Press release

Biomass Market (Japan vs US 2025): Growth & Key Differences | Major Players - Sumitomo Corporation, Tokyo Gas, Toho Gas, Renov, JFE Engineering

Japan has aggressively expanded biomass power as part of its post-Fukushima shift toward renewables and carbon neutrality goals by 2050. Biomass provides stable, baseload-like power (unlike variable solar or wind) and fits well in a country with limited land for large-scale solar or wind farms.Get a Free Custom Research: https://www.datamintelligence.com/custom-research?kb

• In 2024, biomass accounted for approximately 5.9% of Japan's total electricity generation, a slight increase from 5.7% the previous year, contributing to renewables reaching about 26.7% overall (including hydro, solar, etc.).

• The 7th Strategic Energy Plan (finalized in 2025) targets renewables at 40-50% of the power mix by 2040, with biomass projected to hold steady at around 5-6%.

Japan relies heavily on imported woody biomass (e.g., wood pellets from Canada, the US, and Southeast Asia) due to limited domestic supply. Imports have grown, with concerns over sustainability, forest impacts abroad, and supply-chain emissions.

• Dedicated biomass plants and co-firing in coal plants have driven growth, supported by the Feed-in-Tariff (FiT) and Feed-in-Premium (FiP) schemes. Small-scale biomass FiT/FiP prices remained unchanged at ¥24/kWh for 2025-2026.

• Recent developments include large plants coming online, such as a 112 MW facility in Aichi Prefecture (2025) and others like 50 MW plants in Tomakomai and Gobō. The market added significant capacity in 2025, with projections for over 3 GW more by the mid-2030s, though growth may slow post-2030 amid policy shifts (e.g., excluding new large-scale woody biomass from FIT starting FY2026).

• The biomass market (power, steam, fuel) is growing, with estimates of USD 6.0 billion in 2025, heading toward USD 10.9 billion by 2034 at a 6.86% CAGR.

• Japan views biomass as essential for grid stability and regional revitalization, but debates persist over its true carbon neutrality given import emissions.

• Biomass in the United States: Diverse Uses with Stable but Declining Power Role

• The US has abundant domestic biomass resources (e.g., wood residues, agricultural waste, energy crops), making it a leader in overall bioenergy production. Biomass contributes to electricity, biofuels, heating, and more.

• In recent data (2024 baseline), biomass power generation was around 50.5 billion kWh, but projections from the EIA show a slight decline to 20.3 billion kWh in 2025 and 20.2 billion kWh in 2026, reflecting limited new capacity additions and competition from cheaper renewables like wind/solar.

• Biomass accounts for a small share of renewable electricity (2% in recent years), with capacity stable at 4.9 GW (split between wood and waste biomass).

• Broader biomass consumption is rising in some areas: wood biomass expected to increase to 1.95 quads in 2025 and 2.05 quads in 2026, while waste biomass dips slightly.

• The US has 184 dedicated solid-biomass power plants (many idled but operable), plus strong biofuel sectors (e.g., biodiesel, renewable diesel, ethanol). The Billion-Ton Report highlights potential to triple biomass production sustainably.

• Policies like the Renewable Fuel Standard drive liquid biofuels, while power generation sees less growth due to economics and incentives favoring other renewables.

• The US emphasizes domestic feedstocks and integration across sectors (e.g., densified biomass exports, heating), contrasting with Japan's import dependence.

• Biomass energy continues to evolve in both Japan and the United States, with Japan seeing robust project additions in 2025 amid policy shifts, while the US focuses on stable operations, niche innovations, and broader bioenergy applications. Sustainability debates, import reliance (Japan), and competition from other renewables persist.

Recent Projects in Japan

✅ Japan added significant capacity in 2025, with over 3 GW projected globally in biomass-to-energy but strong contributions from Japan despite potential slowdowns post-2030 due to FIT exclusions for new large-scale woody biomass starting FY2026.

✅ Sendai Port Biomass Power Plant (Miyagi Prefecture): One of Japan's largest dedicated facilities (112 MW), commenced commercial operations in November 2025. Jointly developed by Sumitomo Corporation, Tokyo Gas, Hokuriku Electric Power, and others; uses certified wood biomass for 800,000 MWh annually (powering 260,000 households).

✅ Tahara Biomass Power Plant (Aichi Prefecture): 112 MW facility started operations in 2025 (commercial commencement around April 2025), led by JFE Engineering with partners like Tokyo Century, Chubu Electric Power, and Toho Gas; primarily fueled by imported wood pellets, generating ~770 million kWh/year.

✅ Yonezawa Biomass Power Plant (Yamagata Prefecture): Became operational in December 2025, fueled mainly by woodchips; developed with involvement from Takuma.

✅ Other notable 2025 completions: 50 MW plants in Tomakomai and Gobō.

Upcoming: Hiroshima Gas's Onoura biomass plant (construction started 2025, eyeing July 2026 COD); smaller projects like a 7.1 MW woody biomass plant in Tochigi (Kansai EPCO-led, with virtual PPA to Tokyo Metro).

