Press release

Mobile Payment Market Players - Competitive Positioning, Strategic Strengths & Investor Outlook

The Mobile Payment Market has evolved into one of the most dynamic segments of the global financial technology ecosystem. As digital wallets, contactless payments, QR-code systems, and peer-to-peer (P2P) transfers become mainstream, mobile payments are reshaping how consumers and businesses transact. Rapid smartphone penetration, expanding internet access, regulatory support for digital financial inclusion, and the growth of e-commerce have positioned the Mobile Payment Market at the center of global digital transformation.Today, mobile payments extend far beyond simple transactions. They now encompass embedded finance, buy now pay later (BNPL) solutions, cross-border remittances, subscription billing, super apps, and merchant analytics platforms. The competitive landscape is characterized by technology giants, fintech disruptors, traditional financial institutions, and telecom operators, all vying for market share.

From an investment perspective, the Mobile Payment Market represents a strategic convergence of payments infrastructure, data analytics, cybersecurity, and consumer engagement platforms. Understanding the competitive positioning of leading players provides valuable insight into where long-term value is being created.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8366

Top Companies & Their Strategies

1. PayPal Holdings, Inc.

PayPal remains a dominant force in the Mobile Payment Market, leveraging its global brand recognition and extensive merchant network. Its mobile wallet, Venmo platform, and strong cross-border capabilities position it as a leader in digital commerce. PayPal's strategy focuses on ecosystem expansion-integrating BNPL services, cryptocurrency functionality, and embedded checkout solutions.

The company's strength lies in its two-sided platform connecting merchants and consumers, offering seamless payment experiences across devices. Its continued investments in fraud detection and AI-driven risk management reinforce its competitive edge.

2. Apple Inc. (Apple Pay)

Apple Pay commands a strong presence in the premium smartphone segment. Its competitive advantage stems from tight hardware-software integration and secure biometric authentication through Face ID and Touch ID. Apple's focus on privacy and security differentiates it within the Mobile Payment Market.

The company continues to expand Apple Pay's reach through partnerships with banks and transit systems, while also embedding financial services such as savings accounts and installment payments within its ecosystem.

3. Google (Google Pay)

Google Pay benefits from Android's extensive global footprint, particularly in emerging markets. The company's strategy revolves around simplifying peer-to-peer payments, integrating with local banking networks, and leveraging Google's data analytics capabilities.

Google's strength lies in its scalability and ability to embed payments into its broader digital ecosystem, including e-commerce, advertising, and cloud services.

4. Square (Block, Inc.)

Block, formerly Square, has built a comprehensive payment ecosystem targeting small and medium-sized enterprises (SMEs). Its mobile POS solutions, Cash App, and integrated financial services provide end-to-end merchant solutions.

Block's strategy emphasizes financial inclusion and merchant empowerment. By offering hardware, payment processing, payroll, and lending services under one platform, it strengthens customer retention and cross-selling opportunities.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-8366

5. Alipay (Ant Group)

Alipay is a dominant player in Asia's Mobile Payment Market, operating within a super-app ecosystem that integrates payments, lending, insurance, and wealth management. Its QR-code payment infrastructure has driven widespread adoption across urban and rural regions.

The company's scale and integration with e-commerce platforms provide a significant competitive advantage, particularly in markets with high digital payment penetration.

6. Stripe

Stripe focuses on developers and enterprises, offering API-driven payment infrastructure for online and mobile commerce. Its strength lies in flexibility and global payment support, enabling businesses to integrate mobile payment solutions seamlessly.

Stripe's emphasis on innovation, including embedded finance and subscription billing tools, positions it as a strategic partner for digital-first businesses.

➤ View our Mobile Payment Market Report Overview here: https://www.researchnester.com/reports/mobile-payment-market/8366

SWOT Analysis

Strengths

Leading players in the Mobile Payment Market benefit from strong brand recognition, extensive user bases, and robust technology infrastructure. Their integration with smartphones, POS systems, and e-commerce platforms creates high switching costs for consumers and merchants. Advanced fraud detection systems, AI-powered analytics, and secure encryption technologies enhance trust and reliability. Additionally, partnerships with banks, telecom providers, and retailers strengthen ecosystem resilience.

Weaknesses

Despite their strengths, mobile payment providers face high operational costs related to cybersecurity, compliance, and infrastructure maintenance. Profit margins can be pressured by transaction fees and regulatory constraints. Some platforms are heavily reliant on specific geographic markets, exposing them to localized economic or policy risks. Additionally, interoperability challenges and fragmented regulatory frameworks can limit seamless cross-border expansion.

Opportunities

The Mobile Payment Market presents significant opportunities in emerging economies where digital financial inclusion is accelerating. Expansion into embedded finance, digital identity verification, and blockchain-based payments opens new revenue streams. Integration with IoT devices, wearable technology, and connected vehicles could redefine transaction ecosystems. Partnerships with governments for digital public infrastructure initiatives also provide growth avenues.

Threats

Cybersecurity risks and data breaches remain persistent threats, potentially undermining consumer trust. Increasing regulatory scrutiny, particularly concerning data privacy and antitrust issues, poses operational challenges. Intense competition from fintech startups and traditional banks adopting digital transformation strategies heightens market pressure. Economic volatility and currency fluctuations can also impact transaction volumes and profitability.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-8366

Investment Opportunities & Trends

The Mobile Payment Market continues to attract strong investor interest, particularly in segments that combine payments with broader financial services capabilities.

