Press release

DeFi Market to Reach $174.7B by 2036 | 21.8% CAGR Growth

DeFi market grows 21.8% CAGR with tokenized assets, Layer-2 scaling, institutional adoption & RWA expansion.

The global Decentralized Finance (DeFi) market was valued at USD 20.2 billion in 2025 and is projected to grow significantly to USD 174.7 billion by 2036, expanding from USD 24.2 billion in 2026 at a CAGR of 21.8% during the forecast period (2026-2036).

The market's rapid expansion is fueled by the growing demand for financial inclusion, increasing institutional participation in blockchain-based capital markets, and the accelerating tokenization of real-world assets (RWAs). As financial institutions seek programmable settlement layers, cost-efficient cross-border infrastructure, and automated compliance mechanisms, DeFi protocols are becoming foundational to modern digital finance ecosystems. The proliferation of Layer-2 scaling infrastructure, high-throughput blockchain networks, and institutional-grade custody frameworks is further enhancing liquidity depth, execution speed, and regulatory compatibility across global markets.

Download Sample Report Here: https://www.meticulousresearch.com/download-sample-report/cp_id=6415

Market Overview

Decentralized Finance (DeFi) refers to blockchain-based financial infrastructure enabling peer-to-peer lending, trading, payments, and asset issuance without centralized intermediaries. Core technological components include automated market makers (AMMs), smart contract execution engines, oracle networks, non-custodial liquidity pools, and Layer-2 rollups and cross-chain bridges.

These systems optimize capital allocation, enhance transparency, and reduce operational friction in high-frequency trading and institutional treasury operations. The market spans simple token swap protocols to complex multi-collateral lending systems and algorithmic stablecoin frameworks. With the integration of zero-knowledge proofs, optimistic rollups, and automated compliance modules, DeFi is evolving into a scalable infrastructure layer for both retail and institutional finance.

Competitive Landscape

The global DeFi ecosystem is driven by protocol developers, liquidity platforms, staking providers, and tokenization specialists. Leading protocol developers include Uniswap Labs, Aave, Compound Labs, and MakerDAO. Specialized liquidity and derivatives platforms include Lido Finance, Curve Finance, Synthetix, and PancakeSwap. Tokenized asset and yield optimization innovators include Ondo Finance, Centrifuge, Balancer, dYdX, SushiSwap, and Yearn Finance. Market leadership increasingly depends on scalability, regulatory integration, cross-chain operability, and institutional liquidity support.

Market Drivers

Demand for Financial Sovereignty and Institutional DeFi

Global investors are demanding permissionless capital access, composable yield products, and programmable liquidity solutions. Institutions are integrating smart contracts into treasury workflows, settlement automation, and risk management systems. Automated market makers and algorithmic lending pools are becoming critical infrastructure components in modern capital markets.

Tokenized Real-World Assets (RWAs)

The rapid expansion of tokenized fixed income, private credit, real estate, and treasury products is accelerating institutional-grade DeFi adoption. Platforms such as Ondo Finance and Centrifuge are enhancing liquidity depth while reducing settlement latency and custodial dependencies.

Browse in Depth : https://www.meticulousresearch.com/product/decentralized-finance-market-6415

Layer-2 Scaling & Cross-Chain Innovation

Layer-2 networks such as Arbitrum, Optimism, and Base are enabling high-throughput, low-cost transactions while preserving Layer-1 security guarantees. These systems support large-scale retail trading and institutional settlement operations.

Market Opportunity

The expansion of blockchain-based cross-border payments and stablecoin-powered treasury systems presents significant growth opportunities. Enterprises require modular DeFi solutions capable of multi-jurisdiction compliance, real-time audit trails, and transparent pricing models. As asset digitization accelerates globally, DeFi protocols are positioned to replace traditional clearing systems in specific capital market segments.

Market Restraints

Despite rapid growth, several constraints persist including regulatory uncertainty across major jurisdictions, smart contract security risks, high volatility in digital asset markets, and institutional hesitation due to compliance complexity. To mitigate these risks, developers are integrating compliance layers, formal verification audits, and real-time monitoring mechanisms into next-generation DeFi systems.