✅ Companies like Renova operate multiple plants (e.g., 445 MW biomass capacity by early 2026) and accelerate fuel procurement (targeting 2 million tons in FY2025-26).

Recent Projects in the United States (2025-2026 Focus)

=> US biomass power generation remains stable but projected to decline slightly (from 50.5 billion kWh in 2024 to 20.3 billion in 2025 and 20.2 billion in 2026 per EIA), due to limited new additions and competition. Focus shifts to integrated uses, BECCS potential, and repurposing.

=> 184 dedicated solid-biomass power plants operational or idled (total >6,400 MW capacity), many using wood residues, ag waste, etc.

Emerging trends: Links to wildfire risk reduction via forest thinning (e.g., California projects moving south for biomass markets); potential growth in BECCS and modular units.

=> Notable activity: Acquisitions like NewYork GreenCloud's Buena Vista facility (2025/2026) for carbon-negative AI applications; DOE funding for wood heater innovation and algal systems (up to $10M+ in 2025).

=> Broader bioenergy: Emphasis on biofuels, RNG, and untapped potential via executive actions promoting timber/bioenergy.

Mergers & Acquisitions (M&A) and Investments (2025-2026)

Japan:

🔹 Limited direct biomass M&A highlighted, but strong renewable/infrastructure activity (e.g., ENEOS's past renewable acquisitions). Policy shifts (FIT changes) prompt reappraisals; financial institutions revise woody biomass policies amid sustainability concerns.

🔹 Outbound focus: Japanese firms heavily invest in US energy (e.g., gas/LNG upstream), indirectly supporting biomass via energy security. Breakthrough Energy (Bill Gates-linked) partnered with Japan in 2025 for biomass/hydrogen acceleration.

United States:

🔹 Biomass-specific M&A quieter; examples include facility acquisitions for innovative uses (e.g., carbon-negative power).

🔹 Massive Japan-US deals: $550B investment framework (2025 agreement) targets US energy/LNG/infrastructure, with Japanese firms like Mitsubishi ($5.2B Haynesville acquisition), JAPEX ($1.3B tight oil/gas), Jera ($1.5B investment) - more gas-focused but tied to broader energy transition.

Overall investments favor diversified renewables, with biomass as a dispatchable bridge.

Key Players

Japan:

• Utilities/developers: Sumitomo Corporation, Tokyo Gas, Hokuriku Electric Power, JFE Engineering, Chubu Electric Power, Toho Gas, Renova (multiple plants, strong fuel procurement), Takuma.

• Others: Mitsubishi Heavy Industries, IHI Corporation, Japan Renewable Energy Corporation (JRE), ENEOS (renewables incl. biomass).

United States:

• Operators: Drax Group, Enviva Partners LP (pellets/supply), Covanta Energy, Engie North America, Georgia Biomass LLC.

• Others: Ameresco, DTE Biomass Energy; emerging innovators like Carba, Erg Bio; associations like American Biomass Energy Association and California Biomass Energy Alliance.

Comparison and Outlook

✦ Japan treats biomass as a core renewable for reliable power in a resource-constrained island nation, leading to higher electricity share (5-6%) despite imports and sustainability questions. The US leverages vast domestic resources for diverse applications, but biomass power is a smaller, stable-to-declining part of its massive renewable mix (dominated by wind/solar/hydro).

✦ Both face challenges: sustainability concerns (e.g., emissions from woody biomass), competition from cheaper renewables, and policy evolution. Japan continues strong additions in 2025-2026, while US power output edges down but overall bioenergy potential remains high.

✦ Biomass remains a bridge fuel in the energy transition for both regions, supporting decarbonization while addressing grid reliability.

Related Reports

Biomass Gasification Technology Market (2025-2032)

https://www.datamintelligence.com/download-sample/biomass-gasification-technology-market?kb

Biomass Briquette Market

https://www.datamintelligence.com/download-sample/biomass-briquette-market?kb

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Biomass Market (Japan vs US 2025): Growth & Key Differences | Major Players - Sumitomo Corporation, Tokyo Gas, Toho Gas, Renov, JFE Engineering here

News-ID: 4390057 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

Accountable Care Solutions Market to Reach USD 34.76 Billion by 2033 at 10.8% CA …

The Accountable Care Solutions Market was valued at USD 14.12 billion in 2024 and is projected to reach USD 34.76 billion by 2033, expanding at a CAGR of 10.8% during the forecast period from 2025 to 2033. This strong growth reflects growing global emphasis on improving quality of care while controlling costs, especially as healthcare systems shift from fee-for-service toward value-based care models. Accountable care solutions, which include care coordination…

Computer Aided Detection (CAD) Market to Reach USD 9.59 Billion by 2033 at 12.8% …

The Computer Aided Detection (CAD) Market was valued at USD 4.28 billion in 2024 and is projected to reach USD 9.59 billion by 2033, expanding at a CAGR of 12.8% during the forecast period from 2025 to 2033. This strong growth is driven by increasing adoption of CAD systems in medical imaging to enhance early disease detection, improve diagnostic accuracy, and support clinicians in complex decision-making. As healthcare providers face…

Hydrogel Dressing Market Forecast for Robust Growth to USD 1,371.79 million by 2 …

Market Overview

The global hydrogel dressing market was valued at USD 829.0 million in 2025 and is expected to grow steadily over the forecast period. The market is projected to increase from USD 870.07 million in 2026 to USD 1,371.79 million by 2034, registering a CAGR of 5.90% between 2026 and 2034. In 2025, North America led the market, accounting for a dominant 40.00% share.

