Press release

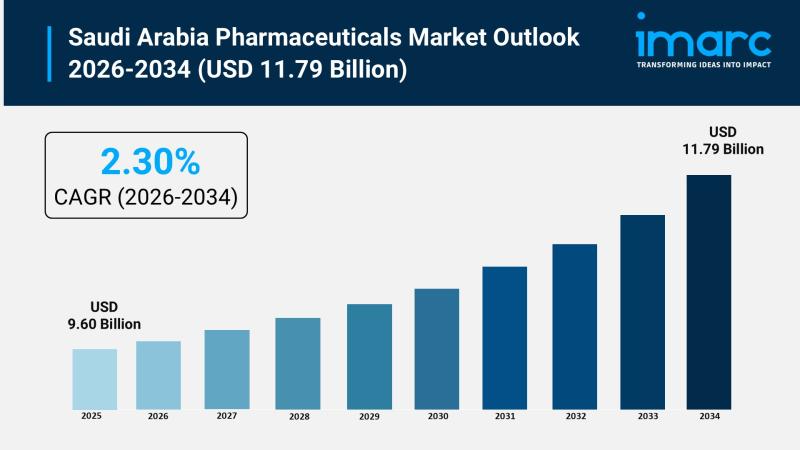

Saudi Arabia Pharmaceuticals Market Size To Worth USD 11.79 Billion By 2034 | CAGR of 2.30%

Saudi Arabia Pharmaceuticals Market OverviewMarket Size in 2025: USD 9.60 Billion

Market Size in 2034: USD 11.79 Billion

Market Growth Rate 2026-2034: 2.30%

According to IMARC Group's latest research publication, "Saudi Arabia Pharmaceuticals Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia pharmaceuticals market size was valued at USD 9.60 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.79 Billion by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Pharmaceuticals Market

● AI-powered drug discovery platforms are revolutionizing pharmaceutical research and development by analyzing vast molecular datasets, identifying potential drug candidates, and significantly reducing the time required to bring new medications from concept to clinical trials.

● Machine learning algorithms optimize supply chain management and inventory forecasting for pharmaceutical distributors, ensuring adequate stock levels of essential medications while minimizing waste from expired products across hospitals and retail pharmacies.

● Artificial intelligence-driven clinical decision support systems assist healthcare professionals in prescribing appropriate medications by analyzing patient medical histories, drug interactions, genetic profiles, and treatment outcomes to recommend personalized pharmaceutical interventions.

● Smart manufacturing systems powered by AI enhance pharmaceutical production quality control through real-time monitoring of manufacturing processes, automated defect detection, and predictive maintenance of critical equipment, ensuring consistent drug quality and regulatory compliance.

● Intelligent virtual health assistants and chatbots provide instant patient support for medication adherence, answer queries about drug interactions and side effects, and facilitate seamless prescription refill processes across digital pharmacy platforms.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-pharmaceuticals-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Pharmaceuticals Industry

Saudi Arabia's Vision 2030 is revolutionizing the pharmaceuticals industry by promoting economic diversification, enhancing domestic manufacturing capabilities, and positioning the Kingdom as a regional pharmaceutical innovation hub. The initiative drives unprecedented investment in local pharmaceutical production facilities, reducing dependency on imported medications while creating thousands of high-skilled employment opportunities for Saudi nationals in research, development, and manufacturing sectors. Through substantial government funding and strategic partnerships, Vision 2030 fosters the establishment of world-class pharmaceutical manufacturing plants, biotechnology research centers, and drug development facilities in major industrial cities including Riyadh, Jeddah, and Dammam. The government's commitment to increasing local pharmaceutical production from current levels to meet a significant portion of domestic demand aligns with broader economic objectives of reducing import reliance and strengthening supply chain resilience.

