Press release

Segmentation, Major Trends, and Competitive Overview of the Prompt Governance in Banking Artificial Intelligence (AI) Market

The field of prompt governance for banking artificial intelligence (AI) is rapidly evolving as financial institutions increasingly rely on AI technologies. This market is set to experience significant growth due to heightened regulatory demands and the growing need to manage AI responsibly within banking operations. Let's explore the projected market size, key players, driving factors, and segmentation to understand what lies ahead for this niche but critical sector.Forecasted Market Size and Growth Trajectory for Prompt Governance in Banking AI

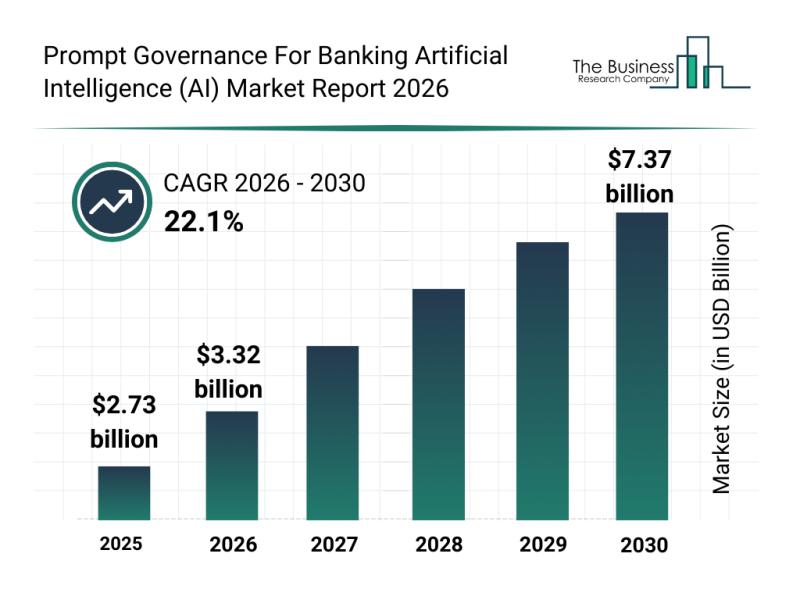

The global prompt governance for banking artificial intelligence (AI) market is anticipated to expand dramatically over the next several years. By 2030, it is projected to reach a value of $7.37 billion, growing at a robust compound annual growth rate (CAGR) of 22.1%. This surge is fueled by stricter AI governance requirements, a rising emphasis on responsible AI usage, rapid growth in cloud-based banking infrastructures, increasing needs for fraud prevention analytics, and heightened cross-border financial compliance mandates. Important market trends expected to shape this growth include greater adoption of prompt audit and logging tools, enhanced demand for bias and fairness evaluation solutions, broader deployment of access control and approval workflow technologies, expansion of AI prompt risk assessment platforms, and the integration of sophisticated reporting and compliance dashboards.

Download a free sample of the prompt governance for banking artificial intelligence (ai) market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=32365&type=smp&utm_source=OpenPR&utm_medium=Paid&utm_campaign=Feb_PR

Key Factors Propelling Growth in Prompt Governance for Banking AI

Regulatory pressures play a crucial role in accelerating the adoption of prompt governance solutions in banking AI. As governments and financial authorities enforce more stringent AI governance mandates, banks must implement robust frameworks to ensure AI models are used ethically and transparently. This regulatory landscape is encouraging financial institutions to invest heavily in governance tools that provide auditability, fairness checks, and compliance monitoring.

Another significant driver is the rapid expansion of cloud-based banking infrastructure. Cloud platforms enable scalable AI deployment but also introduce new challenges related to security, privacy, and compliance. This growth in cloud adoption is pushing banks to employ advanced governance systems that can seamlessly integrate with cloud environments while maintaining rigorous control and oversight over AI prompts and workflows.

View the full prompt governance for banking artificial intelligence (ai) market report:

https://www.thebusinessresearchcompany.com/report/prompt-governance-for-banking-artificial-intelligence-ai-market-report?utm_source=OpenPR&utm_medium=Paid&utm_campaign=Feb_PR

Prominent Players Steering the Prompt Governance for Banking AI Market

Several leading companies dominate this market, including Amazon Web Services Inc., Google LLC, Microsoft Corporation, Deloitte Touche Tohmatsu Limited, accenture* Plc, International Business Machines Corporation (IBM), PricewaterhouseCoopers International Limited, Ernst & Young Global Limited, KPMG International Limited, Tata Consultancy Services Limited, Capgemini SE, Cognizant Technology Solutions Corporation, Infosys Limited, HCL Technologies Limited, Wipro Limited, SAS Institute Inc., Palantir Technologies Inc., Fair Isaac Corporation, AlphaSense Inc., and ThoughtSpot Inc.