Chronic wound management remains a significant healthcare…

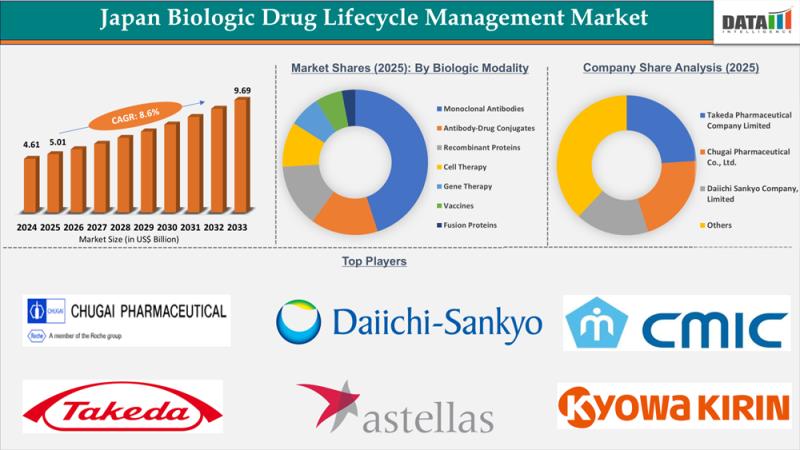

Japan Biologic Drug Lifecycle Management Market (2026-2033) | Market expected to …

Japan Biologic Drug Lifecycle Management Market reached US$4.61 Billion in 2024, rising to US$5.01 Billion in 2025 and is expected to reach US$9.69 Billion by 2033, growing at a CAGR of 8.6% from 2026 to 2033.

Within the Biologic Modality segment, Monoclonal Antibodies (mAbs) dominated the Japan Biologic Drug Lifecycle Management Market, accounting for the largest revenue share of 45% in 2025.

Get a Free Sample PDF Of This Report (Get Higher…

More Releases for Japan

Vision Guided Robotic Systems Market Size 2022 - FANUC(Japan), KUKA(Germany), AB …

The Vision Guided Robotic Systems Market research report also provides an in-depth analysis of key players in the market, including their company profiles, business offerings, recent development, market strategies, and critical observation related to the product. The research study provides extensive coverage of the Vision Guided Robotic Systems Market size across all industries and businesses. In addition, it offers detailed insights into market size and growth depending upon various segments…

Japan Agriculture Market, Japan Agriculture Industry, Japan Agriculture Livestoc …

The agriculture sector is a very significant sector in Japan. Agriculture sector exists in every part of country, but is especially essential on the northern island of Hokkaido that accounts for approximately 10% of national production. Modern methods such as commercial fertilizers, hybrid seeds, insecticides, and machinery, have been used so efficiently in farming. Japan is the second major agricultural product importer in the world (after the U.S.). Almost all…

Car Navigation ECU Market 2019: Top Key Players are AW Software (Japan), Contine …

Car Navigation ECU Market 2019 Report analyses the industry status, size, share, trends, growth opportunity, competition landscape and forecast to 2025. This report also provides data on patterns, improvements, target business sectors, limits and advancements. Furthermore, this research report categorizes the market by companies, region, type and end-use industry.

Get Sample Copy of this Report@ https://www.researchreportsworld.com/enquiry/request-sample/13844912

Global Car Navigation ECU market 2019 research provides a basic overview of the industry…

Global Car Navigation ECU Market Outlook to 2023 – AW Software (Japan), Contin …

An automotive navigation system is part of the automobile controls or a third party add-on used to find direction in an automobile and the ECU is the core part control it.

Car Navigation typically uses a satellite navigation device to get its position data which is then correlated to a position on a road. According to this study, over the next five years the Car Navigation ECU market will register a…

Global Car Navigation Parts Market Research Report 2019-2025 | Global Key Play …

This research report titled “Global Car Navigation Parts Market” Insights, Forecast to 2025 has been added to the wide online database managed by Market Research Hub (MRH). The study discusses the prime market growth factors along with future projections expected to impact the Car Navigation Parts Market during the period between 2018 and 2025. The concerned sector is analyzed based on different market factors including drivers, restraints and opportunities in…

Global Automotive 3D Scanning Laser Radar (3D-LiDAR) Market 2019-2025 | Velodyne …

Researchmoz added Most up-to-date research on "Global Automotive 3D Scanning Laser Radar (3D-LiDAR) Market Insights,Forecast to 2025" to its huge collection of research reports.

3D LiDAR uses a pulsed laser to detect distance, velocity and angle with high precision. LiDAR can classify objects, detect lane markings, and may also be used to accurately position an autonomous vehicle relative to a high definition map.

3D LiDAR is prominent, as it is a key…