Saudi Arabia Pharmaceuticals Market Trends & Drivers:

Saudi Arabia's pharmaceuticals market is experiencing robust growth, driven by the increasing prevalence of chronic diseases including diabetes, cardiovascular conditions, hypertension, cancer, and respiratory disorders that require continuous medication management and specialized treatments. The country's rapidly growing and aging population creates sustained demand for pharmaceutical products across therapeutic categories, with demographic shifts increasing the need for medications addressing age-related health conditions and lifestyle diseases. Government initiatives to enhance healthcare infrastructure through massive investments in hospital construction, specialized medical centers, primary care clinics, and diagnostic facilities expand access to healthcare services and pharmaceutical products across urban and rural regions. Rising healthcare expenditure supported by growing disposable incomes and expanding health insurance coverage enables more citizens and residents to access prescription medications, over-the-counter drugs, and specialty pharmaceuticals previously considered cost-prohibitive.

The implementation of mandatory health insurance schemes for citizens and expatriates significantly expands the insured population base, driving increased pharmaceutical consumption as patients gain financial coverage for medications and treatments. Strategic collaborations between local pharmaceutical manufacturers and international companies facilitate technology transfer, knowledge sharing, advanced manufacturing capabilities, and the introduction of innovative medications to the Saudi market. The government's focus on localizing pharmaceutical production through the Made in Saudi initiative, the Saudi Industrial Development Fund, and various economic incentives encourages domestic manufacturing investments, reducing import dependency while creating local employment opportunities. Advancements in biotechnology and the growing emphasis on personalized medicine create opportunities for specialized treatments including biologics, biosimilars, targeted therapies, and precision oncology medications addressing complex diseases requiring sophisticated pharmaceutical interventions.

The expanding network of retail pharmacies, hospital pharmacies, and the emergence of online pharmacy platforms improve medication accessibility and convenience, enabling patients to obtain prescriptions through multiple distribution channels including traditional outlets and digital platforms. Growing health awareness among the population driven by public health campaigns, preventive care initiatives, and increased access to health information encourages proactive healthcare seeking behavior and preventive medication use. The government's regulatory reforms streamlining drug registration processes, enhancing pharmacovigilance systems, and aligning with international pharmaceutical standards create a more efficient and attractive market environment for pharmaceutical companies. The COVID-19 pandemic's lasting impact heightened awareness of healthcare preparedness, vaccine importance, and pharmaceutical supply chain resilience, driving continued investments in domestic pharmaceutical manufacturing capabilities and emergency stockpiling strategies. The rising prevalence of lifestyle-related conditions including obesity, type 2 diabetes, and metabolic syndrome resulting from changing dietary patterns and reduced physical activity levels creates sustained demand for therapeutic interventions and chronic disease management medications. Medical tourism initiatives positioning Saudi Arabia as a regional healthcare destination attract patients from neighboring countries, increasing demand for high-quality pharmaceutical products and specialized medications available through Saudi healthcare facilities.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=9945&flag=E

Saudi Arabia Pharmaceuticals Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● Prescription drugs

● Branded Drugs

● Generic Drugs

● Over the counter (OTC) drugs

Application Insights:

● Cardiovascular Diseases

● Diabetes

● Cancer

● Obesity

● Infectious Diseases

● Others

Distribution Channel Insights:

● Hospital Pharmacy

● Retail Pharmacy

● Online Pharmacy

Breakup by Region:

● Western Region

● Northern and Central Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players. Some of the major market players include AstraZeneca, GSK plc, Hikma Pharmaceuticals PLC, Jamjoom Pharma, Julphar, Novartis AG, Pfizer Saudi Limited Corporate (Pfizer Inc.), Sanofi KSA (Sanofi S.A.), Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Tabuk Pharmaceuticals (ASTRA Industrial Group), among many others.

Recent News and Developments in Saudi Arabia Pharmaceuticals Market

● February 2026: Saudi pharmaceutical companies announced strategic collaborations with international biotechnology firms to establish joint research facilities focusing on developing innovative treatments for chronic diseases prevalent in the Kingdom.

● January 2026: The Saudi Food and Drug Authority introduced enhanced regulatory guidelines for expedited approval of critical medications, streamlining the process for bringing new pharmaceutical products to market while maintaining stringent safety standards.