In a notable development in February 2025, Corridor Platforms Inc., a US-based technology firm, collaborated with Google Cloud to assist financial institutions in unlocking the full potential of customer-facing generative AI applications while adhering to strict regulatory and compliance standards. This partnership aims to accelerate adoption of AI solutions within banking by offering scalable, industry-specific governance platforms that help manage risks effectively and maximize returns on AI investments. Google LLC, known for providing secure and compliant AI-powered cloud services, serves as a key technology partner in this initiative.

Market Segmentation in Prompt Governance for Banking Artificial Intelligence

The prompt governance for banking AI market is segmented based on several criteria:

By Component: Software and Services

By Deployment Mode: On-Premises and Cloud

By Organization Size: Small and Medium Enterprises and Large Enterprises

By Application: Risk Management, Compliance, Fraud Detection, Customer Service, Credit Scoring, and Other Applications

By End-User: Retail Banking, Corporate Banking, Investment Banking, and Other End-Users

Further subsegments include:

Software categories such as Prompt Management Platforms, Policy Enforcement Engines, Audit and Logging Tools, Risk Assessment Modules, Compliance Monitoring Systems, and Analytics and Reporting Dashboards.

Service categories include Consulting and Advisory Services, Implementation and Integration Services, Training and Education Services, Monitoring and Support Services, Governance Framework Development, and Regulatory Compliance Services.

This detailed segmentation highlights the comprehensive scope of the market, addressing the diverse needs of banking institutions as they adopt AI technologies with a strong focus on responsible governance and compliance.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Segmentation, Major Trends, and Competitive Overview of the Prompt Governance in Banking Artificial Intelligence (AI) Market here

News-ID: 4391706 • Views: …

More Releases from The Business Research Company

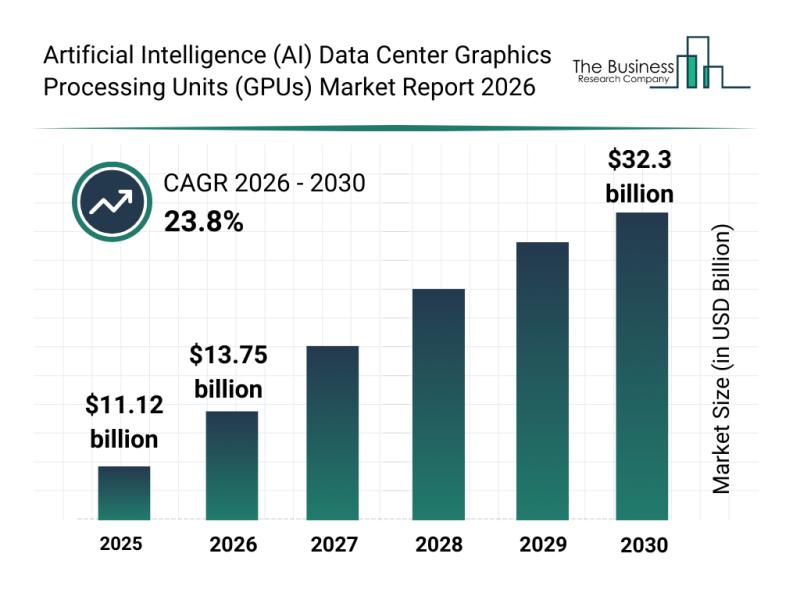

Artificial Intelligence (AI) Data Center Graphics Processing Units (GPUs) Market …

The artificial intelligence (AI) data center graphics processing units (GPUs) market is on the verge of remarkable expansion as demand for advanced computing solutions continues to surge. Driven by rapid advancements in AI technologies and growing infrastructure needs, this sector is set to significantly reshape the capabilities of data centers worldwide. Let's delve into the market's projected value, key players, emerging trends, and detailed segmentation to better understand this dynamic…

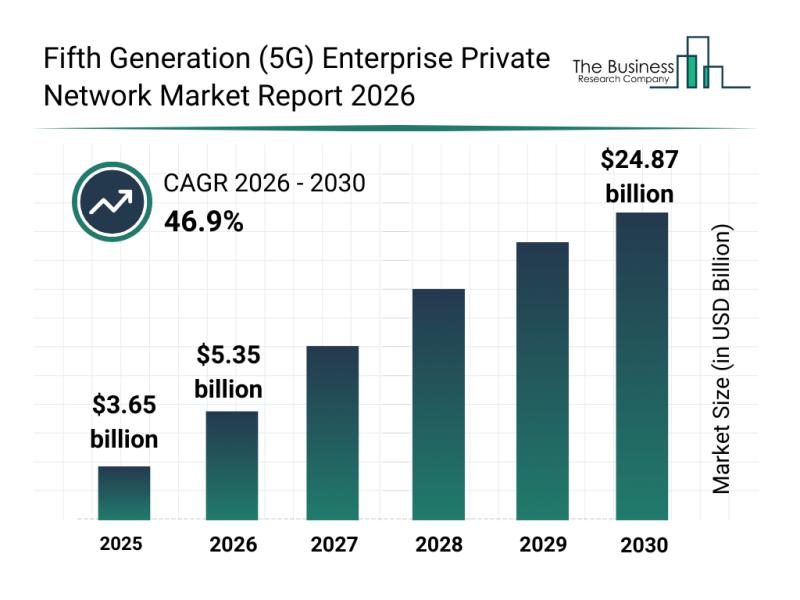

Key Strategic Developments and Emerging Changes Shaping the 5G Enterprise Privat …

