Press release

Analysis of Key Market Segments Driving the Decentralized Trading Platform Market

The decentralized trading platform industry is undergoing rapid transformation, fueled by technological innovation and expanding adoption across financial markets. This sector is set to experience remarkable growth as new protocols and functionalities emerge, reshaping how digital assets are traded and managed. Let's explore the market size projections, key players, current trends, and segmentation driving this dynamic arena.Market Size Projections and Expansion Outlook in the Decentralized Trading Platform Market

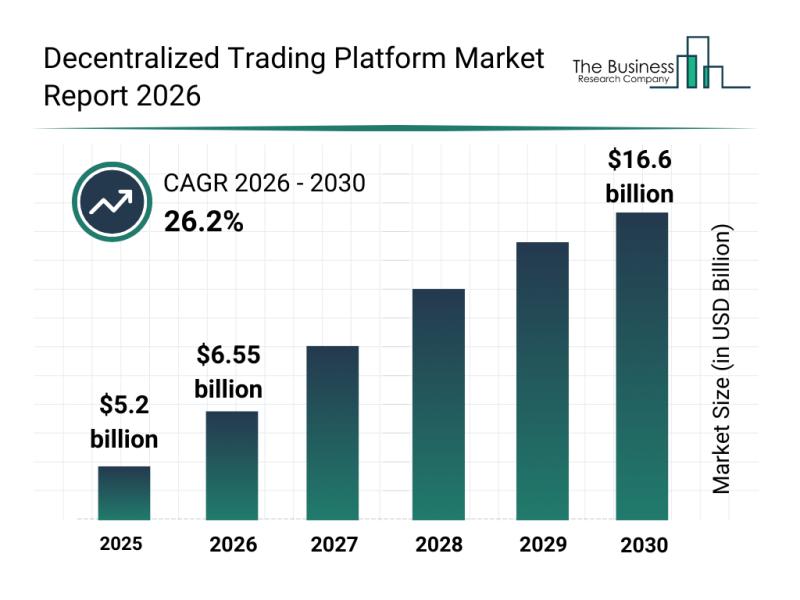

The decentralized trading platform market is anticipated to grow substantially, reaching a valuation of $16.6 billion by 2030. This impressive expansion corresponds to a compound annual growth rate (CAGR) of 26.2%. Several factors contribute to this growth, including increased institutional participation in decentralized finance (DeFi), clearer regulatory frameworks for digital assets, advancements in cross-chain interoperability, improved liquidity mechanisms, and the adoption of decentralized identity solutions. Key trends expected to shape the market during this period include non-custodial asset trading, smart contract-based transaction execution, liquidity pool-driven trading models, cross-chain asset swaps, and protocols governed by developer communities.

Download a free sample of the decentralized trading platform market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=32581&type=smp&utm_source=OpenPR&utm_medium=Paid&utm_campaign=Feb_PR

Prominent Players Leading the Decentralized Trading Platform Sector

The decentralized trading platform landscape features a number of influential companies, including SushiSwap LLC, Raydium Foundation, Uniswap Labs Inc, dYdX Trading Inc, Trader Joe LLC, STON fi DAO, PancakeSwap LLC, Synthetix Limited, MDEX Foundation, Aerodrome Finance DAO, DODO Foundation, Kyber Network Crystal Limited, ParaSwap SAS, WanSwap Protocol, SundaeSwap Labs Inc, Curve Finance DAO, Balancer Labs Ltd, BiSwap DAO, Degen Chain Foundation, 0x Labs Inc, Odos DAO, Tokenlon Technology Limited, and Bisq DAO.

Strategic Acquisition to Enhance Platform Capabilities

In July 2025, dYdX, a US-based decentralized exchange focused on perpetual trading and cryptocurrency derivatives, acquired Pocket Protector for an undisclosed amount. This strategic move aims to boost dYdX's platform by integrating social trading features and user-driven tools, thus enhancing community engagement, accelerating innovation, and supporting the growth of the decentralized derivatives ecosystem. Pocket Protector specializes in social crypto trading solutions and user-centric decentralized trading tools, making it an ideal addition to dYdX's offerings.