How Does DeFi Create Value?

DeFi transforms raw blockchain data into programmable financial logic. It enables automated liquidity provisioning, real-time settlement finality, cross-chain capital mobility, transparent yield generation, and reduced intermediary costs. By reducing custodial friction and enhancing capital efficiency, DeFi strengthens both retail participation and institutional treasury optimization.

Regional Outlook

North America Leads the Market

North America holds the largest market share in 2026, driven by strong institutional participation, venture capital concentration, and leading protocol development activity in the United States and Canada. The region's advanced blockchain infrastructure and regulatory engagement further support sustained dominance.

Asia-Pacific: Fastest-Growing Region

Asia-Pacific is projected to witness the fastest CAGR during the forecast period, supported by aggressive retail trading participation, digital payment innovation, and blockchain integration across financial services. Rapid crypto adoption in emerging markets is reinforcing regional liquidity expansion.

Europe Strengthens Regulatory-Driven Adoption

Europe is experiencing steady growth, driven by regulatory clarity, digital asset policy frameworks, and integration of DeFi solutions into institutional treasury and tokenization platforms. Countries such as the UK, Germany, and France are actively fostering compliant DeFi innovation.

Segmental Insights

Protocol Type: Decentralized Exchanges (DEXs) Dominate

The DEX segment holds the largest market share in 2026, primarily due to its role in automated market making, perpetual derivatives, and spot trading execution. Ethereum and Layer-2 ecosystems represent a substantial share of DEX transaction volume. Tokenized RWA platforms are projected to grow at the fastest CAGR through 2036, reflecting institutional asset digitization trends.

Application: Trading & Investment Lead

The trading and investment segment accounts for the largest share, driven by high liquidity demand, speculative capital flows, and decentralized portfolio management strategies. Payments and remittances are projected to witness the fastest growth, propelled by stablecoin-based cross-border settlements and programmable treasury management.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1732

Deployment: Layer-2 Shows Highest Growth

Layer-2 deployments are projected to grow at the fastest rate through 2036 due to transaction fee reduction and throughput optimization. Layer-1 networks maintain a substantial share, offering superior decentralization, settlement finality, and institutional-grade security.

End-User: Retail Leads, Institutions Accelerate

Retail users hold the largest market share in 2026, driven by global participation in yield farming, liquidity mining, and token trading. However, institutional investors and asset managers represent the fastest-growing segment, as regulatory clarity and custody innovation enable capital migration into decentralized ecosystems.

Related Reports:

Biodiversity and Natural Capital Credit Market: https://www.meticulousresearch.com/product/biodiversity-and-natural-capital-credit-market-6154

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release DeFi Market to Reach $174.7B by 2036 | 21.8% CAGR Growth here

News-ID: 4391221 • Views: …

More Releases from Meticulous Research®

Global High-Barrier Films Market for Food Packaging: Trends, Applications, and G …

The global high-barrier films market for food packaging has experienced notable growth over the past several years, driven by evolving consumer preferences, technological advancements, and increasing demand for packaged food products. In 2025, the market was valued at approximately USD 25.2 billion. High-barrier films, designed to provide superior protection against oxygen, moisture, light, and other environmental factors, are essential for preserving the flavor, texture, and nutritional value of food products.…

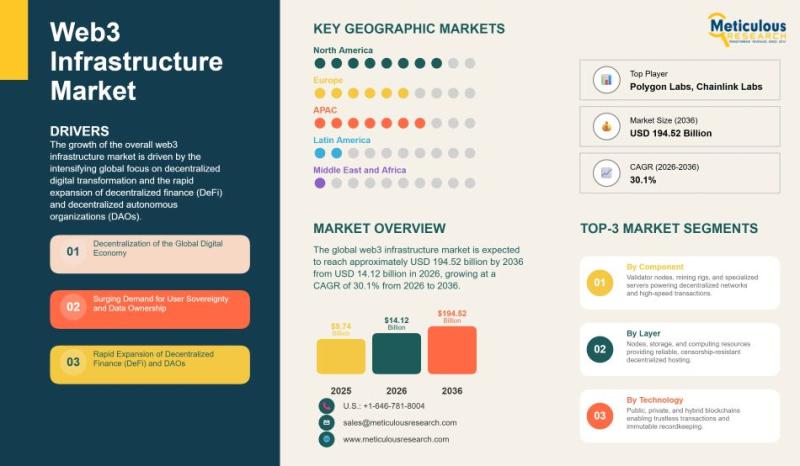

Global Web3 Infrastructure Market Analysis and Forecast (2026-2036)