The fifth generation (5G) enterprise private network market is on the verge of remarkable expansion, driven by rapid technological advancements and growing industry adoption. As businesses across sectors increasingly rely on private 5G networks to enhance connectivity and operational efficiency, this market is expected to witness substantial growth in the coming years. Let's explore the projected market size, influential companies, emerging trends, and key segments shaping this dynamic industry.

Projected Market…

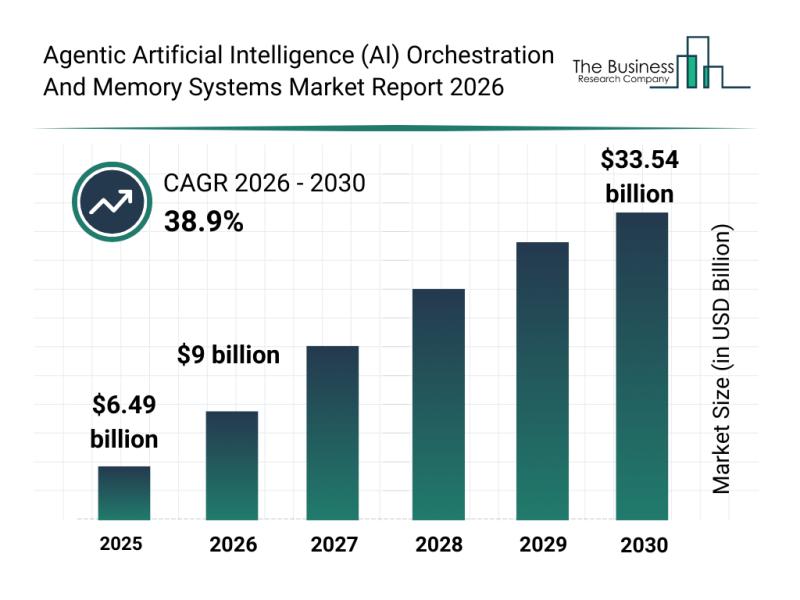

Competitive Analysis: Leading Companies and Emerging Participants in the Agentic …

The agentic artificial intelligence (AI) orchestration and memory systems market is on track for remarkable expansion in the coming years. Driven by technological advances and growing enterprise adoption, this sector is set to transform how intelligent agents operate and interact in complex workflows. Let's explore the market's anticipated growth, key players, emerging trends, and the main segments shaping its future development.

Projected Market Value and Growth of the Agentic AI Orchestration…

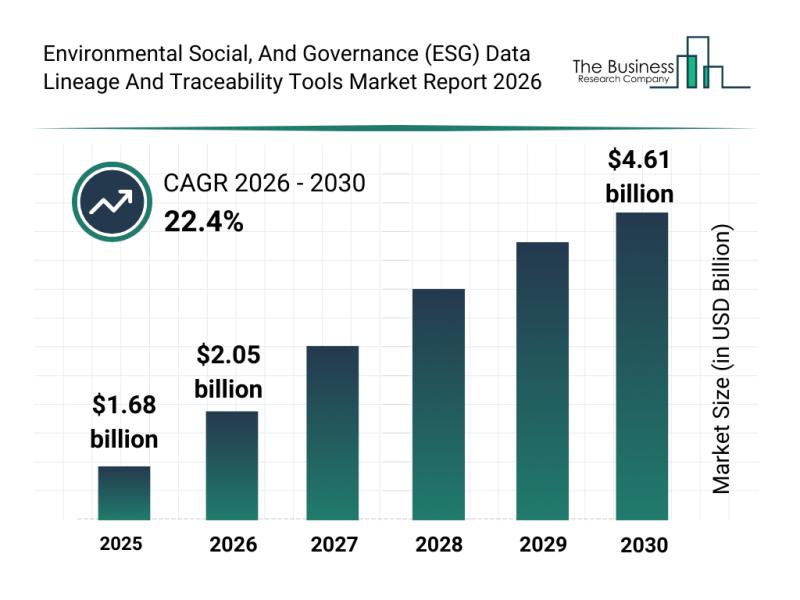

Emerging Sub-Segments Transforming the Environmental Social and Governance (ESG) …

The Environmental Social and Governance (ESG) data lineage and traceability tools market is poised for remarkable expansion in the coming years. As organizations worldwide prioritize sustainable practices and regulatory compliance, the demand for transparent and reliable ESG data management solutions is rapidly increasing. Let's examine the market's projected growth, key players, driving forces, emerging trends, and crucial segments shaping its future.

Projected Growth Trajectory of the ESG Data Lineage and Traceability…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…