View the full decentralized trading platform market report:

https://www.thebusinessresearchcompany.com/report/decentralized-trading-platform-market-report?utm_source=OpenPR&utm_medium=Paid&utm_campaign=Feb_PR

Current Trends Driving Innovation in the Decentralized Trading Platform Industry

Leading companies in this market are concentrating on building sophisticated protocol architectures, particularly decentralized finance (DeFi) platforms that offer developers greater flexibility. These platforms enable highly customizable on-chain trading features, allowing users to trade, lend, borrow, and manage digital assets through smart contracts, all without centralized intermediaries.

A case in point is Uniswap Labs, a US-based DeFi provider, which unveiled Uniswap v4 in January 2025. This latest iteration delivers enhanced developer empowerment through modular hooks, singleton architecture, and reduced gas fees. The upgrade supports advanced liquidity strategies, improved protocol efficiency, and the creation of personalized decentralized trading experiences, reinforcing Uniswap's leadership in advancing on-chain trading ecosystems.

Segmented Market Insights of the Decentralized Trading Platform Industry

This market is categorized based on several criteria, including:

1) Platform Type: Automated Market Maker, Order Book, Liquidity Pools, Decentralized Exchange Aggregators

2) Asset Type: Cryptocurrencies, Tokens, Stablecoins, Asset-Backed Tokens

3) Functionality: Trading, Swapping, Staking, Yield Farming

4) User Type: Retail Investors, Institutional Investors, Developers, High-Frequency Traders

Further breakdowns include:

- Automated Market Maker subtypes such as Constant Product, Constant Sum, Weighted, and Stablecoin Optimized AMMs

- Order Book varieties including Centralized, Hybrid, Auction, and Dark Pool Order Books

- Liquidity Pools segmented into Single-Asset, Multi-Asset, Incentivized, and Time-Weighted Pools

- Decentralized Exchange Aggregators featuring Multi-DEX Routing, Best-Price Discovery, Smart Order Routing, and Liquidity Optimization

These detailed segments illustrate the market's complexity and the diverse solutions catering to various user needs and asset classes.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Analysis of Key Market Segments Driving the Decentralized Trading Platform Market here

News-ID: 4391601 • Views: …

More Releases from The Business Research Company

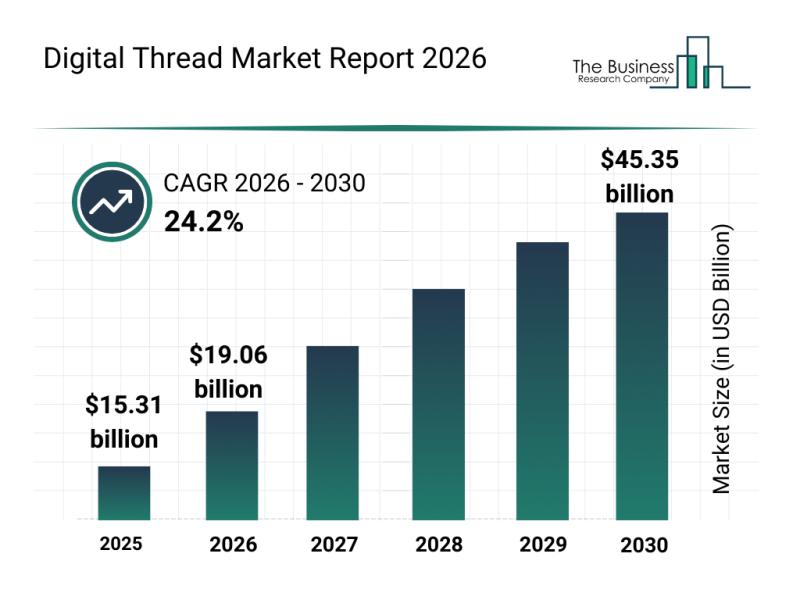

Future Perspective: Key Trends Shaping the Digital Thread Market Up to 2030

The digital thread market is on the brink of remarkable expansion, driven by advancements in connected technologies and increasing demands for seamless data integration across industrial processes. As companies seek to enhance product lifecycle management and operational efficiency, this market is set to experience significant transformations in the coming years.