● December 2025: Major pharmaceutical manufacturers inaugurated advanced production facilities in Saudi industrial cities, significantly expanding local manufacturing capacity for generic medications and reducing reliance on pharmaceutical imports.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Pharmaceuticals Market Size To Worth USD 11.79 Billion By 2034 | CAGR of 2.30% here

News-ID: 4391343 • Views: …

More Releases from IMARC Group

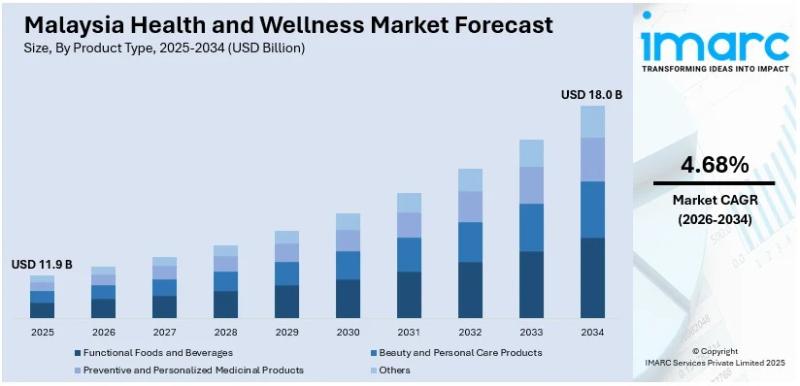

Malaysia Health and Wellness Market to Reach USD 18.0 Billion by 2034, Growing a …

Source: IMARC Group | Category: Healthcare

Report Introduction

According to IMARC Group's latest report titled "Malaysia Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Region, 2026-2034", the market is growing due to rising health consciousness, digital health integration, and the revival of traditional herbal medicine. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The…

Qatar Residential Real Estate Market Size to Hit USD 14,965.12 Million by 2033 | …

Qatar Residential Real Estate Market Overview

Market Size in 2024: USD 7,831.75 Million

Market Size in 2033: USD 14,965.12 Million

Market Growth Rate 2025-2033: 7.46%

According to IMARC Group's latest research publication, "Qatar Residential Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Qatar residential real estate market size reached USD 7,831.75 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 14,965.12 Million by 2033, exhibiting…

India Medical Tourism Market to Reach USD 72.1 Billion by 2034, Growing at 13.09 …

Source: IMARC Group | Category: Transportation and Logistics | Author Name: Gaurav

Report Introduction

According to IMARC Group's latest report titled "India Medical Tourism Market Report by Treatment Type, and Region 2026-2034", the market is growing due to affordable treatment costs, skilled healthcare professionals, and advanced medical infrastructure. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The report covers critical…

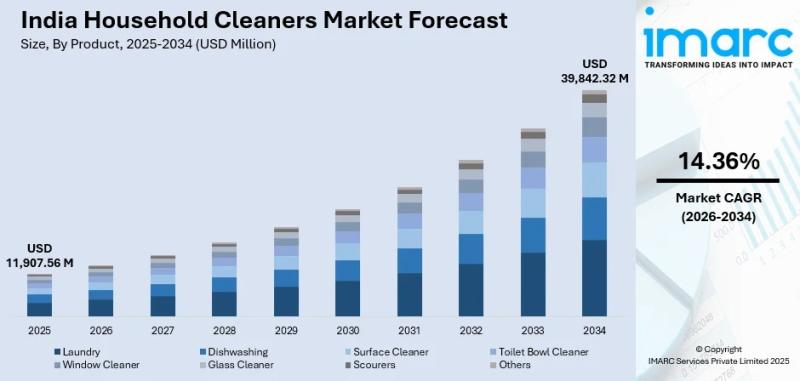

India Household Cleaners Market to Reach USD 39,842.32 Million by 2034, Growing …

Source: IMARC Group | Category: Retail | Author Name: Gaurav

Report Introduction

According to IMARC Group's latest report titled "India Household Cleaners Market Size, Share, Trends and Forecast by Product, Ingredients, Distribution Channel, Income Group, Application, Premiumization, and Region, 2026-2034", the market is witnessing robust growth due to rising hygiene awareness, rapid urbanization, and the expanding middle-class population. The study offers a profound analysis of the industry, encompassing market share, size, growth…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…