1. Embedded Finance and Super Apps

Embedded finance is a major investment theme, enabling non-financial platforms to offer payment and lending services directly within their ecosystems. Companies are acquiring fintech startups to integrate BNPL, digital wallets, and micro-lending features. Super apps in Asia and Latin America are drawing significant capital as they combine payments, shopping, and financial services in unified platforms.

2. Cross-Border and Real-Time Payments

Investments in cross-border payment infrastructure are gaining momentum, particularly in regions with strong remittance flows. Real-time payment networks and blockchain-based settlement technologies are attracting venture funding. Companies that facilitate low-cost international transactions are positioned for long-term growth.

3. AI and Fraud Prevention Technologies

Artificial intelligence is becoming central to risk management and customer personalization. Fintech firms specializing in biometric authentication, behavioral analytics, and machine learning-driven fraud detection are receiving increased funding. Strengthening cybersecurity infrastructure remains a top priority for investors.

4. Regional Capital Flows

Asia Pacific continues to attract substantial investment due to high mobile penetration and digital wallet adoption. Africa is emerging as a promising region, with mobile money platforms driving financial inclusion. North America and Europe are seeing capital flow into enterprise-focused payment infrastructure and regulatory-compliant fintech solutions.

5. Notable Developments in the Last 12 Months

Several leading mobile payment companies have launched AI-driven fraud detection tools to enhance transaction security.

Strategic acquisitions have expanded digital wallet providers into lending and wealth management services.

Partnerships between fintech firms and telecom operators have accelerated digital payment adoption in rural markets.

Governments in multiple countries have introduced digital payment incentives and regulatory frameworks supporting cashless transactions.

Major technology firms have enhanced contactless and NFC-based payment features to strengthen ecosystem integration.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8366

Related News -

https://www.linkedin.com/pulse/what-driving-global-rise-hybrid-solar-wind-energy-storage-shelke-pomuf/

https://www.linkedin.com/pulse/greenhouse-film-market-driving-sustainable-growth-protected-shelke-il2if/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Market Players - Competitive Positioning, Strategic Strengths & Investor Outlook here

News-ID: 4388348 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Premium Cosmetics Market - L'Oréal Luxe, The Estée Lauder …

The Premium Cosmetics Market continues to evolve as consumers increasingly prioritize brand prestige, product efficacy, clean formulations, and personalized beauty experiences. Unlike mass-market cosmetics, premium beauty brands compete on innovation, exclusivity, ingredient quality, packaging sophistication, and omnichannel customer engagement. Digital transformation, influencer marketing, sustainability commitments, and regional expansion are reshaping competitive dynamics across skincare, makeup, fragrance, and haircare segments.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8309

Top Companies & Their Strategies

Several…

Floating Solar PV Market Key Players - Share Consolidation Trends & Capital Grow …

The Floating Solar PV market has evolved from a niche renewable energy application into a strategic segment of the broader solar industry. By utilizing underused water bodies such as reservoirs, lakes, and industrial ponds, floating solar photovoltaic systems offer higher efficiency due to natural cooling effects and reduced land acquisition challenges. As governments and corporations prioritize decarbonization, leading companies in the floating solar PV market are differentiating themselves through technology…

Top Companies in Disinfection Robots Market - Benchmarking Performance & Future …

The Disinfection Robots Market has transitioned from a niche healthcare solution to a strategic component of global hygiene infrastructure. Initially accelerated by pandemic-driven demand, disinfection robots are now embedded in long-term infection control strategies across hospitals, airports, commercial buildings, hospitality venues, manufacturing plants, and public transportation systems. The market is increasingly shaped by advances in ultraviolet (UV-C) technology, autonomous navigation, AI-driven mapping systems, and robotics-as-a-service (RaaS) business models.

As global standards…

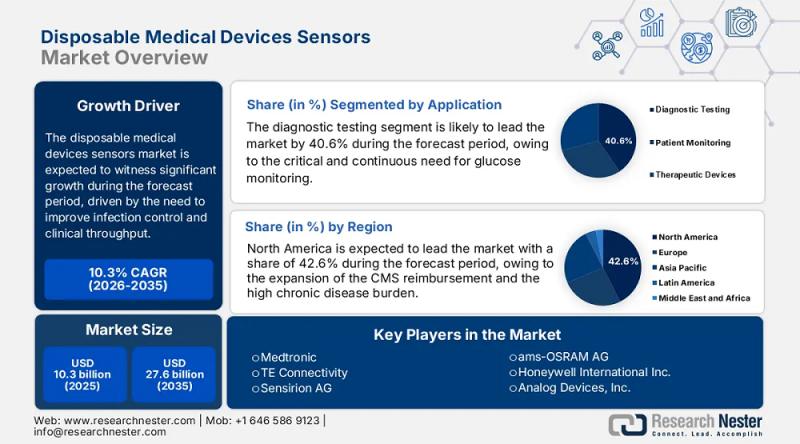

Disposable Medical Devices Sensors Market size to exceed $27.6 Billion by 2035 | …

Market Outlook and Forecast

The Disposable Medical Devices Sensors Market is entering a transformative decade, fueled by accelerating demand for real-time patient monitoring, infection control, and connected healthcare delivery models. Disposable sensors-integrated into single-use medical devices such as catheters, diagnostic strips, infusion pumps, and wearable patches-are redefining clinical workflows across hospitals, ambulatory care centers, and home healthcare settings.

In 2025, the disposable medical devices sensors market is valued at USD 10.3 billion,…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…