Projected Growth Trajectory and Market Size of the Digital Thread Market

The digital thread market is poised for rapid growth,…

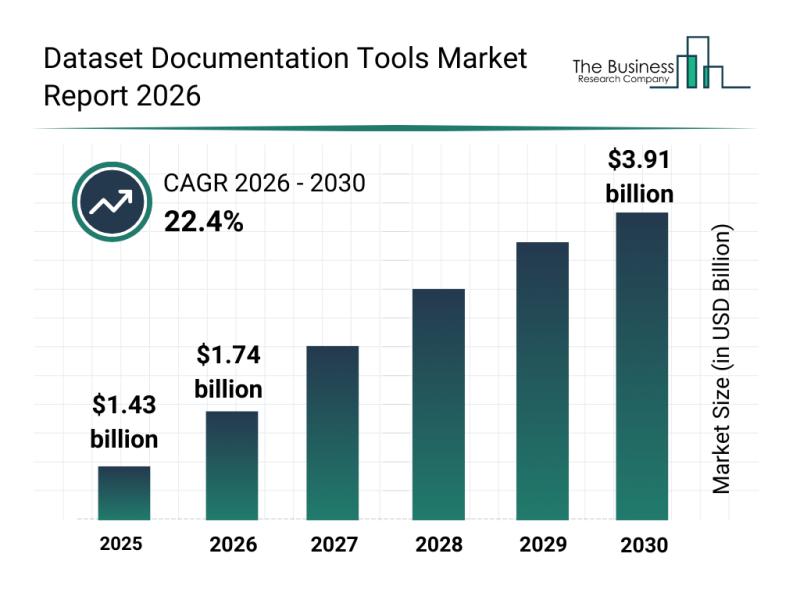

Global Trends Overview: The Rapid Evolution of the Dataset Documentation Tools M …

The dataset documentation tools market is gaining significant momentum as organizations increasingly recognize the importance of managing and governing their data assets effectively. With the rising integration of AI and more stringent regulatory requirements, this sector is set to experience substantial expansion. Let's explore the market's growth outlook, leading players, prominent trends, and its segmentation to better understand the future trajectory of this dynamic market.

Long-Term Growth Projections for the Dataset…

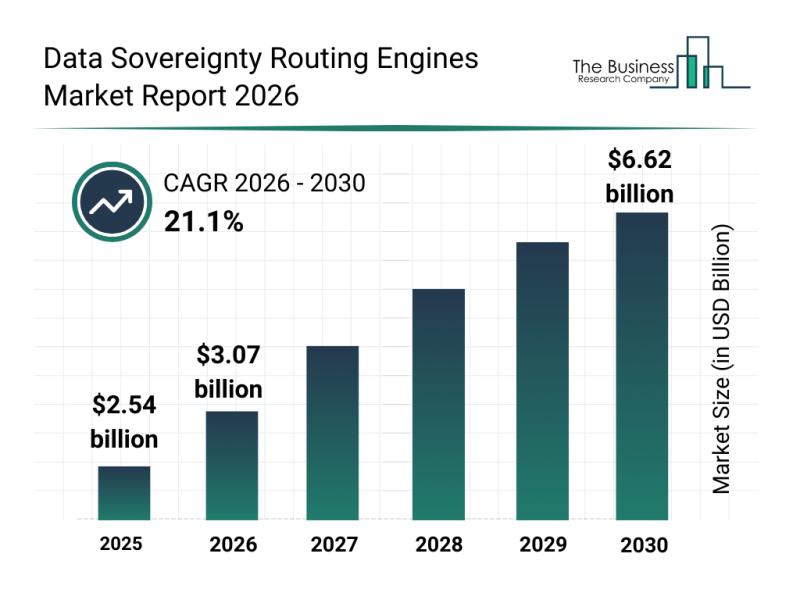

Market Segmentation, Major Trends, and Competitive Overview of the Data Sovereig …

Exploring the future of data management reveals an exciting surge in technologies that prioritize data sovereignty. As organizations worldwide grapple with complex regulatory environments and cross-border data flows, the demand for sophisticated routing solutions is climbing rapidly. Here, we delve into the projected market size, key players, emerging trends, and segmentation of the data sovereignty routing engines industry.