The global web3 infrastructure market is experiencing rapid growth, driven by a shift toward decentralized digital transformation and the increasing adoption of decentralized finance (DeFi) and decentralized autonomous organizations (DAOs). In 2025, the market was valued at approximately USD 9.74 billion, and it is expected to grow to around USD 14.12 billion in 2026. By 2036, the market is projected to reach USD 194.52 billion, expanding at a compound annual…

Global Next-Generation Data Storage Market Forecast 2026-2036: Trends, Drivers, …

The global next-generation data storage market is witnessing substantial growth as organizations increasingly grapple with massive volumes of digital information and the need for efficient, scalable storage solutions. In 2026, the market was valued at USD 53.5 billion and is expected to reach USD 100.6 billion by 2036, growing at a compound annual growth rate of 6.5%. This market includes a variety of advanced storage technologies, such as Storage Area…

Global Natural Sausage Casings Market 2026-2036: Trends, Growth Drivers, Applica …

The market for natural sausage casings has been growing steadily over the past few years, and it doesn't seem to be slowing down anytime soon. In 2025, it was worth about USD 2.61 billion, and estimates show it could hit USD 3.36 billion by 2036. Even in 2026, the market is expected to be around USD 2.67 billion, growing at a slow but steady pace of roughly 2.3% a year.…

More Releases for DeFi

IO DeFi User Base Surpasses 3 Million as Structured DeFi Participation Gains Glo …

IO DeFi has reached a significant milestone as its global user base surpasses 3 million accounts, reflecting growing interest in structured and simplified participation within the decentralized finance sector.

The expansion highlights a broader shift in how users engage with DeFi. As the ecosystem matures, participants are increasingly prioritizing stability, clarity, and reduced operational complexity over constant manual involvement.

A Milestone Reflecting Changing User Preferences

User growth in decentralized finance is no longer…

Decentralized Finance (DeFi) Market From Lending to Prediction: Diverse Applicat …

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Decentralized Finance (DeFi) Market Shaping the Future of Finance: The Expanding …

Decentralized Finance (DeFi) Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth $20.22 billion in 2023 and is poised to reach $398.77 billion by 2031, growing at a CAGR of 45.36% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1607

Current…

Building Defi Staking Platform with PerfectionGeeks Technologies

With each investment-related research you undertake, whether in mutual funds, stocks or gold, you will likely find legal advice to make money by investing correctly.

Today, with one out of 10 investors investing their money into cryptocurrency, the old saying about holding assets over the long term extends to crypto-related investors. Many ways to look at it, more so considering the volatility of crypto that is frequently traded and bought, which…

DeFi (Decentralized Finance) Tool Market Still Has Room to Grow | MetaMask, Dapp …

The latest research study released by Stratagem Market Insights on the "DeFi (Decentralized Finance) Tool Market" with 100+ pages of analysis on business strategy taken up by emerging industry players, geographical scope, market segments, product landscape and price, and cost structure. It also assists in market segmentation according to the industry's latest and upcoming trends to the bottom-most level, topographical markets, and key advancement from both market and technology-aligned perspectives.…

Banking the Banked: Why Defi

“Bank the unbanked! Banking for the people! Upend the dominant paradigm!” Decentralized finance, or DeFi, is touted as the next big revolution in the world of banking and markets, just like Bitcoin was supposed to be the next big revolution in the world of currency. Oh, wait, one Bitcoin is currently worth over USD 10k, so maybe it isn’t going to replace the dollar, but it’s certainly been a revolution.…