasonal demand fluctuations

The Soybean Oil price chart continues to show controlled momentum rather than extreme volatility.

Summary - Key Points:

• Soybean Oil Prices remain moderately volatile but structurally supported.

• Biodiesel demand and crop conditions are primary price drivers.

• The Soybean Oil price index shows stabilization entering 2026.

• Historical data indicates cyclical but resilient pricing patterns.

• The Soybean Oil future price outlook suggests balanced upward momentum.

For detailed Soybean Oil price chart & forecast, Soybean Oil historical price data, and region-wise index tracking, businesses rely on structured price intelligence platforms to support procurement, budgeting, and risk management decisions.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=22325&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, Soybean Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of Soybean Oil price trend, offering key insights into global Soybean Oil market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Soybean Oil demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Soybean Oil Prices Rise in Q4 2025: Trend Analysis & Forecast here

News-ID: 4391717 • Views: …

More Releases from IMARC Group

Polylactic Acid Prices in January 2026: Trend Analysis & Forecast

The Polylactic Acid (PLA) Price Index indicates evolving global momentum driven by feedstock cost shifts, bioplastic demand, and regional supply balances. Recent Polylactic Acid (PLA) Prices have reflected moderate volatility across Asia, Europe, and North America due to changing corn-based feedstock economics and sustainable packaging adoption. This report provides a detailed review of the Polylactic Acid (PLA) price trend analysis 2026, Polylactic Acid (PLA) historical price data, and the Polylactic…

India Gold Loan Market Forecast 2026-2034: Industry Size, Trends, Expansion and …

According to IMARC Group's report titled "India Gold Loan Market Size, Share, Trends and Forecast by Market Type, Type of Lenders, Application, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Gold Loan Market Report

The India gold loan market size reached USD 3.8 Billion in 2025. Looking ahead, the market is projected to grow and reach USD 5.2 Billion…

GCC Jewelry Market Size to Reach USD 24.4 Billion by 2034 | With a 5.47% CAGR

GCC Jewelry Market Overview

Market Size in 2025: USD 14.9 Billion

Market Size in 2034: USD 24.4 Billion

Market Growth Rate 2026-2034: 5.47%

According to IMARC Group's latest research publication, "GCC Jewelry Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034," The GCC jewelry market size was valued at USD 14.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 24.4 Billion by 2034, exhibiting a CAGR of 5.47%…

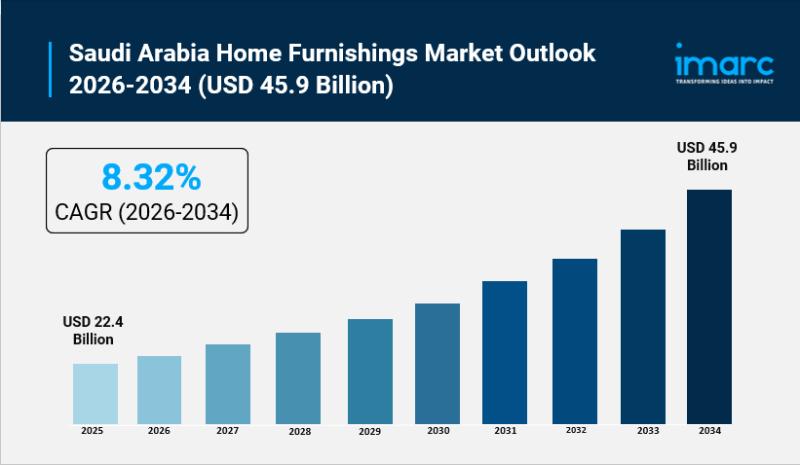

Saudi Arabia Home Furnishings Market Set to Surge to USD 45.9 Billion by 2034, G …

Saudi Arabia Home Furnishings Market Overview

Market Size in 2025: USD 22.4 Billion

Market Forecast in 2034: USD 45.9 Billion

Market Growth Rate 2026-2034: 8.32%

According to IMARC Group's latest research publication, "Saudi Arabia Home Furnishings Market Size, Share, Trends and Forecast by Product, Price, Distribution Channel, and Region, 2026-2034", the Saudi Arabia home furnishings market size reached USD 22.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 45.9…

More Releases for Soybean

Key Trends Reshaping the Soybean Market: Innovations In Soybean Seed Varieties F …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Soybean Market Size Growth Forecast: What to Expect by 2025?

The steady increase in the size of the soybean market has been noted in recent years. It is projected to experience a growth from $160.29 billion in 2024 to $166.7 billion in 2025, indicating a compound annual growth rate…

Key Soybean Market Trend for 2025-2034: Innovations In Soybean Seed Varieties Fo …

What Is the Future Outlook for the Soybean Market's Size and Growth Rate?

The market size for soybeans has experienced robust expansion in the past few years. A growth from $160.29 billion in 2024 to $169.68 billion in 2025 at a compounded annual growth rate (CAGR) of 5.9% is predicted. The expansion during the historical timeframe can be linked to an increase in demand globally, biofuel manufacturing, beneficial weather patterns, international…

Soybean Derivatives Market Report 2024 - Soybean Derivatives Market Size, Trends …

"The Business Research Company recently released a comprehensive report on the Global Soybean Derivatives Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The soybean derivatives market size…

Safeguarding Soybean Crops: Evolution of Effective Soybean Herbicides | Bayer, C …

Soybean Herbicide Market 2023 Forecast: Unveiling Opportunities and Growth

Soybean Herbicide market report presents an overview of the market on the basis of key parameters such as market size, revenue, sales analysis and key drivers. The market size of global Soybean Herbicide market is anticipated to grow at large scale over the forecast period (2023-2029). The main purpose of the study report is to give users an extensive viewpoint of the…

Soybean Industry Report Analysis By opportunities

Stratistics MRC's Soybean Market report provides readers with an understanding of market details, overview, drivers and segmentation with types.

The soybean is one of the most important food plants of the world and seems to be growing in importance. It is an annual crop, fairly easy to grow, that produces more protein and oil per unit of land than almost any other crop. It is a versatile food plant that, used…

Soybean Industry Report Analysis By opportunities

Stratistics MRC's Soybean Market report provides readers with an understanding of market details, overview, drivers and segmentation with types.

The soybean is one of the most important food plants of the world and seems to be growing in importance. It is an annual crop, fairly easy to grow, that produces more protein and oil per unit of land than almost any other crop. It is a versatile food plant that, used…