Projected Market Expansion of Data Sovereignty Routing Engines by 2030

The data…

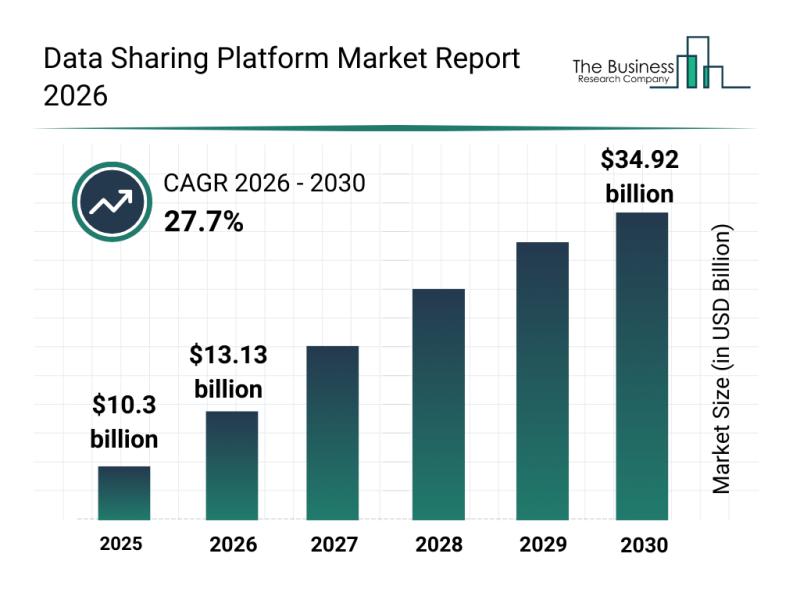

Market Trend Analysis: The Impact of Recent Innovations on the Data Sharing Plat …

The data sharing platform market is poised for remarkable expansion in the coming years, driven by evolving business needs and technological advancements. This sector is rapidly transforming as organizations seek more efficient, secure, and regulated ways to collaborate and leverage data across various industries. Below, we explore the current market size, key players, emerging industry trends, and the segmentation that defines this thriving marketplace.

Expected Growth Trajectory of the Data Sharing…

More Releases for Decentralized

Decentralized Finance (DeFi) Market From Lending to Prediction: Diverse Applicat …

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Decentralized Finance (DeFi) Market Shaping the Future of Finance: The Expanding …

Decentralized Finance (DeFi) Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth $20.22 billion in 2023 and is poised to reach $398.77 billion by 2031, growing at a CAGR of 45.36% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1607

Current…

Decentralized Finance Market Reviews Analysis Report 2024

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Blockchain development: Building decentralized applications (DApps)

Blockchain technology is the new buzzword in today's digital landscape. It has revolutionized the way we conceive and interact with digital assets. And what do you think about these decentralized applications? It is another transformation in blockchain technology that offers transparency, security, and autonomy. Let's delve into the key aspects of building DApps.

Understanding Smart Contracts: Solidity and Ethereum

Smart contracts are agreements that automatically carry out their obligations because…

MULTI CHAIN DECENTRALIZED PROTOCOLS & SERVICES

Upbit.Finance is a project that dates back to 2018. It was launched with a focus on the decentralized finance industry and Its multi-chain ecosystem, where it continues to offer a growing suite of services in this sector. The core objective is to bring value to the Crypto space by delivering disruptive, flexible, and audit technology. This protocol was created with Web3 developers and traders in mind. It is designed to…

Data Scientist Invents Cryptocurrency Decentralized Banq

Meet Anade, he's a Former Uber and Lyft Driver turned Financial Data Scientist.

Almost Five years removed from helping people get from one place to another. He is now helping people build wealth using Blockchain Technology with his company "Cryptoshare Banq".

"In 2018, after I gave up Uber I made a decision to build Wealth and help others in the process.

Our Target Market is the Creditless, Unbanked, and Underbanked (over 25% of…